PHYSICS BEHIND RUBBER TRIBOLOGY

- By 0

- May 04, 2020

By Sunish Vadakkeveetil, Mehran Shams Kondori, and Saied Taheri

Center for Tire Research (CenTiRe), Virginia Tech

Rubber, mainly because of its viscous nature, is a widely used material for most contact applications such as, seals, tyres, footwear, wiper blades, bushings etc. The material possesses the property of both a liquid (viscous) and a solid (elastic). Hence, rubber frictional losses at the contact interface is classified into three mechanisms as shown in Figure 1. Hysteresis (μ_hys ) – Energy dissipated due to internal damping of rubber caused by undulation in the surface. Adhesion (μ_adh ) – Due to intermolecular or Vander Waals attraction at the contact interface. It vanishes in the presence of contaminants or lubricants on the surface. Viscous (μ_visc ) – Due to hydrodynamic resistance caused by the fluid in the contact interface. It mainly occurs under the presence of lubricant or fluid in between the contact interface.

Friction as a concept has evolved, as shown in Figure 2 from a simple empirical relation, developed by Amonton’s (1699) and Columb (1785) to more complex representations by considering these different mechanisms of friction. Initial experimental observations by Bowden and Tabor [1] observed the microscopic behaviour of the contact and obtained that the real area of contact is only a part of the nominal contact area. Grosch & Schallamach [2] performed experimental observation to determine the influential factors and obtain a relation between temperature and velocity-dependent friction to frequency-dependent viscoelastic behaviour. Savkoor[3] considers the frictional losses due to adhesive mechanism at the contact interface using a rudimentary theory where the interaction is considered as a series of processes from the growth of contact area in the initial stage to initiation and propagation of crack in the final stage.

Heinrich [4] developed an analytical representation to estimate the hysteretic component of friction by considering the energy losses at the contact interface to the internal damping of rubber from the undulations of the surface. The energy loss thus obtained is related to the frictional shear stress by the energy relation given by Eq. (2).

ΔE=∫d^3 x dt u ̇ . σ (1)

σ_f=ΔE/(A_0 v t) (2)

Persson and Klüppel [5] extended the theory to consider the effect of the surface roughness by assuming the surface to behave as a fractal nature and obtaining the total energy loss being the sum over the different length scales. Klüppel considers the GW theory to consider the contact mechanics where Persson developed a stochastic based contact mechanics theory assuming the rubber deformations to follow the surface asperities, the results are as shown in Figure 3. To consider the actual deformation profile of rubber, an affine transformation approach [6] is considered to obtain the actual deformation of rubber contact. The results are as shown in Figure 4.

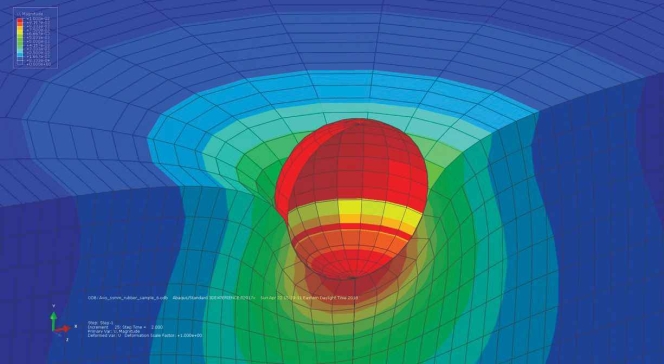

In addition to analytical methods, computational approaches are also considered to estimate deformation behaviour of a rubber block on a rough substrate (Figure 5). The numerical model [7] is validated using indentation experiment and compared against a single asperity model as shown in Figure 6. This is later being extended to obtain friction and wear characteristics of rubber at the contact interface by considering the deformations at the contact interface and obtaining the frictional force [5], [8].

Figure 6: FE Model Of Single Asperity Model & Comparison Of Results With Experimental & Analytical Approach

Wear is mainly due to the frictional shear stress generated at the contact interface leads to energy dissipation at the rubber – substrate contact interface that is either transformed into heat or responsible for crack initiation and propagation eventually leading to material removal. The major contribution of the wear occurs either due to the interaction of smooth asperity and rubber surface (adhesive wear), Figure 7 (a) instantaneous tearing of rubber by sharp asperities (abrasive wear), Figure 7 (b) or due to repeated cyclic contact stress (fatigue wear, Figure 7 (c)).

Due to the importance and complexity of the wear problem, it has been a vital topic of interest studied by many researchers [2]. Numerical techniques and empirical approaches have seen their light in the midst of the expensive and cumbersome experimental observations [9], [10]. Archard’s law states that “the volume rate of wear (W) is proportional to the work done by the frictional forces” as given by Eq. (3), where τ_f is the frictional shear stress and v is sliding velocity.

