Collateral Damage

- By Gaurav Nandi

- April 25, 2025

Retread tyres in Malaysia are unfairly blamed for road accidents. While the tyres enjoy a pristine reputation in export markets, the notoriety within the local market stems from the lack of ability to differentiate them from low-cost and low-quality tyres that fail to comply with performance standards owing to overloading, maintenance and misapplication.

A total of 1.35 million lives are lost each year in road accidents, according to data from the Ministry of Transport Malaysia. Another data set from Statista highlighted that the South Asian country witnessed 545,000 road accidents in 2022, an increase from the previous year data of 370,000.

A large portion of these accidents involve commercial vehicles and the blame is also shared by retread tyres. A recent news report highlighted rising concerns within the Malaysian parliament to ban the use of retread tyres of commercial vehicles citing safety norms.

The situation seems ironic as the Malaysian retread industry enjoys a pristine reputation in export markets. Yet, the notoriety of retread tyres on home turf might be seen as ‘collateral damage’.

Speaking to Tyre Trends exclusively on why retread tyres remain a scapegoat for road accidents, Tyre Retreading Manufacturers Association of Malaysia (TRMAM) President Edmund Wong said, “Retread tyres are often unfairly blamed for road accidents because the public struggles to differentiate them from low-cost, low-quality tyres that fail due to poor maintenance, overloading and misapplication. Many people mistakenly associate tyre debris, especially when it reveals exposed steel cords, with retreads. However, this type of failure is more commonly linked to cheap, substandard tyres rather than retreads, which, when properly maintained and used correctly, can be as safe as new tyres. The focus on retreads allows the real issues such as inadequate tyres maintenance and overloading to remain overlooked.”

IMPROVING ROAD SAFETY

Malaysia has a higher road fatality rate compared to ASEAN peers like Singapore, largely due to motorcycle-related deaths, which make up over 65 percent of fatalities.

Malaysia’s road safety goals have reportedly fallen short despite setting out clear targets. In 2014, the government aspired to reduce road fatalities by 50 percent by 2020 as part of its alignment with United Nations’ Decade of Action for Road Safety 2011-2020. The initiative was a failure and the same target was reiterated in Malaysia Road Safety Plan 2022-2030.

Current figures also raise questions over the supposed success of the target. Commenting on ways that could make the reduction target a reality, Wong noted, “To reduce road fatalities by 50 percent by 2030, Malaysia should enforce traffic laws strictly, including penalties for speeding and disobeying traffic lights, while expanding automated systems like speed and red-light cameras. Enhancing road infrastructure with safety audits, smart technology and dedicated motorcycle lanes is essential.”

Current figures also raise questions over the supposed success of the target. Commenting on ways that could make the reduction target a reality, Wong noted, “To reduce road fatalities by 50 percent by 2030, Malaysia should enforce traffic laws strictly, including penalties for speeding and disobeying traffic lights, while expanding automated systems like speed and red-light cameras. Enhancing road infrastructure with safety audits, smart technology and dedicated motorcycle lanes is essential.”

“Malaysia can adopt best practices, such as dedicated motorcycle lanes, public education campaigns and improved road infrastructure, while learning from Singapore’s success in enforcement, infrastructure and safety culture. Public awareness campaigns should target risky behaviours including running red lights and promote defensive driving. Protecting vulnerable road users, especially motorcyclists and pedestrians, through improved infrastructure and safety regulations is also crucial,” he added.

Alluding to why stringent safety campaigns or regulatory measures are not undertaken to reduce motorbike fatalities, he noted, “The lack of stringent safety campaigns or regulatory measures targeting motorbike users in Malaysia is due to several factors. Firstly, motorbikes are a vital mode of transport for many due to affordability and accessibility, especially in rural areas, making stricter regulations politically sensitive. Secondly, enforcement of existing laws such as helmet use and licensing is inconsistent, particularly in rural regions, allowing unsafe practices to persist. Thirdly, cultural factors like risk-taking behaviour, resistance to change and low awareness of safety risks hinder the adoption of safer practices. Lastly, limited resources, both financial and infrastructural, result in insufficient investment in targeted campaigns and dedicated motorcycle lanes, leaving riders vulnerable.”

