As e-commerce becomes more relevant and vehicle types change drastically, the younger generation may never go to the tyre shop.

Do you remember when you bought your first new tyres? Middle-aged people used to change their car tyres every four to six years. Do you think the younger generation who has never been to a shop will ever visit a dealer and change their car tyres? Probably never, but they have been able to acquire precise knowledge and enough experience to buy the best tyres. What innovations are there in the tyre trade? What will inspire the younger generation to be more aware and better informed?

If the airless tyres are widespread and cover a certain part of the market, do we need to go to the shop? We probably won’t! Or what will be the responsibility of the people when driverless autonomous cars become more popular? Let’s just think. We should keep in mind that many shops have at the same time a traditional car care service outside of tyres for main parts of internal combustion engine cars. The typical large car dealership generates 55 percent of its sales from tyres and related services and 44 percent from automotive services. We know that the market penetration of electric cars is increasing enormously, and essential systems for vehicles with internal combustion engines are missing. Do you think electric vehicles with no fuel system, complicated transmission or exhaust system pose no challenge for dealers and suppliers?

The way tyre retailers do business is changing dramatically; showroom design and product presentation cannot compensate for the overwhelming influence of e-commerce.

OEM sourcing never makes the manufacturer the market leader. Retail, consumer, and commercial sales account for nearly 80 percent of the global market. In this sense, as essential suppliers, manufacturers have always pushed dealers to favour points of sale that strengthen customer loyalty. The lighting of the product and, the showroom, the colours of the decoration allow customising the customer’s look. Showroom smell is also important, which is why some dealers prefer to keep a limited number of tyres in the showroom. Well-ventilated showrooms lead to better sales practices.

Customer trust begins with impressions from the parking lot even before entering the store. Clear and clean windows are always an advantage when the customer starts walking through the store. Worker and employee uniforms as image-bearers keep them customer-oriented. Customers always judge the seriousness and strengthen their loyalty.

These tips for tyre dealers are applied in whole or in part in different ways. However, as technology advances, expectations change dramatically. Today, with a simple touch on a tablet or smartphone screen, a basic operation of a dealer or wholesaler is done in seconds via e-commerce software.

Tyre retailers need to combine and enrich their current business with the latest software tools for inventory organisation, store management and e-commerce tools running on mobile devices.

If you look at all sectors and not just the trade, some customers see e-commerce as a contactless shopping option rather cautiously. However, every day it becomes standard in many ways. It’s trendy and admirable because everyone discusses or talks about what they bought online and how it was suitable, cheaper or quick with happy results. Online shopping is not always successful, and there are always dissatisfied customers. Yes, e-commerce is tough but popular and promoted on all social media platforms.

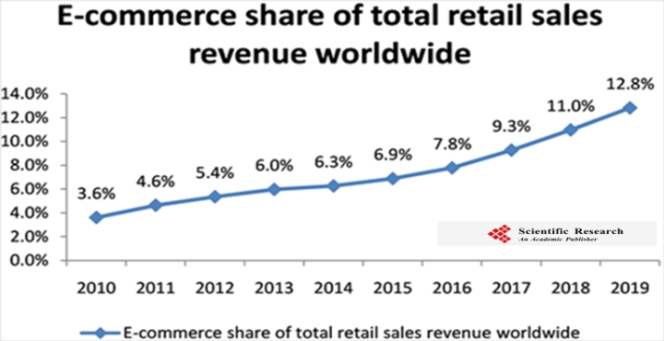

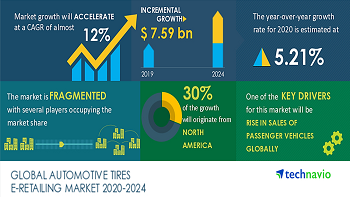

The incremental growth rate of e-commerce will remain the fastest-growing sales channel; it is already called the ‘online to offline platform – O2O – as new online marketing. Nearly one billion shoppers used e-commerce platforms to find and buy the best in 2020. In the industry, 55 percent of buyers research product lines online before purchasing, and around 15 percent of them are already shopping online today. To the extent that online sales channels can schedule appointments at the fitting station, the rate of online sales will increase. This is also the reason why people no longer have to go to a shop to buy tyres.

Online and custom e-commerce programmes are now integrated and include cloud-based web applications running on mobile phones, tablets, PCs, laptops and smartphones through various interface modules used at points of sale, order management, inventory, accounting and marketing and in particular, the e-commerce needs of retailers and wholesalers of all sizes.

Mobile phones are mainly used for online shopping, with a total share of 73 percent. When open, 56 percent of shoppers are happy to visit a store to check quality and shop on the mobile app for the best price and options via ‘Check price and availability.

