PRESENTING THE INDIAN TYRE INDUSTRY THE RIGHT WAY

- By Juili Eklahare & Gaurav Nandi

- August 22, 2022

After being selected as ATMA Chairman, Satish Sharma, President (APMEA) & Whole Time Director, Apollo Tyres, has big plans for the automotive and tyre industries, from enhancing exports to self-sufficiency in Indian rubber. He shares his views on collaborations in the tyre industry, the challenges of the sector and the problem of India being used as a dumping ground. Read on…

How have your priorities changed ever since being selected as the ATMA chairman?

I was the ATMA chairman even four years ago, and this is my second tenure. In terms of priorities, I want to pick up from where I left. At that point, we had started this whole journey of improving our exports. In fact, I was on record to say that the tyre industry could be the poster boy for the Indian government.

Looking back, I’m very happy to see that the exports have improved rather well. And this is just the beginning; we could do much more. Therefore, one priority is to see how we enhance our exports significantly from where we stand today.

The second priority is that a lot of regulations are on the anvil for the vehicles and the tyres as well. So my idea would be to engage with all the stakeholders and get them fast paced rather than going about it in a slow manner. Plus, I would like to get all views on board, optimise them for the industry, the government and different stakeholders and get them rolling, working towards a seamless transition for the regulations and betterment of all the stakeholders.

As for my third priority, it is the self-sufficiency point of the Indian rubber. The Indian rubber is a key priority of the commerce minister, Piyush Goyal, to narrow the gap between domestic demand-supply of natural rubber, which is around 35 to 40 percent. Hence, some of us have come together at his behest and have contributed in monetary terms to help the rubber board to do serious plantations in the potential of the North East. That corpus has been formed and one year of it has gone by. The acronym is NEMITRA. It is a collaboration between the tyre industry and the rubber board, under the aegis and direction of the commerce ministry. So we are very hopeful that the work we put in is going to yield results and India will be able to narrow this deficit between production and consumption.

Speaking of production and consumption, are you seeing a revival in demand?

The demand recovery for tyres is always an organically growing demand. If you look at the GDP of the country, it’s rather sectoral and a K-shaped recovery. Therefore, some sectors associated with infrastructure, e-commerce or the real estate sector, etc. are doing very well. However, at the same time, there is very steep inflation, and there is a possibility or worry that this inflation might destroy demand. The entire supply chain has to pass through this inflation and, finally, it has to be borne by the consumer. Whether the consumer reduces consumption or continues to consume at the rate at which he/she was before is a bit of a worry. But so far, the demand is holding on at a broader level.

OEMs are reviving as the chip shortage is getting under control. We are seeing CVs – a cyclical business – at the beginning of its upcycle, which is good news for them. In PVs, the supply chain issues are getting eased off. Plus, the tractor sector is also reviving; with a good monsoon forecast, the rural economy should come back – maybe not to the same level from two years ago, but still reasonably good.

With the current world situation, from the Covid pandemic to the Russia-Ukraine war to high inflation rates, do you think there is a need for more collaborations between tyre companies?

Collaborations have to be there, but they have to be very finely defined. Collaborations can always be on larger subjects like sustainability or raw materials, where research work can be done, resulting in collaboration. So these are areas where a deeper collaboration will help the industry. But it cannot be used to tackle inflation – that has to be left to market forces.

What are the present challenges you see in the tyre industry that need to be addressed?

The organic challenges include preparing ourselves for electrification and the changing regulatory framework. However, the key challenge for the Indian tyre industry right now is inflation. Our balance sheet sizes have halved over the last year. Moreover, the profitability has reduced significantly. There is a significant phase lag to the cost push. Therefore, these key challenges are what we really need to take care of in the short-term.

There has been a ban on Chinese tyres. How is this impacting the Indian tyre industry?

All global tyre companies that have come in India are now producing their tyres in the country. And therefore, it is self-sufficient as far as tyres are concerned. So technically, imports are not required to that extent, from that point of view.

The problem comes about when we are used as a dumping ground and the economic value of everything that has been put into place gets destroyed. And moreover, the promise we have for the Indian industry is getting short-changed. So that’s the argument.

I was telling my industry colleague, whose company is entering the US market, to not go the wrong way. But, in fact, to go, set up and position the Indian product and brand name the right way and to not spoil the market and get branded as the next cheap manufacturer after China. Because if one does it that way, then he/she is going to spoil it for everyone.

And, truth is, we can really do it the right way. We do have a cost arbitrage. Hence, we can give a more honest price internationally and give tier 1 quality at a tier 2 price. However, if one were to position oneself at the bottom of the barrel, then it will spoil everything.

