India Focuses To Be Global Hub For Quality Tyre Manufacturing: New ATMA Chairman

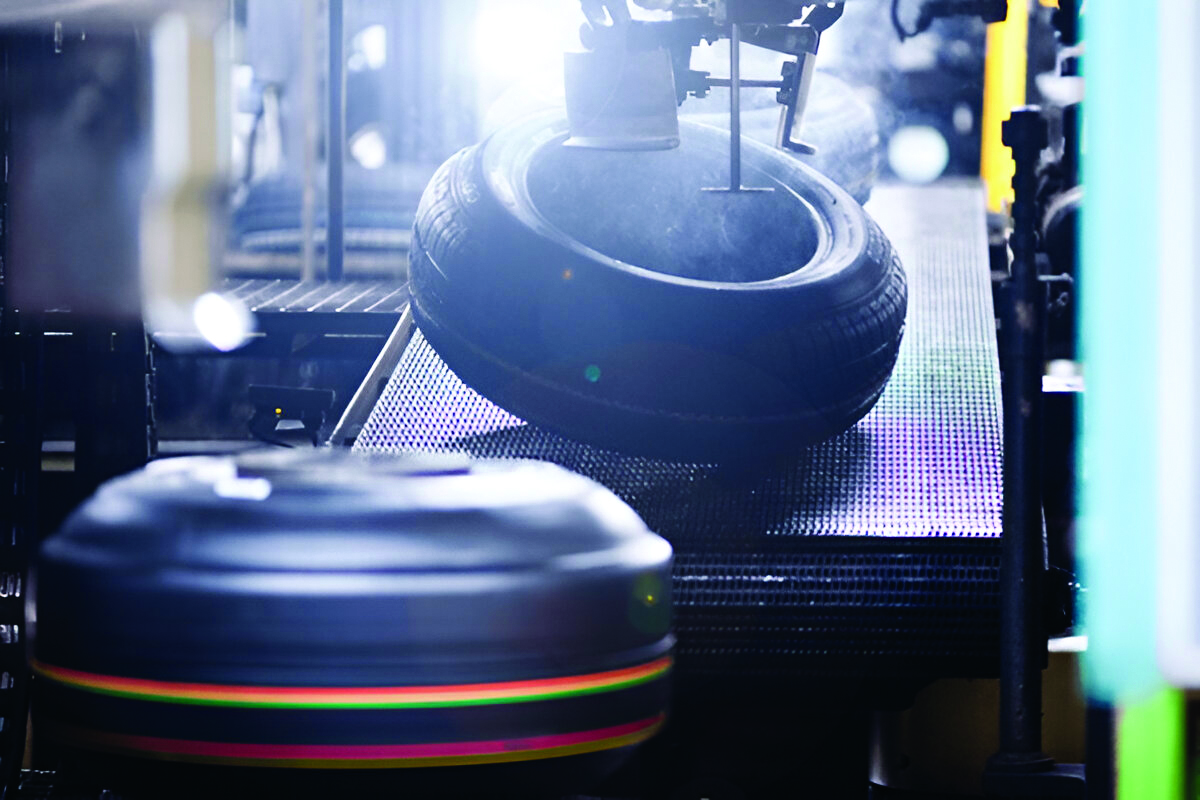

- By Sharad Matade

- April 14, 2025

At a critical juncture for India’s automotive sector, Arun Mammen, Vice-Chairman and Managing Director, MRF Ltd, takes over as Chairman of ATMA (Automotive Tyre Manufacturers’ Association) on its Golden Jubilee Year 2025. At a time when the Indian tyre industry is faced with stringent global challenges, Mammen, with experience of more than three decades, takes over to lead the association through a stage of change with technology revolution, sustainability and strategic expansion. In this one-to-one interview, he presents his thoughts on the industry scenario presently, the challenges in the future that lie ahead and what is India’s vision for the tyre manufacturing industry.

How did the Indian tyre industry fare in FY2025?