CLOSING GAPS

Wong iterated that to improve road safety and support the retreading industry in Malaysia, several regulatory gaps and enforcement lapses need to be addressed. One significant issue is the inconsistent enforcement of tyre standards, especially for imported new tyres.

While Malaysia requires that imported tyres have certifications like the E-mark, DOT or MS, these standards can sometimes fail to verify the genuineness and reliability of the tyres, leading to concerns about the quality and safety of some imports. This lack of stringent checks on tyres authenticity puts road users at risk and undermines confidence in tyre safety.

Additionally, there is a gap in regulations requiring regular tyre maintenance checks, particularly for retread tyres. Without mandatory inspections for tread depth, pressure and overall tyre condition, vehicles, especially commercial fleets, are at higher risk of tyre-related accidents.

Another issue is the weak enforcement of penalties for overloading and the misapplication of tyres such as using retreads in unsuitable conditions. Overloading vehicles puts excessive stress on tyres, increasing the likelihood of tyre failure, and stricter penalties are needed to deter this dangerous practice.

There is limited education on the benefits of retreads and how to use them safely, which affects their acceptance and proper usage. Implementing campaigns that highlight the safety, environmental and economic benefits of retreads could help improve perceptions and encourage safer practices.

Moreover, government procurement policies should prioritise retread tyres for public transportation fleets, encouraging their use across sectors and providing a market boost to the retreading industry.

Lastly, there is a lack of clear regulations on tyre end-of-life management including guidelines for recycling and disposal. Establishing clear regulations for the responsible management of worn-out tyre, including retreads, would support the circular economy and further promote the sustainability of the retreading industry.

Addressing these regulatory gaps and enforcement lapses would not only improve road safety but also foster the growth of a reliable, safe and sustainable retreading industry in Malaysia.

REPUTATION REVIVAL

The shadow of malignance over the local retread industry is daunting, especially considering its stellar reputation abroad. A methodical plan is urgently needed to change the prevailing perception.

Commenting on how the industry can leverage its foreign reputation to promote retreads domestically, Wong explained, “Malaysia can leverage its reputation in the global retreading industry to promote retreads domestically by focusing on education, policy support and sustainability initiatives.”

“Firstly, educating the public about the benefits of retreads, such as safety, environmental advantages and cost-effectiveness, can shift perceptions. Secondly, incentivising businesses to adopt retread tyres would not only increase its usage but also align with sustainability practices. Retreads significantly reduce waste by reusing tyre casings, contributing to lower carbon footprints and less landfill waste. Offering tax breaks, rebates or financial incentives to businesses that adopt retreads can encourage the adoption of this eco-friendly practice, benefiting both companies and the environment,” he added.

He also noted that Malaysia has a well-established certification system with Malaysian Standard 224 (MS 224), which sets high-quality standards for retread tyres. This national standard ensures that domestically produced retreads meet rigorous safety and quality requirements, reinforcing consumer confidence and helping local manufacturers maintain global competitiveness. By promoting this certification and its benefits, Malaysia can further build trust in its retreading industry and drive domestic demand for high-quality retreads.

He also noted that partnerships with universities, research institutions and organisations such as the Malaysian Rubber Board (MRB) could play a pivotal role in establishing Malaysia as a hub for innovation in tyre retreading. These collaborations would enable research and development focused on improving the quality, safety and efficiency of retread tyre, which could enhance their appeal domestically and internationally.

“The Malaysian Rubber Board has extensive expertise in rubber technology and the development of new rubber compounds, which are crucial for retreading. By working with these organisations, Malaysia could explore advanced rubber materials and improve the durability and performance of retread tyres. MRB’s research could focus on optimising the rubber used in tyre retreading, enhancing its resilience and performance under various road conditions, thus improving the overall safety of retreads. Universities and research institutions bring additional expertise in materials science, engineering and sustainability and can help address any technical gaps in the retreading process. They could collaborate with retreading companies, fleet operators and tyre manufacturers to develop new retreading technologies, better tyre monitoring systems and more efficient processes,” explained Wong.

