- Tyresnmore

- RPG Group

- Rakesh Tatikonda

- tyre

- CEAT

- Goodyear

- Apollo

- JK Tyre

- Royal Enfield

- Harley-Davidson

From Click To Fit: The Tyresnmore Revolution

- By Sharad Matade and Gaurav Nandi

- October 30, 2025

The automotive aftermarket sector is evolving as companies look for new ways to deliver services. Tyresnmore is at the forefront, making it easier for people to buy tyres by offering a simple doorstep service instead of the old, complicated process.

When Tyresnmore joined the RPG Group in 2023, the company focused on closing the gap between buying tyres and having them fitted by professionals. Its direct-to-consumer model sends skilled technicians with the right tools to customers, taking care of tyres, batteries and alloy wheels.

In an interview with Tyre Trends magazine, CEO Rakesh Tatikonda explains how the company keeps NPS scores above 85 percent while serving more than 150,000 customers in six cities. Since online tyre sales in India account for only about 0.6-0.7 percent of the market, compared to 15-20 percent in Western countries, Tatikonda discusses how they manage inventory, maintain transparent pricing and plan to grow in this young yet promising industry.

The buyer-seller relationship has radically changed with the advent of the online world. E-commerce sites and online marketplaces have practically redefined the basics of convenient shopping and ease-of-purchase.

Today, one can easily purchase anything from as small as a pencil to as large as an air conditioner at the click of a button. Tyresnmore is taking this convenience a step further by not delivering but fitting tyres, batteries, alloy wheels and wheel covers professionally at a customer’s doorstep.

Acquired by RPG Group in 2023, Tyresnmore operates as an individual entity and offers a unique value proposition to its customers, not limited to doorstep tyre delivery. It provides fitment at their doorstep, helps discover the right product, provides transparent pricing and ensures clear communication throughout.

“The goal is to offer a hassle-free, end-to-end experience across all touchpoints. We treat this as an alternate channel. While some may label Tyresnmore as an online company, it functions much like a traditional dealer as we stock tyres and bring them directly to the customer. This is distinct from customers visiting a store for fitment,” said Chief Executive Officer Rakesh Tatikonda during an exclusive interaction with Tyre Trends magazine.

“We are authorised to sell multi-brand products, and today, we also sell batteries, alloy wheels and accessories. Our aim is to be a true multi-brand player in the auto accessory segment. In the offline channel, too, we recommend options based on customer needs. For example, an Audi or BMW customer who prioritises safety and prefers an international brand will be advised accordingly, whether that’s Pirelli or a tyre marked as Mercedes Original or Audi Original. This consultative approach ensures we remain customer-first without giving preference to any one brand,” he added.

The company has developed a direct-to-consumer (D2C) channel over several years, positioning itself as a multi-brand platform with an extensive catalogue and the convenience of scheduling tyre services at the customer’s preferred time and location in different cities.

According to Tatikonda, doorstep tyre services are increasingly common in Western markets and online penetration accounts for roughly 15–20 percent of sales. He argued that India has significant growth potential for such business as the market is nascent and industry estimates place India’s sales share through this channel at just 0.6–0.7 percent.

Explaining the market factors facilitating growth, Tatikonda explained that the tyre retail market in India is somewhat fragmented. Traditionally, the tyre purchase process ranging from product selection to fitment is disjointed, often requiring consumers to engage multiple parties such as dealers, third-party fitment providers or even puncture shops to complete a single transaction.

He highlighted that even multi-brand or OEM-branded shops tend to focus on particular segments such as passenger car or commercial tyres, leaving two-wheeler customers underserved. Many outlets either refer customers elsewhere for fitment or employ third-party technicians, making the experience cumbersome.

The company’s D2C channel addresses this gap by offering a complete, end-to-end solution. “The promise is the same for all customers. We do all the heavy lifting to make their lives comfortable,” Tatikonda said.

By employing its own trained technicians rather than outsourcing, the company ensures trust and reliability. He emphasised that the D2C model is not in competition with offline retail but rather complements it, catering to consumers seeking convenience, safety and transparency.

“This approach targets diverse customer segments, who may prefer the ease of doorstep services over visiting physical stores,” he stated.

