Rajratan Global Wire Limited On Expansion Spree

- By Sharad Matade

- October 13, 2021

“We will be implementing all our learnings of the previous years into the operations. In choosing a plant location, we consider the distance between our customers and ensure that we can keep up our supply while maintaining sufficient inventory and work on a VMI model, as we do for all the major tyre makers in Thailand. We are working on designing the process lines which will be much better in terms of product quality, environmental standards and productivity. Overall, we aim to install a world-class facility which will make working more efficient and effective in all aspects,” said Yashovardhan Chordia, Director, Rajratan Thai Wire Co , a 100 percent subsidiary of Rajratan Global Wire

“We will be implementing all our learnings of the previous years into the operations. In choosing a plant location, we consider the distance between our customers and ensure that we can keep up our supply while maintaining sufficient inventory and work on a VMI model, as we do for all the major tyre makers in Thailand. We are working on designing the process lines which will be much better in terms of product quality, environmental standards and productivity. Overall, we aim to install a world-class facility which will make working more efficient and effective in all aspects,” said Yashovardhan Chordia, Director, Rajratan Thai Wire Co , a 100 percent subsidiary of Rajratan Global Wire

The company had completed its brownfield expansion in March 2020, post which the national lockdown was announced. However, manufacturing revived sharply when markets re-opened, enabling Rajratan Global Wire to support and meet its customer demands with enhanced capacities. “As explained before, the China + 1 supplier need of global players coupled with the expanding demand for tyre in local and export markets is quite encouraging. It has given us the necessary confidence to go for further expansion in Thailand and a new greenfield plant in India (Chennai, Tamil Nadu). Our Chennai plant will also enable us to meet the increasing export demand owing to its proximity to the port,” explained Chordia.

National lockdown in 2020 affected the company as it did to all industries. The company’s manufacturing activities were shut for more than a month in India and took a planned shutdown for 25 days in Thailand since the demand was relatively low. However, Covid did not create any structural changes to the company’s business. “Except for the first month of the initial lockdown, demand was robust for subsequent months. We have been witnessing good opportunities to sell much bigger volumes.

Also, due to Covid and the logistics turmoil, many customers are looking at a China + 1 supplier strategy for their international business. This has consequently led to a rise in our customer base within export markets. Domestically, we also see customers increasing their buying from local sources to reduce the risk of supply shortage hampering their production, , ” said Chordia.

Rajratan Global Wire now offers bead wire to its customers from both locations – Indore and Thailand, wherever feasible – to ensure regular supplies. It has shifted a few of its export customers to India to counter the poor container availability. “There has been a reduction in the (volume) import of raw materials from China for many years, which now has reduced even further. Covid challenges allowed us to develop other alternatives timely, and these have all been streamlined now,” added Chordia.

Logistic costs have surged to new highs, and the availability of containers and drivers have been challenging. “As I explained previously, we are offering products to our customers from both locations, wherever the logistics cost is cheaper. We have also made few agreements with the shipping lines and other related parties to improve reliability, especially if the price remains unchanged. I think the cost of logistics today is high everywhere, so we are all sailing in the same boat. Over the year, there have been instances where cost went up so much that eventually customers had to explore other sources. At the same time, there are many new markets and a growing list of customers is being added at a steady rate,” said Chordia.

Logistic costs have surged to new highs, and the availability of containers and drivers have been challenging. “As I explained previously, we are offering products to our customers from both locations, wherever the logistics cost is cheaper. We have also made few agreements with the shipping lines and other related parties to improve reliability, especially if the price remains unchanged. I think the cost of logistics today is high everywhere, so we are all sailing in the same boat. Over the year, there have been instances where cost went up so much that eventually customers had to explore other sources. At the same time, there are many new markets and a growing list of customers is being added at a steady rate,” said Chordia.

India is an oligopoly market with four manufacturers followed by imports. Rajratan has the largest manufacturing capacity amongst the four. The size of the Indian market currently stands at approximately 110,000 to 120,000 tonnes, including cycle tyres. Rajratan Global Wire has expanded its capacity to meet the growing requirement of domestic tyre companies which are witnessing strong local and export demand. “The capacity expansions taken up by local tyre manufacturers have given the confidence to set up a new greenfield facility in Chennai (port-based) to target the growing domestic as well as export markets,” explained Chordia.

In Thailand, Rajratan Global Wire is expanding its capacity from 40,000 TPA to 60,000 TPA to meet the local demand, otherwise impacted by the lack of bead wire supplies from manufacturers outside Thailand. “This has also provided the necessary boost to our local Thailand sales figures as we are the only local bead wire manufacturer in Thailand,” said Chordia.

In Thailand, Rajratan Global Wire is expanding its capacity from 40,000 TPA to 60,000 TPA to meet the local demand, otherwise impacted by the lack of bead wire supplies from manufacturers outside Thailand. “This has also provided the necessary boost to our local Thailand sales figures as we are the only local bead wire manufacturer in Thailand,” said Chordia.

Many major Chinese tyre companies have established their base in the SEA countries to avoid US traffic, and this has brought further opportunities to Rajratan Global Wire. According to Chordia, post the pandemic and due to the current logistics issues, the opportunity has become more prominent as all the tyre manufacturers in the SEA region are looking to source more locally. “We have a good opportunity as suppliers since there are six big Chinese tyre companies in Thailand, a couple of them in Vietnam and a few upcoming ones in Indonesia. We are in a sweet spot to meet the requirements of local tyre manufacturers (including Chinese tyre companies) in Thailand as well as from local tyre manufacturers in India, the two biggest tyre manufacturing markets in Asia outside China,” said the company executive.