He added, “These partnerships could also produce credible, science-backed data on the reliability and safety of retread tyre, helping to build public trust and dispel misconceptions about retreads.”

FILLING DATA GAPS

The lack of local data to validate the reliability and safety of both retread and new tyres in Malaysia stems from several key factors, according to Wong.

“Primarily, there is a significant gap in research due to the lack of collaboration between tyre manufacturers, retreaders, fleet operators, research institutions and government agencies. Without cooperation among these stakeholders, there is little incentive or infrastructure to collect and analyse tyre failure data in the local context. This leads to a situation where tyre failure research is outdated or non-existent, leaving the industry to rely on studies from other countries such as US, which may be many years old and not reflective of current tyre technology or local conditions,” noted Wong.

He added, “This problem is not unique to Malaysia; many countries face similar challenges in gathering and sharing tyre-related data. For example, tyre debris reports and studies on tyre failures tend to be infrequent and may not accurately capture the complexities of modern tyre usage, road conditions or fleet operations. To address this gap, a collaborative effort among different stakeholders, both local and international, could be instrumental.”

Collaborations could fund and conduct comprehensive studies on tyres performance under local conditions. By sharing data and expertise, these stakeholders can develop a more accurate understanding of the causes of tyre failures, improve maintenance practices and promote better safety standards for both new and retread tyres.

Additionally, international partnerships could allow for access to global tyre failure databases and new research, enabling Malaysia to adopt best practices from countries like US, Japan or the EU, where more tyre safety research is available.

Establishing a framework for ongoing research and data sharing with regular updates and reports would help fill the data gap and improve tyre safety standards locally. This collaborative approach could ultimately lead to the development of localised tyre safety standards, improved regulations and more informed decision-making by all stakeholders involved.

NEW LEARNING

According to Wong, Malaysia can learn important lessons from countries like Japan and UK, where retread tyres are promoted effectively for their cost-efficiency and environmental benefits. Both Japan and the UK have robust local manufacturing industries for new, high-quality tyres, which ensure a consistent supply of durable tyre casings for retreading.

This industrial advantage helps protect the respective retreading industries by ensuring the availability of reliable casings that meet safety and performance requirements. Japan enforces stringent standards for both new and retread tyres through the Japanese Industrial Standards (JIS) such as JIS D 4202, which defines specifications for automobile tyres. These regulations ensure high-quality tyre production and maintenance, supporting a thriving retreading ecosystem.

Similarly, UK relies on the ‘E’ mark certification system, which aligns with European safety and performance regulations. The ‘E’ mark, prominently displayed on compliant tyres, indicates that a tyre has undergone rigorous testing and meets safety standards. This harmonised approach in UK ensures that only certified-quality tyres are used, reducing risks and building trust in retread tyres.

In Malaysia, the absence of a local new tyre manufacturing industry for trucks presents a challenge. The reliance on imported new tyres, coupled with the fact that Malaysia’s new tyre standard (MS 1394) is not compulsory, allows low-cost and lower-quality imports to flood the market.

These tyres often produce casings unsuitable for retreading, which undermines the retreading industry. To address these issues, Malaysia could make MS 1394 mandatory for new tyres, ensuring better-quality casings and fostering trust in retreads.

Additionally, promoting awareness of retreads’ economic and environmental benefits, strengthening enforcement of Malaysian Standard 224 (MS 224) for retread quality and offering incentives for their adoption could help the industry grow.

Technology, such as tyre monitoring systems, can play a significant role in addressing concerns about retread tyres and improving road safety. These systems provide real-time data on tyre pressure, temperature, tread depth and overall tyre health, helping to ensure that all tyres, including retreads, are properly maintained.