FY2025 has been a year of consolidation wherein Indian tyre industry showed much resilience. Despite global headwinds, the domestic market showed steady growth, buoyed by robust demand in the replacement segment and gradual recovery in OEM demand. Infrastructure and road development, focus areas in successive budgets, contributed positively to the industry’s performance. While raw material costs remained volatile, prudent cost management strategies helped the companies ride through a challenging year.

The Indian tyre industry has faced persistent challenges with raw material volatility. What concrete steps will ATMA take under your leadership to reduce dependency on imported natural rubber (NR)?

Reducing reliance on imported natural rubber is a key priority of the government as well as the industry. The planting under the INROAD project, a public private partnership aimed at new rubber plantations in 200,000 hectares in North East for enhancing domestic NR production, has entered well into the fifth year. The original target of planting 200,000 hectares of land with rubber will be completed by next year. Plantations supported by INROAD will start yielding from 2027 onwards, which will substantially reduce the production consumption gap of NR in India. Once these trees enter the yielding phase, the domestic NR output will certainly help in reducing NR imports. Meanwhile, ATMA will continue to work closely with the Rubber Board to enhance domestic production through means such as scientific farming practices. We are also working with Rubber Board through INROAD to identify the untapped rubber plantations in the country with an objective to find a way to start tapping them.

In spite of government efforts, the demand-supply gap of domestic natural rubber persists. How do you envision bridging this underlying supply hurdle?

Bridging the demand-supply gap requires a multipronged approach. First, improving productivity through agri-extension services and quality planting materials. We are promoting climate-resistant and high-yield clones through the INROAD project. Second, increasing farmer income by improving NR quality to make rubber farming viable. With iSPEED, a project of INROAD to improve quality of rubber produced in the country, we aim at significantly improving the quality of rubber produced in the country within next five years, which will substantially improve the income generation of the rubber farmers. Third, a long-term roadmap involving plantation expansion is essential. ATMA will continue to advocate for policy reforms and a long-term vision to build domestic industry and farmer confidence.

Indian export front has witnessed a peak in exports of tyres in recent years. Still, most export markets are fighting hard now. What will happen to export trends in coming months?

Global uncertainty may temper growth in the short term, but the structural competitiveness of Indian tyre manufacturers – cost efficiency, quality and compliance with international benchmarks – remains intact. While exports may stabilise in traditional markets, we expect opportunities to emerge in new geographies, particularly in Africa, Latin America and Southeast Asia. ATMA is actively engaging with the government to improve export competitiveness and bilateral trade facilitation.

There have been no tyres from China in the last two years. How has that benefitted the Indian tyre industry?

The restriction of Chinese tyres has helped provide a level playing field for domestic players, especially in the truck and bus radial (TBR) segment and also helped in stopping import of poor quality, cheap truck bias tyres which were unsafe to operate under heavy loading conditions in India, compared to the Indian bias tyres which are designed to meet the domestic service conditions. It has accelerated capacity utilisation, encouraged fresh investments and enabled Indian brands to increase their footprint in both replacement and OEM markets. More importantly, it has strengthened the ecosystem for local innovation and quality standards.

Now BIS certification is compulsory for tyre machines being sold in India. How will it help the industry? Also, there are numerous foreign tyre machine manufacturers who are finding it difficult to register and get the certification. As the apex body of the Indian tyre industry, will you assist them in this regard?

BIS certification ensures consistency in machine quality and enhances safety, efficiency and reliability in manufacturing. As tyre production gathers momentum, more avenues will open for machine manufacturers. ATMA, with the support of Department of Heavy Industry (DHI) has facilitated knowledge sharing sessions and interaction between the policy makers and machinery manufacturers, both domestic and international suppliers.

Global leading tyre manufacturers are shifting away from large-scale production of small-size tyres (14” to 18”) towards larger tyres or establishing a stronger presence in premium segments. Is there a sweet spot for Asian tyre companies, particularly Indian, in the global market?

