- VMI

- automation

- AI

- ML

- Harm Voortman

- MILEXX

- electric vehicles

- truck

- Mike Norman

- Vision Systems

- automation

- smart software

VMI And India: A Long-Term Commitment: The importance of VMI’s new India base

- By TT News

- January 03, 2025

VMI’s CEO Harm Voortman was among the senior figures to celebrate the global smart manufacturing technology company’s new Indian engineering and service centre, which opened in Vadodara on 4th October. He gave a positive view on prospects for the Indian tyre market: “India is now among the top five global economies,” he said. “Prospects for the tyre market are exceptionally strong. Vadodara was the natural choice for our new engineering centre, which is now part of our global strategy for customer support, software engineering and long-term growth.”

VMI has been operating in India for years, but the new centre marks a step change for the company’s investment in the region. So what does VMI’s new strategy mean for the Indian tyre and automotive industry?

Helping to drive economic growth

India is the world’s fifth largest economy, and a key driver for growth is large-scale investment in road and transport infrastructure. There is growing demand for tyres, especially for trucks, with higher performance standards a must. Infrastructure investment will have a positive impact on the Indian economy, helping make India an even stronger global economic hub.

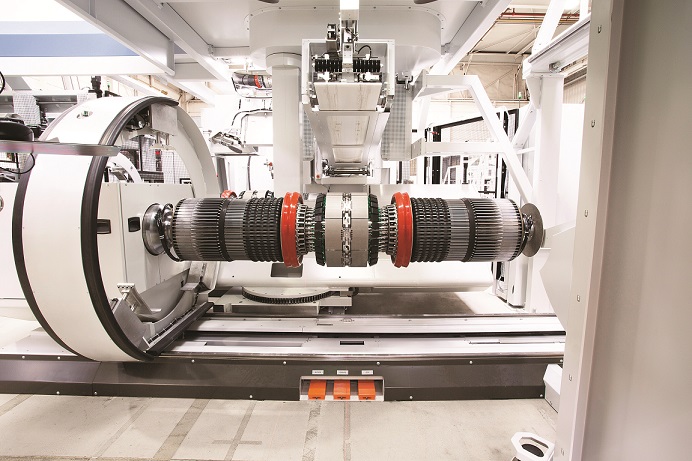

As we reported in July, VMI’s unique MILEXX automated truck tyre building machine is playing a major role in transforming access to the high-quality truck tyres the logistics industry needs inside India. With more and more Indian citizens also moving to electric vehicles, the need for improvement in quality and performance for car tyres is also clear.

Mike Norman, VMI’s Chief Commercial Officer, said, “We expect to see growth in production accelerate over the next five years – and that goes a long way to explaining why VMI has chosen this moment for major new investment in the Indian market.”

Global software engineering

Perhaps the most compelling reason for VMI’s Vadodara investment is the drive to create an integrated, international software engineering capability for the entire business. India is the world’s most important centre for software capabilities: with home-grown businesses becoming household names and foreign companies building their own Indian research and engineering centres, tapping into the outstanding engineering capabilities India provides.

Automation is the key distinguishing feature of VMI production platforms. From the launch of the MAXX TBM 15 years ago, the concept of ‘hands-off, eyes-off’ has dominated VMI’s design thinking. Stage by stage, new concepts, components and functionalities have been introduced to VMI machines, aiming to reduce human contact and deliver error-free, higher quality, maximum efficiency production.

Vision systems were introduced a decade ago to carry out such key tasks as centring materials correctly, making the right cuts and ensuring consistent quality in output. As improved camera and software options become available, VMI introduces them as standard components to new machines and offers retrofitting to the installed base, enabling customers to operate at best practice level always.

Artificial intelligence and machine learning (AI & ML) are now increasingly vital for VMI production platforms, which drives the need for software engineering capabilities of the highest quality. VMI has developed systems that use AI to identify anomalies (foreign bodies and faults in materials), enabling these issues to be dealt with at once, rather than causing scrap later. The same capabilities will soon be deployed to optimise production.