By monitoring tyre performance, these systems can detect early signs of wear, overloading or misapplication, reducing the risk of tyre failure. This not only enhances the safety of retread tyre but also helps prevent accidents caused by poor tyre maintenance or low-quality tyres, leading to a change in perception.

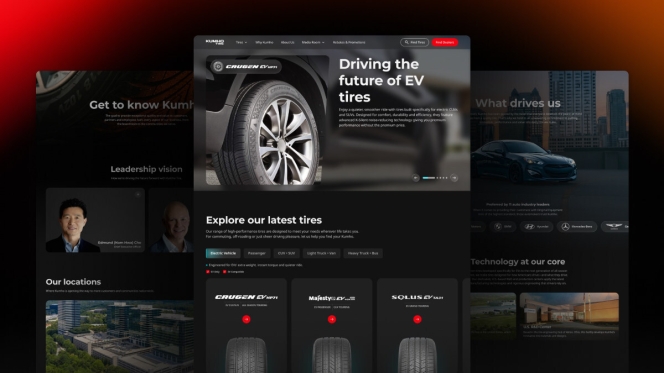

Kumho Tire USA Unveils Consumer-Centric Website Redesign To Elevate Digital Experience

- By TT News

- March 07, 2026

Kumho Tire USA has unveiled a completely overhauled consumer website, marking a pivotal step in its journey to establish itself as a premier alternative in the tyre industry. The redesign is a strategic move to modernise the company’s digital storefront, ensuring it accurately mirrors the brand's forward-thinking vision and evolving market identity.

Central to this transformation was the goal of creating a more intuitive and brand-enhancing user experience. The site’s architecture has been meticulously reorganised to guide visitors seamlessly through Kumho’s product lineup and corporate philosophy. By unifying the visual design, tone and messaging, the new platform projects a cohesive brand story designed to build confidence and instil a sense of pride among customers and partners alike.

More than just a catalogue of products, the updated site functions as a dynamic conduit between the company and its audience. It underscores Kumho’s commitment to delivering exceptional value through an innovation-led approach. This digital ecosystem now actively demonstrates how the manufacturer translates technological advancement into tangible benefits, reinforcing its dedication to exceeding expectations at every point of engagement.

Ed Cho, CEO, Kumho Tire USA, said, "The newly redesigned website marks a significant step in Kumho Tire's journey to solidify its position as a premium brand alternative. The enhanced digital platform showcases KUMHO's commitment to delivering high-quality products at a reasonable price to discerning customers who demand value. Our continued efforts to implement innovative technologies and build a brand that consumers can trust enable our ability to pioneer new segments of the global market."

- Michelin

- Michelin Primacy 5 Energy

- Michelin Lunar Airless Wheel

- BioButterfly Programme

- 2026 Tire Technology Expo

- Tire Technology International Awards

Michelin Sweeps Four Major Awards At 2026 Tire Technology Expo

- By TT News

- March 06, 2026

Michelin has achieved notable recognition at the 2026 Tire Technology Expo in Hannover, Germany, securing four major awards that underscore its leadership in innovation, sustainability and technical expertise. The accolades span breakthrough research, product excellence, environmental advancement and individual career achievement, reflecting the company’s comprehensive approach to advancing mobility both on Earth and in space.

The prestigious Concept of the Year award was presented to the Michelin Lunar Airless Wheel, or MiLAW, developed for NASA’s upcoming Artemis lunar missions. This wheel represents over two decades of research into airless tire architecture, cutting-edge polymers and additive manufacturing techniques such as 3D printing. Engineered to endure the moon’s extreme environment, it must withstand abrasive terrain, intense radiation and temperatures ranging from minus 240 to plus 100 degrees Celsius while ensuring reliable traction and durability. The project demanded advanced digital simulation and rigorous testing, and the resulting innovations are already influencing Michelin’s terrestrial developments, particularly in applications where robustness under challenging conditions is essential.