What is happening to recycling and renewable sources to make tyres? How are things shaping up in India?

One regulation is on the anvil, which is the extended producer responsibility. It is in the draft stage and we are in discussion with the government. Fortunately, by the nature of our country, there is a self-recyclability of any and all products. Of course, this is in the unorganised segment, and we don’t talk or hear about it. But we have seen tyres being sold to make something as useful as slippers. So it finds its own value.

But there are no satellite pictures available in India showing dumps and dumps of used tyres lying anywhere; you will find that in the Middle East. But the government is organising this whole thing, and we have the extended producer responsibility coming – it will have a far higher recyclability and will focus more on renewable energy and getting green raw materials. Plus, it will prioritise the increase in the usage of recycled tyre parts.

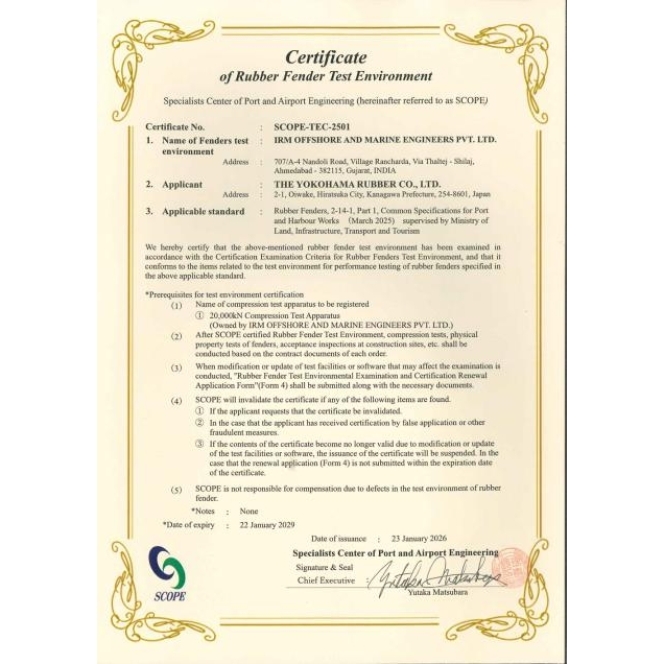

Yokohama Rubber Secures Certificate Of Rubber Fender Test Environment

- By TT News

- January 28, 2026

The Yokohama Rubber Co., Ltd. has successfully secured a Certificate of Rubber Fender Test Environment from Japan’s Specialists Center of Port and Airport Engineering (SCOPE), awarded on 23 January 2026. This certification follows a thorough assessment under SCOPE’s Rubber Fender Testing Environment Certification Program, which validates that the company’s testing facilities for marine rubber fenders operate with integrity and reliability. Specifically, the certification confirms that Yokohama Rubber employs a robust system designed to prevent data fraud, ensuring the trustworthiness of all test results for fenders it manufactures and sells.

These fenders serve as critical safety components, acting as cushioning buffers to protect vessel hulls from impact during harbour mooring and ship-to-ship transfers at sea. To promote safer and more secure maritime operations, SCOPE launched its certification initiative in April 2023, focusing on verifying the reliability of fender testing environments. The programme is aligned with technical guidelines from the World Association for Waterborne Transport Infrastructure (PIANC) and evaluates compliance across multiple SCOPE-defined criteria. These include adherence to static compression testing standards, the elimination of opportunities for data falsification, the integrity of statistical values in test data and the establishment of corporate systems that prevent tampering.

Yokohama Rubber’s expertise in this field dates to 1958, when it pioneered the world’s first pneumatic fender for offshore vessel berthing. Recently, the company has broadened its portfolio beyond high-performance pneumatic fenders to include solid fenders, which represent a principal segment of the fender market. This strategic expansion establishes Yokohama Rubber as a comprehensive fender manufacturer and reinforces its revenue foundation.

The achievement aligns with the company’s ongoing medium-term management plan, Yokohama Transformation 2026 (YX2026), which spans fiscal years 2024 to 2026. A key element of this strategy involves driving growth in the MB Segment by focusing resources on core domains such as hose and couplings along with industrial products. Within this framework, Yokohama Rubber aims to strengthen its product lineup and sustain strong market shares for marine products, including fenders, to secure steady profit growth in the industrial products business.