Smart software is the key to these emerging trends. As demand for new AI-related capabilities accelerates, VMI is building the high functioning, global software engineering team it needs to prosper in this emerging world. By creating an attractive, well-managed centre in Vadodara, VMI expects to mobilise some of the most qualified, ambitious and visionary engineers India can offer. The team is truly global in nature, using a common engineering platform to enable cross-border collaboration and deliver real benefits both to VMI and the Indian economy.

Why is software so important?

Most commentators believe the industry is at an inflection point, where the current business model is changing fast. We see a growing need for many more tyre variants (SKUs), caused by such factors as the move to EVs, need for lighter but stronger and more flexible tyres, introduction of more environmentally responsible new materials (due to lower levels of particulate pollution) and different patterns of demand in the market.

As Norman commented, “The industry is being challenged to move to a different model, with greater production flexibility, less waste and scrap, lower energy costs and reduced emissions.” That means greater process agility and even higher levels of automation. We will need to develop autonomous decision making (requiring AI & ML), near elimination of errors and scrap (better automation of all processes) and the ability to switch from one SKU to another, with short production runs that are still profitable.

None of these changes can happen without intelligent software. Norman added, “The Vadodara investment gives VMI the scale and skills to become the industry leader in flexible AI-enabled systems – with India at its heart.”

Service transformation

The Vadodara centre also means VMI now has a global network of service centres to provide 24/7 ‘follow the sun’ support to customers worldwide. Vadodara is a key part of VMI’s ‘Global but Local’ service approach, covering everything from maintenance, parts and troubleshooting, through to optimisation consulting and training, retrofits and upgrades and remote monitoring to ensure optimal operation.

The Global but Local concept means customers are always served by teams that speak their language and share their culture but operate to consistent, best-practice standards – everywhere. All VMI’s service engineers use the same tools and methods, covering service desk, innovation, core R&D, order engineering retrofits and upgrades.

The Vadodara centre builds on and extends the service support VMI delivers to Indian customers. Now, for example, it is easier and quicker to carry out a routine service on such key components as drums by ‘being local’, with a full maintenance and service facility, minimising downtime and cost. This makes it possible to use a ‘lifecycle approach’ for drums, with much faster swap-over than before.

Investing in the future of India

India is emerging as a highly attractive investment market – perhaps as important as China to foreign companies. Past infrastructure investment levels have been relatively low in India, so there is widespread support for the growth policy now being followed. With the tyre industry now going through a period of significant change, there is huge opportunity for the Indian economy to become one of the most important tyre-building centres in the world.

Norman said, “These are exciting times for us to expand our presence in India. We will be helping to growth the economy in a key sector while tapping into the most important pool of software expertise on earth. As the focus on smart software grows more intense in the next few years, we expect our new Indian colleagues to play a key role in growing both VMI and the Indian economy.”

KraussMaffei Technologies Appoints Dirk Musser As New Managing Director

- By TT News

- February 27, 2026

KraussMaffei Group is set to implement a leadership transition at its subsidiary, KraussMaffei Technologies, with a change at the board level. Jörg Stech, who has served as Chairman of the Board and global head of injection moulding, automation and additive manufacturing since 2023, will be departing on 31 March 2026 at his own request. He will be succeeded by Dirk Musser, the current Head of Group Transformation at the parent company, who has been appointed as the new Managing Director effective 1 April 2026. The leadership handover between Stech and Musser is already in progress, ensuring a seamless transition.

Stech’s tenure unfolded during a difficult economic period marked by financial losses and a contracting market. He responded with decisive measures aimed at margin enhancement and balance sheet improvement, which laid the groundwork for the company's long-term stability. Under his direction, the product lineup for injection moulding and automation was revitalised with the introduction of the LRXplus linear robot, the fully electric PX series and the MC7 control system, all launched in late 2025 alongside new artificial intelligence tools. He also launched a multi-year development initiative and pushed the company into new markets, such as aerospace and drone technology, by leveraging expertise in specialised processes like ColorForm. Through a focus on operational excellence, pricing discipline and capital efficiency, Stech guided the company to a significantly more resilient position compared to three years prior, despite the persistent downturn in injection moulding.

