It all started in early 2019 for TVS Srichakra to expand and concrete its position on the international turf. The tyre company opened its research and development facility in Milan, Italy in early 2019, and then in August, TVS Tyre rebranded to TVS Eurogrip with the introduction of 19 premium tyres. Since then, the company has been aggressive in enhancing its R&D and testing capabilities and market presence globally. According to V Sivaramakrishnan, CTO, TVS Srichakra, the new brand and new product launches such as zero-degree steel-belted radials, new product lines in tubeless bias have appealed to the trade and its customers alike with increasing traction in the market.

However, TVS Srichakra’s new product launch plans did get impacted due to Covid. As the industry started seeing a revival in demand, in March 2021, TVS Eurogrip launched 11 new products which cater to a wide range, from commute to high-performance bikes as well as electric three-wheelers. This year, the Indian two-wheeler major plans to introduce more products designed and developed in the company’s R&D centre in Milan, Italy for the Indian market. More than two dozen products are in the pipeline for future catering to ‘untapped opportunities’. The company will also start its business in APAC and MEA. “Our Milan R&D centre plays a vital role in defining product target performances, product concept design, technical features and organisation of testing sessions that are held on European roads and racetracks. The Milan team and our R&D centre in Madurai work closely in defining the product specifications and technical aspects while creating new products,” said Sivaramakrishnan.

“Establishing our direct presence in developed and growing markets is an important step for us towards building Eurogrip as a strong global brand. It goes hand in hand with the research studies we’ve been conducting on new technologies, which will benefit all markets, including India. With our expertise as a manufacturer of two-wheeler tyres for over three decades, we are confident of making a mark in developed markets, and we look forward to the future growth potential,” added Sivaramakrishnan.

Its recent offering – e-Conta and e-Durapro – for e-rickshaws, according to the company, has garnered a positive response. TVS is planning to introduce a set of new tyre patterns and sizes specially designed to cater to electric two-wheelers in the coming months.

“The company focuses on its research and development efforts in continuously improving the bike and scooter performance for India and global markets. We have developed a range of high-performance radial tyres suitable for the Indian market. TVS Srichakra is the only company in India to have the entire range of radial technology such as textile cross belted, zero degree textile and zero degree steel,” said Sivaramakrishnan.

TVS Eurogrip is also developing a range of high performance zero degree steel- belted radial tyres for Europe and other markets.

Bounce Back With Changes In Trends

Covid has changed the dynamics of the two-wheeler industry. After a setback last year, the motorcycle industry is bouncing back, and a complete recovery is expected in the next three years.

In the luxury travel markets, the company sees an average gradual decrease of displacement and an increase of scooter and street models. In contrast, in the utility markets, there is a gradual increase in displacement and increased models variety and segmentation.

According to the company, the utility vehicle-driven market is growing in the fast-growing economies. It is predominant by personal two-wheelers, consisting mainly of scooters, mopeds and motorcycles with low average displacement and higher average mileage for commuting purposes, whereas in luxury vehicle markets, personal two-wheelers are used for commuting and leisure purposes and as a status symbol.

“Compared to the Indian bike market, bikes in the leisure market such as the US are used mainly for free time purposes by riders with a much higher and ever-increasing average age. As a result, the leisure markets have seen reduced usage and a lower propensity to buy a replacement bike. To tackle this, bike makers are focusing on less represented groups – young people and female riders. An increasing number of manufacturers have recently released various models in 200 to 450 cc range and electric mobility. Compared to the traditional 600 to 1200 cc markets , these midsize motorcycles are lighter, less expensive, easier to ride and on par with their bigger brothers in terms of quality, style and tech equipment. While more and more manufacturers develop and release these models for leisure markets, we expect that their availability will also reach India and other Asian markets,” said a TVS Eurogrip official.

Push For Electric Mobility

Though slower compared to the e-passenger car industry, the electric two-wheeler industry is gaining traction worldwide. Banning ICE-driven two-wheelers in coming decades, stricter regulations on pollution and improving technologies like longer battery duration and charging infrastructure will further fuel demand for electric mobility in two-wheelers.

“To get behind this moment, an increasing number of motorcycles and scooters are being launched to satisfy customers’ expectations. Alongside, traditional manufacturers are enlarging the capability to include electric vehicles. Many new players are emerging with an exclusive focus on the segment,” added the official.

Eurogrip Product Development for Global Market

To boost its international growth, TVS Srichakra is launching several new products aimed to fit vehicles and riders worldwide. In 2021, the company has launched Bee Connect and Bee City. In 2022, the company will launch the Climber XC for the off-road segment, which will target Motocross and Enduro vehicles. The company will also launch the Road Hound. These tyres will be for the sport-touring segment, which will target naked, sports and tourers. It will also launch the BEE Sports for the sport commuting segment to cover scooters and underbones. Going forward, it will target super sports, medium & big trail and cruiser & heavy tourers.