The MICHELIN Primacy 5 Energy tyre earned the Tire of the Year award. This summer tyre has achieved a triple-A rating on the European Union label for wet grip, energy efficiency and noise while also being recognised as the most durable tyre in its category. It has been selected by approximately 20 major global automakers for integration into more than 50 upcoming vehicle models, well ahead of its commercial launch. Designed to meet heightened expectations for safety, electric vehicle compatibility, emissions reduction and sustainable materials, the tyre exemplifies Michelin’s response to evolving market demands.

The BioButterfly programme, a collaborative effort involving Michelin, IFP Energies Nouvelles and Axens, with backing from the French Agency for the Environment and Energy Management, received the Environmental Achievement of the Year – Industrial Contribution award. Following over 12 years of research and an investment exceeding EUR 80 million, an industrial demonstrator at Michelin’s Bassen site successfully proved a method for producing bio-based butadiene from bioethanol. The resulting elastomers meet tyre industry specifications while offering a significantly reduced carbon footprint compared to fossil-fuel-derived alternatives. This breakthrough marks a major step towards establishing a sustainable supply chain for bio-based materials in tyre manufacturing.

Pascal Prost, a Senior Fellow at Michelin, was honoured with the Tire Tech 2026 Lifetime Achievement Award for his 35-year career dedicated to advancing tyre technology. His work has consistently addressed complex and often conflicting performance requirements, particularly in the areas of low rolling resistance and eco-design for passenger and two-wheel vehicle tyres. Beyond his technical contributions, Prost has fostered collaboration across internal teams, academic institutions and automotive partners. His recognition highlights not only his personal dedication but also the collective expertise and innovative spirit present throughout the Michelin organisation.

Together, these four honours illustrate the breadth of Michelin’s capabilities, from fundamental research and product engineering to environmental stewardship and long-term talent development. They affirm the company’s commitment to creating safer, more efficient and sustainable mobility solutions for a wide range of environments.

Philippe Jacquin, Executive Vice President – Research & Development for Michelin and member of the Group Executive Committee, said, “Receiving four awards at Tire Technology Expo is testament to the collective strength of our teams and to the scientific, technological and environmental depth of our innovations. From the Moon to the road, and thanks to Michelin’s deep know‑how in polymer composites, we once again demonstrate our ability to push boundaries, create new experiences, transform research into real‑world solutions and accelerate the emergence of next‑generation materials. These awards honour not only our advances but also the daily commitment of everyone at Michelin who innovates to improve everyday life and drive mobility forward – for people today and for future generations.”

Kama Tyres Treads Cautious Global Expansion Amid Geopolitical Realignment

- By Nilesh Wadhwa

- March 06, 2026

As geopolitical tensions continue to reshape global trade routes and supply chains, tyre manufacturers are being forced to rethink not only where they sell, but how they grow. For KAMA Tyres – Russia’s largest and most diversified tyre manufacturer – this reassessment has become a defining element of its international strategy.

Rather than pulling back amid sanctions and market disruption, the company is steadily opening new doors, with the Middle East emerging as its next strategic frontier.

In an exclusive interaction with Tyre Trends, Shaydullin Ildar, Deputy Director – Marketing, KAMA Tyres, spoke about how the company is looking beyond its domestic market and recalibrating its global ambitions.

“We have rich experience of cooperation with machine producers across the world. This cooperation allows us to produce tyres exactly for certain machines – tyres that are suitable for specific clients,” Ildar said.

That customer-focused manufacturing capability, coupled with a broad and diversified product portfolio, is now underpinning KAMA Tyres’ cautious yet determined push into new international markets.

FROM 50 MARKETS TO 20: A STRATEGIC RESET

Until recently, KAMA Tyres had an expansive global footprint. “Earlier, we exported our tyres to more than 50 countries,” Ildar noted. Today, that number has come down significantly – not due to waning ambition, but because of shifting geopolitical realities.

“Now, because of the situation in the global market, we are exporting our tyres to around 20 countries,” he explained.

