Global Steel Giant Zenith Sets Sights On India’s Booming Tyre Industry

- By TT News

- July 01, 2025

In the state-of-the-art facilities of Huai’an, China, cutting-edge automated production lines craft precision steel cord that will soon strengthen tyres rolling across India’s expanding highway network. For Zenith Steel Group, a USD 28 billion steel and technology leader, these gleaming threads represent an exciting opportunity to support India’s remarkable automotive growth story.

The opportunity is extraordinary. India’s steel cord market, currently at 200,000 tonnes annually, is set to nearly double within a decade as the world’s largest democracy accelerates its infrastructure development and vehicle ownership continues its impressive rise. For Zenith, recognised among China’s top 500 enterprises, partnering with India’s growth represents a natural strategic alignment.

“India is a ‘must win’ place for us,” enthuses Sheng Rongsheng, CEO of Zenith’s International Business, highlighting the company’s commitment to supporting what executives view as the world’s most promising automotive market.

“India is a ‘must win’ place for us,” enthuses Sheng Rongsheng, CEO of Zenith’s International Business, highlighting the company’s commitment to supporting what executives view as the world’s most promising automotive market.

The timing reflects India’s automotive evolution success story. The country’s tyre industry is experiencing a remarkable transformation from traditional technologies to advanced radial systems, creating unprecedented opportunities for innovative steel cord solutions. This transition has generated significant demand while showcasing India’s unique engineering capabilities in adapting global technologies to local requirements.

Zenith’s expansion into India exemplifies positive global collaboration trends. As companies worldwide embrace supply chain diversification, the Chinese innovator’s investment in India demonstrates how international partnerships can deliver mutual benefits through technology transfer and competitive alternatives.

The initiative promises substantial advantages for Indian tyre manufacturers, including access to advanced manufacturing technologies, competitive pricing options and enhanced supply chain resilience. For Zenith, success in India represents validation of its evolution from regional producer to global technology partner.

With India’s automotive sector poised for continued expansion, this collaboration highlights how international expertise can support domestic growth while fostering innovation across the global tyre industry.

In the sprawling industrial complex of Huai’an, China, massive automated production lines hum with precision, producing fine steel cord that glistens like gold yet is strong enough to reinforce truck tyres that traverse India’s expanding highway network. This is the manufacturing heart of Zenith Steel Group’s ambitious global expansion, and India is squarely in its crosshairs.

The USD 28 billion Chinese steel conglomerate, which ranked 175th among China’s top 500 enterprises in 2022, is making calculated moves to capture a significant share of the global (and also India’s) growing tyre reinforcement materials market. With plans to reach 1.6 million tonnes of annual production capacity for high-strength steel cord, bead wire and hose wire, Zenith is positioning itself as a formidable competitor in a market currently dominated by a single established player.

“Our ambition is to become the leader in the worldwide steel cord industry, and needless to say, India plays a critical role in our global strategy given the fact that it has the largest population in the world, and therefore, we believe its market potential on top of today’s sizeable demand of about 200 kt a year is bigger than anybody else. So India is a ‘must win’ place for us,” says Sheng Rongsheng, CEO of Zenith’s International Business.

This strategic push comes at a time when India’s tyre industry is rapidly evolving, driven by infrastructure improvements, vehicle market growth and increasing tyre radialisation rates. The timing appears opportune but breaking into India’s notoriously challenging market will test Zenith’s technical capabilities, localisation strategies and cost competitiveness in what industry experts describe as one of the world’s most demanding tyre markets.

EVOLUTION OF INDIA’S STEEL CORD MARKET

India’s steel cord market has undergone dramatic transformation in recent decades, evolving from a predominantly bias tyre market to increasingly adopting radial technology, which requires steel cord reinforcement.

“The Indian market is one of the few markets where bias tyres have been successful and still are in certain segments. This is due to road and usage conditions like loading and tyre inflation pressures,” explains Srikanth Chakravarthy, Designated Partner and Managing Director of Zenith India, who is representing Zenith in India after spending over 25 years in the steel cord business. “However, over the last three decades, road infrastructure has evolved quite rapidly not only in terms of new roads but quality of highways as well. This helped radialisation and therefore the demand of steel cord in India.”

This transition has created significant market opportunities but also unique challenges. Indian tyre manufacturers have developed distinctively local requirements that differ from global standards, driven by the country’s specific road conditions and vehicle usage patterns.

“Steel tyre cord itself has seen an evolution with initial designs being an outcome of international designs and choices and foreign collaborations. But Indian tyre makers were quick to study local requirements and design in-house leading to rapid product portfolio changes that saw the needle moving, for instance on tensile, from normal tensile to high tensile and now super and ultra tensile,” Chakravarthy notes. “The evolution has been also in terms of the design of cords that are more lightweight, stronger and now there is a big focus on sustainable solutions embracing circularity and reduced Co2 emissions.”