Musser brings to his new role extensive experience in transformation and finance. In his current capacity, he has already been closely involved with KraussMaffei Technologies, collaborating with its leadership to drive strategic initiatives and enhance operational performance. His qualifications include sharp analytical abilities, a strong grasp of industrial processes and a broad international perspective. An economist by training, Musser has accumulated over 20 years of leadership experience across various technology and industrial sectors. His background includes leading major transformation and turnaround projects at CRRC New Material Technologies, where he stabilised plant earnings in North America, as well as directing operational and financial restructurings during his time at Deloitte. He has also held roles with P&L responsibility, managing global supply chains and post-merger integrations at CRONIMET and has prior experience with automotive manufacturers including Daimler and Fujian Benz Automotive in China.

Alex Li, CEO, KraussMaffei Group, said, "Jörg Stech took on responsibility in a difficult situation, set clear priorities and launched decisive initiatives. The successful market launch of the LRXplus linear robot and the all-electric PX machine series, the consistent focus on profitability and the sustainable strengthening of our balance sheet are visible results of this work. We would like to express our sincere thanks to Jörg Stech for his leadership, integrity and team spirit. We value Dirk Musser as a leader who combines strategic clarity with operational excellence. In a short period of time, he has provided vital impetus for the transformation of the group and impresses with his analytical strength, decisiveness and deep understanding of our processes – not least through his successful collaboration with the managing directors of KraussMaffei Technologies. We are convinced that he will continue on this path with clarity and creative drive to successfully align KraussMaffei Technologies."

Stech said, "After many years in an environment full of technological, economic and geopolitical challenges, I look back with great gratitude on a time in which I was always surrounded by an exceptional workforce. Together, we achieved things that many initially thought were impossible. This cooperation, this willingness to push boundaries and create something new, was a joy for me. My special thanks go to all stakeholders in the company and, of course, to all employees. I leave with respect, gratitude and the conviction that this long-established company will continue to achieve great things in the future."

Musser said, "Together with my fellow managing directors Dr Frank Szimmat and Markus Bauer, I want to resolutely drive forward the further development of KraussMaffei Technologies. Our focus is on further expanding stability and performance and taking the necessary steps to successfully position the company in a dynamic market environment. I look forward to shaping this path together with our teams.”

Dario Marrafuschi Succeeds Mario Isola As Pirelli’s Head Of Motorsport

- By TT News

- February 27, 2026

Italian tyre manufacturer Pirelli has announced that Dario Marrafuschi will become the Head of its Motorsport Business Unit, effective 1 March. He succeeds Mario Isola, who will remain with the company until 1 July to assist with the leadership transition.

Marrafuschi joined Pirelli in 2008 and has held positions within the Formula 1 Research and Development department. Most recently, he led the development of the company's road products.

He will report to Giovanni Tronchetti Provera, Executive Vice-President of Sustainability, New Mobility & Motorsport. The appointment comes as the company continues its role as the tyre supplier for various global motorsport categories.

Isola departs the company following a tenure that included the expansion of Pirelli’s motorsport operations. The company stated that Isola will pursue other professional opportunities following his departure in July.

Changing Tyre Dynamics In A Changing Car Market

- By Sharad Matade

- February 27, 2026

For Continental Tires India, the passenger vehicle market in India is entering a phase where scale and structure are finally aligning with its longstanding premium ambitions. Passenger vehicle sales reached a record 4.3 million units in 2024, expanding by 4–5 percent year on year, but it is the composition of that growth – rather than the headline volume – that is reshaping the company’s strategy. Utility vehicles now account for approximately 58 percent of total passenger vehicle sales, up sharply from about 51 percent the previous year, cementing SUVs and crossovers as the dominant force in the market.

