We Are On A Steep Learning Curve Since The Beginning Of 2020: Rogier van Hoof

- By Sharad Matade

- October 13, 2021

Being a global supplier of tyre oil, Nynas supplies its products to major tyre companies worldwide. However, the Covid-19 pandemic brought unforeseen challenges in transporting goods through all three modes of transportations, and Nynas is no exception! In an interview with Sharad Matade of Tyre Trends, Rogier van Hoof, Head of Secondary Distribution Naphthenics at Nynas, says enhanced communication and exchange of information digitally will help the company handle the new challenges. He also added that the container availability is expected to be normalised in 2022 but road transportation will remain a challenge.

Ever since Covid-19 engulfed the world, the job of Rogier van Hoof, Head of Secondary Distribution Naphthenics at Nynas, has become more challenging. Though tyre production is coming back on track speedily, the challenges at the logistic front are still demanding. Recollecting the initial impact of Covid, van Hoof says, "For Nynas, it all started in early 2020, when the lockdowns in China forced factories to close down manufacturing activities. However, the initial shock was largely seen in truck movements. As part of the measures, drivers had to go into quarantine after a long haul drive. They could pick up a container, but they had to go into quarantine when they were back at the delivery point. So we saw an immediate effect on the truck availability. The cascading impact, I don't think anybody could have predicted. We are on a steep learning curve since the beginning of 2020."

van Hoof and his team swung into action and immediately enhanced the communication with its customers, forwarders and logistic partners to evaluate options to tackle the unprecedented challenges. "I don't think anyone was prepared for what had happened afterwards. Before Covid, people used to take logistics for granted that you order something and it's there when you want it. But with the Covid situation, people have realised to approach things differently, not only on the factory levels but also on the logistics sides on a day to day basis. There are still many limitations we have to deal with," says van Hoof.

According to van Hoof, in the last one and a half years, the just-in-time concept is out of the window and long-term planning has become the priority. "In the past, we knew there was a vessel going every week, and we had substantial free times in getting the containers in, getting them loaded and bringing them to the quay. Even if we would miss a vessel, we always could ship it next week, so the delay was manageable – but that has gone completely out of the window today. It is clear that if you miss a vessel, the next vessel with space will be there maybe in a month. This means everyone needs to plan much further ahead," says van Hoof.

According to van Hoof, in the last one and a half years, the just-in-time concept is out of the window and long-term planning has become the priority. "In the past, we knew there was a vessel going every week, and we had substantial free times in getting the containers in, getting them loaded and bringing them to the quay. Even if we would miss a vessel, we always could ship it next week, so the delay was manageable – but that has gone completely out of the window today. It is clear that if you miss a vessel, the next vessel with space will be there maybe in a month. This means everyone needs to plan much further ahead," says van Hoof.

Most countries are now recovering from the Covid impact; however, many major export destinations are still grappling with severe restrictions. Many main ports are congested and containers are either stacking up at cargo ports or in inland depots. This imbalance results in waiting time for space on vessels, according to reports, between three to eight weeks. The logistics supply chain is struggling to get back in balance resulting in extreme price spikes and unpredictable delays. "This is a situation which is unprecedented; we have never seen it before," adds van Hoof.

van Hoof says loyalty and predictability are helping the company sail through the rough time. "We have been working with our logistic partners for a long time and, therefore, they know that what we promise them, we deliver. Predictability towards the stakeholders like transporters, shipping lines, forwarders has become key. In desperation, many companies are making overbooking of containers but failing to utilise the booking fully. In our relationship with our forwarders and the shipping lines, we have been able to show loyalty and keep our promise. If we tell the shipping line that we will ship 50 containers this week, we will make sure that these 50 containers are there. Our loyalty is rewarded by the fact that they will treat us as a preferential client. Price is no longer the highest priority, and this is something people need to realise. There's always somebody who is prepared to pay more,” explains van Hoof.

van Hoof feels the container availability situation will be normalised by 2022, but the driver availability issue will remain a more significant issue.

Currently, the company has 23 depots worldwide, of which Antwerp, Houston and Singapore are central storage facilities and blending stations. Last year, the company transported around 700,000 tonnes of oil by sea. There were also 30,000 deliveries by road tanker, 10.000 container transports and 250,000 drums delivered to customers worldwide.

Currently, the company has 23 depots worldwide, of which Antwerp, Houston and Singapore are central storage facilities and blending stations. Last year, the company transported around 700,000 tonnes of oil by sea. There were also 30,000 deliveries by road tanker, 10.000 container transports and 250,000 drums delivered to customers worldwide.

However, opening more depots to tackle the logistic challenges is not viable, thinks van Hoof. Around 2018-19, shipping costs for containers were at the lowest level ever; companies always preferred shipping over setting up depots. "Now our shipping costs have not only increased substantially, but the reliability of the shipping has gone down to the lowest ever. I think that less than 60 percent of the vessels arrive at the bars on time. So we are continuously looking at what is now the best solution. But you also have to consider that opening a depot in a country is not a temporary thing. It is something you do for the long run," explains van Hoof.

van Hoof also sees a possibility of working with its clients to manage container utilisation. "There are customers who are logistically shipping more than we do. So can we use the strength of both companies to find a solution? For instance, let's say we ship 100 containers to India and our customer ships 200 containers from India, so we are seeing if we can help each other, can we use their containers? We see more and more openness among the stakeholders in tackling logistic challenges," says van Hoof.