W∝τ_f v (3)

In the case of road surfaces, the removal of rubber particles can be considered as a process of nucleation and propagation of crack like defects until it is detached to form a wear particle, as shown in Figure 8. Based on this mechanism of crack propagation, a physics-based theory assuming the crack propagates (Figure 9 & Figure 10) from already present defects or voids on the rubber surface was considered and then later compared with experimental methods performed using Dynamic Friction Tester (Figure 11) [6], [11], [12]. Future studies are being performed using analytical and computational approached to estimate the wear characteristics of a rubber material considering damage mechanics [8] and crack propagation theory considering the effect of surface roughness. An experimental technique is also being developed based on the Leonardo Da Vinci concept to experimental test the friction and wear characteristics of a rubber block under pure sliding.

References:

[1] D. Bowden, F. P., & Tabor, The friction and lubrication of solids. Oxford university press., 2001.

[2] A. Gent and J. Walter, The Pneumatic Tire, no. February. 2006.

[3] A. R. Savkoor, “Dry adhesive friction of elastomers: a study of the fundamental mechanical aspects,” 1987.

[4] H. Gert, “Hysteresis friction of sliding rubber on rough and fractal surfaces,” Pochvozn. i Agrokhimiya, vol. 25, no. 5, pp. 62–68, 1990.

[5] S. Vadakkeveetil, “Analytical Modeling for Sliding Friction of Rubber-Road Contact,” Virginia Tech, 2017.

[6] A. Emami and S. Taheri, “Investigation on Physics-based Multi-scale Modeling of Contact, Friction, and Wear in Viscoelastic Materials with Application in Rubber Compounds,” Virginia Tech, 2018.

[7] S. Vadakkeveetil, A. Nouri, and S. Taheri, “Comparison of Analytical Model for Contact Mechanics Parameters with Numerical Analysis and Experimental Results,” Tire Sci. Technol., p. tire.19.180198, May 2019.

[8] S. Vadakkeveetil and S. Taheri, “MULTI – LENGTH SCALE MODELING OF RUBBER TRIBOLOGY FOR TIRE APPLICATIONS,” Virginia Tech, 2019.

[9] K. R. Smith, R. H. Kennedy, and S. B. Knisley, “Prediction of Tire Profile Wear by Steady-state FEM,” Tire Sci. Technol., vol. 36, no. 4, pp. 290–303, 2008.

[10] B. W. and R. N. D. Stalnaker, J. Turner, D.Parekh, “Indoor Simulation of Tire Wear: Some Case Studies,” Tire Sci. Technol., vol. 24, no. 2, pp. 94–118, 1996.

[11] A. Emami, S. Khaleghian, C. Su, and S. Taheri, “Comparison of multiscale analytical model of friction and wear of viscoelastic materials with experiments,” in ASME International Mechanical Engineering Congress and Exposition, Proceedings (IMECE), 2017, vol. 9.

[12] M. Motamedi, C. Su, M. Craft, S. Taheri, and C. Sandu, “Development of a Laboratory Based Dynamic Friction Tester,” in ISTVS 7th Americas Regional Conference, 2013.

Punia Metox Starts Production At Tirupati Facility

- By TT News

- February 19, 2026

Punia Metox Private Limited has commenced production at a new manufacturing facility in Thottambedu, Tirupati, Andhra Pradesh, with operations starting on 12 February 2026.

The plant has an initial production capacity of 12,000 tonnes a year. Its structural design allows capacity to be doubled within four to six months, providing scope for rapid scale-up as demand grows, the company said.

Punia Metox said the facility has been equipped with modern technology to support operational and energy efficiency, safety, sustainability and consistent product quality. The company added that the plant has been designed to enable smooth and seamless operations from the outset.

The expansion forms part of Punia Metox’s strategy to align capacity growth with customer requirements and strengthen its position as a long-term supply partner. The company said the new unit reflects its focus on customer satisfaction, ethical business practices and value-based growth.

Cabot Expands Circular Carbon Production To Asia-Pacific

- By TT News

- February 19, 2026

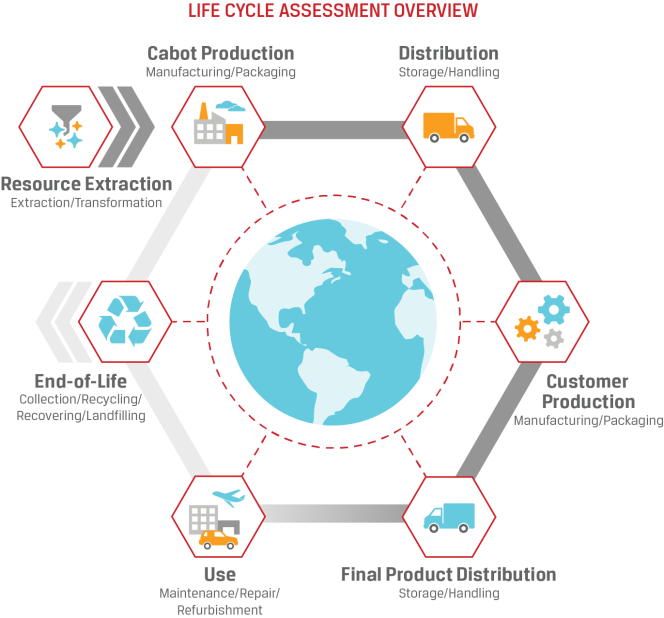

Cabot Corporation said it can now produce circular reinforcing carbons in the Asia-Pacific region after validating manufacturing capability at its plants in Cilegon, Indonesia, and Tianjin, China.