“Steel tyre cord itself has seen an evolution with initial designs being an outcome of international designs and choices and foreign collaborations. But Indian tyre makers were quick to study local requirements and design in-house leading to rapid product portfolio changes that saw the needle moving, for instance on tensile, from normal tensile to high tensile and now super and ultra tensile,” Chakravarthy notes. “The evolution has been also in terms of the design of cords that are more lightweight, stronger and now there is a big focus on sustainable solutions embracing circularity and reduced Co2 emissions.”

According to the company, Zenith is already engaging with multiple Indian tyre manufacturers including Apollo Tyres, MRF, JK Tyre, CEAT, BKT, ATG, MPTL (Ascenso) and Ralson, and also with international players like Yokohama, Goodyear, Bridgestone and Continental. Several companies including JK and BKT have confirmed homologation approvals, marking critical early success for Zenith’s market entry strategy.

Industry analysts estimate that India’s steel cord market is currently around 200,000 tonnes annually with significant growth, almost double, expected in the coming decade as vehicle ownership continues to expand and tyre radialisation rates increase, particularly in the commercial vehicle segment.

THREE-PRONGED STRATEGY

Zenith’s approach to the Indian market follows a carefully staged strategy that balances immediate export opportunities with long-term localisation goals. The company’s leadership team is clear about the methodical approach they’re taking.

“The approach can be divided into three parts,” explains Chakravarthy. “In the short term, the focus is on getting all approvals done quickly from the plant base in Huai’an. In the medium term, as commercial sales initiate, it is to offer outstanding service with warehousing, consignment stock, local technical service, co-development and efficient logistics. In the long term, the plan is to explore partnerships that enable a local footprint or a non-China-based footprint that can continue to offer the full value proposition with the added advantage of local presence.”

This methodical approach reflects Zenith’s understanding of Indian market requirements, where local presence is often a key differentiator. The company is already responding to specific customer requests for enhanced service offerings as Kelfen Zhu, International Sales Director, acknowledges, “Local warehousing has been mentioned by Indian customers, Zenith is seriously working on the solution.”

While the company currently manufactures in China with no production facilities in India, its leadership is clearly signalling future localisation plans that could include partnerships or direct investment. “To become No.1 in this market over time, there are two steps to go: first to become No.1 among all the import players, then when condition allows, to build up local production capacity and eventually become No.1 among all the steel cord suppliers to this market,” shares Rongsheng, outlining the company’s ambitious goals.

The timeline for such moves remains undefined but appears to be part of a long-term vision rather than an immediate priority. Chakravarthy suggests, “As mentioned before, this is part of the long-term strategy and we are already talking to several local players. In time, this dialogue will take shape with the right partner and India will get a very strong alternative that allows it to offer higher value to the automotive OEMs and replacement market.”

QUALITY MANAGEMENT: THE CORNERSTONE OF CUSTOMER ACQUISITION

For Zenith, quality management represents the foundation of its customer acquisition strategy in India. The company received IATF 16949 certification in February 2024 alongside ISO 9001, ISO 14001 and ISO 45001 certifications – credentials that are essential for supplying to global and Indian tyre manufacturers.

“Zenith is committed to building a robust quality management system that is customer-centric, process-oriented and integrates advanced digital solutions to realise full-process traceability and intelligent decision-making based on AI model,” states Bian Keping, Quality Manager at Zenith Steel.

This quality management system adopts both reactive and pro-active approaches to customer feedback. “For reactive way, we respond quickly to customer complaint if and when some failure happened at customer side. The systematic problem-solving mechanism, i.e. 8D methodology, would be triggered to resolve the issues. For pro-active way, we collect customers’ voice via plant visit, technical forum, questionnaire etc. we also seek feedback with an open mind when customers visit us for audits and visit. All VOC will be seriously summarised, analysed and archived to guide both product development and process improvement process,” says Keping. The company claims particular innovation in addressing common defect issues that plague tyre manufacturers. Keping adds, “Till now, Zenith doesn’t have local plant in India. For plants in China, we have introduced lots of error-proof solutions to cope with typical defects at customers sides, e.g. short-length, broken welding, cord formation defects and etc., which can definitely enhance customer satisfaction in India.”

One specific innovation highlighted by the quality team is particularly relevant to Indian manufacturing conditions. “Especially for tip-rise issue, Zenith is the first steel cord manufacturer world-wide to realise non-manual testing of residual torsion of TC spool, which can improve the accuracy and reliability of torsion testing results and significantly reduce the risk of tip-rise,” says Keping. This focus on tip-rise issues appears strategically targeted as Zhu confirms. “Tip-rise is a concern for customers right from trial stage. Professional local technical presence can clear the concern with immediate post-sales follow up and communication,” he says.

R&D CAPABILITIES: ADDRESSING INDIA’S UNIQUE REQUIREMENTS

Zenith’s research and development strategy for India focuses on developing products that address specific challenges in the Indian market, particularly the need for tyres that can withstand heavy loads, variable road conditions and cost pressures.

