Collaboration Is A Growing Need!

- By Sharad Matade & Gaurav Nandi

- June 30, 2025

The tyre industry has undergone significant changes over the past century, particularly in material composition and performance optimisation. While the external appearance of tyres may remain similar, advancements in rolling resistance and the integration of sustainable materials have reshaped the sector. Michelin, alongside its competitors, has been embracing innovation through collaborations to meet its ambitious 2050 sustainability goals, focusing on using 100 percent renewable and recycled materials. However, the challenge lies in scaling up recycling technologies and ensuring effective sorting. As the industry shifts, RFID technology and extended producer responsibility (EPR) regulations are emerging as critical tools for achieving material circularity and enhancing recycling efficiency.

Tyres have changed in the last 100 years. While the basic shape and colour might look the same, the internal composition has evolved significantly. Over the past century, and especially in the last 30 years, there have been major advances. One of the most significant has been the improvement in rolling resistance. Achieving lower rolling resistance without compromising grip has been a major technical challenge, and it has had a direct impact on fuel efficiency. In parallel, there’s been increasing focus on using more sustainable materials in tyre manufacturing. So, while it might not be obvious from the outside, there’s been substantial innovation under the surface.

However, it is a well-known fact that the tyre industry is secretive. Companies keep their research and development as tight as possible, but endeavours for including recyclable materials seem to break that ceiling, prompting towards collaborations.

Speaking exclusively to Tyre Trends, Sander Vermeulen, Vice President for End-of-life Rubber Products Recycling Business at Michelin, said, “There is a growing need and momentum for tyre companies to work more closely together, particularly around sustainability and materials innovation. Many companies have set ambitious goals for 2050, which include using 100 percent sustainable materials, achieving full recyclability or becoming carbon neutral. While each company may define these goals differently, the overarching direction is very similar.”

“A good example of this shift is our recent collaboration with Bridgestone through the ‘Call for Action’ initiative. We discovered that both companies shared similar long-term ambitions. One major challenge we identified was the scalability of innovations, especially from recycling companies. Many of these innovations work well at small scale, but scaling them up to meet the needs of the global tyre industry is a different story. What’s promising is that instead of working in silos, we began engaging in open dialogue. Both Michelin and Bridgestone were receiving proposals for new materials but often found them unsuitable for tyre applications. Rather than simply rejecting these proposals, we asked that how we can help these suppliers improve the products,” he added.

“A good example of this shift is our recent collaboration with Bridgestone through the ‘Call for Action’ initiative. We discovered that both companies shared similar long-term ambitions. One major challenge we identified was the scalability of innovations, especially from recycling companies. Many of these innovations work well at small scale, but scaling them up to meet the needs of the global tyre industry is a different story. What’s promising is that instead of working in silos, we began engaging in open dialogue. Both Michelin and Bridgestone were receiving proposals for new materials but often found them unsuitable for tyre applications. Rather than simply rejecting these proposals, we asked that how we can help these suppliers improve the products,” he added.

He noted that together the tyre makers started defining shared specifications that outline the minimum criteria a new material must meet to be viable for tyre manufacturing. “It’s not a guarantee of adoption, but it provides a clear, transparent benchmark. And if a material doesn’t fall within that box, we can save time for ourselves and the suppliers,” added Vermeulen.

He also quipped that he had never imagined working so openly with a competitor like Bridgestone whilst strictly respecting antitrust rules. But the experience has been incredibly constructive.

Michelin’s 2050 target is bold as it seeks to make 100 percent of its tyres from renewable, recycled or sustainable materials. Recycling sits at the core of that ambition. Internally, the company is aligning efforts across departments to meet this goal with a near-term milestone of 40 percent sustainable content by 2030.

That percentage includes both recycled and bio-based materials. However, Michelin isn’t developing recycling technologies in-house. Instead, it’s working with a network of external partners to identify and scale promising innovations.

Among its collaborators are Enviro and Infiniteria as well as broader initiatives like Biobutterfly and the WhiteCycle consortium, which focuses on recovering textile fibres for tyres. The company remains open to any solution that can help close the loop on tyre materials.

As of the most recent annual report, Michelin reported that 31 percent of the materials used in its tyres are either renewable or recycled. This figure reflects the combined share of both categories, not recycled content alone.

