Steadily Rising To Prominence

- By Rajiv Budhraja

- January 15, 2025

A study of the 2024 Global Tire Report recently released by Tire Business has been a gratifying experience. From a turnover of USD 93 billion in 2004 to USD 192 billion in 2023, the Global Tyre Industry has added nearly 100 billion dollars in the last 20 years, which can only be termed significant. After a flat growth in 2022, the industry witnessed a resurgence in 2023 with a growth of 4 percent to reach the highest-ever turnover of USD 192 billion, breaching the earlier high of USD 189 billion achieved way back in 2012.

The number of global tyre plants has gone up consistently from 497 in 2012 to 573 in 2022 to 584 in 2023. Michelin, Bridgestone, Goodyear and Continental continue to be the four largest global tyre majors for several years now. Interestingly, all these four have a manufacturing presence in India too, making the Indian market a vibrant one.

Asia's dominance continues with the presence of 360 tyre plants (62 percent of total) in the continent. A closer study reveals that India has the second largest number of tyre plants in the world (65) only after 156 of China. With nine plants, MRF holds the second rank in Asia in terms of number of plants after Bridgestone’s 23.

What’s striking is the steady march of Indian tyre companies. Yet again, five Indian companies find pride of place in the top 30 global companies in the world. These include Apollo, MRF, JK, CEAT and BKT, in order of ranking.

Moreover, Indian tyre companies have been moving up the charts. In the last 10 years, MRF has moved up one rank, Apollo has moved up three ranks. In the same period, JK has moved up six ranks, while CEAT has moved up by a full 10 ranks. BKT has made an entry in the top 30 by moving up 12 ranks in the last 10 years.

What has propelled the upward journey of Indian tyre majors is the steady increase in tyre manufacturing footprint in the country and expansion in exports. In the true spirit of Make in India and Atma Nirbhar Bharat, tyre production in India has nearly doubled in the last 10 years. Industry turnover has gone up from INR 450 billion to INR 900 billion during this period and is expected to conclude the ongoing year with a turnover of INR 1 trillion.

Tyre exports too have nearly doubled in the last five years, from INR 128.44 billion in FY20 to INR 230.73 billion in FY24. This expansion in exports underscores India's growing role as a player in the global tyre supply chains, contributing significantly to meeting international demand.

Indian companies rank amongst top five in terms of the number of plants manufacturing different categories of tyres. In the case of TBB, India continues as a major hub of manufacturing, with JK, MRF and Apollo counting amongst the top five. Amongst motorcycle plants, MRF and CEAT are in the top five. BKT is in the top five when it comes to OTR and industrial tyre plants. MRF leads the world with the highest number of racing tyre plants (three) followed by JK.

In terms of Capex spending as a percent of sales, MRF and BKT rank at 2nd and 3rd place amongst top 30 tyre majors in the world. What’s more, CEAT, JK and Apollo are all in the top 20.

When it comes to R&D spend as a percent of sales, all five Indian tyre companies are in top 20 in the world, underscoring the unmistakable accent on innovation and R&D. CEAT leads the chart amongst Indian tyre majors with 1.5 percent of sales apportioned for R&D spend.

The R&D investments are enabling Indian companies to produce high-performance tyres that cater to diverse requirements, from passenger vehicles to specialised uses in agriculture and industry. Another area where R&D effort is directed is the focus on sustainable materials and eco-friendly practices that align well with a global shift towards greener, more responsible manufacturing.

As is evident, Indian tyre manufacturers are not sitting on their laurels. Looking to the future, they are exploring digital technologies, such as IoT and data analytics, to improve efficiency and product performance. This tech-forward approach will be essential for meeting the evolving needs of the automotive industry, especially as electric vehicles (EVs) and autonomous vehicles (AVs) become more prominent.

Here it is important to underline the Indian government’s supportive policies that have been instrumental in the growth of the tyre industry. Initiatives encouraging local manufacturing and favourable trade policies have supported the growth of the Indian tyre industry.

The achievements of the Indian tyre industry are a testament to the resilience and adaptability to rise to the occasion. As the industry evolves, a bright future is promised in the years to come.

The author is the Director General of the New Delhi-based tyre industry association, Automotive Tyre Manufacturers’ Association (ATMA). The views expressed here are personal.

KraussMaffei Technologies Appoints Dirk Musser As New Managing Director

- By TT News

- February 27, 2026

KraussMaffei Group is set to implement a leadership transition at its subsidiary, KraussMaffei Technologies, with a change at the board level. Jörg Stech, who has served as Chairman of the Board and global head of injection moulding, automation and additive manufacturing since 2023, will be departing on 31 March 2026 at his own request. He will be succeeded by Dirk Musser, the current Head of Group Transformation at the parent company, who has been appointed as the new Managing Director effective 1 April 2026. The leadership handover between Stech and Musser is already in progress, ensuring a seamless transition.