Dr Wang Aiping , Head of R&D at Zenith, outlines the company’s approach: “Our approach is to develop higher strength steel cord such as ST/UT and new steel cord with better fatigue performance. We will also develop customised steel cord with certain requirements like better rubber penetration and provide advanced test service such as aged adhesion, fatigue, rubber penetration etc.”

The company appears to be investing significantly in its research and development capabilities for the Indian market with Dr Aiping indicating that at least three percent of sales income will be allocated to R&D expenditures focused on Indian operations, depending on the progress.

This research and development strategy emphasises both performance and cost considerations, reflecting an understanding of the unique price-performance demands of the Indian market. “We will focus more on both steel cord strength and fatigue performance with tyre overload condition. We will also acquire experienced senior steel cord application expertise,” Dr Aiping notes when describing how Zenith’s research and development approach differs from competitors in addressing Indian market needs.

The integration of sustainability into product development also appears to be a key differentiator for Zenith’s research and development strategy. The company is developing a carbon emission management platform tailored for Indian industries to help monitor, report and reduce emissions, supporting compliance with national ESG and carbon credit regulations. “Our research and development efforts are focused on higher strength steel cord development including ultra-tensile (UT) and mega-tensile (MT) variants, which reduce material usage and enhance fuel efficiency for automotive applications,” notes Dr Aiping.

Zenith is also introducing steel cords manufactured from high scrap ratio wire rods (≥60%), promoting circular manufacturing and reducing the carbon footprint in line with India’s green steel and recycling policies.

It is evident that tyre manufacturers globally are increasingly focused on sustainability metrics, driven by both regulatory requirements and market demand for reduced environmental impact. Zenith’s emphasis on carbon footprint measurement and recycled content appears designed to address this emerging requirement in the Indian market.

THE INTELLIGENT FACTORY

Zenith’s manufacturing capabilities represent a central pillar of its value proposition to Indian customers. The company has invested heavily in creating what it describes as an ’Intelligent Factory’ in Huai’an, featuring advanced robotics, automated material handling systems and advanced process controls.

Chakravarthy, who has extensive experience in the steel cord industry, makes a bold claim about these facilities stating, “I have spent nearly 2.5 decades in the steel cord business and I have not seen a plant as modern, efficient and sophisticated in the steel cord business like the Zenith plant in Huai’an.”

This manufacturing sophistication appears designed to address two critical requirements for the Indian market, namely consistent quality and cost competitiveness. The automated systems promise reduced variability, while scale and efficiency aim to deliver competitive pricing despite the logistical challenges of serving India from China.

A distinctive feature of Zenith’s manufacturing approach is its emphasis on traceability and carbon emissions management. The company has developed what it calls an ‘Integrated Carbon Emission Management System’ that provides product carbon footprint data at the SKU level with third-party verification. This system allows Zenith to provide tyre manufacturers with detailed emissions data for their supply chain reporting – an increasingly important consideration for global tyre companies and their automotive customers.

“Zenith invested much more in automation and digitalisation than any other competitors. With these technologies in place, we can definitely create extra value for our customers. One example here is the product traceability, and we are the only one in the industry who is able to realise full process information traceability, from the wire rod to the finished goods,” notes Rongsheng when discussing important technology transfers to Indian operations.

Industry experts observe that manufacturing scale is increasingly important in the capital-intensive steel cord industry, where economies of scale drive cost competitiveness. Zenith’s ambitious capacity expansion plans, which will see it reach 1.6 million tonnes of annual production capacity across multiple plants, position the company as the largest global producers of steel cord and bead wire.

CHALLENGE OF COST COMPETITIVENESS

Despite its technological and quality advantages, Zenith faces significant challenges in achieving the cost competitiveness demanded by Indian tyre manufacturers, who operate in one of the world’s most price-sensitive markets.

Chakravarthy is forthright about this challenge. He says, “A challenge of local steel cord being cost competitive with international options is a matter of concern to the tyre industry. Also, the world of technology is rapidly evolving, and we must acknowledge that in this industry the Chinese players have made significant strides and therefore offer an equally superior infrastructure and sustainable solutions, but scale of economy will be a challenge for time to come.”

Indian tyre customers have particularly demanding requirements as Chakravarthy explains. “Indian tyre makers have a unique challenge to make the best tyre that is abuse proof, high performing, absolutely reliable, sustainable, safe, giving the best fuel efficiency and longest tyre life at the lowest cost. It might sound ridiculous, but this is reality, and Indian tyre makers have constantly risen to this challenge and developed the radial tyre market this way,” he says.

Meeting these challenging requirements while maintaining competitive pricing is the central challenge for Zenith’s India strategy. Chakravarthy emphasises that Indian customers expect steel cord partners to have a focus on innovation, consistent quality (low variations), intervention-free processability, traceability of carbon emissions, recycled content in steel cord without compromising quality and above all cost competitiveness.

BUILDING LOCAL PRESENCE

Recognising the importance of local presence, Zenith is planning to establish a technical and commercial team in India in the second half of 2025. “A professional local team with senior experts from industry will be built in H2 2025,” according to Zhu.

