Challenge Of Change And Business Strategy: Thinking Wide

- By PP Perera

- October 13, 2021

Change and impermanency is the common denominator of all phenomena and processes in nature, which include human activities as well. Heraclitus, the 5th Century BC Greek philosopher, has said that no man can step into the same river twice. This statement from Heraclitus means that the world constantly changes and that no two situations are exactly the same. Just as water flows in a river, one cannot touch the exact same water twice when one steps into a river. This view has been affirmed by Lord Buddha around the same period.

In fact, the challenge of change can be considered as the key driver in all the human endeavours across history and the main motivating factor of business strategies that have evolved through the four industrial revolutions spanning form the mid-18th century to the present day of mass digitalisation. The four principles of change management at any level – be it personal, family, workplace, company or a country – are:

- Understand the change

- Plan the change

- Implement the change

- Communicate the change

Some of the significant contributors to the management of change which resulted in the emergence of new approaches and working models that became popular during the past 50 years can be enumerated as:

- Lewin’s Change Management Model

- McKinsey 7S Model.

- Kotler’s Change Management Theory

- Nudge Theory

- ADKAR Theory

- Bridge’s Transition Model

- Kubler-Ross Five Stage Model

There are many schools of thought around managing organisational change, but there's one thing that's clear. Change managers need to structure their organisational changes and need to avoid 'ad hoc' change management. They need to look at organisational change from a programmatic perspective, leverage subject matter experts around the impacts of change and look at the ‘change beyond the change’.

Corporate change has always been associated with leadership, and Jack Welch, the master of transformational leadership, has once quoted that “good business leaders create a vision, articulate the vision, passionately own the vision and relentlessly drive it to completion.”

Notwithstanding the tremendous utility value of these approaches, I have witnessed the beginning, growth, decline and final exit of some great business empires in Sri Lanka, which could not survive up to the third generation. Similarly, there are exemplary business organisations, the roots of which can be traced back in history to a single person who started with a few rupees and later developed in to corporate giants that are thriving through the third generation. It is therefore apparent that there are no hard and fast norms or standard ground rules, but an emerging factor is the importance of the people at all levels, despite the benefits of automation and digitalisation. Success and failure episodes are abundant throughout the world and corporate graveyards are cluttered with casualties.

Change and business strategy are always closely interlinked without clear boundaries. The ‘Art of War’ – which is attributed to the ancient Chinese military strategist Sun Tzu (around 5th century BC) – remains the most influential strategy text in East Asian warfare and has influenced both Eastern and Western military thinking, business tactics, legal strategy, lifestyles and beyond.

The Covid-19 outbreak, which started around two years ago and developed in to a devastating pandemic, has brought about years of change in the way companies in all sectors and regions do business. The entire world scenario which we currently witness is reminiscent of the opening paragraph of ‘A Tale of Two Cities’, an 1859 historical novel by Charles Dickens.

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.”

The Coronavirus has rapidly made ‘business as usual’ a phrase from the distant past. There is no ‘usual’ in this uncertain time. But organisations that outmanoeuvre uncertainty create a resilience they can count on, irrespective of the changes that come

. We’ve all changed the way we operate during the Covid-19 crisis. Some changes were forced on us, while others represent the height of innovation in a crisis. There’s been a reset of the workforce and work itself, a reset of the employer/employee relationship and a reset of the business ecosystem. For most of them, the business impact of the pandemic has been negative; for some, positive.

The pandemic may have wiped our strategy slate clean (or at least it feels that way), but we have also garnered invaluable experience. Now it’s time to bring together our executive team and use those lessons to reconfigure the business and operating models for a new reality. It appears that in addition to the conventional 3Rs (reduce, reuse and recycle), with respect to resource consumption and sustainability, a set of new 3Rs, namely respond, recover and renew, has emerged during the Covid-19 crisis.

As we shift from response to recovery, the key for senior leaders is to make strategic decisions that will lead them to a renewed future state, however paralysing the uncertain outlook may seem. We can borrow a leaf from the strategy and tactics of the Covid-19 virus itself in learning how to adapt for survival by adopting new paradigms, namely producing more virulent strains such as the Delta variety.

In the absence of a 100 percent effective vaccine or cure for Covid-19, any rebound in business activity could easily be followed by another round of response, recover, renew; so the imperative is to absorb lessons learned quickly and build sustainable changes into business and operating models.

But first, we need to determine exactly where and how the crisis has stretched and broken our existing models, and where the risks and opportunities lie as a result. When talking about risks and opportunities, I cannot help going back to the basics of ISO 9001:2015 Quality Management System (QMS) requirements which expect a company to evaluate the external and internal issues (Clause 4.1), expectations of interested parties (4.2), determining the risks and opportunities (6.1) and planning for change (6.2). In some of the companies that I happen to audit, the priority given to these is at a minimum or no priority given at all apart from stagnant records which do not show any objective evidence of monitoring and review.

