- Plastic ( soft or malleable) at normal ambient temperatures

- A melting point above approximately 45 °C.

- A relatively low viscosity when melted (unlike many plastics)

- Insoluble in water

- Hydrophobic

We shall be discussing here on the waxes which are only being used in the rubber and plastic industry. Beeswax, perhaps , is the first wax which used by human in the beginning of our civilization, was one of the important renewable source of fuel. The honey comb formed by bees has typical hexagonal geometric pattern (Fig.1). Bees wax is used in tire building drum, if the rubber is too sticky, it can also be used in two roll mill to take care of rubber sticking to the rolls. It is frequently being used in the BC, MC, PC, TB inner-tube making industry during pre-forming operation in the green stage when inner-tubes are expanded under mild air pressure just before curing in mold.

The main commercial source of wax is, however, crude oil but not all crude oil refiners produce wax. "Mineral" wax can also be produced from lignite. Plants, animals and even insects produce materials sold in commerce as "wax". There are five categories of waxes being used in rubber industries :

- Bees Wax

- Paraffin Wax - made of long-chain alkane hydrocarbons

- Microcrystalline Wax - with very fine crystalline structure

- Chlorinated Paraffin Wax

- Polyethylene Wax

- Chlorinated Polyethylene Wax

The major uses of petroleum based waxes are in rubber, cosmetics and in Candle industry. They are generally white in color but show usual brown color (Fig.2) due to contaminated with oil traces. Two types of waxes, in general, are used in rubber industry, Paraffinic wax and Microcrystalline wax. Its normal dose is 1-3 phr and high level of wax impairs low temperature flexibility and compression set. Rubber compounder considers wax as a very important processing aid because it has following advantages:

- Improves mixing properties

Fig No 2

Petroleum Based Wax - Improves dispersion of filler and other ingredients

- Improves extrusion properties

- Improves upon extrudate and calendared surface finish

- Protects surface and acts as antioxidant /antiozonate

Paraffin and Microcrystalline waxes are derived from petroleum. They are easy to recover and offer a wide range of physical properties that can often be tailored by refining processes. Most producers offer two distinct types of petroleum waxes: paraffins, which are distinguished by large, well formed crystals; and microcrystallines, which are higher melting waxes with small, irregular crystals. Microcrystalline wax contains substantial proportions of branched and cyclic saturated hydrocarbons in addition to normal alkanes.

Some producers also sell "intermediate" wax, in which the boiling range is cut where the transition in crystal size and structure occur. Petroleum wax producers also characterize wax by degree of refinement; fully refined paraffin has oil content generally less than 0.5% and fully-refined micro-crystalline less than 3%. Paraffin wax produced from petroleum is essentially a pure mixture of normal and iso-alkanes without the esters, acids, etc. found in the animal and vegetable-based waxes.

Paraffin wax (or simply "paraffin") is mostly found as a white, odorless, tasteless, waxy solid, with a typical melting point between about 47-64 °C and having a density of around 0.9 g/cm3. It is insoluble in water, but soluble in ether, benzene, and certain esters. Paraffin is unaffected by most common chemical reagents, but burns readily. Paraffin wax is generally unbranched hydrocarbon having carbon above C17 and are solid at room temperature. Their carbon atoms typically ranges between C17 - C30 and having typical melting point around 60°C. All paraffinic wax are recovered from fractional distillation of petroleum.The name paraffin implies that it contains straight hydrocarbon structure but it has branch also. Branched paraffins are called ‘Isoparafins’ and cyclic parafins are called ‘Cresines’ or ‘Isoceresies’.

Pure paraffin wax dose in rubber compounding varies from 1-3 phr. Pure paraffin wax is rarely used these days in rubber industry as it has oozing character and in excess it causes blooming on green rubber components, that results in reduction in compound tack. They are frequently blended with microcrystalline wax in rubber compounding therefore.

Pure paraffin wax is an excellent electrical insulator, with an electrical resistivity of between 1013 and 1017 ohm meter. This is better than nearly all other materials except some plastics (notably teflon or polytetrafluoroethylene). It is an effective neutron moderator and was used in James Chadwick's 1932 experiments to identify the neutron. Paraffin wax (C25H52) is an excellent material to store heat, having a specific heat capacity of 2.14–2.9 J g–1 K–1 (joule per gram per kelvin) and a heat of fusion of 200–220 J g–1(joule per gram). This property is exploited in modified drywall for home building material.