In the meantime, the company is leveraging its regional presence with Zhu noting that Zenith’s customer service representatives in SEA countries can back up Indian market whenever required.

This gradual approach to building local presence appears designed to match resources with market development progress. Chakravarthy acknowledges that it is only three months that he is associated with Zenith and the focus is on introducing the company, having tyre customers visit and audit the facility as they conduct approvals. “Our talent acquisition and development will be based on the various stages of growth as mentioned earlier and we will not settle for anything less than the best,” he says.

The company’s commitment to local presence seems rooted in an understanding of the Indian market’s preference for local technical support and service responsiveness. “Think global and act local is the way to go,” says Rongsheng. “We understand that India is a very demanding market; we will for sure deliver our products with the best quality, in cooperation with Sri and his team, who is by far the best local partner we could have in this region. As time goes by, we will build up local warehouses in order to foster delivery flexibilities to our customers,” he adds.

A STRATEGIC DIFFERENTIATOR

A distinctive feature of Zenith’s market approach is its design integration on sustainability and carbon emissions. The company transports its wire rod by water ways, reducing its C02 emissions per tonne per km significantly vs road transport. The use of energy efficient motors, solar power on site, optimal plant layout maximising efficiency with Co2 capture at every stage is what sets the Huai’an plant apart. This, coupled with the deployment of sophisticated systems for tracking and reporting carbon emissions throughout the production process, offers tyre manufacturers detailed data for their sustainability reporting.

The company’s investments in sustainability technologies reflect growing market demand for environmentally responsible manufacturing practices. One of the biggest challenges for carbon emission management is to understand carbon emission in Scope 3. The carbon emission management system of Zenith integrates all product carbon footprint data throughout the supply chain, from raw material sourcing to product distribution.

GLOBAL COMPETITION AND MARKET POSITIONING

Zenith’s push into India comes amid broader global trends of supply chain diversification and regionalisation in the steel and automotive supply chains. Global trade tensions, shipping disruptions and sustainability considerations are all driving tyre manufacturers to seek more resilient and localised supply networks.

This context creates both opportunity and urgency for Zenith’s India strategy. On one hand, tyre manufacturers are actively seeking supply alternatives to reduce concentration risk. On the other hand, competitors are also pursuing similar strategies, creating a race to establish market position.

This context creates both opportunity and urgency for Zenith’s India strategy. On one hand, tyre manufacturers are actively seeking supply alternatives to reduce concentration risk. On the other hand, competitors are also pursuing similar strategies, creating a race to establish market position.

The company’s aggressive capacity expansion in China – investing in projects totalling 1.6 million tonnes of annual production, a full-fledged R&D facility, integrated steel manufacturing, access to harbour, talented work force – positions it to serve not only India but global markets too. This scale could provide advantages in new technology development, raw material sourcing and manufacturing efficiency that benefit the Indian business.

However, relying exclusively on exports from China also creates vulnerability, particularly if trade tensions or shipping constraints resurface. This reality likely explains Zenith’s interest in eventually establishing non-China production capacities, potentially including India itself.

Industry experts note that India’s government has been actively encouraging greater localisation of manufacturing across various industries including automotive components. This policy direction could create both incentives and pressures for Zenith to accelerate its plans for local production capabilities in India.

CUSTOMER ENGAGEMENT

Zenith’s approach to the Indian market emphasises close technical collaboration with tyre manufacturers, recognising the unique requirements of the Indian market and the value of co-development in addressing these needs.

“We organise technical forum with customers’ research and development team to listen to their concerns and feedback. For some critical issues, management team will assign corresponding resource to cope with,” the company’s Quality Manager notes when describing collaboration with research and development to improve product quality.

This collaborative approach appears designed to address the specific technical challenges faced by Indian tyre manufacturers, who must design products for uniquely challenging operating conditions. “Indian customers value reliability, cost-effectiveness and localised post-sales support. Zenith prioritises trust-building through transparent communication, joint problem-solving and tailor-made new product development,” notes Zhu.

“The company’s research and development team is also focused on supporting this collaborative approach with plans to have regular technical meeting and build-up co-operation project with certain customer,” according to Dr Aiping.

GROWTH PROJECTIONS

Zenith’s current production capacity and expansion plans are substantial, reflecting the company’s global ambitions. According to the company, Zenith expects to reach around 500,000 tonnes of sales in 2025 and over 800,000 tonnes in 2026. This rapid scaling of production capacity underscores the company’s global ambitions.