Testing Capabilities

Today, the company has test tracks in Madurai for testing handling performance and grip in wet and dry conditions on various surfaces such as asphalt, concrete etc. with different friction coefficients. It has its own indoor durability laboratory for tyres, which is capable of testing tyres up to speeds of 300 kmph, and indoor tyre characteristics laboratory, which is capable of accurately measuring tyre rolling resistance, 3-axis stiffness, tyre force and moment characteristics, footprint pressure distribution etc.

“Finite Element Methods (FEM) and Multi-Body Dynamics (MBD) are two focus areas for us, where we use internally developed methods to predict the performance of the tyre on a standalone basis using FEM and simulate driveability performance using MBD. With such simulation tools, we can get the right tread pattern, tyre construction and compound combination to deliver precision performance,” said the company CTO.

The company’s research and development activities are focused on reducing the impact on the environment and maximising performance for end customers. “We continuously explore and adopt technologies which enable us to use recycled material, biodegradable material and reduce energy consumption in tyre production. We have many patents filed in this area,” added Sivaramakrishnan. (TT)

- Comerio Ercole

- Tire Technology Expo 2026

- Tire Technology International Awards 2026

- Tire Manufacturing Innovation of the Year Award

Comerio Ercole Honoured With Top Innovation Award At Tire Technology Expo 2026

- By TT News

- March 07, 2026

Comerio Ercole has concluded a successful participation in the Tire Technology Expo 2026, a premier international event for the tyre sector held in Hannover, Germany. Over the three-day exhibition, the company’s stand drew considerable attention from a global audience of customers, partners and industry professionals. The event served as a vital hub for fostering technical dialogue and commercial relationships, leading to the acquisition of new orders and forward-looking discussions that resonated deeply within the international tyre manufacturing community.

A defining moment for the company at this year’s expo was its recognition at the Tire Technology International Awards for Innovation and Excellence 2026. Comerio Ercole was honoured with the ‘Tire Manufacturing Innovation of the Year’ award, an accolade that underscores its enduring commitment to technological advancement. This achievement was complemented by the company’s status as a finalist in three additional award categories, highlighting its pervasive leadership and innovative edge in calendering technology.

These accolades reinforce Comerio Ercole’s standing as a pivotal technology partner for the global tyre industry. The recognition affirms the company’s strategic focus on engineering increasingly sophisticated solutions to meet the evolving demands of the market and shape its future trajectory.

CEAT Drives Women’s Leadership And Inclusion Through Comprehensive Workplace Policies

- By TT News

- March 07, 2026

CEAT has introduced a comprehensive set of policies aimed at supporting the specific needs of its women employees and fostering their professional advancement. The organisation emphasises work-life balance as a means to enhance both personal well-being and workplace productivity, offering flexible remote work options in coordination with managers. A Wellness Leave policy allows women two days of monthly work-from-home or leave during menstruation without requiring justification, while shopfloor employees can access on-site Occupational Health Centres for shift changes or rest as necessary.

To cultivate leadership and career growth, CEAT has implemented targeted programmes such as Womentoring, the Women Accelerator Program and STARS, which focus on building digital, functional and leadership competencies. The EmpowHer Employee Resource Group further promotes inclusion and facilitates open dialogue within the organisation.

The company also provides extensive support for mothers, including 26 weeks of paid maternity leave, hospitalisation coverage and facilities such as crèches and lactation rooms across offices and plants. Returning mothers can benefit from flexible hours and a reduced four-hour workday until their child turns one, while shopfloor workers are assigned morning shifts during the first year after childbirth. A gender-neutral Child Caregiver Travel and Stay Policy ensures that caregiving responsibilities do not hinder career progression.

In manufacturing, CEAT has enhanced accessibility by introducing automated machinery, ergonomic fixtures and lift-assist devices. These changes have contributed to a 20 percent women workforce at the Chennai facility and 28 percent representation on the Nagpur shopfloor, which was the first in Maharashtra to introduce night shifts for women. Safe transport, women security personnel and ergonomic workplace design further support this inclusion. Collectively, these efforts reflect CEAT’s commitment to enabling women to lead and succeed in diverse roles.

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

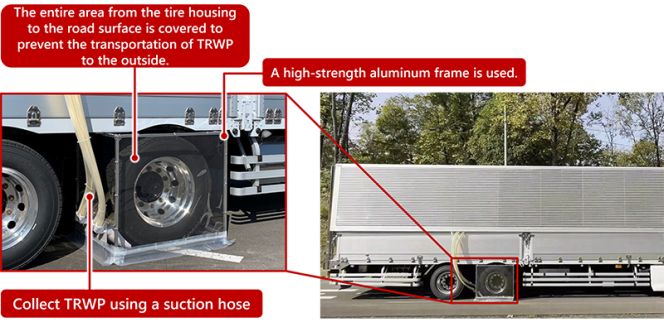

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

Comments (0)

ADD COMMENT