- BANF

- tyre pressure monitoring system

- TPMS

- Ron Yoogun Lee

- Begin a New Future

- South Korea

- Volvo

- Hyundai

BANF Aims To Bring Real-Time Tyre Insights To Vehicles, Going Beyond TPMS

- By Nilesh Wadhwa

- January 08, 2025

South Korean start-up is transforming tyre safety by delivering real-time data insights that go beyond traditional TPMS, monitoring tyre pressure, temperature, wear and alignment. Targeted at fleet operators and manufacturers, BANF’s system improves vehicle safety, reduces costs and supports sustainability. With global partnerships including Volvo and Hyundai, BANF is also exploring market opportunities in India.

When it comes to vehicle safety and fuel efficiency, the role of tyres has often been underrated. Modern vehicles have undergone significant advancements over the decades, evolving from basic mechanical structures to sophisticated mechatronic and digital systems. However, for most, tyres remain largely unchanged – seemingly confined to the traditional black, rubber look without much technological upgrade.

The Tyre Pressure Monitoring System (TPMS), introduced in 1986 within high-end luxury cars, has yet to achieve global standardisation. Apart from a few countries where it is mandated, TPMS remains a novelty even in modern vehicles.

BANF (Begin a New Future), a South Korean start-up focusing on software and hardware technology to fully digitalise tyre information, is determined to change this. In an exclusive conversation with Tyre Trends, Ron Yoogun Lee, VP of Global Business Development at BANF, explains the company’s purpose:

“BANF was founded to address this critical need by integrating smart sensor technology and data analytics into tyre management. Our mission is to elevate vehicle safety, enhance tyre performance and reduce environmental impact through the digitalisation of tyre data. By providing real-time insights into tyre conditions, BANF empowers fleet operators, manufacturers and drivers to optimise maintenance, lower costs and promote sustainability. This drives us to tackle industry challenges with transformative solutions, pioneering a safer and more connected future for mobility.”

Expanding beyond basic TPMS capabilities

Lee explains that one of the primary limitations of current TPMS is its restricted data scope. Traditional TPMS sensors monitor tyre pressure at low frequencies, transmitting data every few minutes but focusing solely on air pressure.

BANF’s technology, however, gathers a wider range of tyre data, including pressure, temperature, tread wear, wheel alignment and even lug nut stability. This approach goes well beyond air pressure monitoring, providing insights that make tyres ‘smarter.’

Using machine learning, BANF’s system analyses the data to offer valuable insights to drivers and fleet operators regarding not only tyre health but also cargo load measurements and road surface conditions. The data is reportedly up to 90 percent accurate.

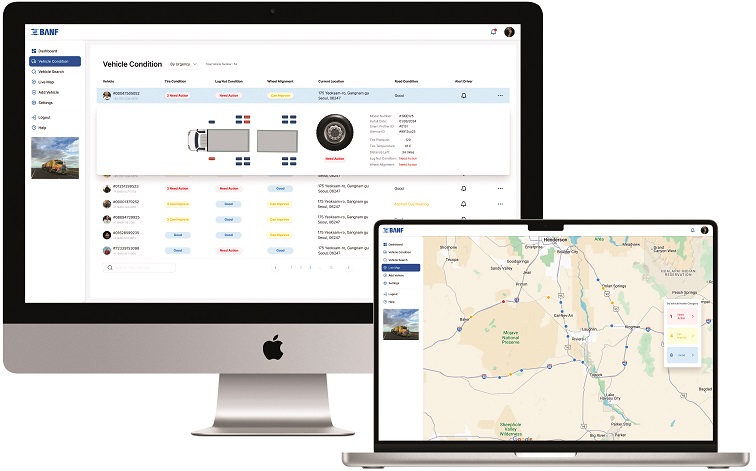

Lee details the core of BANF’s solution, which is built on two main components:

