THE LITTLE STORY ILLUMINATES THE WAY FORWARD IN TYRE INDUSTRY

- By 0

- June 23, 2020

Assuming nothing will be the same with COVID-19, all associated economic growth figures will be revised in the near future. The European tyre market was severely affected in the first quarter of 2020 and declined by around 20% in all segments, which is exactly the opposite of the previous forecast of achieving a total CAGR of 20% for the 2018-2022 period. It will not return to normal short-term trends and will certainly be revised.

With the global economic slowdown, the Chinese tyre market, with earlier growth of more than 6%, will no longer be mentioned in the coming years. The global pandemic has overshadowed the global economy, and the most important tyre manufacturers are only showing moderate optimism for 2020. The downward trends in demand in many international markets are therefore irreversible. When the entire industry is back on track and at the same time safe?

Tyre Industry will not return to normal short-term trends and all economic figures will certainly be revised.

In the 1950s and 1960s, the margins for industrial products were good. Many companies in industrialised countries have been looking for alternatives to invest in different parts of the world, and export rates have continuously helped them make enough money. So far, globalisation has prompted investors to tackle the underdeveloped eastern globe. The 1970s in this direction were the new way of investing a large amount of accumulated capital for the countries of the Far East. China and Singapore, then Vietnam, Thailand and Malaysia were the subject of foreign direct investment. Indonesia seems to lag behind the Philippines and Taiwan for foreign investors. Exceptionally, Japan and partially South Korea won in the early 1950s and 1960s and were more aware of the importance of technological culture. They managed to develop their own capital to invest in technological products. The tyre and rubber industry were two of the main companies.

Globalisation has prompted investors to tackle the underdeveloped eastern globe. The 1970s in this direction were the new way of investing a large amount of accumulated capital in Far East.

Western automakers had also sparked interest in countries in the eastern world. This has helped investors to focus more on this part of the world. When investors were looking for new horizons to make more money, all supporting technologies came to these countries.

When we entered the 1990s, Glasnost began to influence Europe's socio-economic structure. The main European brands initially focused on Eastern Europe to invest in the main products. Foreign direct investment went to the Central and Eastern European countries. Major European brands in the tyre industry have acquired certain tyre factories. Some factories were opened late.

It is a difficult task to attract foreign direct investment. Many parameters need to be combined, including incentives, laws, rules, agencies and procedures to attract foreign investment. The Central and Eastern European countries spent a lot of time and effort and finally made it. Not only legislative issues, but also macroeconomic measures such as combating inflation, the goal of joining the euro area, setting competitive but sustainable tax rates and laying the foundation stone for companies that acquire applications for property permits, liberalisation of the labor market, privatisation of all areas of the economy finance, public services and telecommunications, as well as road and airport construction are different pieces of equipment than investors. Usually you look for them first.

When we reached 2000, the primary concerns of European and North American tyre manufacturers were attacks on poor quality tyres

The Czech Republic, Hungary, Poland and Slovakia are the first four countries to follow. Ukraine, Romania, Bulgaria and Croatia tend to attract foreign direct investment over time. In any case, they have all learned that low labour costs are not enough to attract foreign investment if the main attractive features are not realised.

The Czech Republic, Hungary, Poland and Slovakia are the first four countries to follow. Ukraine, Romania, Bulgaria and Croatia tend to attract foreign direct investment over time. In any case, they have all learned that low labour costs are not enough to attract foreign investment if the main attractive features are not realised.

When we reached 2000, the primary concerns of European and North American tyre manufacturers were attacks on poor quality tyres in the East and Far East regions. Instead of banning imports, the safety problems of tyres in this part of the world are highlighted and certain measures are taken to prevent the huge import channels of these branded tyres. ETRMA, the association of the largest tyre and rubber manufacturers, mainly followed the REACH restrictions of these companies. The media also supported user conscience. The tyre labeling is also the result of safety concerns. The European Commission and the White House have introduced additional anti-damping and additional countervailing duties on tyres made in the Far East. The cheaper tyres no longer had the opportunity to be rated well. Note, however, that companies in the Far East are now able to manufacture high-quality high-tech tyres and organise deliveries in the market.

