Kokusai Drives Tyre Testing Into A New Era

- By Sharad Matade & Gaurav Nandi

- April 15, 2025

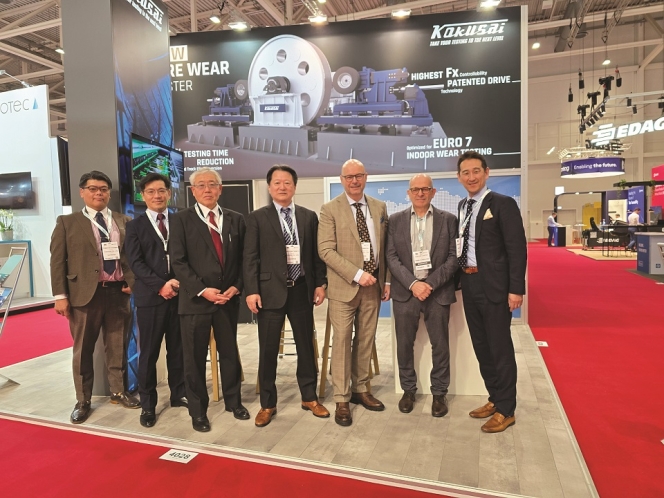

In an interview with Tyre Trends, Markus Winter, Director of Marketing and Sales at Kokusai Europe, and Kazuhiro Murauchi, Vice President and Head of Engineering at Kokusai Headquarter, share insightful perspectives on the fast-changing reality of tyre testing. With regulatory demands increasing and car technologies developing, Winter shares how the industry responds to new challenges presented by electric vehicles, tighter emission requirements and shifting consumer demands. With Kokusai manufacturing around 130 tyre test machines every year, Winter presents a special point of view regarding the technological advancements and market forces that are determining the future of tyre development and testing practices.

Every nook and cranny within tyre markets across the globe, big or small, is echoing a confluence of old and new practices in the age of new mobility. Attempts to constantly derive upcoming trends are massively influencing stakeholders within the tyre ecosystem as they mull over operational shifts for meeting future demands. The intricate world of tyre testing is also attuning itself to such changes to deliver a seamless transition to end users as progress unfolds.

Markus Winter, Director – Marketing and Sales, Kokusai Europe, contended that tyre testing has surged in recent times as emission norms become stricter and manufacturers methodically formulate new compounds to develop tyres for new-age vehicles.

“Over the past five to 10 years, tyre testing has undergone significant changes driven by regulatory pressures and evolving consumer expectations. In Europe, automotive manufacturers have prioritised high-speed uniformity testing to enhance ride comfort,” noted Winter while speaking exclusively to Tyre Trends.

“Simultaneously, there has been a strong industry-wide push towards improving wet grip, not only for new tyres but also for worn ones. More recently, with the introduction of Euro 7 regulations, the spotlight has turned to wear testing. The emphasis is on minimising microplastic emissions and fine dust particles, aligning with broader environmental and health concerns. As regulatory scrutiny intensifies, tyre manufacturers are expected to invest further in wear-reduction technologies, shaping the next phase of innovation in the industry,” he said.

“Simultaneously, there has been a strong industry-wide push towards improving wet grip, not only for new tyres but also for worn ones. More recently, with the introduction of Euro 7 regulations, the spotlight has turned to wear testing. The emphasis is on minimising microplastic emissions and fine dust particles, aligning with broader environmental and health concerns. As regulatory scrutiny intensifies, tyre manufacturers are expected to invest further in wear-reduction technologies, shaping the next phase of innovation in the industry,” he said.

The Japan-headquartered company that produces around 130 tyre testing machines each year believes that Euro 7 regulations will impose stringent limits on wear particle emissions, leading to a major shake-up within the global tyre industry.

The new rules, targeting a 30 percent reduction in particulate emissions, could disqualify a substantial number of current tyre models from original equipment (OE) fitment on new vehicles. While exact figures remain uncertain, industry estimates suggest that up to 50 percent of existing tyre types may be phased out, with some projections even higher. This has placed immense pressure on manufacturers to accelerate testing and compliance efforts.

The initial response from tyre makers will likely focus on outdoor testing, given its simplicity. However, there is growing consensus that standardised drum testing will be essential for consistent evaluation. Over the next one to three years, demand for advanced wear testing solutions is expected to surge, creating significant business opportunities for testing providers.