Microcrystalline waxes: This is produced by de-oiling petrolatum, as part of the petroleum refining process. Microcrystalline wax contains a higher percentage of isoparaffinic (branched) hydrocarbons and naphthenic hydrocarbons. It is characterized by the fineness of its crystals in contrast to the larger crystal of paraffin wax. It consists of high molecular weight saturated aliphatic hydrocarbons with comparatively higher melting point than paraffinic wax. It is generally darker, more viscous, denser, tackier and more elastic than paraffin waxes. The elastic and adhesive characteristics of microcrystalline waxes are related to the non-straight chain components which they contain. Typical microcrystalline wax crystal structure is small and thin, making them more flexible than paraffin wax. It is commonly used in rubber formulation and cosmetic formulations.

Its usual carbon atom ranges from C40–C70 , having comparatively higher melting point (Fig.4) between 80-105 0C because they have higher number of carbon. Common dose in rubber compounding is between 1-3 phr. Some time higher dose of 100% Micro crystalline wax is difficult to process and as a result they are often blended with paraffinic wax for rubber use. Blending is also done for economical reasons as microcrystalline wax is comparatively costlier. Paraffinic wax, having smaller molecular weight bleeds faster in cured rubber article, whereas, 100% micro crystalline wax will have inherent resistance to faster volatilization and eventually, blended wax will have an intermediate property. Refineries may also utilize blending facilities to combine paraffin and microcrystalline waxes. This type of activity is prevalent especially for industries such as tire and rubber industries.

Higher dose of antioxidant and anti ozonates are always advised to add along with microcrystalline wax because the later help slower migration of antioxidant and antiozonates on the product surface and thereby increase on the product durability against ageing process. Tire curing bladder is often blended with 1-3 phr of microcrystalline wax.

_0.jpg)

Fig.7: Chlorinated Polyethylene waxes (CPE)

Chlorinated Paraffin Wax

Upon chlorination of paraffinic wax we get Chlorinated Paraffin Wax(CPW). This is available in batch process that is processed from effective exothermic reaction. This reaction generates a by-product hydrochloric acid that is later removed out of the solution. Finally stabilizer and solution is mixed that provide the required final product, which is used in various industrial applications. With 30 to 70% chlorine and insolubility in water, these CPWs have low vapor pressure. Chlorinated Paraffin Wax is highly inert, insoluble in water and they have low vapor pressure. Generally used as plasticizers in plastic and elastomers, where flame retardant property is important.

Polyethylene waxes (PE-Wax)

Polyethylene waxes or PE-Wax is same familiar polyethylene chemical structure (Fig.5) but with lower molecular weight , generally around or less than 3000.This is a processing aid in elastomer and plastics but basically they are a form of synthetic resins. It is a white solid product (Fig.6) appears in the market as powdery, lumpy, or flaky product. It is a non-toxic product having concentrated distribution of molecular weight of 1500 with specific gravity about 0.94 with high softening point but low fusion viscosity with melting point; 112 - 118°C, melt peak 110 °C, flash point 210°C, minimum. It has excellent stability against polishing, scratch resistance, metal mark resistance, scuff resistance. PE-Wax is resistant to water and chemical materials.

Global Natural Rubber Market Tightens Amid Improved Demand, ANRPC Reports

- By TT News

- November 07, 2025

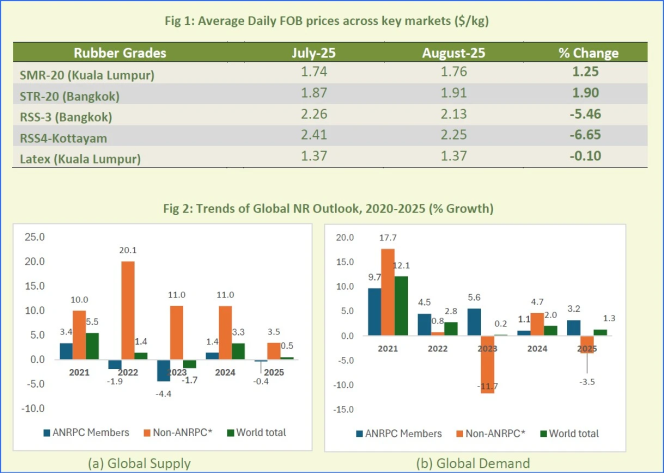

The global natural rubber (NR) market experienced fluctuating prices in August 2025 as supply constraints coincided with signs of improving demand, the Association of Natural Rubber Producing Countries (ANRPC) said in its latest Monthly NR Statistical Report.

