If the phrase was heavy, the package was heavier still. As big as Rs 20-lakh crore (with thirteen zeroes) package was announced by the Government for a self-reliant India. The package intends to help the country tide over the all-round economic disruption caused by the raging Covid-19 outbreak and a series of lock-downs. Besides the economic stimulus package which is 10% of India's GDP, PM also made a pitch for promoting local businesses.

As was the plan, the next few days witnessed Finance Minister Nirmala Sitharaman unveiling a slew of measures with the intention to help the Indian economy recover from the adverse impact of the coronavirus crisis. While the jury is still out about the direct stimulus of the economic package for the corporate sector, certain transformational and structural reforms have been introduced across several key areas, which certainly hold the potential to rebuild the Indian economy and pave the way for a sustained economic revival.

These include radical reforms in agricultural sector, redefinition of the micro, medium and small enterprises (MSMEs), key steps to revitalise the power sector, liberalisation of the coal and mining sectors and raising of the foreign direct investment (FDI) limit in defence manufacturing. These reform measures tried to address key pain points of the economy and to contribute towards enhancing India’s global competitiveness at a time when the world stands at a critical turning point.

However, what exactly Aatma Nirbhar means has been a subject of intense debate. Two leading lights that have been at the helm of affairs of Indian industry have shed appropriate light to make it sound cogent.

Amitabh Kant, the celebrated CEO of NITI Aayog made it very clear when he said Aatma Nirbhar Bharat is all about making India self-reliant to take the global competition head-on by achieving cost competitiveness through size and scale, quality and cutting edge technologies.

Achieving such lofty ideals is easier said than done and necessitate whole lot of policy enablers many of which have been cited by Kant himself including the need to provide industries with regular and cheap supply of power to boost competitiveness, identifying large land banks and equipping them with infrastructure, easing labour laws, timely land acquisition, environmental & other clearances and easy credit.

Some measures need special mention for instance efficiencies in the logistics sector - India’s port turnaround time is around 60 hours against that of China’s 20 hours and Korea’s 12 hours.

Union Minister for Commerce & Industry Mr Piyush Goyal hit the nail on the head when at Digital Summit organised by CII, he stated (through video conferencing of course) that Aatma Nirbhar Bharat was not just about greater self-reliance but also engaging with the world from a position of strength. India should be seen as a dependable partner and reliable friend in the world market, particularly when the global supply chains are undergoing a rejig, he stated. He specifically mentioned that India had a huge opportunity to promote indigenous production in the auto component sector.

And that brings us to India’s tyre sector which has been a less celebrated manufacturing success stories. As has been communicated earlier, a big chunk, nearly 20% of the domestic tyre production is exported to over 100 countries in the world. And these include discerning ones such as US and European countries. India has potential to increase exports of tyres significantly since domestic capacity is ahead of the demand curve. The quality of Indian made tyres is well established and that’s an added advantage when it comes to exports.

There is little doubt that Covid-19 has pressed the reset button and is likely to lead to a change in the world order. Perhaps that thought spurred the PM to state “Today it is the need of the hour that India should play a big role in the global supply chains”.

Tyre Industry is well aligned with the Government in its stated mission. However as shown by China, it is important to encourage domestic value addition by minimizing the raw material uncertainty and uncompetitive prices. For a sector like Tyre Industry, that will be true Aatma Nirbharta.

Tolins Tyres Reports Higher Quarterly Revenue As Volumes Recover

- By Sharad Matade

- February 20, 2026

Tolins Tyres Limited reported a rise in quarterly revenue as demand recovered across retreading materials and new tyre segments.

Revenue for the three months to 31 December 2025 increased 33.8 percent year on year to INR 933 million, while earnings before interest, tax, depreciation and amortisation (EBITDA) rose to INR 142 million. Net profit declined to INR 105 million from INR 109 million a year earlier.

For the first nine months of the financial year, revenue rose 11.8 percent to INR 2.49bn. EBITDA fell to INR 366 million from INR 426 million, and net profit declined to INR 268 million from INR 294 million.

Tolins Tyres said growth in the quarter was supported by higher volumes in domestic markets and increased contribution from recently launched agricultural tyres. The India business remained the main source of revenue, while UAE operations contributed steadily.

Dr K V Tolin, promoter, chairman and managing director of Tolins Tyres Limited, said, “Q3 FY26 marked a strong rebound in performance with robust year-on-year revenue growth and clear recovery in volumes across both retread and new tyre segments. The deferred demand witnessed in Q2 has meaningfully converted into orders during the quarter, reflecting improved customer sentiment and normalized buying patterns following the GST revision.

The agricultural segment delivered encouraging traction, with our newly launched tractor rear tyre range beginning to contribute meaningfully to revenues. The increasing share of tractor tyres in our overall mix validates our strategic focus on expanding presence in high-demand farm tyre categories. Distribution expansion and deeper engagement with institutional customers further supported volume growth across key markets.

For the nine-month period, the Company has demonstrated resilience and improved operational momentum. With demand visibility strengthening, a diversified customer base, and continued cost discipline, we believe Tolins Tyres is well-positioned to sustain growth in the coming quarters while maintaining focus on margin stability and operational efficiency.”

