Finorchem’s Tackifying Resins: The Science Behind Advanced Adhesion, Performance And Sustainability

- By TT News

- July 07, 2025

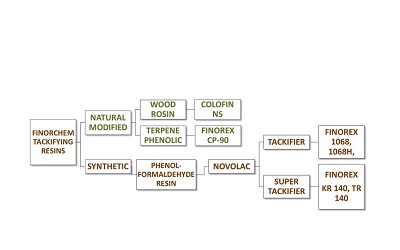

Tackifying resins or tackifiers are versatile organic substances with low molecular weight, high glass transition temperature and a softening temperature above room temperature. They exist as solid materials, derived from certain trees or chemically synthesised. Tackifiers can be broadly classified as natural (rosin-based and terpene-based) and synthetic (C5 & C9 based aliphatic or aromatic hydrocarbon and coumarone-indene) and, finally, phenol-formaldehyde condensation resins.

Phenolic tackifiers enhance adhesion by promoting superior surface contact and intermolecular interactions with rubber substrates, ensuring high initial tack and long-term retention. Unlike general tackifiers that rely primarily on weak Van der Waals forces, phenolic resins offer exceptional cohesion, heat resistance and humidity stability, making them ideal for demanding applications. Their low loading levels minimise heat build-up, optimising processing efficiency while preserving physical, dynamic and rheological properties. Additionally, phenolic tackifiers demonstrate remarkable stability and environmental compatibility, ensuring consistent performance without compromising formulation integrity. This balance of adhesion strength, thermal durability and sustainability makes them a preferred choice in rubber compounding.

Phenolic tackifiers enhance adhesion by promoting superior surface contact and intermolecular interactions with rubber substrates, ensuring high initial tack and long-term retention. Unlike general tackifiers that rely primarily on weak Van der Waals forces, phenolic resins offer exceptional cohesion, heat resistance and humidity stability, making them ideal for demanding applications. Their low loading levels minimise heat build-up, optimising processing efficiency while preserving physical, dynamic and rheological properties. Additionally, phenolic tackifiers demonstrate remarkable stability and environmental compatibility, ensuring consistent performance without compromising formulation integrity. This balance of adhesion strength, thermal durability and sustainability makes them a preferred choice in rubber compounding.

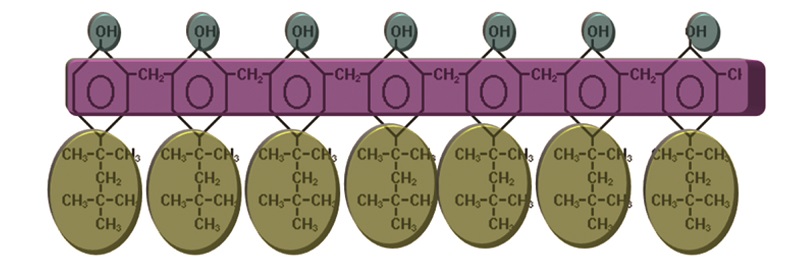

Para-tertiary octyl phenol formaldehyde (PTOP) resin is a high-performance phenol-formaldehyde resin, widely utilised in rubber applications, coatings and adhesives as an industrial tackifier. PTOP resins are preferred tackifiers due to their ideal molecular weight, polarity and superior compatibility with rubber matrices, ensuring strong adhesion through hydrophobic interactions. Their octyl chain length facilitates optimal softening, enhancing wetting, green strength and cohesion.

The effectiveness of these resins is influenced by fillers that reduce tack, while PTOP enhances tack through improved interfacial bonding. Excessive oil incorporation can diminish tack by disrupting resin-rubber interactions. Balancing superior adhesion, thermal stability and process efficiency, PTOP resins remain indispensable in demanding industrial formulations.

Finorchem offers a diverse range of high-performance tackifying resins, catering to various rubber applications. Finorchem’s commitment to innovation and sustainability ensures a superior range of tackifying resins, tailored to meet the evolving demands of rubber compounding and industrial applications. Through precisely engineered formulations, Finorchem delivers exceptional adhesion performance, green tack enhancement and process optimisation, offering a strategic advantage in manufacturing. From PTOP-based FINOREX series to sustainable terpene and wood rosin resins, each solution reflects a dedication to quality, efficiency and environmental responsibility.