With our cost advantage, strong engineering base and growing R&D capabilities, Indian companies are well positioned to become reliable suppliers in the volume segment, even as we continuously scale up in the premium niches. End-of-life tyre disposal is still not organised in India, even with regulations. Why has the industry failed to develop efficient recycling infrastructure, and what’s your strategy to deal with this environmental risk? The EPR regulations are a step in the right direction, but the ecosystem is still evolving in the country. ATMA is working on creating an industry-wide platform for end-of-life tyre traceability, supporting sustainable disposal technologies and partnering with recyclers to build a viable circular economy model. We are liaisoning with the authorities to create pollution-free ELT disposal by the recyclers. ATMA member companies are helping the pollution control department through auditing the process of recyclers to speed up setting checks and balance in this sector. ATMA is also following up with the government to ban import of used tyres, for the purpose of pyrolysis, into the country.

Increasing logistics costs are tightening industry margins. What are the infrastructural bottlenecks that most deeply affect the tyre industry, and how are you approaching government stakeholders to resolve them?

Increasing logistics costs are tightening industry margins. What are the infrastructural bottlenecks that most deeply affect the tyre industry, and how are you approaching government stakeholders to resolve them?

High road freight costs, port congestion and insufficient rail-freight linkages are key concerns. We are in discussions with the government to improve multimodal transport connectivity, optimise freight corridors and simplify port logistics. Faster clearances and digital infrastructure can significantly lower turnaround time and costs. ATMA continues to be an active participant for policy formulation in this domain.

Some of the world’s major tyre makers have become carbon neutral in their businesses. Why are Indian companies not following suit, and how will ATMA propel sustainability?

Sustainability is a top priority, and many Indian tyre majors have already made significant strides in renewable energy usage, water recycling and carbon reduction. While carbon neutrality takes time and scale, we’re moving in that direction. ATMA is working on a sustainability roadmap to support industry players with benchmarks, best practices and technology collaboration to accelerate green transitions.

What could be the major challenge for the tyre industry in the near future and how do you plan to overcome it?

We need to look at the challenges for tyre industry along with that of the auto industry. With sustainability gaining traction and Euro 7 and BS7 standards likely to kick off in 2026/27, auto industry may have to work overtime to meet the proposed deadlines. Transition to non-fossil fuel combustion engine, hybrid engine and EV will gain traction. There could also be some standards on tread road wear particle emission (TRWPE) although there is no clear statistics to establish the current quantity of TRWP emission. In this regard, we should be careful not to copy / paste any European legislation without considering India specific challenges. For example, India is still a major bias tyre market and there are a large number of loyal customers for this product. Instead of replacing bias tyre entirely by radial tyre, we should focus on specific interventions to make bias tyre bridge the gap with radial tyre.As far as TRWP is concerned, we will have to admit that Indian road surface as well as road terrain is totally different from Europe. So this subject need a much larger study. To begin with we need to establish a proper data base to understand and work on the problem. We are sure that we will soon find a solution for all the above problems.

How do you see FY2026?

FY26 is expected to be a growth year, supported by robust infrastructure spending and sustained vehicle demand. While global macro challenges remain, the Indian tyre industry’s fundamentals are strong. Digitisation, innovation and sustainability will be our key focus areas as we aim to position India as a global hub for quality tyre manufacturing.

A New Hand On The Tread

- By Gaurav Nandi

- March 11, 2026

Antonio Tulio Jou Inchausti has stepped into the role of Chief Executive Officer at Unique Rubber Technologies, taking charge at a pivotal moment as the company sharpens its focus on innovation, operational discipline and long-term growth in the global retreading industry. Speaking exclusively to Tyre Trends, he unfolds the forward path.

What are the first three strategic priorities you plan to redefine Unique Rubber Technologies in your first 12–18 months as CEO?

Focus will be strengthening what truly sustains the company viz-a-viz our people, culture and responsibility for the future. The safety of our teams comes first, and throughout 2026, we are implementing a robust SafeStart programme to further embed a culture of care, prevention and accountability across the organisation.