At the other end of the world, many industries which invest mainly in China initiated alternatives to return to the continent in 2015.

When the time came, the former Eastern Bloc countries began to join the EU. After 2010, Chinese and Far Eastern tyre manufacturers accelerated or invested in new factories in Eastern Europe. South Korea and China have started to have tyre factories in this region. Tyres manufactured in Europe or Eastern Europe indicate the Western European and US markets and are exempt from high customs taxes. They have set up a production line that is adapted to the requirements of European and American consumers.

When we reached the other side of the world in 2015, many industries with investments mainly in China initiated alternatives to return to the continent. Export tariff barriers and rising labor costs, state requirements for environmental legislation and industrial reforms do not keep foreign investors and local companies alive. The international climate and the atmosphere of the trade struggle between East and West also play a role in this latter trend. Today, investments in Eastern Europe in the countries of Asia and Western Europe continue. However, this is not a guarantee for the next few years.

Whatever the truth is or it is assumed that yesterday's reality will be opposite or different. Therefore, nothing will be similar or as expected. Companies that covered risks today and had tools today are luckier and will be successful tomorrow.

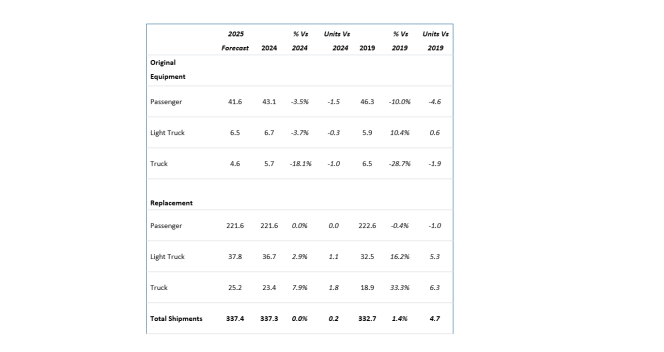

The US Tire Manufacturers Association (USTMA) expects total US tyre shipments to reach 337.4 million units in 2025, marginally above the previous record of 337.3 million units set in 2024 and up from 332.7 million units in 2019.

The association noted that the forecast was prepared without August and September trade data, which were delayed by the US government shutdown. It said this may result in higher-than-usual estimation errors for replacement tyre shipments.

Original-equipment shipments of passenger, light truck and truck tyres are projected to fall by 3.5 percent, 3.7 per cent and 18.1 percent respectively in 2025, a combined decrease of 2.8 million units compared with 2024.

Replacement shipments are expected to remain flat for passenger tyres, rise by 2.9 per cent for light truck tyres and increase by 7.9 percent for truck tyres. Total replacement shipments are forecast to grow by 3.0 million units.

Trelleborg Tires Named Best Agricultural Tyre At Visão Agro Brazil Awards

- By TT News

- December 12, 2025

Trelleborg Tires has been named “Best Agriculture Tire” at the 22nd Visão Agro Brazil Awards, held in Ribeirão Preto, São Paulo, on 4 December. The award recognises the company’s focus on technological development and its contribution to sustainable growth in Brazil’s agricultural sector.

The trophy was accepted by Fábio Metidieri, Agri Sales Director at Yokohama TWS Brasil. Metidieri said the accolade strengthened the company’s commitment to Brazilian farming and reinforced the value of its investment in product innovation, field validation and local expertise.

Trelleborg is expanding the use of its ProgressiveTraction technology across its TM range, from the TM600 for row-crop applications to the TM1000 for high-horsepower tractors. The design employs a dual-edge lug intended to improve traction, self-cleaning and vibration levels, supporting efficiency, tyre longevity and soil protection.

“Receiving this award at such a prestigious event once again reinforces our commitment to Brazilian agriculture,” Metidieri said. “Our goal is to keep advancing in technology and field performance, ensuring that every Trelleborg tire delivers real value — helping farmers operate more efficiently, sustainably, and profitably.”