Current e-commerce techniques are rapidly being restructured by combining physical and digital experiences online.

Retailers should be prepared for possible and repeated store closures. Customer preferences are direct online platforms that offer physical environments and integrate physical and digital experiences through a new generation of digital channels.

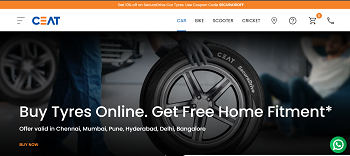

The latest trend is ‘live streaming selling’, which is already popular and being adopted by well-known retail giants. Current online retail programmes allow online shoppers to see a visual preview of exactly how the tyres will look on their vehicle with a simple click. Live streaming takes the guesswork from customers who don’t have face-to-face interaction with the product. This is solved with a real person showing you the tyres and answering your questions in real-time. Personal and unique interactions with consumers via social channels are also proliferating.

‘Live streaming selling’ is presently the latest point before augmented reality is streaming on retail shops. These two latest trends explain why the younger generation does not have to go to dealer retail shops to buy a new set of tyres.

The coming energy crisis and war-related economic sanctions, together with the e-commerce appetite of major tyre brands, bring new days of disaster for tyre retailers.

Dealers around the world are usually second or third generation and have seen many disaster days in the past. Sales volumes have yet to fully recover to the pre-Covid level; on the other hand, soaring energy and fuel prices and unstoppable inflation rates are leading to new economic uncertainties, less travel and lower demand.

Due to the invasion of Ukraine, a further decline in demand is expected. The inevitable impact of economic costs will further slowdown economies. Sanctions on transactions and logistics will bring uncertainty. Toughest days are coming in world trade. Therefore, European production and small retailer activities will be very vulnerable.

Major tyre manufacturers have launched online retail programmes to sell passenger tyres directly to consumers. The programme is explained in response to changing consumer behaviour and the ongoing transition to e-commerce. They say the programme is bringing in additional customers for dealers rather than bypassing them. Under this programme, tyres are provided by the manufacturer while dealers remain as e-commerce partners and are paid for tyre fitting labour. The other big brand’s “Rolling Programs” covers sales and assembly at the address is built in.

Given that the new economic difficulties are weighing on everyone, we understand that the tyre retailing will always be in a good mood, except for the dealers.

- INDIAN TYRE INDUSTRY

- TYRE RETREADING

- BIS STANDARDS

- IS 15704

- ECE R109

- CIRCULAR ECONOMY

- MSME CHALLENGES

- AUTOMOTIVE REGULATION

- CARBON REDUCTION

- FREIGHT

- LOGISTICS

Retreading Hangs In Balance Over Regulatory Conundrum

- By Gaurav Nandi

- December 30, 2025

A population of over 1.4 billion people catapulting into the world’s third largest automobile market with four million trucks plying across a road network of 6.3 million kilometres supported by a USD 13.4 billion tyre market and a mining sector contributing around 2–2.5 percent of the country’s GDP demonstrate the strength of India’s automobile, freight and tyre sectors.

The story doesn’t end there as the Central Government adopts a strategic approach on reducing carbon emissions across these verticals, especially automobile and tyres, with targets such as the Net Zero Carbon Emissions by 2070, battery electric vehicles target by 2030, zero-emission truck corridors, Extended Producer Responsibility for the tyre sector; the list just goes on.

Amidst all such statistics and targets, a silent spectator remains the old and varied sector of tyre retreading. In a recent news story reported by Tyre Trends, the Indian Tyre Technical Advisory Committee (ITTAC) had made a proposal to Tyre Retreading Education Association (TREA) for mandating certain standards that will improve the quality of retreads. ITTAC has made recommendations to the BIS committee. TREA is part of the same committee. ITTAC and TREA are recommending different standards.

These standards included BIS retread standards, namely IS 15725, IS 15753, IS 15524 and IS 9168. The ITTAC had partially aligned Indian requirements with ECE R109, the European regulatory benchmark.

In a reply to the proposal, which was accessed by Tyre Trends, TREA urged the Indian Tyre Technical Advisory Committee to seek a deferment or non-applicability of BIS standard IS 15704:2018 for retreaded commercial vehicle tyres, warning that mandatory enforcement could cripple the sector.

In the letter, TREA argued that IS 15704:2018 is largely modelled on new tyre manufacturing norms and is technically unsuitable for retreading, which is a restoration and recycling process.