Opining on whether recycled materials are easier to use in commercial or passenger tyres, Vermeulen said, “It really depends on the specific application. Some applications allow for a higher percentage of renewable or recycled content than others. But we don’t break down our targets or current performance by tyre category. The current figure we’ve communicated in our annual report is a global average across all types of tyres.”

EVOLVING VALUE CHAIN

As tyre companies remain steadfast towards the respective goals of using recycled and renewable materials, a glaring question that remains is the fate of current suppliers. Explaining how the value chain will be impacted once tyre companies reach the goals, Vermeulen stated, “They will also need to adapt. The entire value chain must evolve. That means synthetic rubber producers and oil suppliers need to develop renewable or recycled versions of the materials they currently provide. Everyone, from upstream raw material providers to downstream manufacturers, will need to contribute if we’re going to meet these ambitious goals.”

Commenting on whether such shift will restructure the entire tyre industry, he said, “It’s hard to make specific predictions, but one thing is clear that the entire value chain is already beginning to change. All raw material suppliers now understand the direction tyre manufacturers are heading. We’re already seeing many traditional suppliers exploring new approaches to reduce the reliance on fossil-based materials. Some are developing recycled alternatives, while others are exploring biobased feedstocks.”

“In this effort, a concept we explored in a large-scale European project was called BlackCycle. It brought together various actors from the entire tyre industry value chain including raw material suppliers and other stakeholders to map out how we can extract maximum value from end-of-life tyres. It looked at viable recycling pathways including how pyrolysis oil can be integrated into chemical supply chains. We all need to work together to co-create solutions based on renewable and recycled materials,” he added.

Michelin doesn’t plan to produce recycled materials itself. Instead, its focus is on defining performance and quality specifications, then partnering with companies ranging from start-ups to established suppliers that can deliver materials meeting those standards.

Commenting on the same lines, he added, “The entire tyre industry has a strong interest in gaining access to recycled materials that can be reused in new products. And to achieve that, partnerships are essential. There’s no way we can meet these ambitions if every company stays within its traditional boundaries and works in isolation. We believe in collaborating across the value chain. Often, smaller companies have breakthrough technologies or innovative ideas but lack the resources or infrastructure to scale. In those cases, if we can help them access funding or industrialise the processes, it’s a win-win for the industry as a whole.”

While performance gaps between recycled and virgin materials are a known concern, Michelin sees scalability as the more critical barrier. Many recycling innovations show promise at the lab or prototype level, but few are ready for industrial-scale production.

To bridge that gap, Michelin and others in the sector are working closely with innovators to help mature these technologies to meet industry demands.

REGULATION & TECHNOLOGY

The extended producer responsibility (EPR) has been a staunch advocate for recycling end-of-life tyres across countries. The regulation is not only limited to European markets but has expanding into countries like India too.

Commenting on whether EPR regulations will help drive more effective recycling, Vermeulen said, “Extended producer responsibility plays a key role in tyre recycling by making manufacturers responsible for collecting and recycling tyre after use. In countries with EPR laws, such as most of Europe, producers and importers must ensure proper tyre collection and recycling. This legally mandates tyre producers to manage the end-of-life stage of the products. However, EPR is not the only model that can ensure effective recycling. In regions without EPR, like the United States, tyre recycling is still managed through a free-market system driven by industry and service providers. Even in Germany, which lacks an EPR law, tyres are still collected and managed properly through industry-driven solutions.”

“While EPR can certainly help in places with limited infrastructure, the key to effective tyre recycling lies in how well the system is organised. Whether through EPR or free-market models, both can be effective as long as the collection and recycling infrastructure is well established,” he added.