Stech’s tenure unfolded during a difficult economic period marked by financial losses and a contracting market. He responded with decisive measures aimed at margin enhancement and balance sheet improvement, which laid the groundwork for the company's long-term stability. Under his direction, the product lineup for injection moulding and automation was revitalised with the introduction of the LRXplus linear robot, the fully electric PX series and the MC7 control system, all launched in late 2025 alongside new artificial intelligence tools. He also launched a multi-year development initiative and pushed the company into new markets, such as aerospace and drone technology, by leveraging expertise in specialised processes like ColorForm. Through a focus on operational excellence, pricing discipline and capital efficiency, Stech guided the company to a significantly more resilient position compared to three years prior, despite the persistent downturn in injection moulding.

Musser brings to his new role extensive experience in transformation and finance. In his current capacity, he has already been closely involved with KraussMaffei Technologies, collaborating with its leadership to drive strategic initiatives and enhance operational performance. His qualifications include sharp analytical abilities, a strong grasp of industrial processes and a broad international perspective. An economist by training, Musser has accumulated over 20 years of leadership experience across various technology and industrial sectors. His background includes leading major transformation and turnaround projects at CRRC New Material Technologies, where he stabilised plant earnings in North America, as well as directing operational and financial restructurings during his time at Deloitte. He has also held roles with P&L responsibility, managing global supply chains and post-merger integrations at CRONIMET and has prior experience with automotive manufacturers including Daimler and Fujian Benz Automotive in China.

Alex Li, CEO, KraussMaffei Group, said, "Jörg Stech took on responsibility in a difficult situation, set clear priorities and launched decisive initiatives. The successful market launch of the LRXplus linear robot and the all-electric PX machine series, the consistent focus on profitability and the sustainable strengthening of our balance sheet are visible results of this work. We would like to express our sincere thanks to Jörg Stech for his leadership, integrity and team spirit. We value Dirk Musser as a leader who combines strategic clarity with operational excellence. In a short period of time, he has provided vital impetus for the transformation of the group and impresses with his analytical strength, decisiveness and deep understanding of our processes – not least through his successful collaboration with the managing directors of KraussMaffei Technologies. We are convinced that he will continue on this path with clarity and creative drive to successfully align KraussMaffei Technologies."

Stech said, "After many years in an environment full of technological, economic and geopolitical challenges, I look back with great gratitude on a time in which I was always surrounded by an exceptional workforce. Together, we achieved things that many initially thought were impossible. This cooperation, this willingness to push boundaries and create something new, was a joy for me. My special thanks go to all stakeholders in the company and, of course, to all employees. I leave with respect, gratitude and the conviction that this long-established company will continue to achieve great things in the future."

Musser said, "Together with my fellow managing directors Dr Frank Szimmat and Markus Bauer, I want to resolutely drive forward the further development of KraussMaffei Technologies. Our focus is on further expanding stability and performance and taking the necessary steps to successfully position the company in a dynamic market environment. I look forward to shaping this path together with our teams.”

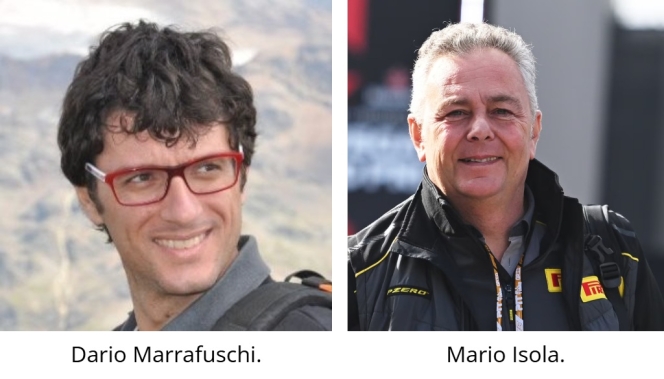

Dario Marrafuschi Succeeds Mario Isola As Pirelli’s Head Of Motorsport

- By TT News

- February 27, 2026

Italian tyre manufacturer Pirelli has announced that Dario Marrafuschi will become the Head of its Motorsport Business Unit, effective 1 March. He succeeds Mario Isola, who will remain with the company until 1 July to assist with the leadership transition.

Marrafuschi joined Pirelli in 2008 and has held positions within the Formula 1 Research and Development department. Most recently, he led the development of the company's road products.