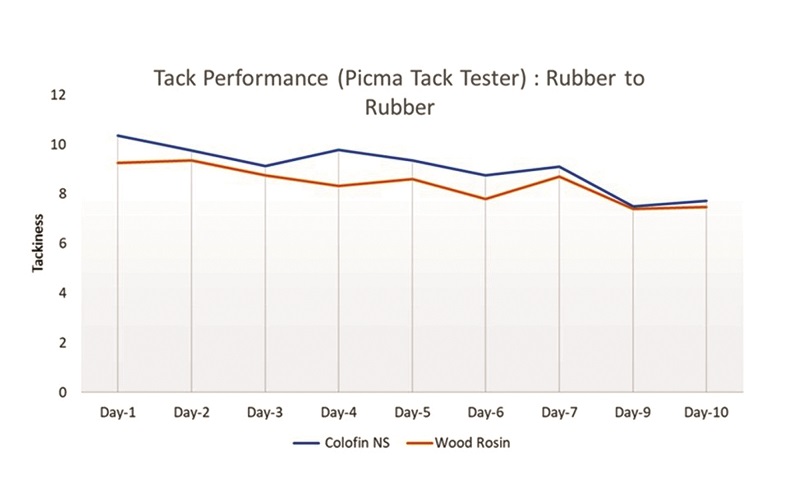

For naturally obtained sustainable tackifying solutions, Finorchem provides COLOFIN NS, a modified wood rosin resin in pastille form, and CP-90, a terpene-phenol-based resin derived from pine tree. Colofin NS enhances rubber processing efficiency with free-flowing, non-sticky pastilles, minimising manual handling, cracking, enabling automated weighing and serving as a sustainable tackifier alternative to rosin and synthetic options. These resins also enhance green tack, filler incorporation and stock flow, making them cost-effective choices for rubber products like tyres, hoses, belts, footwear, flooring and moulded goods.

FINOREX 1068 & FINOREX 1068H, based on PTOP novalac resins, deliver exceptional tack properties with high initial tack and longer tack retention, particularly in synthetic rubber formulations. The difference between the two lies in their softening points, allowing flexibility in application.

FINOREX 1068 & FINOREX 1068H, based on PTOP novalac resins, deliver exceptional tack properties with high initial tack and longer tack retention, particularly in synthetic rubber formulations. The difference between the two lies in their softening points, allowing flexibility in application.

Additionally, FINOREX KR 140 & FINOREX TR 140, developed with para- tertiary butyl phenol & aldehyde-based novalac chemistry, offer superior tack performance under severe environmental conditions, outperforming PTOP-based tackifying resins. Their high softening point ensures sustained tack retention, making them ideal for ENR (Epoxidized Natural Rubber) compounds with high silica content and rubber cushion formulations requiring durability under severe loading conditions.

By integrating cutting-edge tackifying technologies, Finorchem strengthens the durability and reliability of rubber articles under challenging conditions, making them an indispensable partner in high-performance applications. As industries seek sustainable, high-impact solutions, Finorchem remains at the forefront – bridging advanced science with industrial excellence, shaping the future of rubber adhesion. The dedicated chemists and scientists at Finorchem’s state-of-the-art Technology Innovation Centre – featuring an NABL-accredited Chemical Synthesis Lab, Analytical Development Lab and Rubber Application Centre – continue to drive advancements, shaping better prospects for the future.

Author: Tamsuk Goswami – Senior Manager, Product Management & Marketing at FInorchem.

Zeon And Visolis Sign Binding Term Sheet To Advance Bio-Isoprene And SAF Commercialisation

- By TT News

- February 16, 2026

Zeon Corporation and Visolis Inc. have formalised their partnership by signing a binding term sheet, marking a pivotal advancement in the commercialisation of bio-based isoprene monomer and sustainable aviation fuel (SAF).

This collaboration, which now moves from technology verification towards project implementation, is built upon the progress made since their initial memorandum of understanding in March 2024 and the subsequent joint feasibility study announced in April 2025. Bio-based isoprene monomer serves as an essential component in the production of synthetic rubbers and various other materials, while SAF is increasingly recognised as a critical next-generation fuel for reducing carbon emissions within the aviation industry.

The newly established term sheet outlines a foundational agreement on the key elements required for a final investment decision. These include defining the business structure and the respective roles of each company, establishing technology and development strategies and advancing detailed engineering for the proposed production facility. Furthermore, the agreement covers the evaluation of potential sites, the process for engaging with suppliers, securing necessary regulatory approvals and planning the financing pathway.