Bridgestone India Taps Punjabi Star Parmish Verma For Regional Growth Push

- By TT News

- January 27, 2026

In a strategic move to strengthen its connection with vital regional audiences, Bridgestone India has partnered with multifaceted Punjabi star Parmish Verma. This collaboration is designed to resonate deeply in North India, a crucial and rapidly expanding market fuelled by increasing vehicle ownership and a youthful demographic. Verma, a prominent cultural figure and known automobile enthusiast, aligns naturally with the brand’s emphasis on safety, reliability and performance. His authentic passion for vehicles and responsible driving complements Bridgestone’s identity as a leading mobility solutions provider.

Central to this alliance is the co-creation of engaging, music-led narratives and digital content for Bridgestone’s campaigns, leveraging Verma’s artistic talents and significant social influence. This approach recognises the powerful role of popular culture in shaping brand preferences within the region. The partnership also advances the company’s broader regional engagement goals, aiming to build deeper trust with consumers nationwide. Furthermore, it embodies the ‘Emotion’ principle of Bridgestone’s corporate commitment, which seeks to inspire excitement and deliver joy through mobility. By uniting with a figure of Verma’s reach and genuine interest, Bridgestone India fosters a more dynamic and culturally relevant dialogue with its audience.

Rajiv Sharma, Executive Director – Sales & Marketing, Bridgestone India, said, “North India is a strategically important market for us. Parmish Verma’s credibility and deep connection with audiences make him an ideal partner to represent Bridgestone. This collaboration enables us to engage meaningfully with young consumers who seek fresh, inspiring and relatable brand experiences.”

Verma said, “Bridgestone is a brand people trust for safety and performance. I’m proud to be associated with an organisation that values quality and puts customers first. I look forward to connecting with audiences in a new and meaningful way through this partnership.”

Bridgestone Americas Appoints Michele Herlein As New Chief People Officer

- By TT News

- January 24, 2026

Bridgestone Americas has appointed Michele Herlein as its new Chief People Officer. In this role, she will oversee all human resources operations across the Americas, Europe, Middle East and Africa. Her primary focus will be advancing the company's Culture 2.0 initiative, which aims to enhance teammate empowerment, collaboration and accountability.

Herlein rejoins Bridgestone with over two decades of executive leadership expertise. Her background includes previous positions within Bridgestone Americas and Bandag, Inc., centred on culture, leadership development and succession planning. Most recently, she was the Founder and CEO of CultureMax and previously served as the Chief Administrative and Human Resource Officer at Barge Design Solutions. She is also a published authority on creating high-performance organisational cultures. Beyond her corporate work, Herlein is a co-founder of Impact100 Nashville, a philanthropic women’s collective that has awarded more than USD 1.2 million in grants to area nonprofits.

Scott Damon, Bridgestone West CEO and Group President of Bridgestone Americas, said, “I am excited to welcome her back to Bridgestone, recognising the perspective and presence she will add to our West leadership team, the HR function and the broader organisation.”

- Alliance Tyres

- Yokohama-ATG

- Agri Star II Row Crop

- LAMMA UK 2026

- Agricultural Tyres

- Off-Highway Tyres

Alliance Displays Agri Star II Row Crop Tyre At LAMMA UK 2026

- By TT News

- January 24, 2026

Alliance, a prominent global tyre brand under Yokohama-ATG, introduced its new Agri Star II Row Crop tyre to the UK agricultural sector during the recent LAMMA UK 2026 event. This launch marked the product's UK debut following its initial presentation at Agritechnica 2025. The tyre is specifically engineered for row crop tractors and specialist machinery, including self-propelled and trailed sprayers, operating in crops such as cereals, maize and oilseed rape.

Central to the tyre's design is Alliance's Stratified Layer Technology (SLT), which incorporates two distinct rubber layers within each lug to maintain reliable traction and stability even as the tyre wears. This approach is part of a design focused on mitigating soil compaction through a wider tread that improves load distribution, thereby helping to protect soil structure and preserve crop yields.

To address the evolving demands of modern farming, the tyre is built for high-speed road travel, boasting an E-speed rating that allows for operational speeds up to 70 kmph. This capability accommodates the increasing distances machinery must cover between fields. Simultaneously, the tyre is engineered to provide effective low-pressure performance during actual field work. It brings VF technology to this segment, a critical development as agricultural equipment continues to grow in both weight and the frequency of road use.

The construction emphasises durability, incorporating features like a stubble guard and advanced, wear-resistant compounds to ensure a long service life under challenging conditions. Available in rim sizes ranging from 24 to 54 inches, the Agri Star II Row Crop is designed for compatibility with a broad spectrum of contemporary farm machinery. This new model extends the proven platform of the Agri Star II series, of which over one million units have been sold globally, delivering its established technological benefits into the specialised realm of row crop agriculture.

Comments (0)

ADD COMMENT