The association noted that seasonal factors supported stronger consumption, particularly in China, where declining port inventories signalled healthier demand. However, heavy rainfall and labour shortages in key producing regions curtailed tapping activities, tightening supply conditions.

“Natural rubber prices experienced a fluctuating trend due to several factors, including constrained supply and improving demand,” ANRPC said. “Seasonal factors boosted consumption, particularly in China, where inventory reductions at major ports indicated improved demand. However, rainfall and labour shortages in producing regions limited tapping activities, tightening supply.”

According to updated data from member countries, global natural rubber production is projected to increase by 0.5 percent in 2025 compared with 2024, while demand is expected to grow by 1.3 percent over the same period.

The association said market sentiment had turned “increasingly optimistic” with stronger purchasing interest, driven by the traditional peak season for natural rubber, especially from the all-steel tyre and heavy-duty truck segments.

The ANRPC encouraged subscribers and stakeholders seeking more in-depth insights to refer to the full report or contact the ANRPC Secretariat for subscription details.

India Opens Anti-dumping Probe Into Halobutyl Rubber Imports From China, Singapore And US

- By Sharad Matade

- November 06, 2025

India has launched an anti-dumping investigation into imports of Halo-Isobutene-Isoprene Rubber (HIIR) from China, Singapore and the United States, following a complaint from Reliance Sibur Elastomers Private Limited, the Directorate General of Trade Remedies (DGTR) said in a notification.

The domestic producer alleged that the three countries were exporting the rubber to India at unfairly low prices, causing injury to the local industry. The company has sought the imposition of anti-dumping duties on the product, which is used in tyre inner liners, hoses, seals, tank linings, conveyor belts and protective clothing.

The DGTR said there was prima facie evidence that imports had risen “significantly” and were being sold below normal value, resulting in price depression and affecting the domestic manufacturer’s capacity utilisation and profitability. The authority noted that the dumping “is causing material injury to the domestic industry”.

The investigation will cover the period from July 2024 to June 2025, with an examination of injury trends dating back to April 2021.

HIIR, also known as halobutyl rubber, is classified under the broader synthetic rubber tariff category. Reliance Sibur Elastomers is currently the only producer of the material within India.

If the investigation confirms dumping and injury, the DGTR may recommend the imposition of duties to offset the impact and “remove the injury to the domestic industry”. Interested parties have 30 days to submit data and make their representations to the authority.

Global Carbon Black Market To Hit USD 44.8 Bln By 2034, Driven By Tyre And Autom Demand

- By TT News

- November 06, 2025

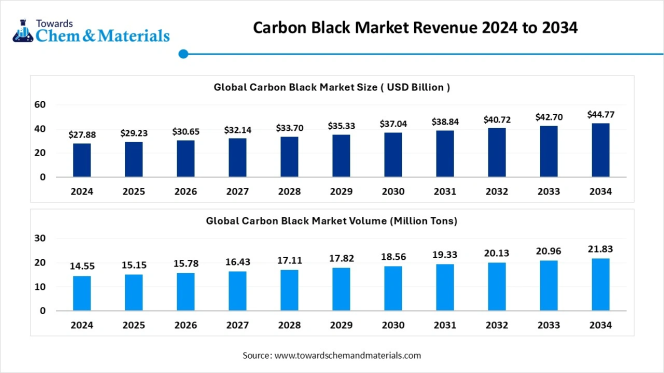

The global carbon black market is projected to grow from USD 27.88 billion in 2024 to USD 44.77 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.85 percent between 2025 and 2034, according to a new report by Towards Chemical and Materials, a research arm of Precedence Research.

The study estimates that the global market volume will rise from around 15.15 million tonnes in 2025 to 21.83 million tonnes by 2034, growing at a CAGR of 4.14 percent, driven primarily by increasing demand for tyres, automotive components and high-performance plastics.

