- Mercedes-Benz India

- Mercedes-Benz EQS SUV 580 4MATIC

- Mercedes-Benz

- BEVs

- Luxury Cars

- Luxury SUVs

- Electric Vehicles

Need To Improve Tyre Service Personnel Safety

- By ADAM GOSLING

- October 13, 2021

I have been puzzled for more years than I care to consider as to why tyres, and so the personnel that service our tyres, are treated so poorly. Before replying, have a wander around a car park at the supermarket, or at the truck stop, and look at the condition of the tyres. My team’s fathers have taught their children to look at tyres and so they have become ‘tyre aware’. The children report to me with what they observe of the tyres on vehicles adjacent to them when stopped at traffic lights or in traffic, and they are most concerned! They well understand that their primary safety starts with tyres that are in good condition and appropriately inflated. Thankfully, with TPMS, pressure maintenance has been semi-automated, if the driver takes any notice of the notification on the dash.

So, the personnel who ‘repair’ our tyres, the people at the local tyre shop, or the heavy vehicle service centre or maybe even on a mine site manoeuvring a 4-metre giant tyre onto a wheel or rim, with a combined mass of 5 tonnes to be fitted to a giant haul truck providing a GVM of 600 tonnes, have one thing in common – they are in the firing line if a catastrophic tyre failure occurs during service.

A quick search on the internet will bring a plethora of such events recorded. Why is it serious? A medium size 22.5-inch truck tyre has a burst potential of more than 12 tonnes – a larger tyre of course has a higher potential. There is a serious differentiation that needs to be explained here: a tyre burst is the instantaneous (or near to) release of contained inflation pressure. The resultant force is directly related to the inflation pressure. A tyre explosion is the result of combustion within the tyre’s air chamber. The resultant forces may be magnitudes higher than the initial inflation pressure.

A burst has an effect on the human body not unlike that of a military hand grenade; agreed there is no thermal outcome in a tyre burst and no chemical effects, but the air blast is somewhat equivalent. We expect our tyre service personnel to work on equipment of unknown history or unknown service life on pavements of greatly varying quality without question. Experience is what differentiates older tyre service personnel from a new starter. Sure there are training facilities as well as the school of hard knocks. I do say to trainees, “do not use your first chance with tyres, you may not get another.” Then I show some tyre burst videos and the understanding is set in place.

The quality of components for a pressure vessel – as a tyre assembly actually is – is most critical. The tyre itself must be carefully inspected and be sound and free of defects as far as an external examination can determine. The wheel or rim components, particularly lockrings, MUST be in sound condition and must be compatible with the wheel/rim base they are being mounted onto. If the tyre service personnel are not 100 percent certain of compatibility, then it’s a no fit event.

A tyre being inflated after mounting is worthy of a formal risk assessment. A “what if” process, questions of what if the tyre failed during inflation, what if the wheel/rim failed or in the case of a multi piece assembly disassembled, who is in the firing line in such a case? Yes, inflation cages are a mandate (or should be) in professional tyre shops. The simple hoop style cage will prevent large pieces being ejected from a catastrophic failure but still permits the air blast to escape, potentially damaging any human body within 2–3 metres.

The damage an air blast impacts onto a human body may not be visible from the outside. Such an air blast may impart serious injury to soft internal organs such as lungs, kidneys, digestive systems and may even result in embolisms that can traverse the blood returns to the brain or heart where injury is a not if but how bad.

If you are unfortunate enough to be involved in or attend a catastrophic tyre failure, then have the service personnel attended by an emergency physician with continued observation for 24 hours. The damage to the body may not be immediately apparent.

So why do we permit untrained (read lacking confirmed competence) personnel to work in such a high risk environment? It circles back to why people purchase budget priced tyres; they just don’t see any value in paying for quality. A quick story: a 4WD pulls into the local tyre shop, the driver exclaims he wants the best off-road tyres in the shop and then explains, “Oh, my wife will be with the family car next week, just a set of cheapies on hers will be fine.” There is total confusion in the value proposition here. His toy has to have the best, but the family vehicle can have cut or rock bottom price items. HELLO??? The same phenomenon happens with tyre service work. A smart transport operator well understands that the cost of operating their tyres is a lot more than just the tyre’s purchase price. The tyre bay that supports the operation and keeps it rolling is a key component of the operation. So why not invest in trained and skilled personnel? I say to these owners, a good tyre service personnel knows all their tyres by their first names. Just as the transport operator can tell you about the habits of different vehicles, a competent tyre person can identify aspects of tyre performance most would not even think about; no, most don’t even think about their tyres, let alone care!

So why do we permit untrained (read lacking confirmed competence) personnel to work in such a high risk environment? It circles back to why people purchase budget priced tyres; they just don’t see any value in paying for quality. A quick story: a 4WD pulls into the local tyre shop, the driver exclaims he wants the best off-road tyres in the shop and then explains, “Oh, my wife will be with the family car next week, just a set of cheapies on hers will be fine.” There is total confusion in the value proposition here. His toy has to have the best, but the family vehicle can have cut or rock bottom price items. HELLO??? The same phenomenon happens with tyre service work. A smart transport operator well understands that the cost of operating their tyres is a lot more than just the tyre’s purchase price. The tyre bay that supports the operation and keeps it rolling is a key component of the operation. So why not invest in trained and skilled personnel? I say to these owners, a good tyre service personnel knows all their tyres by their first names. Just as the transport operator can tell you about the habits of different vehicles, a competent tyre person can identify aspects of tyre performance most would not even think about; no, most don’t even think about their tyres, let alone care!