The company’s manufacturing facilities are organised into multiple plants, each focusing on specific product lines:

- Plant 1: 240,000 tonnes/year of steel cord (full operation)

- Plant 2: 300,000 tonnes/year of bead wire (3/6 lines installed)

- Plant 7: 280,000 tonnes/year of steel cord (800 tonnes/day)

- Plant 6: 280,000 tonnes/year of steel cord (construction started in April 2024)

- Plants 3 and 5: 500,000 tonnes/year of steel cord (to be launched in 2025/2026)

This capacity expansion is backed by substantial investment with the company noting that it will invest over USD 140 million on its research and development centre to make sure it will remain a winner tomorrow. ”Zenith’s state-of-the-art production facilities and its very experienced team guarantee high product quality as well as stability. Because of its large production capacity, Zenith has a strong economy of scale and therefore is able to offer very competitive prices to Indian customers. Zenith will invest over USD 140 million on its research and development centre to make sure it will remain a winner tomorrow,” adds Rongsheng.

AMBITIONS AND REALISM

Zenith’s ambitions for the Indian market are clearly substantial, but so are the challenges. The company faces competition not only from the established local player but also from other global steel cord manufacturers eyeing India’s growth potential.

Chakravarthy sees the opportunity for Zenith to become a very strong alternative that allows India to offer higher value to the automotive OEMs and replacement market. He suggests that what Zenith could offer the Indian tyre industry is an extremely cost-competitive source that is able to provide the most modern technology, efficiency, highest levels of quality, deep innovation and enough volumes to support the growth of Indian market requirements in the years to come.

However, realising this vision requires executing across multiple dimensions simultaneously including building customer relationships, establishing local presence, ensuring cost competitiveness and eventually pursuing local manufacturing partnerships.

The company’s leadership appears clear-eyed about both the opportunities and challenges. “India can only become more important for Zenith in the future. It’s a growing market and the demand is going up every year. You cannot find this promising trend in those mature or developed markets,” says Rongsheng.

For the Indian market specifically, success will ultimately be measured by commercial performance and customer acceptance. While several Indian tyre manufacturers are already engaging with Zenith for approvals and trials, converting these initial engagements into substantial, regular supply relationships represents the true test of the company’s strategy.

As Chakravarthy puts it, “Being a steel cord player, where approvals themselves take a couple of years or more, requires a long-term vision and commitment. The level of commitment can simply be measured by how much investment a company is making for catering to the future needs of the industry. Zenith’s investments are not only towards securing volume needs of the Indian tyre industry but also fulfilling evolving technological, quality, sustainable and economic viability needs. “

A NEW FORCE

As Zenith advances its India strategy, the company appears poised to become a significant force in the country’s steel cord market. Its combination of manufacturing scale, technical capabilities and strategic focus on Indian requirements positions it well to challenge existing suppliers and support the continued growth of India’s tyre industry.

“It is not an easy road, and the only way to succeed is to collaborate with the best in the industry who can address all these aspects, not just some of these aspects,” Chakravarthy observes, capturing both the opportunity and challenge that lies ahead for Zenith in India.

For Indian customers, Zenith’s entry marks the first ever steel cord supplier who is backward integrated with steelmaking offering complete control on quality and scale and capacity and thereby supports a unique value proposition built on the principles of quality, sustainability, innovation, service and cost competitiveness. For Zenith, success in India represents not just a commercial opportunity but a strategic imperative as the company seeks to transform from a China-focused producer to a truly global steel cord supplier.

As the company enters its next phase of market development in India, all eyes will be on its ability to deliver on the twin promises of quality and cost competitiveness that define success in this demanding market. With its ambitious capacity expansion plans, investments in advanced manufacturing technologies and growing engagement with Indian customers, Zenith appears determined to establish itself as a long-term player in India’s evolving steel cord landscape.

“India presents a growth market in the long term with a strong case for doubling its steel cord demand within the decade. Unlike some global manufacturing platforms that are largely export dependent, India has a healthy domestic market with a continued and healthy growth projection both for domestic and exports,” Chakravarthy noted, summarising the strategic rationale behind Zenith’s India push.

In the global context of supply chain diversification and growing emphasis on sustainability, Zenith’s investment in India reflects broader trends reshaping the steel and automotive supply chains. The company’s success or failure in India will serve as a case study in how Chinese manufacturers can navigate the complex process of expanding beyond their home market into challenging but potentially rewarding growth markets.

As one industry analyst put it, “The entry of players like Zenith brings much-needed competition to India’s steel cord market. If they can deliver on their promises of quality, cost and eventually local manufacturing, Indian tyre makers stand to benefit significantly from an expanded and more competitive supplier base.”

The months and years ahead will reveal whether this confidence is justified and whether Zenith can translate its ambitious plans into market reality in one of the world’s most challenging and promising tyre markets.

THE PATH FORWARD: STRATEGIC IMPERATIVES AND CHALLENGES

As Zenith advances its India strategy, several key imperatives and challenges emerge from the company’s approach:

1. Balancing global scale with local adaptation: Zenith must leverage its global scale while adapting to the specific requirements of the Indian market. “Think global and act local’ is the way to go,” as Rongsheng puts it.

2. Establishing local presence: Building a local technical and commercial team will be crucial for addressing Indian customers’ expectations for responsive service and support. “Professional local team with senior experts from industry will be built in 2H’2025,” according to Zhu.