At the same time, we will continue to invest strongly in the development of our people, empowering them to deliver their best every day and reinforcing talent as a key pillar of our success. These priorities support our sustainable growth journey, honouring the legacy of the 50 years we have recently completed while preparing the company for its next phase of evolution, guided by consistency, purpose and long-term vision.

Where do you see the company under-positioned today and how do you intend to close that gap?

Unique Rubber Technologies is well positioned as one of the most relevant players in the retreading market in Latin America, holding leadership positions through its Tipler and Borex brands. Our continuously expanding dealer network delivers strong value to the market by offering products and services recognised for its high quality, reliability and outstanding mileage performance, exactly what end customers expect from our solutions.

Looking ahead, our focus is on expanding into new and complementary markets, growing alongside our existing customers while also addressing opportunities in product segments where we see room to evolve through innovation and embedded technologies in our processes.

How do modern manufacturing and retreading heritage come together in your value proposition?

We are proud to operate one of the most modern manufacturing facilities in the industry, which reinforces safety, consistency and product quality. At the same time, we remain committed to preserving and advancing the company’s legacy by promoting the efficient use of natural resources, inherent to our retreading processes, and by contributing to lower transportation costs through products that combine high mileage performance, safety and reliability.

How will you balance research and development ambition with cost discipline and time-to-market pressures?

Innovation at our company is guided by a disciplined and long-term approach. Our research and development teams continuously monitor developments not only in the domestic market but also in key international markets, ensuring we remain aligned with the most advanced product concepts, equipment and manufacturing technologies available globally.

At the same time, we consistently optimise our processes to maintain a cost structure that is well aligned with market demand, allowing us to remain competitive while accelerating time to market. Our perspective is not short-term; we regularly review our strategic planning with a five-year horizon, focusing on improvements that will translate into superior products and services over time.

How do you balance innovation with market needs to deliver consistent performance?

We firmly believe that high-quality products delivering superior mileage and performance will always earn customer preference and balancing innovation with market needs, execution discipline and sustainable results is at the core of how we continue to move forward every day.

What specific inefficiencies in operations or supply chain have you already identified and what measurable improvements should stakeholders expect?

As with any industrial operation operating at scale, there are always opportunities to improve efficiency and our focus has been on identifying areas where greater integration, predictability and agility can be achieved across operations and the supply chain.

We have already identified opportunities to optimise process flows, reduce variability and strengthen coordination with key suppliers, leveraging data, standardisation and better planning tools. These initiatives are designed to improve lead times, increase reliability and enhance overall operational efficiency without compromising quality or safety.

What measurable improvements can stakeholders expect from this strategy?

Stakeholders can expect measurable improvements in service levels, operational consistency and cost efficiency over the coming cycles as well as a more resilient supply chain capable of supporting our growth strategy. Our approach will be focused on delivering tangible results and keep building a continuous and stronger operational foundation for the future.

How will your approach to client engagement differ from the previous co-CEO model, particularly with global OEMs and strategic partners?

Approach to client engagement is built on continuity while further strengthening clarity, consistency and proximity in how we engage with our customers and partners. The company has established strong relationships over the years and my role as CEO is to enhance those connections through more direct and structured strategic dialogue, particularly with global OEMs and key strategic partners.

We will ensure closer alignment between our commercial, technical and operational teams, enabling faster decision-making and a more cohesive value proposition across markets. Beyond transactional interactions, our focus is on deepening long-term partnerships through collaboration, joint development initiatives and shared growth agendas.

With the former co-CEOs remaining active in governance bodies, how will decision-making authority be clearly defined to avoid strategic overlap or delays?

The transition to a single-CEO model is supported by a well-defined governance structure that clearly separates strategic oversight from executive decision-making. While the former co-CEOs continue to contribute through governance bodies, their role is focused on guidance, continuity and long-term perspective, rather than day-to-day management.