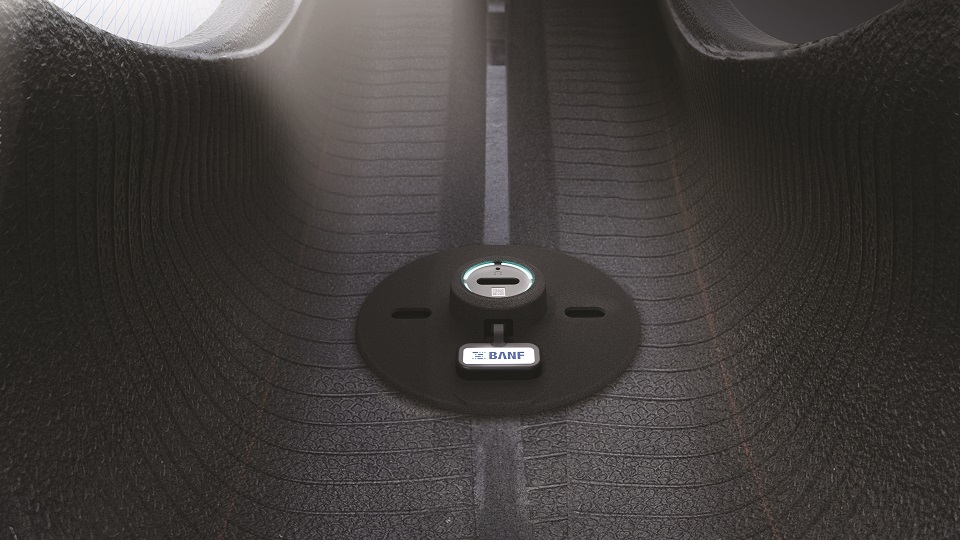

Tyre-Mounted Sensor (iSensor): A 3-axis accelerometer-based sensor attached (glued) inside the tyre’s inner liner, the only point of contact between the vehicle and the road.

Smart Profiler (Transmitter): Mounted on the mud flap or wheel arch and connected to the vehicle’s battery, this device wirelessly powers the sensor using magnetic resonance, gathering data on the tyre's internal and external conditions.

“Unlike standard TPMS, our system collects and analyses a comprehensive range of data points, offering real-time insights into tyre health and performance. This includes not only pressure but also factors such as temperature, tread wear and load, providing a more complete picture of the tyre’s condition,” he says.

BANF considers its unique selling point to be its advanced digitalisation and data analytics capabilities. The system empowers fleet managers, manufacturers and drivers to make proactive, data-driven decisions to enhance safety, optimise tyre performance and reduce maintenance costs. This comprehensive approach to tyre monitoring addresses the limitations of traditional TPMS, meeting the rising demand for safer, smarter and more efficient mobility solutions.

Continuous power and data collection

BANF’s technology enables continuous power supply to high-speed rotating tyres using resonant wireless power transmission. This allows the internal sensors to continuously collect data while driving, capturing 3-axis (X, Y, Z) accelerometer data to support advanced algorithm development. Additionally, BANF leverages mathematical modelling expertise to ensure high efficiency and minimal error in resonant wireless power environments.

Despite TPMS technology existing for over four decades, it still lacks widespread adoption. Why is that? Is it due to cost, awareness or maturity of the technology? Lee attributes the slow adoption of basic TPMS to limited consumer awareness and the system’s restricted functionality.

While TPMS provides basic air pressure information, it does not address other crucial aspects of tyre health, such as temperature, tread wear and load. This limited capability diminishes its perceived value, especially among consumers and manufacturers seeking comprehensive solutions.

“However, with the inevitable rise of electric vehicles (EVs) and autonomous vehicles (AVs), the demands on tyres are increasing. EVs, with their heavier batteries and higher torque, place additional stress on tyres, while AVs, designed for continuous operation, further amplify this strain. Traditional tyre monitoring methods, such as visual inspection, are inadequate for autonomous vehicles. As these trends reshape the automotive landscape, the need for advanced tyre monitoring systems that go beyond basic TPMS is growing. This shift will likely increase consumer awareness and drive the adoption of more comprehensive tyre monitoring solutions,” explains Lee.

While BANF may still be relatively unknown, the Korean start-up is already collaborating with major players like CampX by Volvo Group, Hyundai Motor Group, DHL and more than 20 other global organisations.

“Our primary target clients are fleet management companies operating commercial vehicles, particularly in the Truck and Bus Radial (TBR) segment. These clients benefit most from our advanced tyre monitoring solutions due to the significant return on investment (RoI) from optimised tyre usage, enhanced safety and reduced maintenance costs. By providing real-time insights into tyre health, we enable fleet operators to make data-driven decisions that minimise downtime and maximise efficiency. We currently produce 1,000 units monthly and are expanding our manufacturing capabilities,” shares Lee.

Plans for India and tyre safety

India, traditionally a cost-conscious market, has emerged as a major manufacturing hub and one of the fastest adopters of new technologies. In response to a question on BANF’s potential interest in India, Lee reveals:

“We are currently working with several companies in India, including major tyre manufacturers, vehicle manufacturers and last-mile fleet operators. We are supported by KISED, an arm of the Ministry of SMEs of Korea and NIPA, part of the Ministry of Science and ICT. We are actively engaging with stakeholders in the Indian innovation ecosystem and will be visiting India shortly to strengthen partnerships and explore further opportunities.”