This structural shift has direct consequences for tyre manufacturers operating at the upper end of the value spectrum. Larger vehicles bring higher kerb weights, bigger wheel diameters and greater expectations around refinement, safety and performance. For Continental, the change represents not merely an increase in addressable demand but a decisive move towards tyre categories where technology differentiation and pricing discipline can coexist.

Samir Gupta, Managing Director of Continental Tires India, calls this phase a turning point, not a temporary high. He says the surge in utility vehicles – driven by electrification and more premium cars – fundamentally changes the economics of the passenger tyre market in India.

“Let me clarify one thing first. The utility vehicle segment is no longer small. Last year, around 60 percent of passenger vehicles sold in India were utility vehicles, and including first-time buyers upgrading within this segment, the share goes beyond 65 percent,” Gupta says.

Industry data broadly supports this assessment. SUVs alone contributed close to three-fifths of all passenger vehicle sales in 2024, with compact utility vehicles accounting for a significant share of incremental volumes. The overall passenger vehicle market, at around 4.3 million units, has thus become structurally skewed towards larger formats – an inflection with long-term implications for tyre sizing, load ratings and product mix.

This shift shows in replacement demand. As vehicle footprints grow, rim diameters are increasing. “The market is clearly moving from smaller to bigger rim sizes. Demand for 17-inch and above tyres is rising sharply,” Gupta says. While these tyres are still a minority, their growth far outpaces the overall passenger tyre market.

Electrification is accelerating the shift. A substantial proportion of electric passenger vehicles sold in India today are SUVs, and Continental expects EVs to account for more than 50 percent of the passenger vehicle segment within five years. For tyre manufacturers, this creates new technical requirements – higher torque tolerance, lower rolling resistance and stringent noise control. “That creates a significant opportunity for us because our strengths lie in premium, high-performance tyres,” Gupta says.

Despite these favourable structural trends, premium tyres have historically struggled to gain traction in India. For much of the past decade, the market remained intensely price-sensitive, with tyres treated largely as commoditised replacement items. Continental’s response, Gupta explains, has been consistent rather than tactical pricing. “Right from the beginning, we have focused on fair pricing. The idea is simple – if we can clearly differentiate on performance and consistently deliver on those promises, price recovery will follow,” he explains.

The broader environment is now becoming more supportive. As vehicle prices rise and consumers migrate towards larger, more sophisticated vehicles, willingness to spend on tyres that enhance safety, comfort and driving confidence is increasing. This trend is also evident at the top end of the market. Premium and luxury passenger vehicle sales reached approximately 51,500 units in 2024, up around 6 percent year on year and crossing the 50,000-unit threshold for the first time – a symbolic marker of premium consumption in India.

Gupta sees premiumisation extending beyond luxury vehicles. “Earlier, India was extremely price-sensitive, but that is changing in higher segments. Consumers are upgrading vehicles and are more willing to invest in tyres that enhance safety, comfort and confidence,” he says.

The intensification of competition, with global premium tyre brands expanding or re-entering India, is viewed as a positive development. “Competition is always good,” Gupta says. “It gives you room to grow and improve.” More importantly, he believes it will help reframe the market. “More premium players will help move the market away from being purely cost-driven to being value-driven,” he adds.

Replacement market dynamics reinforce this view. Of the roughly 32–33 million passenger tyres replaced annually in India, tyres sized 17 inches and above account for about 12–13 percent. While the overall replacement market grows at 5–6 percent per year, this high-diameter segment is expanding at over 20 percent annually, closely tracking the shift in new vehicle sales.

This sharper focus on passenger tyres also explains Continental’s decision to exit the truck and bus radial segment in India. Gupta stresses that the decision was strategic rather than operational. Continental entered the TBR market in 2014, invested significantly and received strong feedback on product performance.

However, the economics proved limiting. Gupta says, “TBR in India is largely a B2B, fit-for-purpose market. Even if you have the best tyre, willingness to pay remains limited because fleet operators are under constant margin pressure.” Although commercial tyres offer higher absolute margins per unit, they consume substantially more raw material. “One commercial tyre uses six to eight times the raw material of a car tyre. Percentage margins are actually higher in passenger tyres,” Gupta explains.