The company focuses on several key aspects like adhesive strength, rubber coverage, elongation and tensile strength to achieve the required quality. “These are areas we continuously keep working on to improve our offerings to our customers. We at Rajratan have developed that culture of improvement, and it has been our key to whatever success we have had in business today,” added Chordia.

Rajratan Global Wire is working on digitalising and automating its operations in line with Industry 4.0 and on the sustainability front. The company aims to reduce its water consumption by 70-80 percent and use more recycled raw material (steel) to make its product. Rajratan Global Wire has also improvised on its product packing and reduced the usage of paper, wood and plastic.

Rajratan Global Wire is working on digitalising and automating its operations in line with Industry 4.0 and on the sustainability front. The company aims to reduce its water consumption by 70-80 percent and use more recycled raw material (steel) to make its product. Rajratan Global Wire has also improvised on its product packing and reduced the usage of paper, wood and plastic.

Bead wire forms nearly three percent of the cost of making a tyre but is a critical product as it is instrumental in holding the tyre to the wheel’s rim. Rajratan Global Wire’s product is a critical raw material in the tyre and affects the safety factor of the tyre. The company is putting significant efforts to improve the product quality continuously. “We are always in dialogue with our customers on identifying areas of improvement to grow our presence. We manufacture the widest range of bead wire (sizes) in India,” added Chordia.

Talking about the changing bead wire technology for EV tyres, Chordia said, “From whatever we know till now from our customers, there is no major change in the use of bead wire for the EV tyres. Yes, I think their focus will be to make lighter tyres for EV. There is a possibility that this might further change the bead wire sizes and strength of the wire. I have not come across any discussion about a substitute for the existing bead wire up until now.”

Talking about the changing bead wire technology for EV tyres, Chordia said, “From whatever we know till now from our customers, there is no major change in the use of bead wire for the EV tyres. Yes, I think their focus will be to make lighter tyres for EV. There is a possibility that this might further change the bead wire sizes and strength of the wire. I have not come across any discussion about a substitute for the existing bead wire up until now.”

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

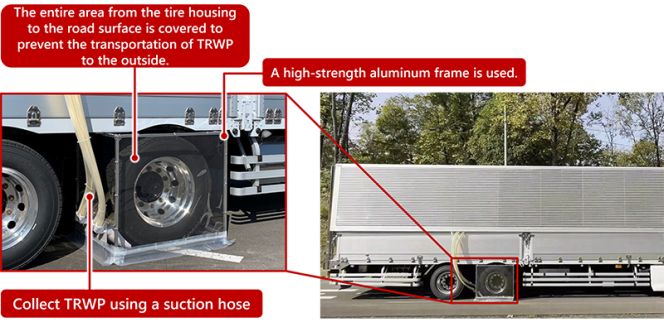

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

UTAC Expands In China With New EV-Focused Proving Ground In Anhui

- By TT News

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

- DUNLOP Tyre Europe

- DUNLOP Tyres

- Sumitomo Rubber Industries

- DUNLOP BLUE RESPONSE TG

- Circuito de Sevilla

- Seville Driving Event

- Summer Tyres

DUNLOP To Showcase BLUE RESPONSE TG Summer Tyre At Seville Driving Event

- By TT News

- March 06, 2026

DUNLOP Tyre Europe GmbH (DUNLOP) is preparing to introduce its latest innovation, the BLUE RESPONSE TG, an all-new summer tyre engineered to advance safety, efficiency and driving dynamics. This model marks a significant milestone as the first DUNLOP summer tyre developed by Sumitomo Rubber Industries (SRI) and will make its official debut this weekend at the Circuito de Sevilla in Spain. The 4.2-kilometre track, known for its 16 corners and lengthy 822-metre straight, provides a demanding environment ideal for showcasing the tyre’s capabilities. Under the theme ‘the art of perfect balance’, the BLUE RESPONSE TG will undergo rigorous evaluation on the Spanish circuit to demonstrate its well-rounded performance.

A dynamic launch event has been arranged to give 120 attendees, including customers, journalists and influencers, a firsthand look at the tyre’s abilities across multiple conditions. Participants will engage in slalom exercises on both dry and wet surfaces, while braking and obstacle avoidance drills will highlight stopping power and responsiveness. Handling assessments will allow for direct comparison with rival products, focusing on cornering stability and steering accuracy. Additional tests will examine comfort and noise levels, emphasising rolling smoothness and sound reduction, as well as efficiency, showcasing lower rolling resistance and reduced fuel consumption. The experience will be complemented by guided road drives and track laps, offering a thorough perspective on the tyre’s dynamic qualities.

To illustrate the versatility of the BLUE RESPONSE TG, the test fleet includes a diverse selection of modern vehicles. Among them are the Audi e-tron, BMW 5 Series, Mercedes-Benz EQE, Mercedes-Benz G-Class, Toyota GR Yaris and Nissan GT-R R35, spanning from premium electric cars to high-performance sports machines. Developed specifically for contemporary vehicle platforms, the tyre integrates an advanced tread design, a novel rubber compound and a reinforced construction. These elements work together to deliver precise handling, short braking distances, strong wet grip and low rolling resistance, catering to drivers seeking safety, comfort and stability in both routine travel and more demanding scenarios.

Markus Bögner, President and Managing Director, DUNLOP Tyre Europe, said, “This is our first DUNLOP event since the acquisition, which is precisely why the launch of our summer tyre is so important to us. Direct interaction with customers and the media here on site is crucial for us, as it is the only way we can hear their perspectives and continue to develop in a targeted manner.”

Comments (0)

ADD COMMENT