3. Ensuring cost competitiveness: Despite technological advantages, Zenith must deliver competitive pricing to succeed in India’s price-sensitive market. “The Indian consumers are a price and value sensitive market, and therefore it is not sufficient to just have a local footprint without addressing the key questions of cost competitiveness, sustainability and technology sufficiently,” Chakravarthy notes.

4. Developing market-specific products: India’s unique road conditions and vehicle usage patterns require specialised steel cord solutions. “To consider both steel cord strength and fatigue performance with tyre overload condition,” Dr Aiping emphasises.

5. Building long-term partnerships: Success in India will require strong relationships with tyre manufacturers and potentially local manufacturing partners. “In time, this dialogue will take shape with the right partner and India will get a very strong alternative that allows it to offer higher value to the automotive OEMs and replacement market,” Chakravarthy suggests.

KraussMaffei Technologies Appoints Dirk Musser As New Managing Director

- By TT News

- February 27, 2026

KraussMaffei Group is set to implement a leadership transition at its subsidiary, KraussMaffei Technologies, with a change at the board level. Jörg Stech, who has served as Chairman of the Board and global head of injection moulding, automation and additive manufacturing since 2023, will be departing on 31 March 2026 at his own request. He will be succeeded by Dirk Musser, the current Head of Group Transformation at the parent company, who has been appointed as the new Managing Director effective 1 April 2026. The leadership handover between Stech and Musser is already in progress, ensuring a seamless transition.

Stech’s tenure unfolded during a difficult economic period marked by financial losses and a contracting market. He responded with decisive measures aimed at margin enhancement and balance sheet improvement, which laid the groundwork for the company's long-term stability. Under his direction, the product lineup for injection moulding and automation was revitalised with the introduction of the LRXplus linear robot, the fully electric PX series and the MC7 control system, all launched in late 2025 alongside new artificial intelligence tools. He also launched a multi-year development initiative and pushed the company into new markets, such as aerospace and drone technology, by leveraging expertise in specialised processes like ColorForm. Through a focus on operational excellence, pricing discipline and capital efficiency, Stech guided the company to a significantly more resilient position compared to three years prior, despite the persistent downturn in injection moulding.

Musser brings to his new role extensive experience in transformation and finance. In his current capacity, he has already been closely involved with KraussMaffei Technologies, collaborating with its leadership to drive strategic initiatives and enhance operational performance. His qualifications include sharp analytical abilities, a strong grasp of industrial processes and a broad international perspective. An economist by training, Musser has accumulated over 20 years of leadership experience across various technology and industrial sectors. His background includes leading major transformation and turnaround projects at CRRC New Material Technologies, where he stabilised plant earnings in North America, as well as directing operational and financial restructurings during his time at Deloitte. He has also held roles with P&L responsibility, managing global supply chains and post-merger integrations at CRONIMET and has prior experience with automotive manufacturers including Daimler and Fujian Benz Automotive in China.

Alex Li, CEO, KraussMaffei Group, said, "Jörg Stech took on responsibility in a difficult situation, set clear priorities and launched decisive initiatives. The successful market launch of the LRXplus linear robot and the all-electric PX machine series, the consistent focus on profitability and the sustainable strengthening of our balance sheet are visible results of this work. We would like to express our sincere thanks to Jörg Stech for his leadership, integrity and team spirit. We value Dirk Musser as a leader who combines strategic clarity with operational excellence. In a short period of time, he has provided vital impetus for the transformation of the group and impresses with his analytical strength, decisiveness and deep understanding of our processes – not least through his successful collaboration with the managing directors of KraussMaffei Technologies. We are convinced that he will continue on this path with clarity and creative drive to successfully align KraussMaffei Technologies."

Stech said, "After many years in an environment full of technological, economic and geopolitical challenges, I look back with great gratitude on a time in which I was always surrounded by an exceptional workforce. Together, we achieved things that many initially thought were impossible. This cooperation, this willingness to push boundaries and create something new, was a joy for me. My special thanks go to all stakeholders in the company and, of course, to all employees. I leave with respect, gratitude and the conviction that this long-established company will continue to achieve great things in the future."

Musser said, "Together with my fellow managing directors Dr Frank Szimmat and Markus Bauer, I want to resolutely drive forward the further development of KraussMaffei Technologies. Our focus is on further expanding stability and performance and taking the necessary steps to successfully position the company in a dynamic market environment. I look forward to shaping this path together with our teams.”