At the same time, the industry is closely monitoring regulatory discussions and standardisation efforts as test methodologies continue to evolve. Regional differences are evident with Japanese and European manufacturers prioritising distinct approaches to compliance.

While no dedicated testing equipment for wear particle emissions exists yet, there is increasing interest in integrating sensors and analytical systems into existing tyre wear testing frameworks.

As regulations tighten, companies positioned at the forefront of wear testing innovation will be well-placed to capitalise on the shifting market dynamics.

SHIFTING DYNAMICS

The rise of electric vehicles (EVs) is fundamentally reshaping the tyre testing industry. With EVs requiring bigger, heavier tyres and delivering significantly higher torque, testing methodologies must adapt to these changing dynamics.

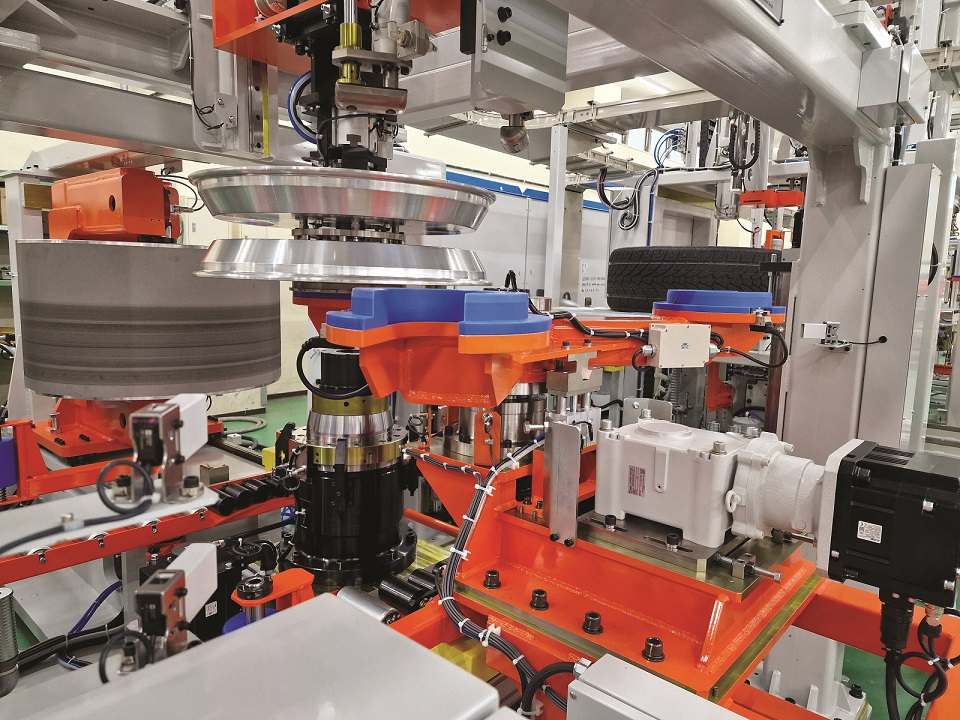

“With EVs demanding bigger, heavier tyres and generating higher torque, the industry must adapt. Our testing concepts are divided into two key areas including force and moment testing, which accounts for the torque and velocity changes and endurance testing such as tyre wear assessments. While high torque isn’t a requirement for endurance testing, these machines must still meet rigorous performance standards,” noted Winter.