Executive authority and accountability are clearly defined within the leadership team, enabling agile, timely and consistent decision-making. This structure ensures strategic alignment without overlap, preserves institutional knowledge and allows us to move forward with clarity, speed and discipline, fully aligned with our long-term objectives and growth strategy.

Will future growth come from expansion, new products or deeper market penetration?

Our future growth will be driven by a balanced combination of geographic expansion, innovation in product platforms and deeper penetration in existing markets. We see significant opportunities to strengthen our presence where we already operate by expanding our portfolio, increasing customer proximity and extracting more value from established relationships.

At the same time, we will selectively pursue geographic expansion into markets that align with our capabilities and long-term strategy. Innovation remains a key enabler across all fronts, allowing us to develop new product platforms and solutions that respond to evolving customer needs and regulatory requirements. This diversified growth approach provides resilience, scalability and consistency, ensuring that the company continues to grow in a disciplined and sustainable manner.

How prepared is the company to meet stricter regulatory and ESG demands?

Sustainability is deeply embedded in our business model and operational practices, well beyond branding or positioning. Our retreading solutions inherently contribute to the efficient use of natural resources and lower environmental impact, which places us in a strong position to meet increasingly stringent regulatory and ESG requirements.

We continuously invest in safer, more efficient processes, advanced technologies and responsible sourcing to ensure compliance with evolving regulations across the markets we serve. At the same time, we work closely with customers to align our products and services with their sustainability and compliance mandates, offering solutions that combine environmental responsibility, safety, performance and economic value.

Which competitors or substitute technologies pose the biggest threat to your business model over the next five years?

Rather than focusing on individual competitors, we closely monitor broader industry dynamics and substitute technologies that could influence customer choices over the next five years.

The main competitive pressure comes from solutions that promise lower upfront costs or alternative lifecycle approaches, even if they do not always deliver the same levels of performance, safety or sustainability over time.

How does the company turn industry and regulatory shifts into competitive advantage?

Our business model is built on proven technology, high-quality products and superior mileage performance, which continue to be highly valued by customers focused on total cost of ownership and operational efficiency.

We remain attentive to technological shifts, regulatory changes and evolving mobility trends and we continuously invest in innovation, process optimisation and product development to ensure our solutions remain relevant and competitive. This proactive and disciplined approach allows us not only to mitigate potential threats but also to turn industry evolution into opportunities for differentiation and long-term growth.

How will you define success in this role?

I will define success in this role by the strength and sustainability of the organisation we continue to build. Success means a company where people feel safe, engaged and empowered, where customers recognise us as a trusted and long-term partner and where our products consistently deliver quality, reliability and performance.

It also means advancing the company’s strategic objectives with discipline, clarity and consistency while preserving the values and legacy built over the past 50 years. Ultimately, success will be reflected in the company’s ability to grow responsibly, adapt to change and create lasting value for customers, employees and all stakeholders.

- Alberta Recycling Management Authority

- ARMA

- Extended Producer Responsibility

- Sustainability

- Environmental Stewardship

ARMA Appoints Vahid Rashidi As New Vice President Of EPR To Lead Sustainability Initiatives

- By TT News

- March 10, 2026

Alberta Recycling Management Authority (ARMA) has announced the appointment of Vahid Rashidi as its new Vice President of Extended Producer Responsibility (EPR). The leadership addition marks a strategic step in the organisation's ongoing evolution to better serve the needs of Albertans.

Rashidi brings extensive experience and strategic vision to the role, with a strong track record in driving impactful results. His appointment underscores ARMA’s commitment to navigating complex regulatory systems and strengthening its leadership capacity. He is expected to play a pivotal role in advancing the organisation’s EPR initiatives and reinforcing its dedication to sustainability and compliance excellence.

His results-oriented approach aligns with ARMA’s mission to deliver responsible solutions for industries and communities across the province. The organisation anticipates that his leadership will accelerate progress towards its goals, inspire internal teams and help position ARMA for continued success within a shifting regulatory landscape. The appointment has been met with enthusiasm as the authority looks to build on its momentum in environmental stewardship.