Eastern Treads Appoints Navas Meeran As Managing Director

- By Sharad Matade

- February 20, 2026

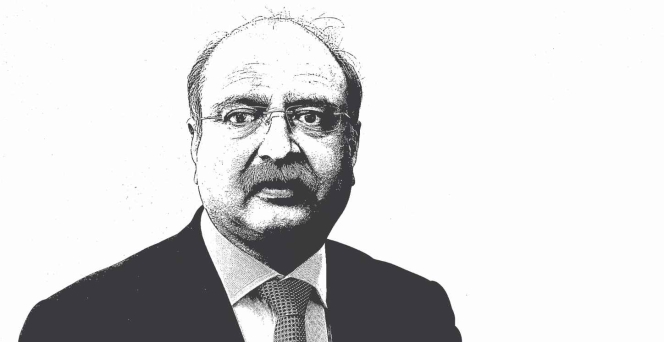

Eastern Treads Limited has appointed Navas Meeran as managing director following the expiry of the tenure of M E Mohamed.

Meeran’s appointment took effect from the close of business on 14 February 2026 and is subject to shareholder approval. Mohamed ceased to hold office on the same date on completion of his term.

Eastern Treads said its key managerial personnel now comprise Navas Meeran as Managing Director, Devarajan Krishnan as Chief Financial Officer and Abil Anil as Company Secretary.

The company stated that Meeran has more than 33 years’ experience in the tyre retreading industry and previously held roles including Chairman of the Confederation of Indian Industry’s southern region and membership of its national council.

It added that Shereen Navas, a Director of the company, is the spouse of Meeran.

UK Tyre Export Checks Failing As Most Shipments Remain Undocumented, TRA Says

- By TT News

- February 19, 2026

The UK’s enhanced verification system for waste tyre exports is failing to ensure compliance, with fewer than 25 percent of consignments meeting reporting requirements, according to government data cited by the Tyre Recovery Association.

In a letter to Mary Creagh, Minister For Waste And Recycling, the association said the majority of exported end-of-life tyres (ELTs) remain untracked after shipment, despite strengthened rules introduced in 2025.

Parliamentary answers published on 12 February show 3,281 Annex VII export notifications were authorised from October 2025. Of 1,891 consignments past the eight-week reporting deadline, 1,370 returned no post-shipment information. Of those that did respond, 458 met required standards, leaving more than 75 percent of recent whole-tyre exports undocumented.

The data, disclosed in response to questions tabled by Tessa Munt, also indicate limited enforcement. The association said there was no evidence the Environment Agency had removed non-compliant receiving sites from its approved list or issued stop notices to brokers failing to submit documentation.

The Tyre Recovery Association urged the UK to adopt a “shred-only” export policy modelled on Australia’s December 2021 ban on exporting whole or baled tyres. Under that regime, tyres must be processed into shred or crumb of no more than 150 mm before export.

The group said at least 150,000 tonnes of licensed domestic recycling capacity remained unused because of weak enforcement of existing rules. It also called for removal of the T8 waste-tyre exemption, arguing the low-cost permit for small-scale operators had been widely abused and created an uneven market for compliant recyclers.

Peter Taylor, Secretary-General of the Tyre Recovery Association, said: “A new system with a 75% failure rate is not a solution. Despite the Government’s best intentions to sharpen the Environment Agency’s teeth, the new enhanced verification measures are being ignored by brokers and operators who continue to fuel unregulated pollution overseas.

“The only way to secure the integrity of our waste stream and protect the environment is to move beyond paperwork and mandate a ‘shred-only’ export policy. A model with proven success in Australia.

“We now know recent efforts to improve enforcement of existing rules still have a long road to travel before signs of success. The legitimate operators in the UK continue to be disadvantaged and significant domestic capacity lies idle.

“2026 must be the year that the UK stops exporting its environmental responsibilities – bring in the Australian model and build a robust, truly circular UK economy for tyres.”

Pirelli Secures Spot In The Elite ‘Top 1%’ Category Of S&P Global Sustainability Yearbook 2026

- By TT News

- February 19, 2026

Pirelli has once again distinguished itself in the 2026 edition of S&P Global’s Sustainability Yearbook, earning a place in the elite ‘Top 1%’ category. This achievement makes Pirelli the only tyre manufacturer worldwide to receive this highest level of recognition.

The honour stems from an evaluation of over 9,200 companies based on their environmental, social and governance performance. It reflects Pirelli’s outstanding result in the 2025 Corporate Sustainability Assessment, where the company achieved a score of 86 points. Notably, this was the highest score awarded in both the Auto Components and the broader Automobiles sectors, underscoring Pirelli’s leadership in sustainability within the automotive industry.

Giovanni Tronchetti Provera, Executive Vice President – Sustainability, New Mobility and Motorsport, Pirelli, said, “Pirelli’s confirmation in the Top 1% of the 2026 Sustainability Yearbook represents a great validation of the company’s journey. Innovative development and responsible growth specifically guide our operational choices: continuous investment in technology, transparent management of the entire value chain and a strong focus on safety, skills and people development. This approach strengthens our competitiveness and our ability to create long-term value for all our stakeholders.”

Comments (0)

ADD COMMENT