Agile and Flexible Solutions To Sustainable Mobility

- By Sharad Matade

- October 13, 2021

Michelin India Technology Centre has been operating for over five years. Could you highlight how the centre has been playing its role in research and development for Michelin's domestic and international markets?

Michelin India Technology Centre has been operating for over five years. Could you highlight how the centre has been playing its role in research and development for Michelin's domestic and international markets?

The centre has grown over the years in terms of developing competencies and delivering products and solutions to businesses in the local market, region and globally. The agility and flexibility in delivery of solutions to sustainable mobility is one of our key strengths. The product solutions that are developed in conjunction with other regional teams have the cutting edge, keeping Michelin ahead of the curve. The gender and domain diverse team at the centre has brought unique dimensions to meet customer aspirations specific to different vehicle platforms. There are forward looking concepts and products that are being developed in different life cycle stages by the team in India that have upgraded their skills due to their world class training. Our teams are also exposed to global norms and developments in mature markets, thus enabling them to bring in such perspectives while developing products in the domestic market.

What will drive the Indian truck and bus tyre market in future?

This is very interesting and all of us have seen a reset of a new normal due to Covid-19 in ways we are conducting the different facets of our businesses. The Indian market is smart, agile and ahead in their thought process compared to some of the other markets. The digital solutions, smarts, AI and services will drive the Indian truck and bus tyre market. Customers, whether they own transportation fleets or personal vehicles, want the worry-free ‘fit and forget’ tyre solutions. At Michelin, we have many such services, charging cost per kilometre to customers, which have been deployed in mature markets as well as in India, allowing our customers to focus on other aspects of their business models or personal routines.

The other driving factor will be ‘smarts’ in the tyre industry. The embedded chips in tyres for V2X interfaces are a huge opportunity for the mobility ecosystem with a vast application playfield that includes monitoring tear wear, tyre rotation periods, driver behaviour, inputs fed to active integrated suspensions for ride comfort, adjusting speed depending on terrain for safety and ergonomics of driver comfort as well as cargo movement.

Advanced materials will change the game with growing percentages of recycled rubber in tyre design and manufacturing. These will be an enabler in reducing carbon footprint of a vehicle and the holistic ecosystem including tyre dust. Faster curing materials, self-sealing tyres are around the corner in India. There are pilots and that will be the real ‘aah-ha’ moment for the industry and consumers.

The centre also has a material testing lab. Sustainable raw materials are growing focus of tyre companies. What are the activities of the centre in the material testing space?

Materials, we believe, will be the strategic edge of our products and solutions as mentioned earlier. The centre does leverage material testing, monitoring various aspects of product development. The automation of test data for faster evaluation and upstream design actions is an important aspect with regard to speed to market. This is something that our teams are good at creatively innovating at the centre and the lab downstream.

How do you distinguish the product requirements for developed and developing countries?

It is not the product but the solutions and services that are adapted for different regions. This is decided based on local regulations and norms, and the ecosystem and the infrastructure available there to support it. Product development also considers the tech savviness in the totem poles of the customers. The smartness in deploying the right solutions at the right price, at the right time will continue to be a distinguishing and winning factor for us across the globe.

MITC joined hands with IIT Bombay and ARAI. According to you, how will the new mobility shape in India, and how are you preparing, through R&D work, to offer the customised products in India?

This is one amazing aspect of India that we believe can be leveraged to the advantage of the Indian ecosystem. The Indian competitiveness for delivering ‘more customer value with lesser resources’ will help Michelin progress with these engagements. We will have students exposed to mature markets, working with global academia and experienced Michelin engineers to straight-on take the lead in their careers and solution mindset. We are confident that these and such partnerships are the diving boards to our collective growth. To use the cricket analogies, we are here to play well, in both the T20 and the test matches, and we are building teams that can switch on and off the pace between such situations due to their exposure, mentoring and talent acceleration.

Will you be open to more partnerships in India?