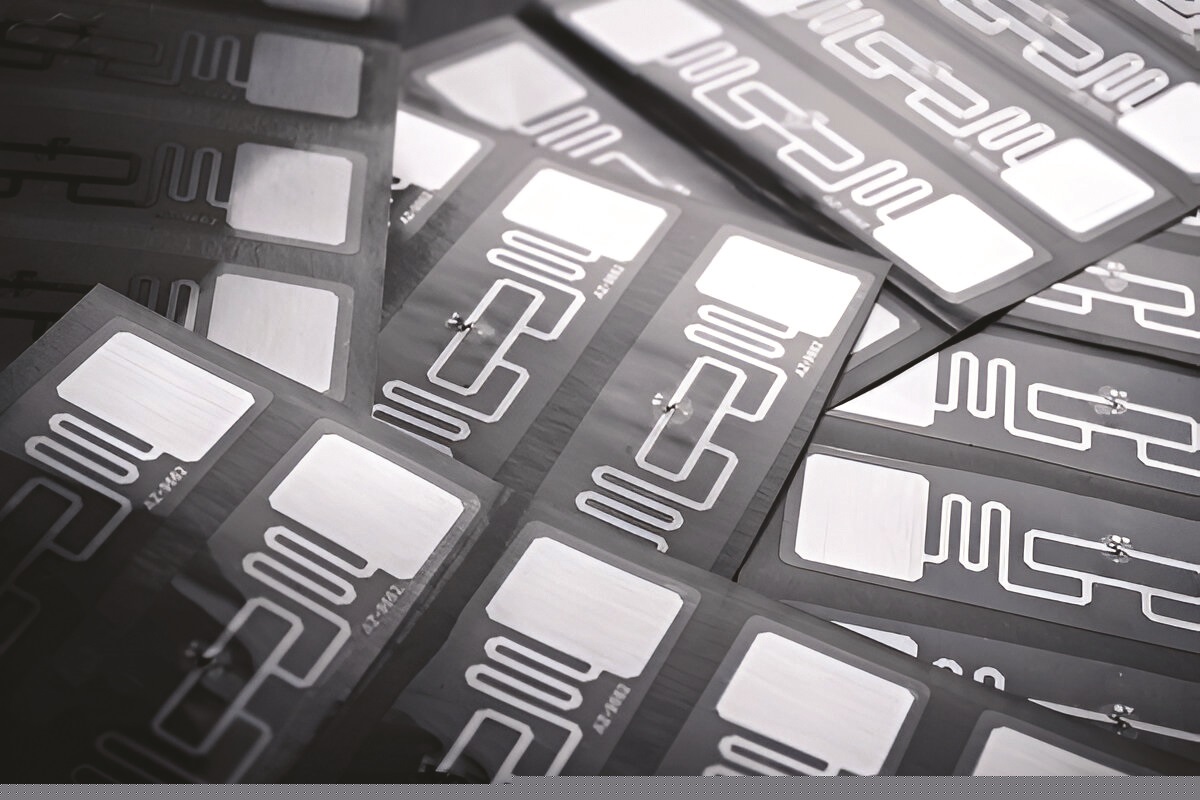

Vermeulen also views RFID technology as a crucial enabler for achieving material circularity in the tyre industry. By embedding RFID tags, tyres can be tracked and identified with precise information about its composition, helping to streamline the recycling process. This technology allows for better sorting of tyres based on specific material make-up, which is critical for maximising the quality of recycled materials.

Just as with household recycling, the challenge is to ensure that materials are sorted effectively. With too many sorting categories, costs rise without guaranteeing better quality. RFID makes it easier to identify the correct ‘bin’ for each tyre, whether it’s a winter, truck or passenger car tyre.

Additionally, RFID can help differentiate between new, retreaded and partially worn tyres, which often have varying materials and recycling needs. This enables more efficient sorting, improving the overall quality of the recycling output while keeping costs manageable. Michelin sees RFID as an essential tool in making the recycling process more effective and economically viable.

Zeon And Visolis Sign Binding Term Sheet To Advance Bio-Isoprene And SAF Commercialisation

- By TT News

- February 16, 2026

Zeon Corporation and Visolis Inc. have formalised their partnership by signing a binding term sheet, marking a pivotal advancement in the commercialisation of bio-based isoprene monomer and sustainable aviation fuel (SAF).

This collaboration, which now moves from technology verification towards project implementation, is built upon the progress made since their initial memorandum of understanding in March 2024 and the subsequent joint feasibility study announced in April 2025. Bio-based isoprene monomer serves as an essential component in the production of synthetic rubbers and various other materials, while SAF is increasingly recognised as a critical next-generation fuel for reducing carbon emissions within the aviation industry.

The newly established term sheet outlines a foundational agreement on the key elements required for a final investment decision. These include defining the business structure and the respective roles of each company, establishing technology and development strategies and advancing detailed engineering for the proposed production facility. Furthermore, the agreement covers the evaluation of potential sites, the process for engaging with suppliers, securing necessary regulatory approvals and planning the financing pathway.