Despite the contraction, the company has retained a presence across a geographically diverse mix of regions. “For example, Egypt, Brazil, Turkey, Mongolia, Vietnam. Russia has good relations with Vietnam, so this is one of our key markets,” Ildar said.

Despite the contraction, the company has retained a presence across a geographically diverse mix of regions. “For example, Egypt, Brazil, Turkey, Mongolia, Vietnam. Russia has good relations with Vietnam, so this is one of our key markets,” Ildar said.

This pragmatic reassessment mirrors a broader trend across Russian manufacturing – prioritising markets where political alignment, trade frameworks and logistics remain workable.

“At the same time, we are trying to open new markets. Right now, we are opening for ourselves the Gulf countries,” he added.

This shift also explains KAMA Tyres’ growing presence at regional trade exhibitions. “That is why we are here at this exhibition,” Ildar said, referring to Automechanika Dubai 2025. “This is the first time we are participating here.”

For KAMA Tyres, the Middle East represents a significant opportunity – but one that requires patience. “Yes, for us it is a really big opportunity. We are trying to open it step by step,” he said.

MIDDLE EAST ENTRY: OPPORTUNITY WITH A COMPLIANCE HURDLE

While the Middle East offers scale and strategic relevance, entry into the region is far from straightforward. Regulatory compliance remains the biggest challenge.

“We haven’t started selling our tyres here yet. At the moment, we are preparing,” Ildar clarified.

That preparation, he explained, is extensive. “We are doing all the necessary procedures to start selling our tyres. This includes connecting with potential clients and preparing documents and certification for this market.”

Certification is, by far, the most demanding hurdle. “The main opportunity for us is opening a new market, new clients and new sales. The big challenge is that this market needs different certification,” he said.

Still, the company remains resolute. “We are doing it and we will do it anyway,” Ildar said firmly.

KAMA has already begun building visibility in the region through trade events. “In May, we participated in an exhibition in Riyadh – I think it was Automechanika Riyadh,” he recalled.

The timeline for commercial entry is now clearly defined. “In 2026, we are planning to start selling our tyres here,” he confirmed, with the first quarter of calendar year 2026 emerging as the tentative target.

ONE COMPLEX, EVERY TYRE SEGMENT

One of KAMA Tyres’ key competitive strengths lies in the breadth of its manufacturing capability. Unlike many tyre manufacturers that specialise in one or two segments, KAMA operates as a fully integrated tyre complex.

“We are the only tyre complex in Russia that produces all groups of tyres,” Ildar explained.

The portfolio spans passenger car tyres (PCR), light truck tyres, truck and bus radials (TBR) and off-the-road (OTR) tyres. “We are ready to offer different kinds of tyres. And potential customers are asking us for different groups,” he said.

This versatility gives KAMA considerable flexibility as it enters new markets such as the Gulf, where demand spans multiple vehicle categories. “We can offer both TBR tyres and PCR tyres,” Ildar noted, adding that OTR tyres are also part of the company’s global offering.

Rather than rushing to push specific products, the approach is deliberately measured. “We want to understand the market first. And then offer what is needed,” he said.

This mindset reflects KAMA’s longstanding experience of working closely with OEMs and equipment manufacturers. “Our cooperation with machine producers allows us to make tyres exactly suitable for the machines,” Ildar reiterated.

SANCTIONS, SUPPLY CHAINS AND PREPAREDNESS

Sanctions have been a defining force shaping Russian industry over the past decade. For KAMA Tyres, however, preparedness has significantly softened the impact.

“About sanctions – we are prepared for this situation from 2014,” Ildar said.

This long-term approach has been especially critical in securing raw material supplies, an area where many global tyre manufacturers continue to face volatility.

“At the moment, we don’t have problems with supplying raw materials. We have producers of raw materials in the Russian market and in the Asian market too,” he explained.

By diversifying its sourcing base early, KAMA has ensured continuity even during periods of global disruption. “We are searching for different ways to be ready for any problems in the future,” he said.