Will you be open to more partnerships in India?

The power of Collective Intelligence is second to none when it comes to delivering smarts to our customers through such valuable partnerships. The centre is already working with few of the academic institutions in India and is in discussions with the right-minded players that are on the same page. We have a clear understanding of ‘where to play’ as it forms our evaluation matrix when we are exploring start-ups, incubation parks and innovation accelerators. We will continue this journey as it helps with the step-change in the Indian ecosystem on many aspects of mobility and related solutions that are beneficial to all stakeholders.

According to you, what are the more significant challenges for scientists and engineers in the tyre industry?

Challenges are to find, train and retain individuals with the right kind of skill-sets. The gestation period to train and get an engineer to deliver high quality smart solutions requires patience and commitment. The more experienced scientists and engineers are at cross roads to delegate to the pipeline of talent that graduates out of our engineering institutions in their early professional journey. The infra and technical power needs to grow in India since the AI solutions and digitalisation can be catapulted very well in an existing innovation mindset for deployment. The race to get to the senior positions without developing a depth in domains is a challenge and not sustainable for growth in the long term. Talent in AI and data analytics tied to tyre and mobility domains is growing, but this talent is enticed by other non-mobility industries, creating a churn and dampening the speed to market and ability to provide attractive solutions and products to our customers. (TT)

CEAT Drives Women’s Leadership And Inclusion Through Comprehensive Workplace Policies

- By TT News

- March 07, 2026

CEAT has introduced a comprehensive set of policies aimed at supporting the specific needs of its women employees and fostering their professional advancement. The organisation emphasises work-life balance as a means to enhance both personal well-being and workplace productivity, offering flexible remote work options in coordination with managers. A Wellness Leave policy allows women two days of monthly work-from-home or leave during menstruation without requiring justification, while shopfloor employees can access on-site Occupational Health Centres for shift changes or rest as necessary.

To cultivate leadership and career growth, CEAT has implemented targeted programmes such as Womentoring, the Women Accelerator Program and STARS, which focus on building digital, functional and leadership competencies. The EmpowHer Employee Resource Group further promotes inclusion and facilitates open dialogue within the organisation.

The company also provides extensive support for mothers, including 26 weeks of paid maternity leave, hospitalisation coverage and facilities such as crèches and lactation rooms across offices and plants. Returning mothers can benefit from flexible hours and a reduced four-hour workday until their child turns one, while shopfloor workers are assigned morning shifts during the first year after childbirth. A gender-neutral Child Caregiver Travel and Stay Policy ensures that caregiving responsibilities do not hinder career progression.

In manufacturing, CEAT has enhanced accessibility by introducing automated machinery, ergonomic fixtures and lift-assist devices. These changes have contributed to a 20 percent women workforce at the Chennai facility and 28 percent representation on the Nagpur shopfloor, which was the first in Maharashtra to introduce night shifts for women. Safe transport, women security personnel and ergonomic workplace design further support this inclusion. Collectively, these efforts reflect CEAT’s commitment to enabling women to lead and succeed in diverse roles.

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

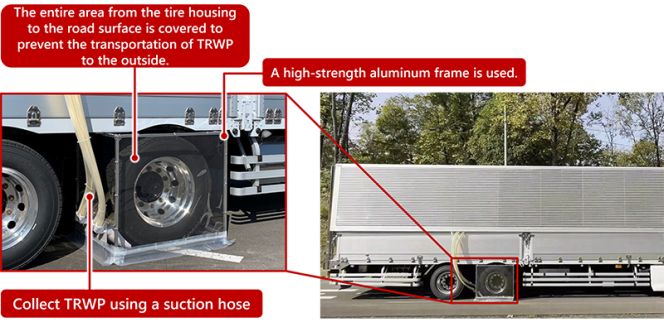

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

UTAC Expands In China With New EV-Focused Proving Ground In Anhui

- By TT News

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

Comments (0)

ADD COMMENT