The envisioned facility is set to commence commercial-scale output after successfully demonstrating mass production capabilities for biomass-based isoprene and SAF, utilising Visolis’ proprietary technology. Both companies are now committed to expediting the path to full-scale production and ensuring a steady supply of these sustainable products to the global market.

Zeon Backs Chemify To Accelerate Digital Chemistry Innovation

- By TT News

- February 12, 2026

Zeon Corporation has deepened its commitment to digital chemistry through a strategic investment and partnership with Chemify Limited, secured via its corporate venture arm Zeon Ventures Inc. Chemify, a growth-stage UK enterprise, is reshaping molecular research by integrating digital tools with automated laboratory systems. Its proprietary Chemputation technology translates molecular targets into executable chemical code, which operates directly on robotic platforms to complete integrated Design–Make–Test–Analyze cycles without manual intervention. This closed-loop automation allows Chemify to explore previously inaccessible areas of chemical space while reducing the timeline from concept to synthesized compound by up to tenfold.

A cornerstone of Chemify’s capability is its recently inaugurated Chemifarm in Glasgow – one of the most sophisticated automated facilities in the world for molecular design and construction. The facility enables accelerated iteration and autonomous synthesis of novel small molecules, converting chemical code into tangible compounds with unprecedented efficiency. These advances are critical for developing functional, synthesisable molecules that can contribute solutions to urgent global issues spanning public health, energy efficiency and environmental protection.

Zeon has been at the forefront of adopting digital methodologies in chemical R&D, recognising their transformative potential from an early stage. This investment is positioned to strengthen Zeon’s internal digital chemistry efforts and catalyse the invention of novel materials capable of addressing complex societal needs. The move aligns with Zeon’s STAGE30 corporate strategy, which targets a rise in revenue contribution from four key growth sectors – Mobility, Healthcare and Life Sciences, Telecommunications and Green Transformation – to 48 percent by fiscal 2028. By backing pioneering enterprises and cultivating advanced materials, Zeon continues to advance its dual vision of a sustainable planet and a secure, progressive society.

- Rubber Board Of India

- Rubber Producers’ Societies

- Sulphur Dusting

- Powdery Mildew

- Rubber Plantations

- Rubber Board Subsidy

Rubber Board Announces Sulphur Dusting Subsidy For Rubber Producers

- By TT News

- February 09, 2026

The Rubber Board of India has announced the opening of an application window for financial aid for sulphur dusting to combat powdery mildew disease in rubber plantations for the year 2026. The scheme is open to all Rubber Producers’ Societies (RPS) operating in both traditional and non-traditional growing regions.

From 10 to 20 February 2026, eligible societies must submit their applications online through the 'ServicePlus' portal on the official Rubber Board website. Societies requiring help with the submission process are advised to contact their nearest Rubber Board regional office or field station, or to consult the board's website for further guidance.

French Recognition Of TPO Bolsters Pyrum's Circular Economy Model

- By TT News

- February 09, 2026

Pyrum Innovations AG has welcomed the official recognition by French authorities on 17 January 2026, which classifies tyre pyrolysis oil (TPO) as a legitimate raw material for the chemical sector. This pivotal regulatory milestone for pyrolysis oil derived from end-of-life tyres substantially enhances the product’s integration into established chemical value chains. It also provides greater predictability for future purchase and partnership frameworks, thereby accelerating the development of industrial material cycles.

For Pyrum, which processes scrap tyres through pyrolysis to recover pyrolysis oil, industrial carbon black and steel, this decision underscores the critical need for standardised and reliable regulatory conditions. Such clarity is fundamental for scaling investments, production volumes and supply chains, particularly as the chemical industry and circular economy converge. The establishment of clear product categories is essential to ramp up the market for high-quality recycled raw materials.

The company remains committed to tracking further developments in France and the wider European dialogue regarding the classification and application of recycled feedstocks. Pyrum’s overarching objective is to expand industrial-scale recycling solutions for scrap tyres. This regulatory progress directly supports the company’s mission to secure long-term, quality-assured supply agreements with partners across the chemical industry, thereby advancing a more sustainable and circular economic model.

Pascal Klein, CEO, Pyrum Innovations AG, said, “The decision in France is an important step for the industrial use of pyrolysis oil from waste tyres. It supports a trend that we are seeing in many markets, where the chemical industry is seeking reliable, technologically robust and clearly classified alternative raw materials.”

Comments (0)

ADD COMMENT