ROLLOUT

A catalogue of over 2,000 stock keeping units (SKUs) across brands and sizes is maintained on the platform. SKUs not available in stock are procured directly from OEMs and customers are informed about expected delivery timelines.

While delivery is offered nationwide, fitment services are currently restricted to the six cities with operational dark stores. Convenience, reliability and transparency are provided to all customers including first-time online buyers and specific segments such as women and elderly consumers.

An in-depth explanation of the company’s D2C business model provided by Tatikonda highlights a full-stack approach ranging from brand awareness to fitment. Brand awareness is created using social media, SEO to generate leads.

Customers are offered the option to explore the website, www.tyresnmore.com, for product discovery or to contact customer care for consultative support. Detailed information on tyres including brand, SKU, price, warranty and unique selling points is presented to enable informed choices.

Selection of products is based on vehicle type, terrain, mileage and previous brand experience. Approximately 50–55 percent of orders are placed directly through the website, while the remaining orders are facilitated through customer care, where brands, price options and fitment slots are recommended.

Once an order is confirmed, it is routed to the city operations team and fulfilment is coordinated through a network, the dark stores. Stocking is carried out based on sales history, brand popularity and size demand.

The dark stores are maintained in six cities including Delhi NCR, Mumbai, Pune, Bangalore, Hyderabad and Chennai, where delivery and fitment are performed by trained in-house technicians rather than outsourced personnel.

Typical installation timelines once technician reaches the customer’s doorstep are 45 minutes for four-wheeler tyre installation, 30 minutes for two-wheelers and 15–20 minutes for batteries. Customers are notified at every stage, from order confirmation and invoicing to scheduling.

“In the six cities where we operate, customers don’t have to go anywhere. In other cities like Aurangabad or Jalandhar, we’ve seen organic traffic from customers we couldn’t fully serve, so we now provide tyre delivery even though fitment isn’t available there yet. Our multi-city presence allows us to source products quickly. Even if a tyre isn’t available in one hub, we check across others and fulfil the order. At present, however, outside our core network, we only deliver tyres and haven’t tied up with third parties for fitment,” noted the executive.

BALANCING ORDERS

Managing tyre inventories online remains a challenge given the sheer variety of products. Tatikonda said about 40 SKUs generate roughly 60 percent of sales, and those high-volume items are kept in stock to enable faster turnaround and same-day fitment.

Orders for these tyres are typically fulfilled within 24 hours of confirmation, underscoring the platform’s ability to match offline service standards. For the remaining 40 percent of SKUs, nearly 90 percent can still be sourced within the same city from OEMs, clearing and forwarding agents or distribution centres, allowing installation within a day.

Only rare or less common SKUs fall outside this framework with delivery timelines of two to five days. Customers are informed upfront about expected wait times, a transparency Tatikonda described as central to the model’s reliability.

Furthermore, tyre pricing in India is unlike batteries or alloys, which come with a manufacturer’s maximum retail price (MRP). “Tyres are considered unpackaged products and regulations don’t mandate an MRP,” Tatikonda explained. That leaves room for variation with dealers often bundling tyres with services and quoting composite rates.

The company, he said, tries to bring transparency by offering benchmarked prices that reflect market norms, typically within five percent either way of what dealer’s charge. Customers benefit from knowing upfront what is included and what isn’t.

“Convenience is a big factor. We operate at market prices, but we save people time, fuel and hassle. Consumers value that,” Tatikonda added.

He pointed to high customer ratings and the platform’s decade-long track record as further proof of trust. While prices are not fixed, Tatikonda stressed that the company follows OEM guidelines and market benchmarks to ensure fairness. “Even if it isn’t an MRP product, there’s always a market operating price. That’s what we go by,” he stated.

The platform hosts more than 10 tyre brands including CEAT, Goodyear, Apollo and JK Tyre, alongside several international labels. On the battery side, major players such as Exide and Amaron dominate the listings, providing consumers with a broad choice.

The company’s fitment vans have been equipped with the latest pneumatic tools including tyre changers, balancers, compressors and nitrogen-filling machines. Currently, 13 vans are deployed across six cities with some locations hosting three to four vans and others one or two.

