Hankook’s Collaborative Effort To Help Lessen Tyre Waste Generation

In an effort to make the world sustainable, Hankook Tire has collaborated with shoe brand YASE to launch eco-friendly shoes made of recycled tyres.Together, they have got on board the ‘Zero – Leave Nothing Behind’ project which aims to upcycle ELTs to make sustainable shoe products.

Hankook Tire has always been at the forefront of sustainable practices with having set goals such as achieving 100 percent of sustainable raw material use by 2050 and reducing greenhouse gas emissions by 50 percent compared to that of 2018. These initiatives also extend to R&D where the tyre maker has minimised the rolling resistance of its tyres to improve the fuel efficiency of vehicles and ultimately reduce greenhouse gas emissions. The company also established an ESG committee to further strengthen its sustainability management efforts.

Hankook Tire has always been at the forefront of sustainable practices with having set goals such as achieving 100 percent of sustainable raw material use by 2050 and reducing greenhouse gas emissions by 50 percent compared to that of 2018. These initiatives also extend to R&D where the tyre maker has minimised the rolling resistance of its tyres to improve the fuel efficiency of vehicles and ultimately reduce greenhouse gas emissions. The company also established an ESG committee to further strengthen its sustainability management efforts.

Jimmy Kwon, Vice President of Hankook Tire’s Brand Lab, talks to Rajni Jose from Tyre Trends about this collaborative effort.

Q) What are the purpose and goals associated with this collaboration?

Jimmy Kwon: Hankook Tire and YASE embarked on the ‘Zero – Leave Nothing Behind’ project with a commitment to sustainable materials and environmental protection. As sustainability is a core value and key agenda for us, we have taken the topic of tyre recycling as one of the top agendas each year. We are glad to make good use of recycled tyres by turning them into hard-wearing and robust shoes in collaboration with YASE. We also believe this collaboration will offer the MZ generation, who have not had an opportunity to use tyres yet, a chance to experience Hankook Tire since a pair of shoes is a necessity that people use on a daily basis.

Q) What role does Hankook play in this collaboration? What are the processes involved in the upcycling of used tyres into shoes?

Jimmy Kwon: Hankook Tire will collect discarded tyres and extract rubber from them to pulverise rubber into a powder so that it can be processed into the outsole. Regarding the processes, upcycling itself benefits the environment as it minimises the volume of discarded materials and waste dumped into the landfills. It also reduces the need for production using new or raw materials, which leads to a reduction in air pollution, water pollution and greenhouse gas emissions.

Q) Is the company looking to produce products other than shoes?

Jimmy Kwon: Currently, Hankook Tire is focusing mainly on footwear in terms of collaboration items as both tyres and shoes share common traits of playing a crucial role in mobility and touching the ground on a daily basis. They also protect people from possible dangers on the road with durability and stability.

Q) What are the other materials used to make these shoes?

Jimmy Kwon: The upper part of the shoes is made of synthetic vegan leather, whereas the insole is made of OrthoLite and natural latex.

Q) By upcycling used tyres, how much carbon emissions do we save?

Jimmy Kwon: For this collaboration, we have recycled 50 used tyres to manufacture 2,000 pairs of shoes in total. According to the Korea National Institute of Forest Science, 2.8 tonnes of carbon dioxide emissions is reduced by recycling 50 used tyres which weigh approximately 1.5 tonnes. This is equivalent to planting 425 pine trees. Likewise, around 1.9 kg of carbon dioxide emissions is reduced per kg of tyres recycled. This is not a small amount as a 20-year-old tree consumes 6.7 kg of carbon dioxide emission.

Q) Does the company have a take-back policy? If not, how can the shoes be disposed of sustainably after use?

Jimmy Kwon: We do not have a related policy so far, but our decision to embark on the project of launching upcycling footwear displays our deep sense of care and commitment towards sustainability and environmental protection. It is thrilling that we are giving consumers an option to choose eco-friendly footwear. Shoes made of our old tyres will not only make a positive social impact but will also be hard-wearing and robust as our tyres are developed with high-quality materials and cutting-edge technologies.

Q) Currently, other brands offering shoes made from upcycled used tyres have priced their products higher than regular shoes. How does the company plan to price the products so that customers prefer this sustainable alternative over regular shoes?

Jimmy Kwon: The collaboration items are not specifically priced high compared to regular shoes sold by YASE. For example, a pair of Hankook Tire x YASE Chelsea boots are priced at KRW 102,000 (USD 86) while a pair of existing 506 5CM Chelsea boots are KRW 98,000 (USD 83). It is 4 percent more expensive, but the prices are different only because their designs are different. Hankook Tire is trying to provide customers with excellent quality products at a reasonable price whether they be tyres or shoes.

Q) What are the marketing strategies adopted to attract customers?