Nynas is currently implementing a transport management system within the company, which will allow it to digitalise the information. The transport management system allows exchanging data between stakeholders, including Nynas' depots, transporters, forwarders, inspectors and customs agents. "Today, everybody's under stress, and people need real information in real time," adds van Hoof.

The company plans to go into the second phase to integrate all that information with other stakeholders.

The Nynas executive advises the youngsters in the transporting job to be agile and eager to learn to tackle unusual situations. "You need to deal with much information and make sense of that information and use it correctly. So if you are somebody who gets up in the morning and goes to work, and has no idea what will happen during the day, then you're a suitable candidate for the job. For me, I make a little list of two or three things to do every day, and at the end of the day, I'm always happy that I've done two or three jobs, because, during the day, there are so many other things that need attention or immediate attention," concludes van Hoof. (TT)

- Comerio Ercole

- Tire Technology Expo 2026

- Tire Technology International Awards 2026

- Tire Manufacturing Innovation of the Year Award

Comerio Ercole Honoured With Top Innovation Award At Tire Technology Expo 2026

- By TT News

- March 07, 2026

Comerio Ercole has concluded a successful participation in the Tire Technology Expo 2026, a premier international event for the tyre sector held in Hannover, Germany. Over the three-day exhibition, the company’s stand drew considerable attention from a global audience of customers, partners and industry professionals. The event served as a vital hub for fostering technical dialogue and commercial relationships, leading to the acquisition of new orders and forward-looking discussions that resonated deeply within the international tyre manufacturing community.

A defining moment for the company at this year’s expo was its recognition at the Tire Technology International Awards for Innovation and Excellence 2026. Comerio Ercole was honoured with the ‘Tire Manufacturing Innovation of the Year’ award, an accolade that underscores its enduring commitment to technological advancement. This achievement was complemented by the company’s status as a finalist in three additional award categories, highlighting its pervasive leadership and innovative edge in calendering technology.

These accolades reinforce Comerio Ercole’s standing as a pivotal technology partner for the global tyre industry. The recognition affirms the company’s strategic focus on engineering increasingly sophisticated solutions to meet the evolving demands of the market and shape its future trajectory.

CEAT Drives Women’s Leadership And Inclusion Through Comprehensive Workplace Policies

- By TT News

- March 07, 2026

CEAT has introduced a comprehensive set of policies aimed at supporting the specific needs of its women employees and fostering their professional advancement. The organisation emphasises work-life balance as a means to enhance both personal well-being and workplace productivity, offering flexible remote work options in coordination with managers. A Wellness Leave policy allows women two days of monthly work-from-home or leave during menstruation without requiring justification, while shopfloor employees can access on-site Occupational Health Centres for shift changes or rest as necessary.

To cultivate leadership and career growth, CEAT has implemented targeted programmes such as Womentoring, the Women Accelerator Program and STARS, which focus on building digital, functional and leadership competencies. The EmpowHer Employee Resource Group further promotes inclusion and facilitates open dialogue within the organisation.

The company also provides extensive support for mothers, including 26 weeks of paid maternity leave, hospitalisation coverage and facilities such as crèches and lactation rooms across offices and plants. Returning mothers can benefit from flexible hours and a reduced four-hour workday until their child turns one, while shopfloor workers are assigned morning shifts during the first year after childbirth. A gender-neutral Child Caregiver Travel and Stay Policy ensures that caregiving responsibilities do not hinder career progression.

In manufacturing, CEAT has enhanced accessibility by introducing automated machinery, ergonomic fixtures and lift-assist devices. These changes have contributed to a 20 percent women workforce at the Chennai facility and 28 percent representation on the Nagpur shopfloor, which was the first in Maharashtra to introduce night shifts for women. Safe transport, women security personnel and ergonomic workplace design further support this inclusion. Collectively, these efforts reflect CEAT’s commitment to enabling women to lead and succeed in diverse roles.

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

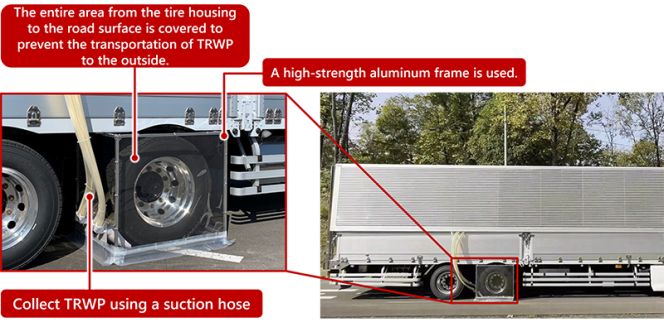

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

Comments (0)

ADD COMMENT