The envisioned facility is set to commence commercial-scale output after successfully demonstrating mass production capabilities for biomass-based isoprene and SAF, utilising Visolis’ proprietary technology. Both companies are now committed to expediting the path to full-scale production and ensuring a steady supply of these sustainable products to the global market.

Zeon Backs Chemify To Accelerate Digital Chemistry Innovation

- By TT News

- February 12, 2026

Zeon Corporation has deepened its commitment to digital chemistry through a strategic investment and partnership with Chemify Limited, secured via its corporate venture arm Zeon Ventures Inc. Chemify, a growth-stage UK enterprise, is reshaping molecular research by integrating digital tools with automated laboratory systems. Its proprietary Chemputation technology translates molecular targets into executable chemical code, which operates directly on robotic platforms to complete integrated Design–Make–Test–Analyze cycles without manual intervention. This closed-loop automation allows Chemify to explore previously inaccessible areas of chemical space while reducing the timeline from concept to synthesized compound by up to tenfold.

A cornerstone of Chemify’s capability is its recently inaugurated Chemifarm in Glasgow – one of the most sophisticated automated facilities in the world for molecular design and construction. The facility enables accelerated iteration and autonomous synthesis of novel small molecules, converting chemical code into tangible compounds with unprecedented efficiency. These advances are critical for developing functional, synthesisable molecules that can contribute solutions to urgent global issues spanning public health, energy efficiency and environmental protection.

Zeon has been at the forefront of adopting digital methodologies in chemical R&D, recognising their transformative potential from an early stage. This investment is positioned to strengthen Zeon’s internal digital chemistry efforts and catalyse the invention of novel materials capable of addressing complex societal needs. The move aligns with Zeon’s STAGE30 corporate strategy, which targets a rise in revenue contribution from four key growth sectors – Mobility, Healthcare and Life Sciences, Telecommunications and Green Transformation – to 48 percent by fiscal 2028. By backing pioneering enterprises and cultivating advanced materials, Zeon continues to advance its dual vision of a sustainable planet and a secure, progressive society.

- Rubber Board Of India

- Rubber Producers’ Societies

- Sulphur Dusting

- Powdery Mildew

- Rubber Plantations

- Rubber Board Subsidy

Rubber Board Announces Sulphur Dusting Subsidy For Rubber Producers

- By TT News

- February 09, 2026

The Rubber Board of India has announced the opening of an application window for financial aid for sulphur dusting to combat powdery mildew disease in rubber plantations for the year 2026. The scheme is open to all Rubber Producers’ Societies (RPS) operating in both traditional and non-traditional growing regions.

From 10 to 20 February 2026, eligible societies must submit their applications online through the 'ServicePlus' portal on the official Rubber Board website. Societies requiring help with the submission process are advised to contact their nearest Rubber Board regional office or field station, or to consult the board's website for further guidance.

French Recognition Of TPO Bolsters Pyrum's Circular Economy Model

- By TT News

- February 09, 2026

Pyrum Innovations AG has welcomed the official recognition by French authorities on 17 January 2026, which classifies tyre pyrolysis oil (TPO) as a legitimate raw material for the chemical sector. This pivotal regulatory milestone for pyrolysis oil derived from end-of-life tyres substantially enhances the product’s integration into established chemical value chains. It also provides greater predictability for future purchase and partnership frameworks, thereby accelerating the development of industrial material cycles.

For Pyrum, which processes scrap tyres through pyrolysis to recover pyrolysis oil, industrial carbon black and steel, this decision underscores the critical need for standardised and reliable regulatory conditions. Such clarity is fundamental for scaling investments, production volumes and supply chains, particularly as the chemical industry and circular economy converge. The establishment of clear product categories is essential to ramp up the market for high-quality recycled raw materials.

The company remains committed to tracking further developments in France and the wider European dialogue regarding the classification and application of recycled feedstocks. Pyrum’s overarching objective is to expand industrial-scale recycling solutions for scrap tyres. This regulatory progress directly supports the company’s mission to secure long-term, quality-assured supply agreements with partners across the chemical industry, thereby advancing a more sustainable and circular economic model.

Pascal Klein, CEO, Pyrum Innovations AG, said, “The decision in France is an important step for the industrial use of pyrolysis oil from waste tyres. It supports a trend that we are seeing in many markets, where the chemical industry is seeking reliable, technologically robust and clearly classified alternative raw materials.”

Comments (0)

ADD COMMENT