He will report to Giovanni Tronchetti Provera, Executive Vice-President of Sustainability, New Mobility & Motorsport. The appointment comes as the company continues its role as the tyre supplier for various global motorsport categories.

Isola departs the company following a tenure that included the expansion of Pirelli’s motorsport operations. The company stated that Isola will pursue other professional opportunities following his departure in July.

Changing Tyre Dynamics In A Changing Car Market

- By Sharad Matade

- February 27, 2026

For Continental Tires India, the passenger vehicle market in India is entering a phase where scale and structure are finally aligning with its longstanding premium ambitions. Passenger vehicle sales reached a record 4.3 million units in 2024, expanding by 4–5 percent year on year, but it is the composition of that growth – rather than the headline volume – that is reshaping the company’s strategy. Utility vehicles now account for approximately 58 percent of total passenger vehicle sales, up sharply from about 51 percent the previous year, cementing SUVs and crossovers as the dominant force in the market.

This structural shift has direct consequences for tyre manufacturers operating at the upper end of the value spectrum. Larger vehicles bring higher kerb weights, bigger wheel diameters and greater expectations around refinement, safety and performance. For Continental, the change represents not merely an increase in addressable demand but a decisive move towards tyre categories where technology differentiation and pricing discipline can coexist.

Samir Gupta, Managing Director of Continental Tires India, calls this phase a turning point, not a temporary high. He says the surge in utility vehicles – driven by electrification and more premium cars – fundamentally changes the economics of the passenger tyre market in India.

“Let me clarify one thing first. The utility vehicle segment is no longer small. Last year, around 60 percent of passenger vehicles sold in India were utility vehicles, and including first-time buyers upgrading within this segment, the share goes beyond 65 percent,” Gupta says.

Industry data broadly supports this assessment. SUVs alone contributed close to three-fifths of all passenger vehicle sales in 2024, with compact utility vehicles accounting for a significant share of incremental volumes. The overall passenger vehicle market, at around 4.3 million units, has thus become structurally skewed towards larger formats – an inflection with long-term implications for tyre sizing, load ratings and product mix.

This shift shows in replacement demand. As vehicle footprints grow, rim diameters are increasing. “The market is clearly moving from smaller to bigger rim sizes. Demand for 17-inch and above tyres is rising sharply,” Gupta says. While these tyres are still a minority, their growth far outpaces the overall passenger tyre market.

Electrification is accelerating the shift. A substantial proportion of electric passenger vehicles sold in India today are SUVs, and Continental expects EVs to account for more than 50 percent of the passenger vehicle segment within five years. For tyre manufacturers, this creates new technical requirements – higher torque tolerance, lower rolling resistance and stringent noise control. “That creates a significant opportunity for us because our strengths lie in premium, high-performance tyres,” Gupta says.

Despite these favourable structural trends, premium tyres have historically struggled to gain traction in India. For much of the past decade, the market remained intensely price-sensitive, with tyres treated largely as commoditised replacement items. Continental’s response, Gupta explains, has been consistent rather than tactical pricing. “Right from the beginning, we have focused on fair pricing. The idea is simple – if we can clearly differentiate on performance and consistently deliver on those promises, price recovery will follow,” he explains.

The broader environment is now becoming more supportive. As vehicle prices rise and consumers migrate towards larger, more sophisticated vehicles, willingness to spend on tyres that enhance safety, comfort and driving confidence is increasing. This trend is also evident at the top end of the market. Premium and luxury passenger vehicle sales reached approximately 51,500 units in 2024, up around 6 percent year on year and crossing the 50,000-unit threshold for the first time – a symbolic marker of premium consumption in India.

Gupta sees premiumisation extending beyond luxury vehicles. “Earlier, India was extremely price-sensitive, but that is changing in higher segments. Consumers are upgrading vehicles and are more willing to invest in tyres that enhance safety, comfort and confidence,” he says.

The intensification of competition, with global premium tyre brands expanding or re-entering India, is viewed as a positive development. “Competition is always good,” Gupta says. “It gives you room to grow and improve.” More importantly, he believes it will help reframe the market. “More premium players will help move the market away from being purely cost-driven to being value-driven,” he adds.

Replacement market dynamics reinforce this view. Of the roughly 32–33 million passenger tyres replaced annually in India, tyres sized 17 inches and above account for about 12–13 percent. While the overall replacement market grows at 5–6 percent per year, this high-diameter segment is expanding at over 20 percent annually, closely tracking the shift in new vehicle sales.