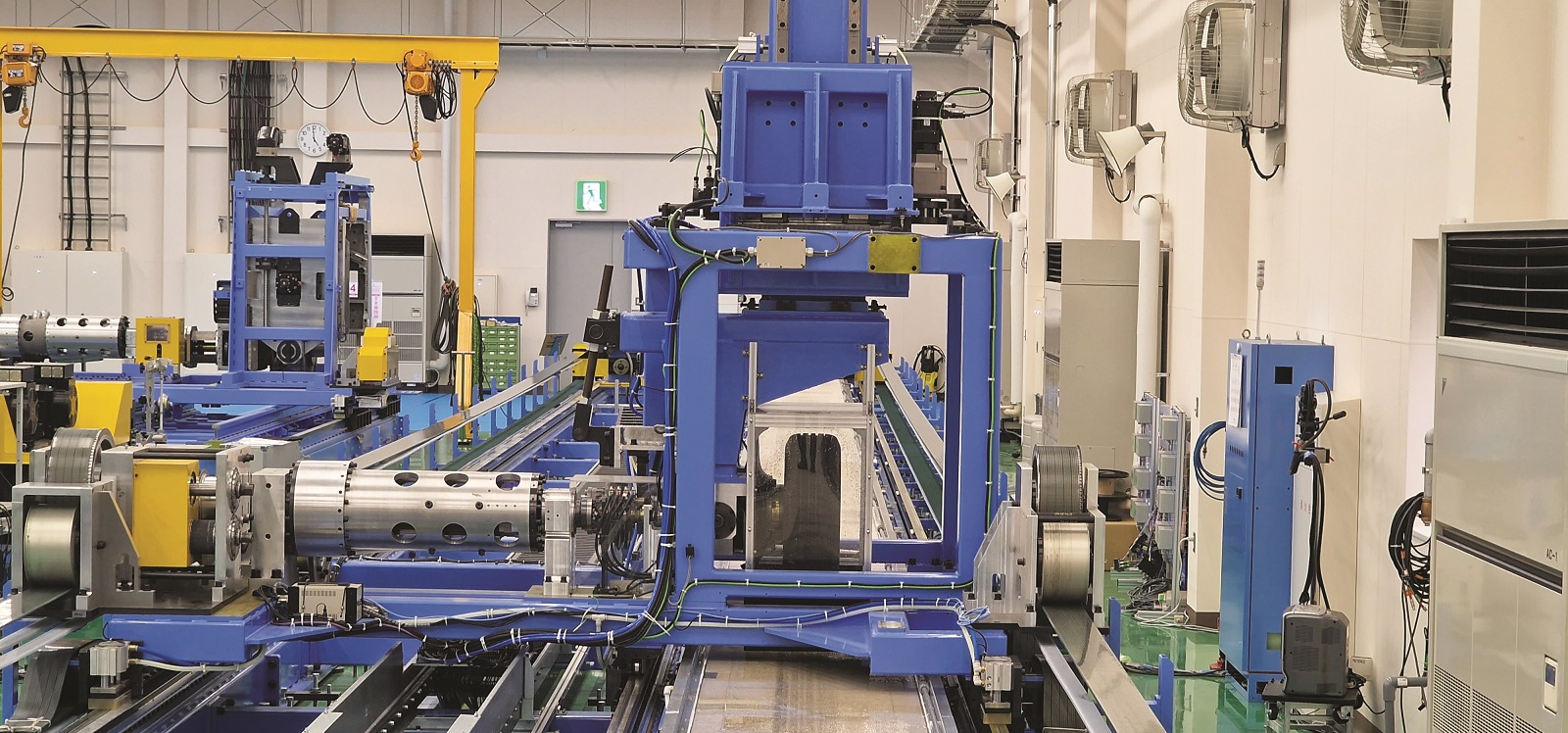

Another major transformation is the accelerated development cycle of new tyres. Previously, a single tyre model would take six months to a year to develop, but manufacturers are now introducing new models every three months. Each iteration features different materials, tread designs and wear characteristics, increasing the need for highly flexible and efficient testing solutions. “This shift creates a greater demand for flexible, high-throughput testing solutions. We’ve opened a technical centre in Tokyo, where manufacturers can evaluate new tyre designs and test methods in real time,” informed Murauchi.

Smart tyre technology is also influencing the testing landscape. According to the executive, tyre testing involved manually recording data such as temperature, pressure and wear characteristics in the past. Today, with the integration of tyre pressure monitoring system sensors and RFID tracking, data collection is becoming increasingly automated. These advancements allow for real-time analysis and improved accuracy in performance evaluations. Although not all tyres currently include RFID technology, the trend is clearly moving towards fully automated data integration.