Jimmy Kwon: Not only the shoes themselves but the packaging is designed with sustainability initiative as well. Shoeboxes, tags and pamphlets are made of 100 percent sugarcane material. Hankook Tire expects this will resonate with customers who are early adopters and are conscious about the environment. In addition, we have chosen an online fashion retailer that is popular among the MZ generation as a sales channel in Korea since we have found that this generation is especially environment-conscious and keen to making green purchase decisions.

Q) Where will these be produced?

Jimmy Kwon: These eco-friendly shoes are produced in Korea where the YASE factory is located.

Q) Is the company looking into exports?

Jimmy Kwon: Although we are not considering shipping overseas or exports at the moment, we would like to proceed in the future when there is an opportunity.

Q) What are the further expansion plans of the range?

Jimmy Kwon: Currently, we have unveiled five products through collaboration: four dress shoes and one comfort insole. We plan to continue collaboration with YASE to add special edition running shoes in October.

Q) What future do you see for upcycled used tyre products in the fashion industry?

Jimmy Kwon: Consumers are getting more and more conscious of the damaging effects of wastes, which explains why upcycling is becoming increasingly popular in the fashion industry. A tyre is a good resource for upcycling since tyres, especially the ones developed with Hankook’s high-quality materials and cutting-edge technologies, are durable and robust. We believe it’s a kind of collaboration that leads to mutually inspired progressive innovation for both industries and that there can be many opportunities forward. It’s a great way to widen customers’ eco-friendly options and to give old tyres a second life.(TT)

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

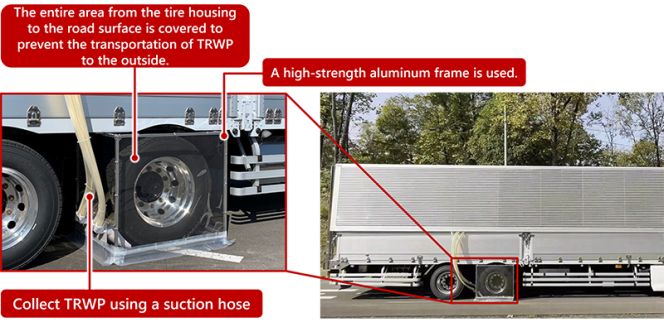

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

UTAC Expands In China With New EV-Focused Proving Ground In Anhui

- By TT News

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

- DUNLOP Tyre Europe

- DUNLOP Tyres

- Sumitomo Rubber Industries

- DUNLOP BLUE RESPONSE TG

- Circuito de Sevilla

- Seville Driving Event

- Summer Tyres

DUNLOP To Showcase BLUE RESPONSE TG Summer Tyre At Seville Driving Event

- By TT News

- March 06, 2026

DUNLOP Tyre Europe GmbH (DUNLOP) is preparing to introduce its latest innovation, the BLUE RESPONSE TG, an all-new summer tyre engineered to advance safety, efficiency and driving dynamics. This model marks a significant milestone as the first DUNLOP summer tyre developed by Sumitomo Rubber Industries (SRI) and will make its official debut this weekend at the Circuito de Sevilla in Spain. The 4.2-kilometre track, known for its 16 corners and lengthy 822-metre straight, provides a demanding environment ideal for showcasing the tyre’s capabilities. Under the theme ‘the art of perfect balance’, the BLUE RESPONSE TG will undergo rigorous evaluation on the Spanish circuit to demonstrate its well-rounded performance.

A dynamic launch event has been arranged to give 120 attendees, including customers, journalists and influencers, a firsthand look at the tyre’s abilities across multiple conditions. Participants will engage in slalom exercises on both dry and wet surfaces, while braking and obstacle avoidance drills will highlight stopping power and responsiveness. Handling assessments will allow for direct comparison with rival products, focusing on cornering stability and steering accuracy. Additional tests will examine comfort and noise levels, emphasising rolling smoothness and sound reduction, as well as efficiency, showcasing lower rolling resistance and reduced fuel consumption. The experience will be complemented by guided road drives and track laps, offering a thorough perspective on the tyre’s dynamic qualities.

To illustrate the versatility of the BLUE RESPONSE TG, the test fleet includes a diverse selection of modern vehicles. Among them are the Audi e-tron, BMW 5 Series, Mercedes-Benz EQE, Mercedes-Benz G-Class, Toyota GR Yaris and Nissan GT-R R35, spanning from premium electric cars to high-performance sports machines. Developed specifically for contemporary vehicle platforms, the tyre integrates an advanced tread design, a novel rubber compound and a reinforced construction. These elements work together to deliver precise handling, short braking distances, strong wet grip and low rolling resistance, catering to drivers seeking safety, comfort and stability in both routine travel and more demanding scenarios.

Markus Bögner, President and Managing Director, DUNLOP Tyre Europe, said, “This is our first DUNLOP event since the acquisition, which is precisely why the launch of our summer tyre is so important to us. Direct interaction with customers and the media here on site is crucial for us, as it is the only way we can hear their perspectives and continue to develop in a targeted manner.”

Comments (0)

ADD COMMENT