Acknowledging India’s cost-sensitive market, Lee adds, “We are considering options for a facility setup worldwide, with India being one of our top choices.”

Road safety remains a priority for both the Indian automotive industry and the world. Despite numerous initiatives and technologies, the World Health Organisation (WHO) reports that 1.19 million lives are lost in road accidents each year. Road traffic injuries are the leading cause of death for children and young adults aged 5–29 years, with 92 percent of fatalities occurring in low- and middle-income countries.

Focus areas for tyre industry safety and efficiency

Lee identifies three key areas where the tyre industry can improve safety and efficiency:

1. Advanced Materials: Developing new tyre compounds that enhance durability and reduce rolling resistance can improve safety and energy efficiency. Lightweight, high-strength materials reduce energy loss and extend tyre life, crucial for EVs demanding lower energy consumption for longer range.

2. Intelligent Monitoring Systems: Smart sensors to monitor tyre health in real-time are increasingly essential. By tracking metrics such as pressure, temperature, tread wear and load, intelligent systems can alert drivers or fleet managers to potential issues before they escalate. This proactive approach enhances safety and fuel efficiency, as well-maintained tyres contribute to better aerodynamics and lower fuel consumption.

3. Sustainable Manufacturing: Optimising production to minimise environmental impact is crucial. Using eco-friendly materials, reducing waste and recycling tyres contributes to a more sustainable industry, aligning with global trends towards green manufacturing and supporting the energy efficiency goals of the automotive industry.

INTERVIEW: Ron Yoogun Lee

What are the upcoming key trends you see in the tyre industry?

One of the key trends in the tyre industry is the increasing emphasis on safety. As vehicles become more advanced, with a growing number of electric vehicles and autonomous vehicles entering the market, the demands placed on tyres are intensifying. EVs, for instance, have heavier loads and higher torque, which increase wear and tear on tyres, while AVs require consistent, reliable performance to operate safely around the clock. These factors are driving the need for smarter tyre solutions that go beyond traditional monitoring systems.

There is a growing demand for intelligent tyre technologies that provide real-time data on various parameters like pressure, temperature, tread wear and load. Such capabilities allow fleet operators, manufacturers and individual drivers to maintain tyre safety proactively, reduce maintenance costs and ensure optimal performance under diverse conditions. Meeting the advanced requirements of EV and AV clients is crucial, as their vehicles rely on enhanced tyre performance for safety and efficiency. As a result, the industry is moving towards digitalisation and smart sensors to address these evolving needs, marking a significant shift in tyre technology and monitoring.

What is BANF’s business plan (OE supplier), or you will also look at aftermarket opportunities?

BANF’s business plan primarily centres around building strong partnerships with Original Equipment (OE) manufacturers and OE suppliers. Our goal is to enhance tyre safety and efficiency directly at the manufacturing stage, ensuring that end customers benefit from high-quality, intelligent tyre solutions from the outset. Currently, our focus is on the commercial vehicle segment, where we see substantial demand for advanced tyre technology to improve safety, performance and operational efficiency.

That said, we also recognise the significant potential in the aftermarket sector and are actively exploring opportunities to expand into this space. The aftermarket offers us the chance to provide a wider range of products and services directly to end-users. By pursuing both OE partnerships and aftermarket avenues, we aim to deliver innovative tyre solutions that meet the evolving needs of our customers across the entire lifecycle of their vehicles.

What are the other products or areas that you would look to focus on?

Looking ahead, we still believe there is a lot can come out from tyre. We are currently developing many other advanced features to be announced soon. In a sense of product portfolio, we are looking into two-wheeler, three-wheeler market and also airplane tyres.

Triangle Tyre Appoints Federico Parmesan As European OTR Technical Manager

- By TT News

- March 04, 2026

Triangle Tyre has significantly strengthened its European off-the-road operations with the appointment of Federico Parmesan as the new European OTR Technical Manager, a position he assumed on 1 March 2026. This strategic appointment represents a key milestone in the company's ongoing efforts to enhance its technical capabilities and expand its market presence across the continent's specialised tyre sector.

Parmesan brings more than three decades of tyre industry experience to his new role, with particular expertise concentrated in OTR and earthmoving applications. His extensive background encompasses not only deep technical knowledge but also a comprehensive understanding of the challenges faced by dealers and end-users operating in demanding environments. This combination of technical proficiency and practical insight positions him to effectively bridge the gap between product development and real-world application requirements.