High-speed uniformity testing is another area undergoing transition. “Demand for this type of testing peaked several years ago, particularly for performance and luxury vehicles. However, as EVs continue to grow heavier, the impact of uniformity variations at high speeds has diminished. A vehicle that is 500–800 kg heavier places less emphasis on tyre uniformity, making it less of a critical factor for the driver. Despite this trend, high-speed uniformity testing remains essential in laboratory settings, where it provides valuable insights into braking performance, torque application and wet grip. While production-line high-speed testing has seen a slight decline, laboratory testing remains a necessary step in ensuring that EV tyres meet safety and performance standards,” noted Winter.

Investment trends in the industry also reflect this evolving landscape. Many tyre manufacturers are opting for outdoor testing because it requires lower upfront investment. Outdoor tests can be conducted by hiring test vehicles and drivers rather than investing in costly laboratory equipment.

Nonetheless, core testing parameters such as uniformity, geometry and balance will remain essential despite the shifts, noted the executive.

INTELLIGENT MACHINES

Winter noted that artificial intelligence (AI) will also play a significant role in tyre testing, particularly in analysing wear test results. While machine builders focus on developing equipment that ensures precise and reproducible testing conditions, AI is increasingly being used in areas like shearography testing.

“For now, AI’s role in direct test result analysis remains limited as interpreting the data largely falls to manufacturers. Testing machines must guarantee consistent results under identical conditions ensuring uniform abrasion rates. However, manufacturers leverage AI to assess tread compounds and wear conditions, an area beyond the machine builder’s core business,” said Murauchi.

Software is also becoming increasingly important in tyre testing, though integration varies by manufacturer size. Major companies prefer to use proprietary quality tools and focus on seamless data integration.

Smaller manufacturers, however, seek guidance on handling test data, creating opportunities for collaboration with software firms.

Despite handling vast amounts of test data, the company is not pursuing a business model centred on data analytics or test services. Some competitors have expanded into internal testing and data-driven solutions, but this firm remains committed to machine building.

UPGRADING SYSTEMS

Customers today are increasingly seeking testing machines that can be upgraded rather than replaced after 15–20 years. Their expectation is to minimise costs while extending the machine’s lifecycle, though upgrading a machine directly in a customer’s plant at minimal cost is not always feasible. Despite this, manufacturers are focusing on designing equipment that allows for easier upgrades over time.

“One key aspect of this shift is the move away from hydraulic systems. All of our testing equipment is now fully electric, whether it is a compression tester, steering tester or vibration tester. This transition was influenced by Japan’s experience with earthquakes, particularly the 2011 disaster that led to power shortages. Following the Fukushima incident, the Japanese Government required manufacturers to reduce power consumption by 15 percent. Unlike hydraulic systems, which require stable oil temperature and pressure, our fully electric machines can be turned on and off instantly, making them more energy-efficient and reducing operational downtime,” averred Murauchi.

“One key aspect of this shift is the move away from hydraulic systems. All of our testing equipment is now fully electric, whether it is a compression tester, steering tester or vibration tester. This transition was influenced by Japan’s experience with earthquakes, particularly the 2011 disaster that led to power shortages. Following the Fukushima incident, the Japanese Government required manufacturers to reduce power consumption by 15 percent. Unlike hydraulic systems, which require stable oil temperature and pressure, our fully electric machines can be turned on and off instantly, making them more energy-efficient and reducing operational downtime,” averred Murauchi.

The focus on energy efficiency extends to long-term improvements in machine performance. Over the years, the company has developed systems that significantly reduce electricity consumption. Since tyre wear testers run for long durations daily, its energy usage directly impacts operating costs.

“We developed an innovative drive concept that provides force-synchronised control of the drum and test tyre, allowing tyre slip to be precisely applied via a highly dynamic torque-on-demand system. Combined with our specially adapted load case collective, this new system achieves a nearly 90 percent reduction in energy consumption compared to conventional hydraulically driven wear testers. As a result, we can dramatically reduce the running cost for our customers. The first sets of these advanced systems have already been successfully implemented at a major Japanese company, demonstrating the effectiveness of our energy-efficient approach,” revealed Winter.

REGULATORY CHANGES

Regulations play a critical role in shaping the tyre testing industry as manufacturers continuously adapt to new requirements. Winter anticipates significant regulatory changes, particularly in Europe and Asia, over the next four to five years that will impact tyre testing and development.