The company maintains a local technical team, conducts extensive field testing and works with well-established OEM partners in major farming regions. This proximity, Metidieri said, helps ensure that tyre development reflects the practical demands of Brazilian agriculture. “This award reflects the trust placed in our team and our products by professionals throughout the sector. It strengthens our commitment to delivering technologies that address local challenges and help shape the future of Brazilian farming.”

The Visão Agro Brazil Awards recognise suppliers and innovators across the national agribusiness sector. A jury of executives, researchers and decision-makers assess companies on innovation, sustainability and performance.

JK Tyre Highlights Regional Product Portfolio At Automechanika Dubai

- By TT News

- December 11, 2025

JK Tyre & Industries has showcased a broad range of products across its truck and bus radial, passenger car radial and two- and three-wheeler segments at Automechanika Dubai 2025, as the Indian manufacturer seeks to deepen its presence in the Middle East and Africa.

The event, held from 9–11 December at the Dubai World Trade Centre, is the largest automotive aftermarket exhibition in the region and marks JK Tyre’s 11th consecutive participation. The company positioned the MEA region as a key driver of its international expansion, citing ongoing infrastructure activity and economic growth as supportive of future demand in the commercial tyre segment.

Dr Arun Kumar Bajoria, Director and President (International) at JK Tyre & Industries, said: “Automechanika provides an excellent platform to meet all our customers under one roof and gain insights into their needs and evolving market demands. We have displayed products from our flagship brands—JK Tyre and Vikrant—along with offerings from our associate company, Valiant. We remain fully committed to serving our customers across the MENA and GCC regions.”

Alongside its regional portfolio, the company unveiled a new range of passenger car and van tyres for Europe, covering summer, winter and all-season use. It also presented its Treel smart solutions, including PCR tyres with embedded sensors, as part of its focus on innovation and sustainability.

Michelin Accelerates India Expansion To Tap Premium Passenger Car Tyre Market

- By Sharad Matade and Gaurav Nandi

- December 11, 2025

Michelin is turbocharged about India. The global tyre manufacturer has increased its investment in its Chennai plant to INR 6.86 billion, up from the INR 5.64 billion announced last September, as it prepares to manufacture premium passenger car tyres locally for the first time. The move comes as India’s automotive landscape undergoes a dramatic shift, with SUVs accounting for half of all new car sales and consumers increasingly willing to pay premium prices for safety and performance.

After more than a decade of producing only truck tyres in India and serving the passenger car segment through imports, Michelin is betting that the time is right to localise production. The company expects India’s premium passenger car tyre market to grow from 10-12 million units today to 17-18 million by 2030, driven by improving road infrastructure and evolving consumer preferences. With its first locally-made passenger car tyres – including the Primacy 5 and Pilot Sport ranges – expected to hit the market in the first half of 2026, Michelin is positioning India not just as a manufacturing base but as a centre of excellence for AI innovation, engineering talent and sustainable production across Africa, Middle East and beyond.

Last year, in September, Michelin had announced an investment of INR 5.64 billion in a brownfield expansion to produce passenger car radial tyres at its Chennai plant. Year-to-date, the company has already ramped up the figure to INR 6.86 billion, fuelled by its confidence in India’s passenger car market.

“We are bullish about India because of two major reasons. One is the transformation of the vehicle market itself, as last year, around 50 percent of new cars sold in India were SUVs. At the same time, road infrastructure is improving dramatically. That leads to the second factor that Indian consumers increasingly want bigger, safer cars with advanced safety features and they are willing to pay a premium for performance,” said Shantanu Deshpande, Managing Director at Michelin India.

Adding to Deshpande, Vitor Silva, President, Africa, India and Middle East (AIM), Michelin, said, “We see this as the perfect time for Michelin to complement that shift with tyres that deliver technology, safety, comfort and long-lasting performance. While we have been manufacturing truck tyres here for more than a decade, we will now also focus on passenger car tyres. Until now, we have been serving the segment largely through imports. But we believe the market dynamics have shifted and this is the right time to localise production.”