The materials are produced using tyre pyrolysis oil derived from end-of-life tyres and an International Sustainability & Carbon Certification (ISCC) PLUS mass-balance approach. With the addition of the two Asian sites, Cabot said it now has circular reinforcing carbon production capacity across Asia, Europe and the Americas.

Tyre manufacturers are pursuing targets to increase sustainable material use in tyre production, with many aiming for 40 per cent by 2030 and 100 per cent by 2050, the company said. Cabot’s circular reinforcing carbons are designed as a drop-in replacement for conventional carbon black, allowing manufacturers to increase sustainable content without affecting tyre performance.

Aatif Misbah, Vice-President and General Manager for sustainable solutions in Cabot’s reinforcement materials segment, said: “This achievement reflects our deep commitment to delivering sustainable solutions across Asia Pacific and globally. Scaling our circular reinforcing carbon capabilities helps strengthen our role as a trusted partner to the tire industry, while helping to drive meaningful sustainability progress. Looking ahead, we remain focused on supporting our customers’ evolving needs and helping enable a more sustainable future.”

Cabot’s facilities in Ville Platte, Louisiana; Mauá, Brazil; and Valasske Mezirici in the Czech Republic had previously demonstrated circular reinforcing carbon production capability. The products are ISCC PLUS-certified and marketed under the recovered category of Cabot’s EVOLVE Sustainable Solutions platform.

The company said it has 13 ISCC PLUS-certified sites supporting circular reinforcing carbon production across Asia, Europe and the Americas, along with two certified masterbatch and compounding sites in Europe.

- Rathi Group

- Indian Tyre Technical Advisory Committee

- ITTAC

- Automotive Tyre Manufacturers’ Association

- ATMA

- Recovered Carbon Black

- rCB

Rathi Group And ITTAC Sign MoU To Advance rCB Integration In Tyre Manufacturing

- By TT News

- February 18, 2026

The Rathi Group has formalised a partnership with the Indian Tyre Technical Advisory Committee (ITTAC) through a Memorandum of Understanding aimed at advancing technical collaboration on recovered carbon black (rCB). The agreement focuses on the responsible integration of rCB into tyre manufacturing, with an emphasis on detailed evaluation and enhancement of its material properties. This initiative will be driven through structured engagement between industry and academia, supported by ITTAC’s technical expertise.

The collaboration is facilitated by the Automotive Tyre Manufacturers’ Association (ATMA) and ITTAC, which have brought together leading technical experts, tyre manufacturers and research institutions on a unified platform. Their coordinated efforts are fostering a science-based approach to accelerate the assessment and adoption of circular materials within the tyre sector. This partnership is seen as a significant step in strengthening industry–academia linkages to advance sustainable practices.

Through this alliance, the Rathi Group aims to contribute to the evolving landscape of tyre-to-tyre circularity. The joint initiative underscores a shared commitment to developing innovative solutions that support environmental responsibility while maintaining technical performance standards in tyre applications.

Birla Carbon Co-Hosts Inaugural CACM 2026 In Hyderabad

- By TT News

- February 18, 2026

Birla Carbon, a leading global manufacturer and supplier of high-quality carbon materials, is joining forces with the Indian Carbon Society (ICS), the International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI) and Birla Institute of Technology and Science (BITS) to host the Conference on Advanced Carbon Materials (CACM) 2026. Scheduled to take place from 18 to 20 February 2026 at the BITS Pilani, Hyderabad Campus, this event underscores Birla Carbon's deep expertise and ongoing dedication to progress in the carbon materials sector. The company’s commitment is evident through its evolving portfolio, which features industry-leading carbon black, carbon nanotubes and sustainable carbon innovations.

During the conference, Birla Carbon will showcase how its engineered carbon solutions are driving next-generation energy systems and advancing nanotube-enhanced materials. Presentations will highlight developments in customised carbon black architectures designed to improve durability and performance in tyres, rubber products and specialised applications. Additionally, the company will share progress on low-carbon materials derived from bio-based and circular feedstocks, contributing to a wider transition towards sustainable manufacturing practices.

CACM 2026 aims to unite leading scientists, technologists and industry professionals in the field of carbon science and engineering. The event seeks to encourage collaboration among academic, industrial and research sectors, highlight groundbreaking innovations and address key strategic and national priorities in the development of advanced carbon materials.

Dr Ann Schoeb, Chief R&D Officer and Energy Systems, Business Head, Birla Carbon, said, “Innovation in carbon materials is at the core of Birla Carbon’s DNA. Our commitment to advancing material science drives us to collaborate with leading academic and research institutions that share our vision for the future. Carbon materials will play an increasingly critical role in enabling high-performance and next-generation applications across industries. At the same time, they are instrumental in enhancing sustainability and circularity, supporting the transition towards a lower-carbon economy and improving quality of life globally.”

Comments (0)

ADD COMMENT