“One of the key upcoming regulations is related to tyre wear. There is increasing focus on how quickly tyres wear out and how that affects road safety and environmental impact. In addition to wear, the wet grip performance

of tyres is expected to come under stricter regulations, pushing manufacturers to provide more transparent data on its products’ real-world performance. Another area of growing interest is tyre lifespan, particularly for commercial truck and bus tyres. Customers are becoming more focused on the overall service life of tyres rather than just wear resistance, which means testing procedures may need to evolve,” said Winter.

“Tyre safety is another area where regulations are expected to tighten. In the past, tyre testing has primarily focused on new tyres, but we foresee that future regulations may require testing on worn tyres as well. This is because a new tyre performs optimally, but its behaviour can change significantly after use. Factors such as tread depth, air pressure variations and temperature fluctuations influence how a tyre performs over time, and regulators may demand better data on these aspects,” he added.

Currently, tyre testing is done under standard conditions, but in reality, tyres are used in extreme temperatures ranging from sub-zero to scorching heat. With the rise of autonomous driving, there is an increasing need for tyres to be tested in a variety of weather conditions.

Future regulations may require more comprehensive testing to ensure that tyres perform predictably across different temperatures, humidity levels and road conditions. Autonomous vehicle systems will likely rely on detailed tyre performance data to make real-time driving decisions, which could drive the development of new testing methodologies.

FOOTPRINT

Asia remains the strongest market for the company, where it has established itself as the market leader with deep customer relationships. While competition is intense in Europe, the company has tested its machines with premium manufacturers and is adapting its equipment to meet the specific needs of different tyre makers.

The company is deploying pilot projects across various segments including passenger car and truck tyres to expand in Europe. These initial installations allow for extended testing before securing approvals to participate in larger procurement processes. In contrast, the wear tester segment is less competitive with only a few global suppliers, positioning the company as a key player with extensive collaborations worldwide. The focus now is on strengthening technical partnerships, installing pilot units and integrating its solutions within the operational frameworks of major tyre makers.

The company has set a target to expand capacity to 150 units per year, potentially by the end of 2025. While European markets face margin pressures, the company’s challenge lies in scaling up production in Asia, US and Europe to meet growing global demand.

Radar Tires Appoints Paul Stahoviak As Territory Sales Manager

- By TT News

- July 01, 2025

Radar Tires has appointed industry veteran Paul Stahoviak as its new Territory Sales Manager for North America. In this strategic role, Stahoviak will spearhead the expansion of Radar's Midwest operations while developing the company's premium Radar Elite Dealer (RED) network. The automotive expert brings four decades of experience working with leading manufacturers and retailers to this position.

Radar Tires has achieved remarkable growth in recent years through continuous product innovation and progressive business strategies. Since entering the US market in 2006, the company has also built a reputation for corporate social responsibility, contributing millions to meaningful initiatives such as breast cancer awareness. By combining high-performance tyres with a commitment to purpose-driven business practices, Radar continues to strengthen its position in the competitive tyre industry.

Rob Montasser, Vice President of Radar Tire, North America, said, “Paul’s deep knowledge of the industry, combined with his relentless energy and positive attitude, makes him a great addition to the Radar team. His longstanding relationships and reputation for excellence will help us continue building strong partnerships and expanding our footprint across the Midwest.”

Stahoviak said, “I’m excited to join Radar Tires and help drive the growth of this great brand. I’m passionate about building lasting relationships with our partners and helping our brand succeed in the marketplace.”

- Audi

- Sebastian Gramstat

- Euro 7

- European Tyre and Rim Technical Organisation

- ETRTO

- U.S. Tire Manufacturers Association

- USTMA

In Need Of Uniform Regulation For Emissions

- By Sharad Matade & Gaurav Nandi

- June 30, 2025

As vehicle emissions regulations evolve, the lack of global uniformity is becoming a growing concern for OEMs and tyre manufacturers. With disparate standards across regions, companies are forced to navigate a complex regulatory maze, straining research and development and production resources. The shift towards electric mobility coupled with heightened focus on non-tailpipe emissions, such as tyre and brake abrasion, further amplifies the need for harmonised frameworks. Industry leaders including Audi’s Sebastian Gramstat argue that collaboration across borders and sectors is essential not just for compliance but for meaningful progress in sustainability and innovation.