However, one important factor we have to consider is that everyone – irrespective of whether it is an individual, family unit, organisation or a country – is on various stages of their unique learning curves, and the strategic horizons have drastically become shorter. Business and strategy planning is no longer an elite task shrouded with mystery and confined to the corporate managers only in their air conditioned rooms but a task to be accomplished in consultation with those who are finally going to implement the strategies and plans. While the Japanese Genba (the actual place) approach is more than 50 years old, it is mostly confined to operational levels, which is rather unfortunate. This crisis has created an opportunity to reset some of our goals and ambitions; it’s time to ask: “As we recover from this crisis, do we want to be different, and if so, how?”

One can see that many companies are in the recovery mode at the moment and trying to do damage control based on profit motive, which is understandable. The entire social, cultural and ethical models and paradigms have changed drastically, and the entrepreneurs need to realise that they are no longer operating in the pre-Covid era. Drastic changes have occurred in the entire supply and value chains with changing customer preferences.

The following quote attributed to many, including Eleanor Roosevelt, a former First Lady of United States, is appropriate to be cited here:

“There are people who make things happen, there are people who watch things happen, and there are people who wonder what happened.”

Change and impermanency is a fact of life, more so today, and if we do not change, change will change us. After all, it was the mathematical genius of the 20th Century, Albert Einstein, who once observed that:

“Insanity is doing the same thing over and over again and expecting different results.”

We can’t keep doing the same thing every day and expect different results. In other words, we can’t keep doing the same workout routine and expect to look differently. In order for our life to change, we must change – to the degree that we change our actions and our thinking, to the degree that our life will change.

The author a Management Counselor from Sri Lanka

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

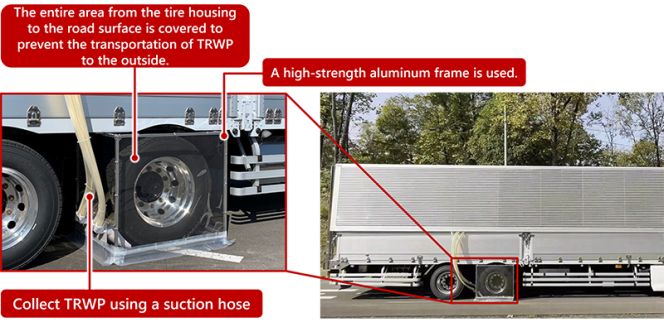

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

UTAC Expands In China With New EV-Focused Proving Ground In Anhui

- By TT News

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

- DUNLOP Tyre Europe

- DUNLOP Tyres

- Sumitomo Rubber Industries

- DUNLOP BLUE RESPONSE TG

- Circuito de Sevilla

- Seville Driving Event

- Summer Tyres

DUNLOP To Showcase BLUE RESPONSE TG Summer Tyre At Seville Driving Event

- By TT News

- March 06, 2026

DUNLOP Tyre Europe GmbH (DUNLOP) is preparing to introduce its latest innovation, the BLUE RESPONSE TG, an all-new summer tyre engineered to advance safety, efficiency and driving dynamics. This model marks a significant milestone as the first DUNLOP summer tyre developed by Sumitomo Rubber Industries (SRI) and will make its official debut this weekend at the Circuito de Sevilla in Spain. The 4.2-kilometre track, known for its 16 corners and lengthy 822-metre straight, provides a demanding environment ideal for showcasing the tyre’s capabilities. Under the theme ‘the art of perfect balance’, the BLUE RESPONSE TG will undergo rigorous evaluation on the Spanish circuit to demonstrate its well-rounded performance.

A dynamic launch event has been arranged to give 120 attendees, including customers, journalists and influencers, a firsthand look at the tyre’s abilities across multiple conditions. Participants will engage in slalom exercises on both dry and wet surfaces, while braking and obstacle avoidance drills will highlight stopping power and responsiveness. Handling assessments will allow for direct comparison with rival products, focusing on cornering stability and steering accuracy. Additional tests will examine comfort and noise levels, emphasising rolling smoothness and sound reduction, as well as efficiency, showcasing lower rolling resistance and reduced fuel consumption. The experience will be complemented by guided road drives and track laps, offering a thorough perspective on the tyre’s dynamic qualities.

To illustrate the versatility of the BLUE RESPONSE TG, the test fleet includes a diverse selection of modern vehicles. Among them are the Audi e-tron, BMW 5 Series, Mercedes-Benz EQE, Mercedes-Benz G-Class, Toyota GR Yaris and Nissan GT-R R35, spanning from premium electric cars to high-performance sports machines. Developed specifically for contemporary vehicle platforms, the tyre integrates an advanced tread design, a novel rubber compound and a reinforced construction. These elements work together to deliver precise handling, short braking distances, strong wet grip and low rolling resistance, catering to drivers seeking safety, comfort and stability in both routine travel and more demanding scenarios.

Markus Bögner, President and Managing Director, DUNLOP Tyre Europe, said, “This is our first DUNLOP event since the acquisition, which is precisely why the launch of our summer tyre is so important to us. Direct interaction with customers and the media here on site is crucial for us, as it is the only way we can hear their perspectives and continue to develop in a targeted manner.”

Comments (0)

ADD COMMENT