Carbon black – a fine black powder made through the incomplete combustion of hydrocarbons – is a critical material used to reinforce rubber in tyre production and enhance strength, durability and UV resistance in plastics, coatings, and batteries.

Asia Pacific accounted for about 58 percent of global market share in 2024 and is expected to remain the largest and fastest-growing regional market, supported by expanding tyre and rubber manufacturing bases in China, India and Southeast Asia. The region’s carbon black market was valued at USD 16.95 billion in 2025 and is projected to reach USD 26 billion by 2034.

“The Asia Pacific region continues to lead both in production and consumption of carbon black, owing to its strong automotive, tyre and plastics industries,” the report noted, adding that China remains the world’s largest producer and consumer.

The furnace black segment dominated the market in 2024, accounting for about 60 percent of global industry share, due to its superior reinforcing properties in tyres and versatility in plastics and coatings. Meanwhile, the tyres and rubber products segment held a 55 percent share, reflecting the material’s indispensable role in the automotive sector.

Performance applications such as batteries, conductive polymers, and specialty coatings are emerging as key growth drivers. Demand for specialty carbon black and conductive grades is rising with the proliferation of electric vehicles, renewable energy systems, and electronics manufacturing.

Artificial intelligence (AI) is also shaping the carbon black industry, with automation and predictive analytics enhancing process efficiency, product consistency, and sustainability, the report said. AI-driven systems are enabling real-time monitoring and predictive maintenance in production plants, reducing waste and energy consumption.

Sustainability remains a key trend, with manufacturers investing in greener technologies, renewable feedstocks and recovered carbon black (rCB) from recycled tyres to meet circular economy goals. “Turning end-of-life tyres and rubber waste into recycled carbon black is opening new sustainable pathways for producers,” the study noted.

Among key players profiled in the report are Tokai Carbon Co., Ltd., Continental Carbon, Jiangsu C-Chem Co., Ltd., Himadri Speciality Chemical Ltd., Sid Richardson Carbon & Energy Company, Cancarb Limited, Philips Carbon Black Ltd., OCI Company Ltd., Columbian Chemicals Co. (Birla Carbon), Aditya Birla Group, and Raven SR, LLC.

Recent industry developments include PCBL Chemical Ltd.’s establishment of a wholly owned US subsidiary in Delaware in July 2025 to enhance supply chain localisation and strengthen its North American footprint, as well as the West Bengal government’s efforts to attract foreign investment in its carbon black industry to support the electric vehicle, tyre, and battery markets.

The report also forecasts rapid growth in North America, fuelled by clean manufacturing practices, sustainable process adoption and expansion in high-performance plastics and battery applications. Europe, meanwhile, is benefiting from stricter environmental regulations and the EU Green Deal, which are promoting eco-friendly and specialty grades.

The global carbon black market is expected to maintain steady long-term growth as manufacturers diversify into advanced applications and invest in sustainable production technologies to meet evolving industrial and environmental demands.

Kraton To Streamline Berre Polymer Operations Focus

- By TT News

- October 26, 2025

Kraton Corporation, a leading global producer of speciality polymers and high-value biobased products derived from pine chemicals, has revealed a new strategic initiative for its Berre, France facility. The plan involves streamlining its polymer operations to concentrate exclusively on manufacturing USBC products, which will result in the cessation of HSBC production at that site.

This move is designed to bolster Kraton's long-term competitiveness by optimising its manufacturing footprint in reaction to a global overcapacity for HSBC. The company has formally started an information and consultation process with the local Works Councils, with a final decision expected following this mandatory period. The company has reaffirmed its commitment to supplying HSBC from its broader global network and to leveraging its worldwide presence to continue adapting to market demands.

Prakash Kolluri, President, Kraton Polymers, said, “Our aim with this plan is to strengthen Kraton’s long-term competitive position by optimising our manufacturing footprint in response to changing market dynamics associated with global overcapacity of HSBC production capability. With this step, we are preparing Kraton for a sustainable future by securing Kraton’s position as the leading global HSBC producer. Kraton is fully committed to supporting our customers through this transition with supply of HSBC products produced within our unmatched global manufacturing network. We recognise the impact of these actions, and are committed to a safe, respectful and supportive transition. The health, safety and well-being of the employees remain our top priorities.”

Comments (0)

ADD COMMENT