In line with this, the Chennai plant will also focus on premium passenger car tyres ranging from 16-inch to 22-inch sizes. According to Deshpande, the market is currently estimated at 10–12 million tyres and is expected to grow to 17–18 million by the end of the decade, making the investment not only timely but essential.

The plant will churn out its most advanced range – LTX Trail ST, Pilot Sport 4 SUV, Pilot Sport 5 and Primacy 5 tailored for the Indian market. The Michelin Primacy 5 will be the first tyre to roll out.

In the coming months, the tyres will undergo homologation and certification processes with BIS and other authorities. Once approved, the first Michelin passenger car tyres will be made available to Indian consumers. While no fixed deadline has been set, the commercial availability of these tyres is expected during the first half of the next year.

Michelin is structured into nine regions for business management purposes. Regarding India’s role in the wider region such as Africa, and the Middle East, operations have been designed to serve both as a production hub and a centre of excellence. The Indian facility will not only cater to domestic demand but will also strengthen Michelin’s position across the region through supply, innovation and talent development.

Its technology centre in Pune was described as one of the most important hubs for the group in the field of artificial intelligence (AI). In addition, strong capabilities in research and development, digital services, IT and corporate functions have been developed there.

India also has been positioned as a centre where talent is nurtured, contributing not only to Michelin globally but also to consumers worldwide through products designed locally.

“Tyres for North America and Europe have been designed in India and around a hundred AI proof-of-concept projects have been initiated, tested and are planned for eventual global deployment. The country is also a key source of raw materials for global operations. Michelin in India represents more than tyres, symbolising innovation, supply chain strength and talent development,” said Silva.

MANUFACTURING PROWESS

The Chennai plant, operational for 12 years, is among the most sustainable in India and globally of Michelin. It is a zero liquid discharge facility with 80 percent of water consumption recycled and 100 percent of waste reused.

By 2024, 45 percent of materials used to make tyres at the Chennai plant were renewable and recyclable, exceeding the global target of 50 percent by 2030. Forty-five percent of electricity comes from green sources, supported by infrastructure investments such as the 2022 solar facility.

AI is integrated into daily operations, analysing machine performance, monitoring quality and supporting decision-making. These tools are accessible to both engineers and frontline operators.

AI is integrated into daily operations, analysing machine performance, monitoring quality and supporting decision-making. These tools are accessible to both engineers and frontline operators.

Currently, the plant’s installed capacity is 54,000 tonnes with flexibility maintained to align production with fluctuating demand as tyre weights vary from 7–8 kilogrammes for 16-inch tyres to 15–16 kilogrammes for 22-inch tyres. Inventory constraints prevent storing six months’ worth of tyres, requiring production and demand to be closely synchronised.

“At Michelin, we homologate products based on the conditions of each region. That means the tyres made and sold in India are essentially the same as those sold globally but validated to perform in Indian conditions. So rather than a separate India-only tyre line, we bring world-class products that are equally well-suited to Indian roads,” contended Silva.

Flexibility has been built into the production lines, allowing a mix of products to be manufactured on the same machines.

Primary focus is given to serving the local market as the industry was regarded as highly complex. While some volumes may be exported and others imported, priority is assigned to the Indian market.

When asked about the impact of starting passenger car tyre production on the OEM segment, Deshpande explained that several large truck manufacturers, including Ashoke Leyland, Volvo, Mercedes and Scania, are already being served.

Regarding the passenger car segment, the focus has been on the replacement market. While several imported cars including the Hyundai Ioniq and multiple Mercedes-Benz models already come equipped with Michelin tyres, OEM engagement in this segment is planned for the future, though replacement currently remains the priority.

Commenting on raw material procurement from India, Silva stated that India is also leveraged as a supplier of raw materials for Michelin’s global factories. Carbon black, natural rubber and chemicals are procured locally. This approach emphasises not only production and services from Pune but also the utilisation of India’s industrial ecosystem to support the company’s worldwide supply chain.