The Needle Barely Moved

- By Sharad Matade & Gaurav Nandi

- March 10, 2026

After more than three decades in tyre recycling, Pliteq CEO Paul Downey argues that despite rising sustainability rhetoric, the industry’s core technologies and material flows have barely evolved. While perceptions of recycled materials have improved, real innovation, he said, has been slower, narrower and far more uneven than expected.

Paul Downey, Chief Executive Officer of Pliteq, has worked in end-of-life tyre recycling since 1990. In that time, he expected major breakthroughs in pyrolysis and tyre-to-tyre recycling. He says they never came.

“When you look at pyrolysis, that hasn’t really changed in 30 years,” Downey said in an exclusive interview with Tyre Trends. “When you look at the use of rubber back into tyres, still a very small percentage of waste tyres goes back into new tyres,” he added.

Despite more money, more participants and more attention on recycling, he describes the sector as remarkably static. These, he said, were the areas where he expected research and to unlock scale. “Frankly the needle hasn’t moved very far in all those years. I’ve only seen very, very small changes in the last 30 years,” Downey noted.

One reason is energy. “Tyres take a tremendous amount of energy to grind up. So, you still need a lot of energy. Energy challenges are going to be an ongoing issue,” he said, pointing to wider stress on energy infrastructure.

That energy intensity affects both mechanical recycling and pyrolysis, where tyres are broken into oil, gas and carbon black. While refining recovered carbon black has long been studied, Downey says progress has been limited.

“You can refine the carbon black to make it more useful by tyre companies in terms of not degrading the quality of the finished tyre,” he said, adding that this has been researched for decades without dramatic improvement.

“You can refine the carbon black to make it more useful by tyre companies in terms of not degrading the quality of the finished tyre,” he said, adding that this has been researched for decades without dramatic improvement.

Pyrolysis remains minor in North America with a significant share of tyres still used as tyre-derived fuel. Downey divides end-of-life tyre use roughly into thirds viz-a-viz moulded goods, tyre-derived fuel and applications such as rubber-modified asphalt, which he says has also seen limited uptake since 1990.

After university, Downey joined a company that was already working with tyre manufacturing waste with materials that could not be used in new tyres due to quality deviations.

“When you produce a tyre, about two to three percent of the materials are off-spec. These materials can’t be used to make a tyre, so that becomes waste. That waste, combined with ELTs, was processed into noise and vibration products, primarily for automotive, heavy truck, and off-the-road vehicle applications,” he explained.

“This was back in the early 1990s. The original use was non-tyre. It was mostly in the noise and vibration space for vehicles,” Downey said.

In 1998, after developing multiple patents in Canada and the United States, Downey founded his own company. Initially, the business model revolved around licensing those patents to manufacturers, largely in the US. Over time, that approach evolved. “When I formed Pliteq, I stopped doing the licensing. All of the patents are now being used by the company,” he said.