In his new capacity, Parmesan will work closely with Triangle's partner network throughout Europe, providing support for both aftermarket and original equipment segments. His responsibilities include strengthening the company's field application expertise and contributing directly to the continued development of the OTR product portfolio. These efforts aim to deliver enhanced value and service to partners across the region.

The appointment reflects Triangle's strategic priority of reinforcing its technical structure to support ambitious growth objectives in the European OTR segment. The company seeks not merely to consolidate its existing market share but to achieve sustainable expansion while elevating support levels for its partners. Parmesan's extensive experience, energetic approach and positive attitude are expected to prove invaluable assets as Triangle pursues these goals and strengthens its position within the competitive European market.

ATF Tyres Appoints Rajesh Vyas As Vice President Of Sales And Marketing

- By TT News

- March 03, 2026

ATF Tyres, one of India’s leading manufacturers of off-highway tyres, has announced the appointment of Rajesh Vyas as its new Vice President of Sales and Marketing. Vyas brings over 25 years of global experience to the role, having worked across diverse international markets to build high-performance sales teams and enhance distribution networks.

His professional background includes leadership roles in brand positioning and product portfolio expansion within competitive sectors. Prior to joining ATF, Vyas served as Vice President at Rubber King Tyre Group. He also held key positions at Balkrishna Industries Limited as Head of Mining Tyres for India and spent a decade at Apollo Tyres Ltd as Business Head for Off-Highway Tyres.

With the company working to expand its footprint in the agricultural, industrial and OTR segments worldwide, Vyas’s strategic leadership and commercial insight are expected to support ATF Tyres in delivering performance-driven solutions across multiple regions.

Continental Intros ‘Nod Of Confidence’ Ambassador To Enhance Tyre-Buying Experience

- By TT News

- March 03, 2026

Continental Tire has introduced a fresh and distinctive marketing figure known as the ‘Nod of Confidence’ ambassador to connect with drivers on a deeper level. This initiative is designed to encapsulate the precise moment a customer feels absolute certainty in their purchase decision, visually represented by a simple, affirming nod. It is a symbolic gesture that conveys the reassurance, trust and satisfaction associated with selecting a premium tyre brand.

For years, Continental has been regarded as the smart choice in the industry, a reputation built on a steadfast dedication to superior quality, advanced technology and dependable performance. The company consistently responds to market demands by engineering tyres that deliver exceptional comfort and peace of mind. Recognising that the process of buying tyres can often be complex and filled with uncertainty, this campaign targets the emotional journey of the consumer. It aims to capture that pivotal moment of clarity when a driver moves from questioning and comparing options to confidently confirming they have chosen the best solution for their vehicle and family.

This new ambassador is an extension of Continental's broader mission to simplify and enhance the tyre-buying experience. By blending cutting-edge tread innovations with customer-focused education and support, the brand continues to prioritise driver needs while reinforcing its leadership in the automotive industry.

Brian Beierwaltes, Head of Marketing US PLT, Continental Tire, said, “We understand that today’s consumers are looking for more than just a product, they’re looking for confidence. This creative idea brings our ‘Smart Choice in Tires’ philosophy to life in a simple, relatable way. That nod represents reassurance, expertise and the peace of mind that comes from selecting a brand that consistently delivers on performance, comfort and innovation.”

GRI Appoints Eldo Verhaagen To Lead Benelux Material Handling And Agriculture Operations

- By TT News

- March 03, 2026

GRI, a leading producer of speciality tyres from Sri Lanka, has named Eldo Verhaagen as its new Sales & Operations Director for Material Handling and Agriculture across the Benelux region. This strategic move underscores the company’s drive to enhance its regional footprint by reinforcing leadership, improving operational efficiency and strengthening relationships with local customers. Verhaagen’s arrival marks a continued push to expand GRI’s presence in both the material handling and agricultural sectors.

With extensive experience in the tyre and automotive fields, Verhaagen brings a proven background in guiding strategy, boosting commercial performance and refining operational processes. His familiarity with a broad range of tyre types – including those used in trucking, farming, construction and material handling – combined with a direct, customer-oriented working style, makes him well-suited to steer the region through its upcoming growth phase.

Verhaagen takes over from Herman Klumpenaar, whom GRI has thanked for his dedicated leadership and smooth handling of the leadership transition. The Benelux team is now set to collaborate closely with Verhaagen, aiming to sustain regional progress and ensure long-term, steady development.

Giorgio Gramegna, Director of Europe – Sales, Marketing and Distribution at GRI, said, “We thank Herman for his leadership and contribution over the years. We are pleased to welcome Eldo and are confident that his experience and market knowledge will further strengthen our presence and performance in the Benelux region.”

Comments (0)

ADD COMMENT