After reviewing its portfolio, Continental chose focus over breadth. Exiting TBR allows the company to concentrate capital, technology and management attention on passenger and light truck tyres, where differentiation is more readily monetised. Gupta rejects the idea that a narrower portfolio weakens the company’s position. Commercial and passenger tyre customers, he argues, are fundamentally different – one driven by procurement economics, the other by consumer perception and emotion.

Indian consumers, Gupta believes, are becoming more tyre-aware. “Premiumisation is happening across the vehicle industry, not just in tyres. As consumers move to larger and more premium cars, their expectations also rise,” he says. Where tyres were once treated as an afterthought, buyers increasingly recognise their role in braking, grip, noise and overall driving confidence.

This change is evident at the retail level. Continental now operates more than 200 brand stores across India, and feedback from retail partners suggests customers are more informed and more demanding. Availability remains critical. “There is no point launching premium tyres if customers cannot find them,” Gupta says.

To support future demand, Continental is investing around INR 1 billion at its Modipuram plant, with the focus squarely on passenger and light truck tyres. The expansion will extend manufacturing capability from the current 20-inch limit to 22–23 inches, aligning local production with emerging vehicle trends.

Localisation, Gupta argues, is about adaptation rather than compromise. Indian road conditions, climate and driving habits require specific tuning without diluting global performance standards. Education and availability remain the principal challenges.

The recent launch of the CrossContact A/T² in India reflects this strategy. Introduced during Continental’s Track Day at Dot Goa 4x4, the product positions India among the early global markets for the tyre. “The first thing you notice is noise – or the lack of it,” Gupta says. “You hear the air-conditioning, not the tyre.” Ride comfort, grip and consistency across terrains define its appeal. As Gupta puts it, “Jahan tak soch jaati hai, wahan tak yeh tyre kaam karta hai.”

Looking ahead, Continental remains largely insulated from shifts in original equipment strategies, such as the gradual removal of spare tyres. Improved carcass design and stronger sidewalls are reducing puncture risk, but the company’s primary focus remains the replacement market.

For Gupta, the question is no longer whether India is ready for premium tyres, but how effectively manufacturers execute. “The market is finally ready for premium tyres,” he concludes. With passenger vehicle sales at record levels, SUVs firmly dominant and premium consumption expanding, Continental believes it is well positioned to grow alongside India’s evolving mobility landscape.

Falken Tyre Europe GmbH Rebrands As DUNLOP Tyre Europe GmbH

- By TT News

- February 26, 2026

Falken Tyre Europe GmbH has officially transitioned to operating under the name DUNLOP Tyre Europe GmbH, following its formal registration with the Offenbach Local Court. This change signifies a pivotal development for the Sumitomo Rubber Industries subsidiary. The rebranding represents a calculated and essential move to establish a more formidable European footprint for the DUNLOP brand. Company leadership acknowledges that this evolution is built upon the considerable equity established by Falken, including its strong market recognition, unwavering product quality and the commitment of its personnel.

This strategic shift positions the organisation under the umbrella of a globally respected marque, with its future strategy firmly centred on expansion, pioneering advancements and ecological responsibility. A prominent symbol of this new chapter will be unveiled shortly, with the renaming of the DUNLOP City Tower in Offenbach. A formal ceremony will mark the occasion, featuring the presentation of the DUNLOP logo at the tower. The event is set to be attended by Offenbach's Lord Mayor, Dr Felix Schwenke, alongside the company’s managing directors, Hiroshi Hamada and Markus Bögner, and the newly enlarged DUNLOP team.

Markus Bögner, Managing Director and President, DUNLOP Tyre Europe GmbH, said, “The name change is an important milestone of which we can be very proud. It strengthens our identity and underlines that we are ready for the next steps. Our strong heritage with Falken is and remains part of our success, laying the foundations for DUNLOP’s future in Europe. Our thanks go to all our employees and partners who have supported and accompanied us on this journey.”

Comments (0)

ADD COMMENT