- India Retreading Industry

- Tyre Retreading 2025

- GST Impact On Tyres

- EPR Compliance

- Pre-Cured Tread Market

- Radialisation TBR Tyres

- Fleet Demand Slowdown

- Circular Economy Tyres

- Retreading Policy India

- Tyre Lifecycle Management

Indian Retreading Struggles Through A Turbulent 2025

- By Gaurav Nandi

- December 22, 2025

A tyre being retreaded

India’s retreading industry closes 2025 on a turbulent note, shaped by volatile demand, uneven GST reforms, rising compliance costs and a partial enforcement of the Extended Producer Responsibility (EPR) regime.

The year began with optimism as pre-cured tread (PCT) sales moved up on the back of growing radialisation and sustained awareness initiatives, but that momentum faded mid-year as policy shifts and softer fleet sentiments weighed down volumes. Retreading companies say 2025 has been defined as much by regulatory shocks as by the struggle to recover pricing power in an increasingly competitive market.

According to Tyre Retreading and Education Association Chairman, Karun Sangi, overall retreading volumes declined through 2025, especially for businesses dependent on larger fleets. Fleet operators delayed retreading cycles as freight movement stayed inconsistent and as the widening GST gap altered cost economics.

Sangi explained that the GST cut on new tractor tyres from 28 percent to 18 percent dramatically changed fleet behaviour. “When the GST on new tractor tyres fell by 10 percentage points, it became easier and cheaper for fleet owners and small operators to opt for new tyres rather than retreading them. This has impacted retreading volumes significantly.”

Retreading GST remains at 18 percent, creating a distortion that disproportionately hurts small farmers and rural operators who traditionally preferred retreaded tyres for cost savings.

Sangi noted that radialisation in the truck and bus segment continued expanding, but many fleets still hesitate to pay for high-quality PCTR material. He stated, “There is a mindset shift that is still incomplete. Radial tyres require proper retreading practices and quality material to deliver full casing life. But many fleet owners still focus only on upfront cost.”

This behaviour forced retreaders to hold pricing steady even as raw material costs rose through the year. Smaller retreaders, lacking scale, were hit hardest, resulting in thinning margins across the industry.

Another major stressor was the implementation of the EPR framework for end-of-life tyres. According to Sangi, the EPR system, although essential for environmental compliance, has created bottlenecks for smaller players.

“EPR has made processes slower, approvals tighter and paperwork heavier. The industry agrees with the intent, but implementation needs streamlining, or SMEs will not survive,” he said.

Retreaders who buy used casings from dealers or fleets now face documentation challenges and ambiguous compliance norms, particularly when handling multi-state movements of scrap tyres.

Sangi emphasised that retreaders have long been part of the circular economy and over-regulation could undermine a segment that inherently extends tyre life and reduces waste.

Treads in disarray

Echoing similar concerns, Kolkata-based Supreme Treads’ Director, Rajesh Verma, said that 2025 has been a difficult year marked by falling demand and rising input costs. He pointed to weak commercial vehicle movement, especially in the long-haul trucking segment, as a key factor.

“When truck utilisation drops, tyre wear drops. That automatically delays retreading cycles and that’s exactly what we saw in 2025,” he explained. Verma added that patchy freight during monsoons and the prolonged slowdown in construction activity further reduced tyre consumption.

Verma highlighted that customers also shifted back towards new tyres due to aggressive discounting by OEMs and Tier-II tyre brands. According to him, “We noticed that many smaller fleets were offered attractive upfront prices for new tyres, almost matching retread economics. For them, the choice became simpler.”

This price war undermined retreaders’ ability to raise rates despite increases in rubber, carbon black and labour costs. He reiterated that while overall radialisation is good for long-term industry health, retread quality across India remains inconsistent because of unorganised operators offering low-priced, low-quality jobs.

One of the leading tread makers of the country, Indag Rubber, echoed the same sentiment. The company’s Senior General Manager Rohit Kapoor said, “Since the start of CY2025, the industry witnessed an uptick in pre-cured tread demand, driven by greater customer awareness around the operational and environmental benefits of retreading. The rising commercial adoption of radial TBR tyres further encouraged fleet operators to opt for retreading as a way to extend tyre life and reduce running costs. However, the September GST reform proved to be a setback: while the tax on new tyres was reduced, the rate on retreaded tyres remained unchanged. This narrowed the price advantage and caused market volumes to fluctuate, although we expect a gradual recovery and steady growth in the coming year.”