The fleet has been continuously upgraded to accommodate evolving tyre sizes, now supporting installations of tyres up to 21 inches.

High-end vehicles have also been serviced with alloy wheels included in the fitment scope. After-service customer concerns are addressed through a dedicated call centre.

CUSTOMER FOCUS

The company’s current focus has been placed on the passenger vehicle segment, while commercial tyre offerings have not yet been explored, despite potential. Within the passenger category, emphasis has been given first to four-wheelers followed by two-wheelers, which range from standard scooters to high-end motorcycles such as Royal Enfield and Harley-Davidson models.

Two-wheeler customers have been reported to value convenience and are willing to pay for doorstep services, which include both tyre replacement and battery servicing.

“After-sales support has been structured as an integral part of the full-stack model. Warranty claims have been recorded at less than one percent monthly and they are managed through a dedicated customer service team. Feedback can be received through online platforms including Google and social media,” explained Tatikonda.

Pro-active follow-ups are conducted to address concerns even if customers do not initiate contact. Issues are triaged in three ways. Minor problems are resolved remotely, genuine warranty claims are directed to OEM network and where complete convenience is requested, technicians are dispatched to the customer’s doorstep for service. A service charge is applied in the latter scenario and detailed reporting is provided for transparency.

“Customer satisfaction metrics have been maintained at high levels with NPS scores consistently exceeding 85 percent. Educational initiatives have been launched to improve consumer knowledge, including a video series on YouTube and social media that covers tyre and battery maintenance, tyre health monitoring and safe driving habits,” added Tatikonda.

Additional content including blogs with guidance on product selection, maintenance and replacement timing is also being developed to reach broader customer segments and enhance informed decision-making.

EXPANSION AND DIVERSIFICATION

According to Tatikonda, the company is exploring adjacent product categories beyond its core offerings. Plans to expand the product portfolio are in the pipeline with a focus on both growth and increasing customer retention through repeat purchases.

“Our evolution has seen a phased launch starting with tyres followed by batteries, alloys, dash cams and tyre and battery protection plans including roadside assistance. A combination of in-house and third-party service providers has been engaged to accelerate category additions and strategic tie-ups,” said Tatikonda.

The executive noted that no category is considered difficult to sell if it performs well in the broader market. Each new category is preceded by detailed market research including trade insights, consumer requirements, buying behaviour and service considerations such as fitment.

Customer acquisition and retention strategies are reported to rely heavily on maximising lifetime value. With a current service record of over 150,000 customers and more than 300,000 tyre fitments, the focus has been placed on servicing existing customers through additional categories and services.

“Efficiency in operations, marketing and fulfilment is prioritised to increase margins. Operational measures include improving van and technician productivity, reducing fulfilment time and optimising route management through technology. Marketing efficiencies are sought through improved conversion rates per marketing rupee, while city-level fixed costs such as rentals and salaries are managed to scale profitably,” he said.

Expansion into marketplaces and other channels is being explored to reach different customer segments while maintaining the full-service model.

Regarding geographic expansion, Tatikonda estimated that the six operational cities currently account for approximately 25–30 percent of India’s four-wheeler tyre and battery market. Two-wheeler tyre demand, however, is described as less city-dependent and more widespread across Tier-I, Tier-II and rural areas. Immediate expansion plans are focused on consolidating scale in existing cities before considering further market entry beyond current territories.

“The goal of entering four to eight additional cities within the next three to five years is on the table. These target cities are expected to be non-metro areas situated close to existing metropolitan hubs. City selection is said to be driven by two primary factors including market potential and the presence of the appropriate consumer segments receptive to online purchases and doorstep convenience services. Resource allocation including bandwidth and operational capacity will be carefully managed to support this expansion,” divulged Tatikonda.

In terms of sales channels, the company has emphasised a strategy of channel diversification. Strategic alliances and synergies with other players are being explored to extend service offerings and reach additional customer segments.

Technology is positioned as a key enabler to deliver superior customer experiences across the entire lifecycle. Convenience, reliability and a broad spectrum of mobility solutions are highlighted as central to achieving this objective.