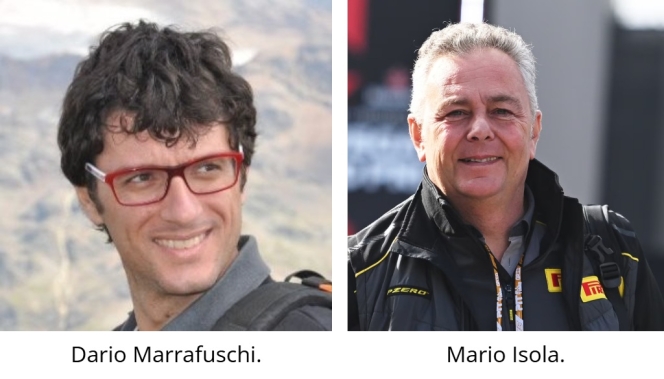

Dario Marrafuschi Succeeds Mario Isola As Pirelli’s Head Of Motorsport

- By TT News

- February 27, 2026

Italian tyre manufacturer Pirelli has announced that Dario Marrafuschi will become the Head of its Motorsport Business Unit, effective 1 March. He succeeds Mario Isola, who will remain with the company until 1 July to assist with the leadership transition.

Marrafuschi joined Pirelli in 2008 and has held positions within the Formula 1 Research and Development department. Most recently, he led the development of the company's road products.

He will report to Giovanni Tronchetti Provera, Executive Vice-President of Sustainability, New Mobility & Motorsport. The appointment comes as the company continues its role as the tyre supplier for various global motorsport categories.

Isola departs the company following a tenure that included the expansion of Pirelli’s motorsport operations. The company stated that Isola will pursue other professional opportunities following his departure in July.

Changing Tyre Dynamics In A Changing Car Market

- By Sharad Matade

- February 27, 2026

For Continental Tires India, the passenger vehicle market in India is entering a phase where scale and structure are finally aligning with its longstanding premium ambitions. Passenger vehicle sales reached a record 4.3 million units in 2024, expanding by 4–5 percent year on year, but it is the composition of that growth – rather than the headline volume – that is reshaping the company’s strategy. Utility vehicles now account for approximately 58 percent of total passenger vehicle sales, up sharply from about 51 percent the previous year, cementing SUVs and crossovers as the dominant force in the market.

This structural shift has direct consequences for tyre manufacturers operating at the upper end of the value spectrum. Larger vehicles bring higher kerb weights, bigger wheel diameters and greater expectations around refinement, safety and performance. For Continental, the change represents not merely an increase in addressable demand but a decisive move towards tyre categories where technology differentiation and pricing discipline can coexist.

Samir Gupta, Managing Director of Continental Tires India, calls this phase a turning point, not a temporary high. He says the surge in utility vehicles – driven by electrification and more premium cars – fundamentally changes the economics of the passenger tyre market in India.

“Let me clarify one thing first. The utility vehicle segment is no longer small. Last year, around 60 percent of passenger vehicles sold in India were utility vehicles, and including first-time buyers upgrading within this segment, the share goes beyond 65 percent,” Gupta says.

Industry data broadly supports this assessment. SUVs alone contributed close to three-fifths of all passenger vehicle sales in 2024, with compact utility vehicles accounting for a significant share of incremental volumes. The overall passenger vehicle market, at around 4.3 million units, has thus become structurally skewed towards larger formats – an inflection with long-term implications for tyre sizing, load ratings and product mix.

This shift shows in replacement demand. As vehicle footprints grow, rim diameters are increasing. “The market is clearly moving from smaller to bigger rim sizes. Demand for 17-inch and above tyres is rising sharply,” Gupta says. While these tyres are still a minority, their growth far outpaces the overall passenger tyre market.

Electrification is accelerating the shift. A substantial proportion of electric passenger vehicles sold in India today are SUVs, and Continental expects EVs to account for more than 50 percent of the passenger vehicle segment within five years. For tyre manufacturers, this creates new technical requirements – higher torque tolerance, lower rolling resistance and stringent noise control. “That creates a significant opportunity for us because our strengths lie in premium, high-performance tyres,” Gupta says.

Despite these favourable structural trends, premium tyres have historically struggled to gain traction in India. For much of the past decade, the market remained intensely price-sensitive, with tyres treated largely as commoditised replacement items. Continental’s response, Gupta explains, has been consistent rather than tactical pricing. “Right from the beginning, we have focused on fair pricing. The idea is simple – if we can clearly differentiate on performance and consistently deliver on those promises, price recovery will follow,” he explains.

The broader environment is now becoming more supportive. As vehicle prices rise and consumers migrate towards larger, more sophisticated vehicles, willingness to spend on tyres that enhance safety, comfort and driving confidence is increasing. This trend is also evident at the top end of the market. Premium and luxury passenger vehicle sales reached approximately 51,500 units in 2024, up around 6 percent year on year and crossing the 50,000-unit threshold for the first time – a symbolic marker of premium consumption in India.

Gupta sees premiumisation extending beyond luxury vehicles. “Earlier, India was extremely price-sensitive, but that is changing in higher segments. Consumers are upgrading vehicles and are more willing to invest in tyres that enhance safety, comfort and confidence,” he says.

The intensification of competition, with global premium tyre brands expanding or re-entering India, is viewed as a positive development. “Competition is always good,” Gupta says. “It gives you room to grow and improve.” More importantly, he believes it will help reframe the market. “More premium players will help move the market away from being purely cost-driven to being value-driven,” he adds.