This sharper focus on passenger tyres also explains Continental’s decision to exit the truck and bus radial segment in India. Gupta stresses that the decision was strategic rather than operational. Continental entered the TBR market in 2014, invested significantly and received strong feedback on product performance.

However, the economics proved limiting. Gupta says, “TBR in India is largely a B2B, fit-for-purpose market. Even if you have the best tyre, willingness to pay remains limited because fleet operators are under constant margin pressure.” Although commercial tyres offer higher absolute margins per unit, they consume substantially more raw material. “One commercial tyre uses six to eight times the raw material of a car tyre. Percentage margins are actually higher in passenger tyres,” Gupta explains.

After reviewing its portfolio, Continental chose focus over breadth. Exiting TBR allows the company to concentrate capital, technology and management attention on passenger and light truck tyres, where differentiation is more readily monetised. Gupta rejects the idea that a narrower portfolio weakens the company’s position. Commercial and passenger tyre customers, he argues, are fundamentally different – one driven by procurement economics, the other by consumer perception and emotion.

Indian consumers, Gupta believes, are becoming more tyre-aware. “Premiumisation is happening across the vehicle industry, not just in tyres. As consumers move to larger and more premium cars, their expectations also rise,” he says. Where tyres were once treated as an afterthought, buyers increasingly recognise their role in braking, grip, noise and overall driving confidence.

This change is evident at the retail level. Continental now operates more than 200 brand stores across India, and feedback from retail partners suggests customers are more informed and more demanding. Availability remains critical. “There is no point launching premium tyres if customers cannot find them,” Gupta says.

To support future demand, Continental is investing around INR 1 billion at its Modipuram plant, with the focus squarely on passenger and light truck tyres. The expansion will extend manufacturing capability from the current 20-inch limit to 22–23 inches, aligning local production with emerging vehicle trends.

Localisation, Gupta argues, is about adaptation rather than compromise. Indian road conditions, climate and driving habits require specific tuning without diluting global performance standards. Education and availability remain the principal challenges.

The recent launch of the CrossContact A/T² in India reflects this strategy. Introduced during Continental’s Track Day at Dot Goa 4x4, the product positions India among the early global markets for the tyre. “The first thing you notice is noise – or the lack of it,” Gupta says. “You hear the air-conditioning, not the tyre.” Ride comfort, grip and consistency across terrains define its appeal. As Gupta puts it, “Jahan tak soch jaati hai, wahan tak yeh tyre kaam karta hai.”

Looking ahead, Continental remains largely insulated from shifts in original equipment strategies, such as the gradual removal of spare tyres. Improved carcass design and stronger sidewalls are reducing puncture risk, but the company’s primary focus remains the replacement market.

For Gupta, the question is no longer whether India is ready for premium tyres, but how effectively manufacturers execute. “The market is finally ready for premium tyres,” he concludes. With passenger vehicle sales at record levels, SUVs firmly dominant and premium consumption expanding, Continental believes it is well positioned to grow alongside India’s evolving mobility landscape.

Falken Tyre Europe GmbH Rebrands As DUNLOP Tyre Europe GmbH

- By TT News

- February 26, 2026

Falken Tyre Europe GmbH has officially transitioned to operating under the name DUNLOP Tyre Europe GmbH, following its formal registration with the Offenbach Local Court. This change signifies a pivotal development for the Sumitomo Rubber Industries subsidiary. The rebranding represents a calculated and essential move to establish a more formidable European footprint for the DUNLOP brand. Company leadership acknowledges that this evolution is built upon the considerable equity established by Falken, including its strong market recognition, unwavering product quality and the commitment of its personnel.

This strategic shift positions the organisation under the umbrella of a globally respected marque, with its future strategy firmly centred on expansion, pioneering advancements and ecological responsibility. A prominent symbol of this new chapter will be unveiled shortly, with the renaming of the DUNLOP City Tower in Offenbach. A formal ceremony will mark the occasion, featuring the presentation of the DUNLOP logo at the tower. The event is set to be attended by Offenbach's Lord Mayor, Dr Felix Schwenke, alongside the company’s managing directors, Hiroshi Hamada and Markus Bögner, and the newly enlarged DUNLOP team.

Markus Bögner, Managing Director and President, DUNLOP Tyre Europe GmbH, said, “The name change is an important milestone of which we can be very proud. It strengthens our identity and underlines that we are ready for the next steps. Our strong heritage with Falken is and remains part of our success, laying the foundations for DUNLOP’s future in Europe. Our thanks go to all our employees and partners who have supported and accompanied us on this journey.”

Comments (0)

ADD COMMENT