Bekaert Acquires Steel Cord Business From Bridgestone In China And Thailand

- By TT News

- January 28, 2026

In a strategic expansion of its global footprint, Bekaert has agreed to acquire Bridgestone’s tyre reinforcement operations in China and Thailand, encompassing the tyre cord production facilities in China (Bridgestone (Shenyang) Steel Cord Co., Ltd) and Thailand (Bridgestone Metalpha (Thailand) Co. Ltd.). This move significantly strengthens the market leadership of Bekaert’s Rubber Reinforcement division, its largest business unit, which has led the global tyre cord sector for decades. The acquisition, set for completion in the first half of 2026 pending regulatory approvals, is a continuation of the division's proven strategy in integrating the captive production of major global accounts.

This transaction reinforces the enduring strategic partnership between Bekaert and Bridgestone, a leading tyre manufacturer. As part of Bridgestone's mid-to-long term plan to boost competitiveness through collaboration, the deal includes a long-term supply agreement ensuring continued provision of high-quality tyre reinforcement. For Bekaert, the integration of these two established production facilities enhances its manufacturing presence and solidifies its position in the tyre cord market.

Financially, the acquisition is projected to contribute approximately EUR 80 million in annual consolidated sales for Bekaert. The purchase involves a cash consideration of EUR 60 million, which will be drawn from the company's existing cash reserves. By securing these key assets and a lasting supply partnership, Bekaert not only expands its operational scale but also deepens its trusted supplier relationship with a pivotal global account.

Yves Kerstens, CEO, Bekaert, said, “Bekaert and Bridgestone share a longstanding strategic partnership built on mutual trust and collaboration. When the transaction closes, we are delighted to welcome the plant teams to Bekaert and remain committed to joint growth and innovation with Bridgestone. The acquisition is also a clear signal of strengthening our global leadership position in the tyre reinforcement industry.”

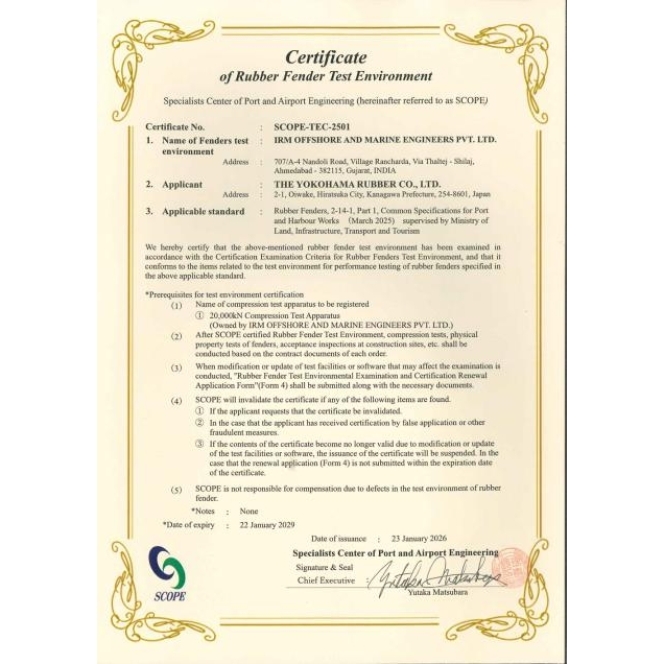

Yokohama Rubber Secures Certificate Of Rubber Fender Test Environment

- By TT News

- January 28, 2026

The Yokohama Rubber Co., Ltd. has successfully secured a Certificate of Rubber Fender Test Environment from Japan’s Specialists Center of Port and Airport Engineering (SCOPE), awarded on 23 January 2026. This certification follows a thorough assessment under SCOPE’s Rubber Fender Testing Environment Certification Program, which validates that the company’s testing facilities for marine rubber fenders operate with integrity and reliability. Specifically, the certification confirms that Yokohama Rubber employs a robust system designed to prevent data fraud, ensuring the trustworthiness of all test results for fenders it manufactures and sells.