Specific materials sourced from India include carbon black, chemicals, steel and other items, all of which must meet Michelin’s strict quality and pricing standards.

“Beyond materials, India also contributes significantly in terms of engineering. At the Chennai plant, a dedicated engineering division has been established to develop machines for our global operations. Certain machines are designed and manufactured in India before being shipped worldwide. Additionally, specific components for global operations are already being produced in India,” said Florent Chaussade, Executive Director, Michelin Chennai.

RETAIL SCOPE

Deshpande emphasised that the company’s focus extends beyond production to transforming the consumer buying experience. A state-of-the-art experience shop was recently inaugurated in Nashik. Premium retail environments are being ensured through clean shops, ample parking, advanced equipment and well-informed staff capable of clearly communicating Michelin’s superior value.

To strengthen the retail network, the Michelin Tyre Service (MTS) network is being expanded. Seventy-five MTS outlets currently operate across India, primarily in metro cities, with plans to establish Michelin Tyre Stores as the benchmark for tyre retail experience nationwide.

On online sales, the company’s approach is two-fold. “Pure e-commerce retail remains negligible in India, but the research online, purchase offline trend is significant. Efforts have been made to ensure accurate digital presence, guiding consumers on suitable tyres,

availability and recommended outlets. This strategy is aimed at aligning the online-to-offline journey with the premium performance of our products, recognising that Indian consumers are tech-savvy yet accustomed to traditional purchasing,” divulged Deshpande.

To communicate safety, comfort and performance to price-sensitive consumers, Michelin has launched a dealer digital programme, enhancing dealers’ online presence to provide accurate brand and outlet information.

Inside outlets, experience shops display simple ‘reasons to believe’, demonstrating value propositions such as lower rolling resistance and superior braking performance. Dealers and technicians are continuously trained to deliver consistent performance, comfort and safety.

“The approach is ongoing and comprehensive, combining digital engagement, premium retail environments, interactive demonstrations and continuous skill development to elevate both the product and the overall ownership experience,” Deshpande added.

MARKET WATCH

The company’s truck and bus radial (TBR) business in India has evolved in recent years to target customers and fleets that value total cost of ownership (TCO). The strategy is centred on tubeless truck tyres, particularly energy-efficient models.

“Around 60 percent of a fleet’s operating cost is fuel, and our Multi Energy Z + tubeless tyres are reported to save 8–10 percent in fuel compared with traditional tube-type radials, directly benefiting the fleet’s bottom line,” contended Deshpande.

He added, “Although the segment remains relatively small, leading coach operators are already 100 percent tubeless. New-generation fleet owners increasingly prioritise TCO and are driving the transition. Demanding fleets such as Delhivery, which operates trucks 16–17 hours daily, covering 20,000 km per month, choose us for reduced downtime, fuel savings and extended tyre life. Other major clients include ITS, DGFC and Best Roadways. In 2022, the Chennai plant produced India’s first four-star rated energy-saving tyre, marking a national milestone.”

Regarding market share, only 10–12 percent of trucks currently run on tubeless tyres, while the rest remain tube-type, explained the executive.

On the two-wheeler front, Michelin already sells locally manufactured tyres through outsourcing arrangements. Fastest growth is observed in the over 350 cc motorcycle segment driven by higher disposable incomes and improved infrastructure, mirroring the SUV boom in passenger cars.

When asked about India’s potential global role amid geo-political shifts including trade barriers, tariffs and overcapacity in countries such as China, it was stated that Michelin’s vision is to operate local-to-local wherever possible.

“The tyre supply chain is highly interconnected with nearly 200 materials used in a single tyre, making it impossible to source everything from a single location. Efforts are focused on reducing raw material intensity, increasing the proportion of renewable inputs and minimising environmental impact through green factories and cleaner materials,” concluded Silva.

Michelin’s India strategy integrates local manufacturing, sustainable practices and advanced consumer engagement to build long-term value.

Comments (0)

ADD COMMENT