He added, “The retreading sector had anticipated that the industry would be included in the GST revisions, given its role in circularity and resource efficiency. We have consistently engaged with policymakers to advocate for a lower tax rate on retreaded tyres and services, in line with global sustainability goals and waste-tyre regulations. Discussions with the authorities are ongoing, and while no formal roadmap has been communicated yet, we remain confident that the policy direction will eventually align with circular-economy principles and support tax rationalisation for retreading.”

2026 Outlook

Both Sangi and Verma agree that despite 2025’s setbacks, the long-term fundamentals of retreading remain strong because India’s expanding logistics and transportation ecosystem will continue to rely on cost-efficient tyre lifecycle management.

Sangi stressed that the industry needs GST rationalisation and smoother EPR processes. Verma added that technology adoption will be crucial for regaining customer trust and delivering consistent performance across applications.

As the year ends, the industry finds itself at an inflection point as the demand turbulence of 2025 exposed structural issues but also clarified what retreaders must prioritise in 2026 viz-a-viz quality, compliance readiness, customer education and tighter collaboration with fleet operators.

The segment has weathered a difficult year, but its intrinsic value proposition of extending tyre life at one-third the cost of a new tyre remains compelling. India’s push for sustainability and rising pressure on operating costs could well reposition retreading as a growth industry again, provided policy and market forces move in alignment.

Magna Tyres Launches LH32 Tyre Engineered For Trailer Applications

- By TT News

- February 17, 2026

Magna Tyres has expanded its portfolio with the launch of the LH32, a new tyre engineered specifically for trailer use in long-haul and regional transport operations. Designed to address the rigorous demands of modern logistics, the tyre delivers a balanced combination of durability, consistent performance and safety across diverse road conditions. Its advanced tread pattern is optimised to provide reliable traction and even mileage on both highways and regional routes, supporting safe and efficient travel regardless of the terrain.

The LH32 features a robust radial casing constructed with a specially formulated compound, which enhances load-bearing capacity and contributes to improved fuel efficiency. This structural integrity not only promotes longer tyre life but also boosts driver confidence through stable handling. Importantly, the tyre holds full ECE approval, confirming its compliance with strict European safety and performance standards. By integrating these technical attributes, the LH32 enables transport companies to elevate operational efficiency while maintaining high safety benchmarks, making it a practical solution for fleets aiming to optimise performance without compromise.

Key specifications of the Magna LH32

Application: Trailer

Segment: Long haul / Regional

Size: 385/65R22.5

PR: 24

Load/Speed Index: 164K

Fuel Efficiency Class: B

Wet Grip Class: B

Markings: 3PMSF & M+S

Noise Level: 73 dB, Class B

GRI Tires Hosts Italian National Distributor Magri Gomme For In-Depth Production Tour

- By TT News

- February 17, 2026

GRI Tires, a leading producer of speciality tyres from Sri Lanka, recently hosted its Italian national distributor, Magri Gomme, at its production plant to showcase the advanced technology and meticulous processes involved in manufacturing its agricultural tyres. The meeting served to deepen their collaborative relationship, providing a platform for constructive discussions about evolving market dynamics, customer requirements and the trajectory of the agricultural tyre sector in Italy.

A comprehensive tour of the facility allowed the Magri Gomme team to observe firsthand the operational scale and exacting standards that characterise GRI’s production methods. The visit demonstrated a comprehensive dedication to quality, tracing the journey from initial raw materials to the final product. It offered a clear view of the rigorous quality assurance protocols, precise process management and ongoing refinement efforts integrated into every manufacturing stage.

Beyond simply observing the production line, the engagement reinforced a unified long-term strategy. Rooted in mutual confidence and open communication, both companies reaffirmed their dedication to supplying Italian agriculture with durable, high-performing tyre solutions that meet the demands of farmers and contractors.

- Bridgestone India

- Bridgestone Select Stores

- ENLITEN Technology

- Bridgestone Turanza 6i

- Bridgestone Dueler All-Terrain A/T002

Bridgestone India Expands Assam Footprint With Two New Select Stores In Guwahati

- By TT News

- February 17, 2026

Bridgestone India has expanded its retail network in Assam with the opening of two new Bridgestone Select Stores in Guwahati. The inauguration ceremony was led by Rajiv Sharma, the company’s Executive Director of Sales and Marketing. One of the newly established outlets, Kamrup Tyres, is situated at 89 No. Dadara Gaon Panchayat, Damdama-Kulhati Road, while the other, The Wheelz Shoppe, is located near the Jaiswal Weigh Bridge on NH-37 in Boragaon.