These fenders serve as critical safety components, acting as cushioning buffers to protect vessel hulls from impact during harbour mooring and ship-to-ship transfers at sea. To promote safer and more secure maritime operations, SCOPE launched its certification initiative in April 2023, focusing on verifying the reliability of fender testing environments. The programme is aligned with technical guidelines from the World Association for Waterborne Transport Infrastructure (PIANC) and evaluates compliance across multiple SCOPE-defined criteria. These include adherence to static compression testing standards, the elimination of opportunities for data falsification, the integrity of statistical values in test data and the establishment of corporate systems that prevent tampering.

Yokohama Rubber’s expertise in this field dates to 1958, when it pioneered the world’s first pneumatic fender for offshore vessel berthing. Recently, the company has broadened its portfolio beyond high-performance pneumatic fenders to include solid fenders, which represent a principal segment of the fender market. This strategic expansion establishes Yokohama Rubber as a comprehensive fender manufacturer and reinforces its revenue foundation.

The achievement aligns with the company’s ongoing medium-term management plan, Yokohama Transformation 2026 (YX2026), which spans fiscal years 2024 to 2026. A key element of this strategy involves driving growth in the MB Segment by focusing resources on core domains such as hose and couplings along with industrial products. Within this framework, Yokohama Rubber aims to strengthen its product lineup and sustain strong market shares for marine products, including fenders, to secure steady profit growth in the industrial products business.

Bridgestone India Taps Punjabi Star Parmish Verma For Regional Growth Push

- By TT News

- January 27, 2026

In a strategic move to strengthen its connection with vital regional audiences, Bridgestone India has partnered with multifaceted Punjabi star Parmish Verma. This collaboration is designed to resonate deeply in North India, a crucial and rapidly expanding market fuelled by increasing vehicle ownership and a youthful demographic. Verma, a prominent cultural figure and known automobile enthusiast, aligns naturally with the brand’s emphasis on safety, reliability and performance. His authentic passion for vehicles and responsible driving complements Bridgestone’s identity as a leading mobility solutions provider.

Central to this alliance is the co-creation of engaging, music-led narratives and digital content for Bridgestone’s campaigns, leveraging Verma’s artistic talents and significant social influence. This approach recognises the powerful role of popular culture in shaping brand preferences within the region. The partnership also advances the company’s broader regional engagement goals, aiming to build deeper trust with consumers nationwide. Furthermore, it embodies the ‘Emotion’ principle of Bridgestone’s corporate commitment, which seeks to inspire excitement and deliver joy through mobility. By uniting with a figure of Verma’s reach and genuine interest, Bridgestone India fosters a more dynamic and culturally relevant dialogue with its audience.

Rajiv Sharma, Executive Director – Sales & Marketing, Bridgestone India, said, “North India is a strategically important market for us. Parmish Verma’s credibility and deep connection with audiences make him an ideal partner to represent Bridgestone. This collaboration enables us to engage meaningfully with young consumers who seek fresh, inspiring and relatable brand experiences.”

Verma said, “Bridgestone is a brand people trust for safety and performance. I’m proud to be associated with an organisation that values quality and puts customers first. I look forward to connecting with audiences in a new and meaningful way through this partnership.”

Bridgestone Americas Appoints Michele Herlein As New Chief People Officer

- By TT News

- January 24, 2026

Bridgestone Americas has appointed Michele Herlein as its new Chief People Officer. In this role, she will oversee all human resources operations across the Americas, Europe, Middle East and Africa. Her primary focus will be advancing the company's Culture 2.0 initiative, which aims to enhance teammate empowerment, collaboration and accountability.

Herlein rejoins Bridgestone with over two decades of executive leadership expertise. Her background includes previous positions within Bridgestone Americas and Bandag, Inc., centred on culture, leadership development and succession planning. Most recently, she was the Founder and CEO of CultureMax and previously served as the Chief Administrative and Human Resource Officer at Barge Design Solutions. She is also a published authority on creating high-performance organisational cultures. Beyond her corporate work, Herlein is a co-founder of Impact100 Nashville, a philanthropic women’s collective that has awarded more than USD 1.2 million in grants to area nonprofits.

Scott Damon, Bridgestone West CEO and Group President of Bridgestone Americas, said, “I am excited to welcome her back to Bridgestone, recognising the perspective and presence she will add to our West leadership team, the HR function and the broader organisation.”

Comments (0)

ADD COMMENT