As a result, the company has largely avoided the supply crunch faced by several global peers. “So now we have suppliers of raw materials and we don’t have a problem with it,” Ildar added.

In an industry increasingly shaped by geopolitical uncertainty, this resilience has become a competitive advantage.

INDIA ON THE HORIZON, BUT NO SHORTCUTS

Given the historically strong ties between India and Russia, the Indian market naturally features in discussions around KAMA Tyres’ longer-term expansion plans. However, Ildar is careful to manage expectations.

“We are moving step by step, starting with the Persian Gulf. If everything goes well, we will look at the Indian market,” he said.

The key constraint, he explained, is production capacity. “It depends on one thing – we have to sell Russian products. If we have free resources, we are ready to look at the Indian market.”

He is also realistic about the competitive intensity in India. “We understand that there are a lot of good products and strong competition in the Indian market,” Ildar noted.

Certification remains another important consideration. “At the moment, we do not export tyres to India because the Indian market needs BIS certification,” he confirmed.

Still, the door remains open. “If in the future we find potential clients who are interested in our products after studying the market, we will be glad to apply for this certification. We will be glad to open the Indian market too.”

For now, execution takes precedence over expansion promises. “Our strategy is to work step by step,” Ildar reiterated.

Giti Tire Unveils Next-Generation GitiSportS2+ Following AutoBild Test Success

- By TT News

- March 05, 2026

Giti Tire has launched its new ultra-high-performance GitiSportS2+ tyre, following an outstanding result in the AutoBild 2026 Summer Tyre Test, where it received one of the most prestigious independent endorsements in Europe. Rated as exemplary by the leading German publication, the tyre secured fourth place overall out of an initial field of 50 competitors. The evaluation praised its exceptional value for money, impressive driving dynamics and substantial safety margins.

Tested on a BMW 5 Series using the 245/45R19 size, the tyre initially shared fourth position based on wet and dry braking performance, recording a total stopping distance of 42.5 metres. It maintained this high standard across 12 additional assessments, ultimately ranking among the top five alongside several premium manufacturers. The new model is scheduled to be available from spring 2026, launching in 19 sizes covering rim diameters from 17 to 20 inches, widths between 225 and 255 and aspect ratios from 35 to 55.

Designed for sporty cars and powerful SUVs, the GitiSportS2+ features a newly engineered compound that reduces wet braking distances by eight percent and dry braking by two percent compared to its predecessor. It also achieves the highest possible EU Wet Grip label rating of ‘A’. In line with the manufacturer’s broader strategy, the tyre bears the AdvanZtech EV Ready sidewall marking, indicating its compatibility with internal combustion engines, mild hybrids, plug-in hybrids and battery electric vehicles.

During the initial rollout, many existing sizes of the original GitiSportS2 will remain on the market, ensuring continued coverage across the sport vehicle segment. Development took place at Giti’s European R&D Centre in Hannover, with testing and fine-tuning conducted at tracks in UK and Spain. The project leveraged the company’s AdvanZtech technology, a globally integrated research and development system.

Fabio Pecci-Boriani, Deputy General Manager – Product Planning PCR and LTR, Giti Tire R&D Centre (Europe), said, “The new GitiSportS2+ is testimony of the achievements that our engineers, testers and manufacturing facilities have been able to deliver in the area of performance while retaining the sustainability, endurance and mileage criteria that are important to the daily driver. To launch a tyre off the back of an ‘exemplary’ rating in AutoBild is nothing short of sensational; we are thrilled that one of the leading automobile titles in Europe has been able to validate and confirm our latest development and we are excited to share this news with our trusted customers.

“The target criteria for the GitiSportS2+ was to deliver further improvements in dynamic driving, enhanced control on wet roads with precise and exciting control on dry roads, all while maintaining the mileage and energy efficiency of the previous generation. Sportiveness is at the heart of the tyre with a particularly stiff design that contributes to stability at high speeds as well as in cornering. The increased grip performance goes is more precise, firm, predictable and constant.”

Comments (0)

ADD COMMENT