Tyre regulations are rules and standards established to ensure that tyres used on vehicles meet safety, environmental and performance criteria. The impetus on new and updated regulations is also growing across regions to reduce pollution brought about by tyre abrasion, rolling noise etc.

The ECE R30, ECE R117, EU Tyre Labelling Regulation (2020/740), which is implemented within the European countries, or JIS Standards of Japan, CCC Certification of China, AIS 142 and BIS Certification of India and FMVSS, DOT Code and UTQG of the United States are different region-specific regulations aiming for a same outcome.

But the vastness of these regulations poses as a challenge for automobile OEMs and tyre makers alike as a lot of energy and resources have to be diverted within production and research and development lines to meet these standards.

Furthermore, the advancement of electric mobility and changes in vehicle dynamics are also slated to impose new regulations worldwide. Hence, the need for a uniform regulation has become a precondition.

Speaking to Tyre Trends on the need for uniform regulations, Dr Sebastian Gramstat, Senior Expert Development Brake System, Audi AG, averred, “Our company delivers products globally and having a unified standard is far more efficient than navigating a patchwork of regional requirements and regulations. Harmonisation brings clear operational and strategic advantages. That’s why we actively support and participate in standardisation and harmonisation working groups.”

“The European Union is involved through bodies such as the Joint Research Centre (JRC), but we also recognise the unique demands of other markets, particularly the US, where customer expectations can diverge significantly. These are often beyond the immediate scope of EU regulators. Our role is to help connect these dots by facilitating dialogue, sharing insights and contributing to building a global standard that benefits the entire ecosystem. We believe this collaborative approach is not only useful but essential to moving the industry forward,” he added.

“The European Union is involved through bodies such as the Joint Research Centre (JRC), but we also recognise the unique demands of other markets, particularly the US, where customer expectations can diverge significantly. These are often beyond the immediate scope of EU regulators. Our role is to help connect these dots by facilitating dialogue, sharing insights and contributing to building a global standard that benefits the entire ecosystem. We believe this collaborative approach is not only useful but essential to moving the industry forward,” he added.

The need for uniformity is exacerbated as OEMs and tyre makers continuously amp up research and development efforts to curb noise and air pollution from tyres. “Noise pollution, particulate matter or overall tyre wear remains a challenge. And the first step to tackle it is collaboration to develop a standardised method for accurately measuring tyre abrasion and wear. We are also working on such collaborations. Without reliable quantification, you can’t evaluate whether any mitigation measure is actually effective,” said Dr Gramstat.

He added, “This method needs to be robust, applicable across a wide range of real-world scenarios and globally accepted. That’s why we’re collaborating not only with industry partners and academia but also with regulatory authorities. This effort is taking place under the auspices of the United Nations and involves close coordination with national bodies, ministries and the European Commission. The goal is to ensure that the methodology we develop isn’t just technically sound but also internationally harmonised with Euro 7 regulations and integrated into UN regulations so it can be implemented consistently across Europe, North America, Asia and beyond.”

THE EURO 7

Tyres are a crucial component of overall vehicle design to the extent that many OEMs have dedicated in-house departments focused solely on tyre development, including Audi AG. While tyres aren’t developed in isolation, the process involves close collaboration with manufacturers to meet specific, often bespoke, requirements. These custom specifications ensure the tyre aligns with the car’s performance targets and regulatory demands including type approval.

When selecting a tyre, OEMs weigh multiple parameters; safety, performance and comfort are chief among them. But increasingly, attention is also given to sustainability and economy. Factors like tyre abrasion, longevity and fuel efficiency are becoming just as critical, particularly as regulatory frameworks begin to formalise such requirements.

Ultimately, the process involves balancing trade-offs. As Dr Gramstat put it, no tyre can deliver 100 percent on every metric. The goal is to find the best possible compromise – one that supports a premium product and meets both regulatory standards and consumer expectations.

Euro 7 is the upcoming EU vehicle emissions regulation set to take effect from 2025 for cars and vans and 2027 for trucks and buses. It introduces stricter limits on nitrogen oxides, carbon monoxide and particulate emissions, covering both combustion and electric vehicles.

It also regulates brake and tyre emissions and requires compliance under real driving conditions. It aims to cut air pollution, support the European Green Deal and standardise emission rules across vehicle types.