FROM PATENTS TO PLITEQ

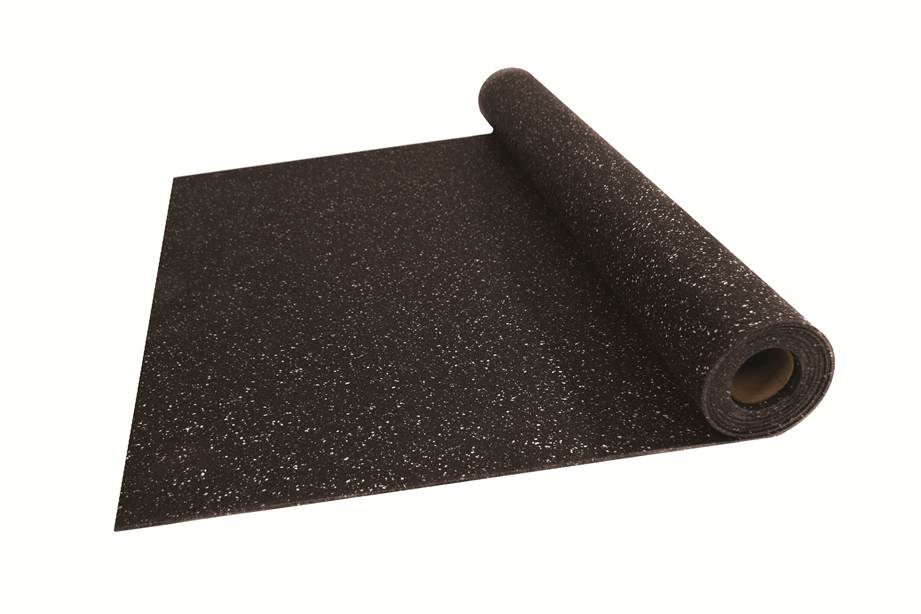

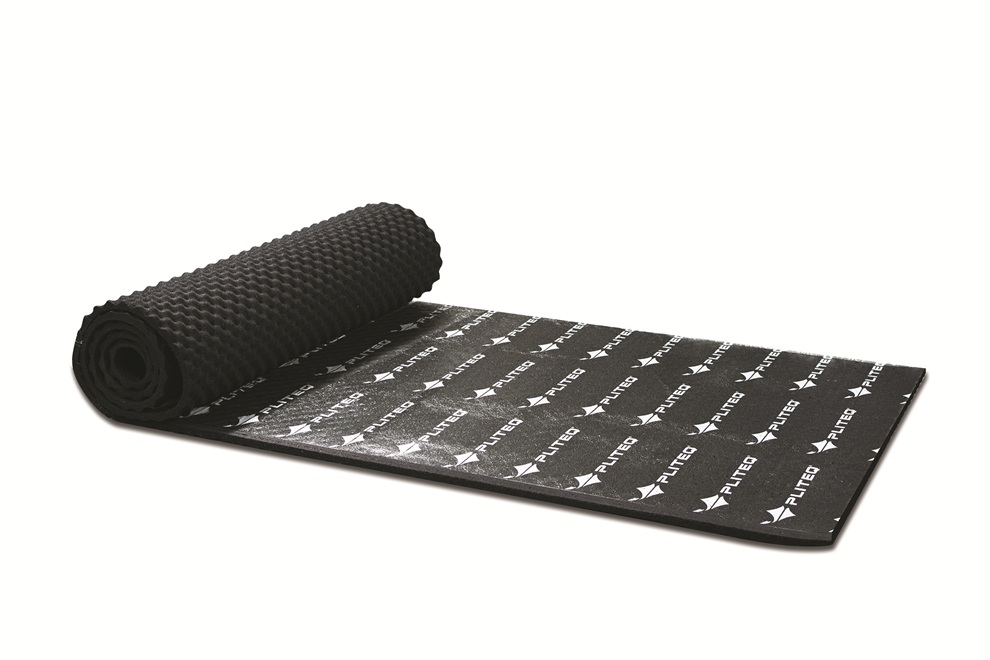

Today, Pliteq focuses on manufacturing finished products rather than licensing technology. The company produces sound and vibration control materials, insulated floor mats and building products made from recycled ELT rubber. Its applications range from isolating vibration caused by subway and railway lines to managing noise and vibration from HVAC systems, pumps, compressors and mechanical rooms in buildings.

“We’re looking at all the places in or around a building under construction where rubber could be used,” Downey explained.

Asked what has changed in the tyre recycling industry over the last 30 to 35 years, Downey’s answer is candid. “Remarkably, little has changed,” he quipped.

While markets for recycled tyres have expanded, the underlying technologies and material flows remain largely the same. Pyrolysis, often cited as a future solution for ELTs, has not progressed as dramatically as expected. “That hasn’t really changed tremendously in 30 years,” Downey noted.