Replacement market dynamics reinforce this view. Of the roughly 32–33 million passenger tyres replaced annually in India, tyres sized 17 inches and above account for about 12–13 percent. While the overall replacement market grows at 5–6 percent per year, this high-diameter segment is expanding at over 20 percent annually, closely tracking the shift in new vehicle sales.

This sharper focus on passenger tyres also explains Continental’s decision to exit the truck and bus radial segment in India. Gupta stresses that the decision was strategic rather than operational. Continental entered the TBR market in 2014, invested significantly and received strong feedback on product performance.

However, the economics proved limiting. Gupta says, “TBR in India is largely a B2B, fit-for-purpose market. Even if you have the best tyre, willingness to pay remains limited because fleet operators are under constant margin pressure.” Although commercial tyres offer higher absolute margins per unit, they consume substantially more raw material. “One commercial tyre uses six to eight times the raw material of a car tyre. Percentage margins are actually higher in passenger tyres,” Gupta explains.

After reviewing its portfolio, Continental chose focus over breadth. Exiting TBR allows the company to concentrate capital, technology and management attention on passenger and light truck tyres, where differentiation is more readily monetised. Gupta rejects the idea that a narrower portfolio weakens the company’s position. Commercial and passenger tyre customers, he argues, are fundamentally different – one driven by procurement economics, the other by consumer perception and emotion.

Indian consumers, Gupta believes, are becoming more tyre-aware. “Premiumisation is happening across the vehicle industry, not just in tyres. As consumers move to larger and more premium cars, their expectations also rise,” he says. Where tyres were once treated as an afterthought, buyers increasingly recognise their role in braking, grip, noise and overall driving confidence.

This change is evident at the retail level. Continental now operates more than 200 brand stores across India, and feedback from retail partners suggests customers are more informed and more demanding. Availability remains critical. “There is no point launching premium tyres if customers cannot find them,” Gupta says.

To support future demand, Continental is investing around INR 1 billion at its Modipuram plant, with the focus squarely on passenger and light truck tyres. The expansion will extend manufacturing capability from the current 20-inch limit to 22–23 inches, aligning local production with emerging vehicle trends.

Localisation, Gupta argues, is about adaptation rather than compromise. Indian road conditions, climate and driving habits require specific tuning without diluting global performance standards. Education and availability remain the principal challenges.

The recent launch of the CrossContact A/T² in India reflects this strategy. Introduced during Continental’s Track Day at Dot Goa 4x4, the product positions India among the early global markets for the tyre. “The first thing you notice is noise – or the lack of it,” Gupta says. “You hear the air-conditioning, not the tyre.” Ride comfort, grip and consistency across terrains define its appeal. As Gupta puts it, “Jahan tak soch jaati hai, wahan tak yeh tyre kaam karta hai.”

Looking ahead, Continental remains largely insulated from shifts in original equipment strategies, such as the gradual removal of spare tyres. Improved carcass design and stronger sidewalls are reducing puncture risk, but the company’s primary focus remains the replacement market.

For Gupta, the question is no longer whether India is ready for premium tyres, but how effectively manufacturers execute. “The market is finally ready for premium tyres,” he concludes. With passenger vehicle sales at record levels, SUVs firmly dominant and premium consumption expanding, Continental believes it is well positioned to grow alongside India’s evolving mobility landscape.

Falken Tyre Europe GmbH Rebrands As DUNLOP Tyre Europe GmbH

- By TT News

- February 26, 2026

Falken Tyre Europe GmbH has officially transitioned to operating under the name DUNLOP Tyre Europe GmbH, following its formal registration with the Offenbach Local Court. This change signifies a pivotal development for the Sumitomo Rubber Industries subsidiary. The rebranding represents a calculated and essential move to establish a more formidable European footprint for the DUNLOP brand. Company leadership acknowledges that this evolution is built upon the considerable equity established by Falken, including its strong market recognition, unwavering product quality and the commitment of its personnel.

This strategic shift positions the organisation under the umbrella of a globally respected marque, with its future strategy firmly centred on expansion, pioneering advancements and ecological responsibility. A prominent symbol of this new chapter will be unveiled shortly, with the renaming of the DUNLOP City Tower in Offenbach. A formal ceremony will mark the occasion, featuring the presentation of the DUNLOP logo at the tower. The event is set to be attended by Offenbach's Lord Mayor, Dr Felix Schwenke, alongside the company’s managing directors, Hiroshi Hamada and Markus Bögner, and the newly enlarged DUNLOP team.

Markus Bögner, Managing Director and President, DUNLOP Tyre Europe GmbH, said, “The name change is an important milestone of which we can be very proud. It strengthens our identity and underlines that we are ready for the next steps. Our strong heritage with Falken is and remains part of our success, laying the foundations for DUNLOP’s future in Europe. Our thanks go to all our employees and partners who have supported and accompanied us on this journey.”

Comments (0)

ADD COMMENT