A well-mounted tyre, i.e. one that has been properly mounted onto the wheel or rim base so that it is concentric with the base, will balance up well, rotate smoothly without continually hammering the suspension on every revolution and as well provide fuel savings AND a safe ride for the driver and passengers. Add properly inflated and then maintained (of course, TPMS provides the easiest form of maintenance), and a tyre will perform at its best, which is what we demand when the vehicle is put into a corner, or required to brake heavily. Why would you not want the tyres to be able to perform at peak performance without fault?

Invest in your tyre service personnel, train them and educate them to not only understand the risks but observe the potentials too. Improved business with your clientele as well as enhanced safety for your work force will result. Remember, the TyreSafe 6M principle’s end result is to??? (If you don’t know, askus@tyresafe.com.au)

Competent and passionate tyre service people are worth their weight in gold. When you find one, you’ll understand what I mean.

Take care, stay safe, isolate as required and enjoy! (TT)

- Comerio Ercole

- Tire Technology Expo 2026

- Tire Technology International Awards 2026

- Tire Manufacturing Innovation of the Year Award

Comerio Ercole Honoured With Top Innovation Award At Tire Technology Expo 2026

- By TT News

- March 07, 2026

Comerio Ercole has concluded a successful participation in the Tire Technology Expo 2026, a premier international event for the tyre sector held in Hannover, Germany. Over the three-day exhibition, the company’s stand drew considerable attention from a global audience of customers, partners and industry professionals. The event served as a vital hub for fostering technical dialogue and commercial relationships, leading to the acquisition of new orders and forward-looking discussions that resonated deeply within the international tyre manufacturing community.

A defining moment for the company at this year’s expo was its recognition at the Tire Technology International Awards for Innovation and Excellence 2026. Comerio Ercole was honoured with the ‘Tire Manufacturing Innovation of the Year’ award, an accolade that underscores its enduring commitment to technological advancement. This achievement was complemented by the company’s status as a finalist in three additional award categories, highlighting its pervasive leadership and innovative edge in calendering technology.

These accolades reinforce Comerio Ercole’s standing as a pivotal technology partner for the global tyre industry. The recognition affirms the company’s strategic focus on engineering increasingly sophisticated solutions to meet the evolving demands of the market and shape its future trajectory.

CEAT Drives Women’s Leadership And Inclusion Through Comprehensive Workplace Policies

- By TT News

- March 07, 2026

CEAT has introduced a comprehensive set of policies aimed at supporting the specific needs of its women employees and fostering their professional advancement. The organisation emphasises work-life balance as a means to enhance both personal well-being and workplace productivity, offering flexible remote work options in coordination with managers. A Wellness Leave policy allows women two days of monthly work-from-home or leave during menstruation without requiring justification, while shopfloor employees can access on-site Occupational Health Centres for shift changes or rest as necessary.

To cultivate leadership and career growth, CEAT has implemented targeted programmes such as Womentoring, the Women Accelerator Program and STARS, which focus on building digital, functional and leadership competencies. The EmpowHer Employee Resource Group further promotes inclusion and facilitates open dialogue within the organisation.

The company also provides extensive support for mothers, including 26 weeks of paid maternity leave, hospitalisation coverage and facilities such as crèches and lactation rooms across offices and plants. Returning mothers can benefit from flexible hours and a reduced four-hour workday until their child turns one, while shopfloor workers are assigned morning shifts during the first year after childbirth. A gender-neutral Child Caregiver Travel and Stay Policy ensures that caregiving responsibilities do not hinder career progression.

In manufacturing, CEAT has enhanced accessibility by introducing automated machinery, ergonomic fixtures and lift-assist devices. These changes have contributed to a 20 percent women workforce at the Chennai facility and 28 percent representation on the Nagpur shopfloor, which was the first in Maharashtra to introduce night shifts for women. Safe transport, women security personnel and ergonomic workplace design further support this inclusion. Collectively, these efforts reflect CEAT’s commitment to enabling women to lead and succeed in diverse roles.

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

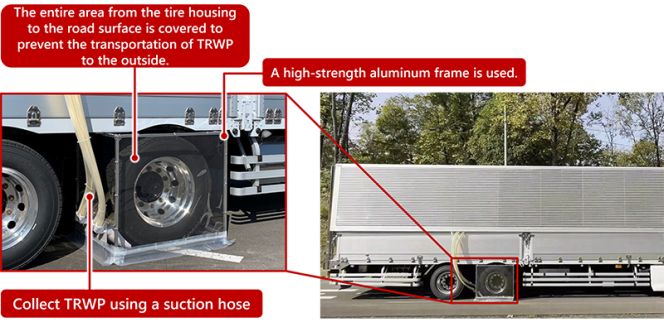

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

Comments (0)

ADD COMMENT