The standard mandates advanced laboratory tests such as spectrometer-based rubber analysis, endurance testing and compound uniformity checks, requirements that most retreading units, particularly small and medium enterprises, are not equipped to meet

The association highlighted that even large retreaders lack the infrastructure and skilled manpower needed for BIS-grade testing, while the sheer number of retreading units would make inspections and certifications operationally unmanageable for regulators.

TREA warned that compliance costs linked to machinery upgrades, audits and quality control could force 70–80 percent of units to shut down, leading to job losses, higher fleet operating costs and adverse environmental outcomes due to reduced recycling

Instead, TREA proposed that BIS prioritise retreading-specific standards such as IS 13531 and IS 15524, which focus on materials, process control, safety and quality consistency.

The body has also called for a phased transition roadmap, MSME support and industry training before any stricter norms are enforced, stressing that abrupt implementation would undermine the sector’s role in India’s circular economy.

The conundrum

India has a total of 36 administrative divisions comprising 28 states and 8 union territories. The tyre retreading sector has been continuously supporting circularity goals since the early 1970s across the world’s largest economy without getting mainstream recognition.

Even after five decades in service, the industry battles different bottlenecks including fragmentation, manpower shortage, tax pressures brought about by the recent GST revisions and now the implementation of such standards, just to name a few.

The sole practice that can simultaneously reduce carbon emissions from tyres and extend tyre life is assumed the nemesis of an ‘infamous and dangerous practice’ in some states of the country.

However, the industry has been drawing its techniques and quality parameters from the world’s oldest retreading economy, Europe.

“Big retreaders in India already have the necessary processes in place that conform to IS 15524 standards. However, as the standard is not yet mandated, we have voiced support for it because it is process-oriented and outlines how retreading should be carried out, including buffing and building procedures,” said TREA Chairman Karun Sanghi.

He added, “This standard focuses on how the work is done rather than imposing product-level testing that cannot be practically implemented. The current debate on IS 15704 stems from it being fundamentally incompatible. The standard includes requirements such as sidewall marking and destructive testing of retreaded tyres, which are impractical in a retreading environment where each tyre differs in brand, size, application and usage history,” he added.

Destructive testing, he argued, assumes uniform batch sizes. In retreading, where every casing is unique, testing even a single tyre would mean destroying finished products without yielding representative results. Applying such a framework would effectively require the destruction of every tyre in a batch, making compliance unviable.

“We have submitted our response to ITTAC and are awaiting feedback from the committee. We remain open to continued dialogue and will engage further once the committee responds to our submission,” said Sanghi.

According to him, a typical retreader processes about 300 tyres a month across multiple brands including MRF, JK Tyre, Apollo and Michelin and applications ranging from buses and trucks to mining vehicles. These casings vary widely in load cycles, operating conditions and duty patterns, often across several models from the same manufacturer.

The committee has cited European standard ECE R109, but Sanghi points to structural differences: “Europe is a global retreading hub where tyre manufacturers such as Michelin and Bridgestone dominate operations, collect their own tyres, retread them and return them to fleets, making batch-based destructive testing relevant. A similar model exists in US, where large tyre companies lead retreading and largely self-regulate without a single overarching standard. The Indian scenario is different, especially with a fragmented market.”

He stressed that the industry is not opposed to standards but to those that cannot be practically applied, warning that adopting European manufacturing-oriented norms without accounting for India’s market structure and operating realities would be counter-productive.

The debate is no longer about whether standards are needed but whether they are fit for purpose. Without accounting for India’s fragmented retreading ecosystem, enforcing impractical norms could dismantle a circular industry in the name of compliance.

TGL Season 2 Kicks Off With Hankook As Founding And Official Tire Partner

- By TT News

- December 29, 2025

The second season of TGL Presented by SoFi, where Hankook Tire serves as the Founding and Official Tire Partner, commenced on 28 December 2025. This innovative league, a venture of TMRW Sports with backing from icons like Tiger Woods and Rory McIlroy, represents a strategic alignment for Hankook, uniting two entities driven by technological advancement. The partnership provides a global platform to reinforce Hankook's premium brand positioning across North America and worldwide through extensive visibility during broadcasts and at the state-of-the-art SoFi Center in Florida.

This unique venue embodies the league's fusion of sport and technology, featuring a massive simulator with a dedicated ScreenZone and a dynamic GreenZone. This area, equipped with a turntable and over 600 actuators, meticulously replicates real-world golf conditions indoors, creating an immersive arena experience. The competition itself is fast-paced and engaging, with teams of PGA TOUR players competing in Triples and Singles sessions over 15 holes. Innovative elements like the point-doubling ‘Hammer’, real-time strategy via ‘Hot Mic’ and a Shot Clock ensure a dynamic spectacle for fans.