Alluding to whether the industry is ready to adopt the regulation, Dr Gramstat noted, “The industry is well-positioned for adoption. The European Tyre and Rim Technical Organisation (ETRTO) plays a central role in coordinating the efforts of tyre manufacturers across the continent, including legacy European brands and Asian manufacturers, with research and development and production facilities in Europe. Beyond Europe, we’re seeing strong international engagement. U.S. Tire Manufacturers Association (USTMA) is actively involved, and on the global standards side, ISO is working in parallel to develop the necessary technical frameworks. Stakeholders from China are also contributing significantly. This is no longer just a regional conversation but a truly global initiative. Experts from continents are collaborating to align regulatory, technical and industrial priorities, ensuring the tyre industry is prepared to meet the evolving demands of Euro 7 and beyond.”

Further outlining the impact of the regulation, he said, “Tyre manufacturers have largely operated under internal benchmarks for metrics like mileage and abrasion till date. Euro 7 represents a shift towards formal regulation, creating a harmonised framework that applies to the entire industry. This will undoubtedly influence existing design priorities. There’s a complex interplay between various tyre performance criteria such as wet grip, rolling resistance, noise and abrasion. Regulatory limits on one can impact the others, so the challenge will be to minimise trade-offs while maintaining overall performance. At this stage, it’s difficult to offer a one-size-fits-all answer. The impact will vary depending on vehicle type.”

REPLACEMENTS

Premium automobile OEMs like Audi have been using tyres from premium European tyre makers for decades. But as the status of Asian manufacturers changes, there might be room for such companies within the supply chain of premium car makers.

“At the end of the day, it’s not about the brand label but meeting the technical and performance specifications we define. Whether a supplier operates in the premium or high-volume segment, what matters is its ability to fulfil our requirements. If a manufacturer can meet those benchmarks and is willing to collaborate and co-develop with us, then they’re absolutely welcome. Competition in the supplier landscape is a positive force. It drives innovation, efficiency and ultimately better outcomes for the end consumer. We believe valuable ideas can come from any corner of the market and we’re open to partners who share our commitment to quality, performance and progress,” said Dr Gramstat.

He also acknowledged that there is a growing trend within the company to include tyres made from renewable and recycled materials. “The move towards sustainable materials is more than a marketing exercise. It’s becoming embedded in product development strategies across the industry. We’re already seeing recycled content being integrated into certain product lines, and the ambition from suppliers to scale this up is very real. What’s encouraging is that this isn’t limited to one-off pilot products. There’s genuine momentum towards making sustainability a core part of tyre manufacturing. For us, this aligns with our broader sustainability goals, and we see it as a critical area of innovation moving forward,” said Dr Gramstat.

However, the executive emphasised the importance of maintaining a balance too. According to him, sustainability is just one of several key factors in vehicle design while others include safety, comfort, performance and cost. He stressed that no single aspect, including sustainability, could come at the expense of another.

To meet these multi-dimensional goals, additional research and development efforts are required to create a product that meets safety and performance standards while also addressing environmental concerns. Economy remains a consideration as well. Internal research conducted under a European-funded project suggested that customers are, in fact, willing to pay a premium for more sustainable products but only up to a point. Price sensitivity remains a limiting factor.

Turning towards next-generation tyre concepts such as airless tyres, Dr Gramstat noted that innovative ideas like this were once viewed as distant possibilities but are now gaining traction. He cited the LEON-TI project from four years ago, in which airless tyre prototypes were first explored. Since then, similar concepts have been tested by various companies, including in pilot programmes for commercial delivery fleets in Asia.

Although these innovations show promise, particularly for reducing noise emissions and improving durability, they are still in advanced development stages.

THE FUTURE IS CHANGING

As the automotive industry moves towards electrification, the conversation around ‘zero-emission’ vehicles is evolving. Dr Gramstat acknowledged that while electric vehicles eliminate tailpipe emissions, other sources of pollution such as brake and tyre abrasion remain unaddressed in regulatory terms.

Currently, there are no standardised methods for measuring particulate emissions from these sources, but the industry is actively working on it. According to the executive, regulatory bodies and stakeholders are collaborating to develop measurement frameworks. Once these standards are in place, automakers will be able to quantify non-tailpipe emissions and provide a more accurate assessment of a vehicle’s overall environmental footprint.