These Bridgestone Select Stores are conceived as comprehensive destinations for tyre and wheel care. They are designed to provide customers with not only premium products but also professional advice, state-of-the-art equipment and services that prioritise safety, comfort and enduring vehicle performance. This expansion reflects the company’s strategic response to the increasing regional demand for dependable and superior tyre solutions. The new locations aim to serve as convenient hubs for passenger vehicle owners in the Guwahati area, offering a full spectrum of tyre-related services under one roof.

Motorists visiting these stores will have access to Bridgestone’s latest premium tyre offerings. This includes the Turanza 6i, which incorporates ENLITEN technology to deliver enhanced comfort, greater efficiency and compatibility with electric vehicles. Also available is the Dueler All-Terrain A/T002, a tyre renowned for its reliable performance on both regular roads and more challenging off-road terrains.

The establishment of these two outlets underscores Bridgestone India's ongoing commitment to growing its customer-focused retail presence. Through this initiative, the company continues to bring its globally recognised tyre solutions and services closer to motorists across the country.

Sharma said, “Assam continues to be an important market for Bridgestone. The opening of these two Select Stores in Guwahati reflects our commitment to offering customers easy access to premium products and trusted services. Our focus is on building long-term relationships by delivering safety, quality and a consistently good experience.”

Pirelli Brings Full Rainbow Of Compounds As F1 Testing Resumes In Bahrain

- By TT News

- February 16, 2026

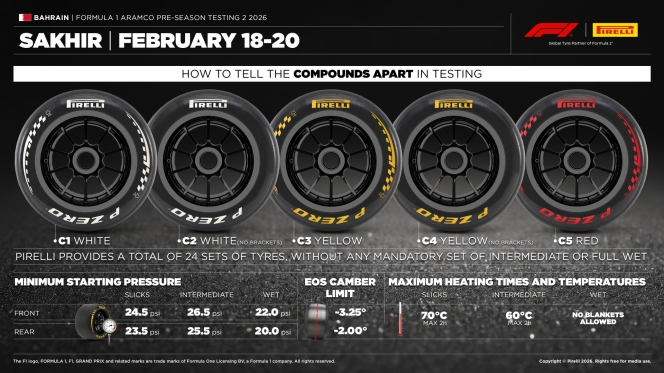

Formula 1 is set to resume on-track action in Bahrain for the second pre-season testing session, beginning 18th February and running through 20th February. This three-day event marks the final opportunity for teams to evaluate their cars ahead of the championship opener, building on the data gathered during the previous week's running.

A significant change for this test is the expanded tyre availability from Pirelli. While the initial session was restricted to the three hardest compounds, teams have now selected 24 sets from the full range of five dry-weather options. They are also permitted to carry over any tyres used for nine laps or fewer during the first test. An analysis of team selections reveals varied strategic approaches. The C3 and C2 compounds emerged as the most popular choices, requested by 10 of the 11 teams. Mercedes was the exception, opting to remain solely with the hardest compounds.

McLaren, Ferrari, Racing Bulls, Audi and Haas broadened their selection by including the C4. In contrast, Red Bull, Alpine, Williams and Aston Martin leaned towards softer specifications. The Visa Cash App RB squad confined its choices to the C2, C3 and C4, whereas Alpine and Williams also incorporated the softest C5 compound. Aston Martin adopted a unique strategy, selecting exclusively the three softest options: the C3, C4 and C5. Notably, incoming team Cadillac distributed its requests across the entire spectrum, making it the only entrant to secure at least one set of every dry compound.

Daily running is scheduled from 10:00 to 19:00. To aid identification, Pirelli has implemented a special colour-coding system for this test. The C1 and C2 compounds will feature white logos, the C3 and C4 will display yellow and the C5 will be marked with red. To differentiate the two compounds sharing the same colour, the harder of the pair will incorporate a distinctive chequered flag pattern on its sidewalls. Consequently, the C2 and C4 will be the only compounds without this additional decoration, bearing only the standard Pirelli and P Zero logos.

Comments (0)

ADD COMMENT