The season opener presented a compelling narrative as a rematch of the inaugural finals, pitting the undefeated Atlanta Drive GC, featuring Justin Thomas and Patrick Cantlay, against a determined New York Golf Club squad led by Matt Fitzpatrick and Xander Schauffele. This match set the tone for an intensive season running through March, where six teams and 24 top golfers will compete. For Hankook, this partnership is more than signage; it is an active engagement with a global community, delivering a distinctive brand experience that bridges cutting-edge mobility and sport for enthusiasts everywhere.

Dunlop Secures CDP ‘A List’ Recognition For Climate Change And Water Security

- By TT News

- December 29, 2025

Dunlop (company name: Sumitomo Rubber Industries, Ltd.) has made its way to the annual A-List of CDP for climate change and water security. This premier designation, awarded for the first time to the company in the 2025 evaluation, recognises world-leading performance in transparency, risk management and environmental action. CDP’s annual assessment is a key benchmark for corporate sustainability across climate, water and forests.

This achievement stems from the Group’s integrated approach to material issues outlined in its corporate philosophy. It treats the interconnected challenges of climate change, biodiversity and the circular economy holistically, advancing concrete initiatives under its long-term ‘Driving Our Future’ sustainability policy.

On climate, the Group’s science-based emission reduction targets for 2030 are validated by the Science Based Targets initiative. Operational efforts include pioneering green hydrogen production at its Shirakawa Factory and developing tyres made entirely from sustainable materials by 2050. The company also works to reduce emissions across its supply chain, lowers tyre rolling resistance to improve vehicle fuel economy and extends product life through retreading.

For water security, the strategy is driven by localised risk assessments at global production sites. In seven facilities identified as high-risk, the goal is to achieve 100 percent wastewater recycling by 2050. Progress is already evident, with the company’s Thailand factory reaching full wastewater recycling in 2024.

These coordinated actions on multiple environmental fronts formed the basis for the Group’s simultaneous top-tier recognition in both critical categories from CDP.

Bridgestone Launches Co-Creation Initiative With Ethiopian Airlines Group

- By TT News

- December 29, 2025

Bridgestone Corporation has initiated a novel co-creation programme in partnership with Ethiopian Airlines and Ethiopian Airports, focused on enhancing aviation safety at Addis Ababa Bole International Airport. This marks Bridgestone’s first sustained three-way collaboration with both an airline and an airport authority, targeting the reduction of Foreign Object Debris on runways and taxiways to support safer and more reliable aircraft operations.

The project was prompted by tyre-related incidents linked to debris at the airport, which previously risked disrupting flight schedules. Leveraging its specialised system for inspecting used airline tyres and analysing debris data, Bridgestone assessed conditions at the hub and proposed a tailored action plan. The company provided continuous support by analysing debris distribution patterns, developing visual hazard maps, advising on efficient collection methods and conducting training to raise awareness among airport personnel.

These sustained efforts have yielded significant results, substantially lowering the rate of tyre damage caused by runway debris compared to levels before the collaboration began. This reduction has supported improved on-time performance for Ethiopian Airlines while advancing overall operational safety. Additionally, the initiative has encouraged greater use of retreaded tyres, promoting economic efficiency and environmental sustainability within the airline’s operations.

Looking ahead, Bridgestone and Ethiopian Airlines Group plan to deepen their co-creation efforts, aiming to generate further value for the aviation sector and broader society through continued innovation and partnership.

Retta Melaku, Chief Operating Officer, Ethiopian Airlines, said, "At Ethiopian Airlines, the safety of our passengers, employees and aircraft is a priority. We are pleased to collaborate with Bridgestone to further strengthen our efforts in reducing FOD at Addis Ababa Bole International Airport and ensure safe operations at the hub airport."

Getaneh Adera, Managing Director, Ethiopian Airports, said, "We remain fully committed to upholding the highest safety standards at Bole International Airport at all times. This significant achievement in reducing FOD is the result of our strong commitment for safe operations and close collaboration with Bridgestone. Through our co-creation activities, we are pleased to have realised safer operations with enhanced productivity and economic value."

Jean-Philippe Minet, Managing Director, Bridgestone Aircraft Tire (Europe) S.A., said, "By combining the learnings and insights from Ethiopian Airlines' operational issues with our analysis technology and know-how, we have deepened our co-creation to propose customised solutions. We are delighted to contribute to safe aircraft operations with peace of mind and to improved operational productivity through the co-creation of efficient FOD reduction on airport surfaces. Through further expansion and evolution of this solution, we will amplify the value of our ‘Dan-Totsu Products’, trust with our customers and value of the data for creating new value."

Comments (0)

ADD COMMENT