The executive stressed that collaboration across the value chain is essential, especially between vehicle manufacturers and tyre companies. Such partnerships already exist within serial and advanced development efforts, including participation in the United Nations’ GRBP task force, which brings together manufacturers, tyre associations and regulators to advance tyre abrasion standards.

Weight reduction remains another key challenge. Automakers continue to look for ways to decrease vehicle mass but face constraints. Safety regulations now require more sensors and electronic control units (ECUs), which cumulatively increase vehicle weight. Although each component adds little individually, the growing number of sensors and accompanying wiring has a significant cumulative impact.

As for tyre development, the question of smart tyre was also addressed. While such technology offers valuable insights during research and development phases, Dr Gramstat expressed scepticism about its near-term viability for mass-market vehicles.

RPM Automotive Taps Fornnax Tech to Boost Tyre Recycling in Australia

- By TT News

- June 26, 2025

In a major step toward sustainable waste management, RPM Automotive Group has partnered with Fornnax to enhance its tyre recycling capabilities in Australia.

As part of the initiative, RPM has integrated Fornnax’s high-capacity SR-200 HD primary shredder into its operations, significantly improving recycling efficiency and material quality.

The collaboration supports RPM’s broader environmental goals and positions the company to process over 180 tonnes of used tyres weekly, with plans to scale beyond 300 tonnes. The move is expected to help RPM capture up to 5 percent of Australia’s national market share in tyre recycling.

Jignesh Kundaria, Director and CEO, Fornnax, said, "At Fornnax, we understand the urgency of addressing end-of-life tyre waste, not just in Australia but globally. The SR-200 HD Primary Shredder is designed for exceptional efficiency, enabling RPM to process vast quantities of discarded tyres while maintaining optimal operational performance. This collaboration showcases our dedication to providing our clients with the robust, high-performance solutions they need to excel in the circular economy."

RPM’s 3,500 sqmt facility not only boosts recycling output but also transforms waste tyres into rubber-based materials for road projects and industrial fuel. Leveraging its distribution network, the company aims to recycle up to 54,000 tonnes of tyres over five years.

The initiative aligns with Australia’s 2021 ban on tyre waste exports and underscores the urgent need for local recycling solutions.

- Himadri Speciality Chemical

- HSCL

- Dalmia Bharat Refractories

- DBRL

- Birla Tyre

- Anurag Choudhary

- Dr Chandra Narain Maheswari

Birla Tyre Unveils New Brand Identity To Position Itself As A High-Performance Brand

- By MT Bureau

- June 18, 2025

Birla Tyre has launched a new brand identity featuring a redesigned logo and corporate website, marking a major step in its transformation journey under new ownership. The company, now backed by a consortium led by Dalmia Bharat Refractories (DBRL) as Resolution Applicant, and strategic partner Himadri Speciality Chemical (HSCL), aims to position itself as a premium, high-performance and future-ready brand.

The company plans to roll out a multi-platform marketing campaign and focus on re-entering key markets, expanding distribution and strengthening its product portfolio.

The refreshed identity reflects Birla Tyre’s renewed focus on speed, innovation and excellence. The new logo includes a custom wordmark symbolising forward motion and a tiger motif – called ‘Tyger’ – representing power, agility and leadership. The blue and orange colour scheme signifies trust and optimism.

Anurag Choudhary, Chairman and Managing Director & CEO, Himadri Speciality Chemical, said, “This rebranding is more than merely a visual transformation; it is a reaffirmation of our dedication to purposeful development and progress.”

Dr Chandra Narain Maheswari, Whole Time Director & CEO, Dalmia Bharat Refractories, said, “Our new logo encapsulates the essence of Birla Tyre, which is founded on four fundamental pillars: a legacy that motivates boldness, a product line that is prepared for the future, an unwavering commitment to continuous innovation and a oneness with world around us. As this new identity signals Birla Tyre’s readiness to meet the evolving needs of the automotive industry with energy, innovation, and purpose.”

- Kumarswamy CE

- Kumarswamy CEThat is good news…but what about public shares which were purchased before insolvency?? Will they be reallocated under new brand ?

Reply

Comments (0)

ADD COMMENT