Similarly, efforts to put recycled rubber back into new tyres have seen limited success. “There have been some efforts by major tyre companies but still a very, very small percentage of waste tyres goes back into new tyres. Those were areas where I thought there was a lot of potential for research, but the needle hasn’t moved very far,” he said.

Where the industry has evolved more meaningfully is in moulded goods. “That’s where we’ve seen the most development,” Downey said, pointing to sound and vibration products, underlayments and recycled rubber flooring used in schools, hospitals, gyms and fitness facilities. In North America, he estimates that moulded goods account for roughly one-third of ELT usage.

Another third of ELTs is used as tyre-derived fuel, while the remainder goes into applications such as rubber-modified asphalt, an area Downey says existed in 1990 and has not seen significant market uptake despite ongoing research.

CHANGING PERCEPTIONS

One of the most significant shifts Downey has witnessed is not technological but cultural. “When I started, recycling was a bad word. People didn’t want to buy recycled products because they thought it was garbage,” he said.

That perception has changed substantially. Today, architects, builders and developers show strong interest in sustainable materials, particularly in construction. While Downey does not attribute this shift directly to regulation, he acknowledges a broader market preference for sustainability.

“Now people don’t view recycling as inferior. That attitude has definitely changed over the last 30 years,” he said.

Moreover, public scrutiny around recycled rubber has intensified in recent years, particularly regarding the use of crumb rubber in athletic fields. Downey addressed these concerns directly, referencing studies he has reviewed.

“I haven’t seen any research that shows a correlation between crumb rubber and health issues. The Synthetic Turf Council conducted a multi-year study that showed exactly the opposite,” he said.

In Downey’s view, the primary concern around crumb rubber is environmental rather than medical. “It’s a powder. Potentially, it can wash away into the water supply,” he said.

Pliteq, however, is not active in the turf infill market. “We don’t sell crumb into athletic fields. We strictly manufacture moulded goods for sound control, vibration isolation, flooring and building products,” Downey clarifies.

SCALE AND FOOTPRINT

Pliteq operates offices in seven countries and sells into approximately 50 markets worldwide. Its main manufacturing facility is located in Canada, supported by two smaller plants in United States. Collectively, these facilities produce about 44,000 metric tonnes of finished products annually.

To achieve this output, Pliteq consumes roughly 60,000 metric tonnes of ELTs. “We don’t use the steel or textile,” Downey explained, referring to the components removed during tyre processing.

The company sources tyres primarily from North America, tapping into a collection network that has been established over the past three decades. ELTs are categorised into three distinct groups viz-a-viz passenger and light truck tyres, heavy truck tyres and mining or off-the-road tyres, each with different rubber compositions and properties.

“We keep those three categories separate. The amount and type of rubber are quite distinct,” Downey said.

“We keep those three categories separate. The amount and type of rubber are quite distinct,” Downey said.

Pliteq’s patents focus on application and use rather than core processing technologies. Beyond patents, the company relies heavily on proprietary know-how. “We have a number of trade secret processes that we don’t disclose,” Downey said.

These include particle selection, tyre source selection, screening, cleaning, formulation, mixing and moulding. “We do things in a way that nobody else in the world is doing. That allows us to achieve certain quality levels, surface finishes and performance characteristics that aren’t generally available,” he says.

Quality control is embedded throughout the manufacturing process. Downey estimated that each product passes through around seven distinct quality checks, supported by machine operators, automated systems and visual inspections. Any waste generated during production is reprocessed and reused, reinforcing a closed-loop manufacturing approach.

Pliteq operates a hybrid business model. Technology development, product design and manufacturing are largely centralised, while sales, warehousing and distribution are managed regionally. This structure allows the company to adapt products to local market needs.

“Some markets have very distinct requirements. What’s needed in UK might not be required in Singapore, Australia or US,” Downey said.

THE ROAD AHEAD

Looking forward, Downey sees gradual rather than dramatic change. Energy consumption remains a major challenge as tyre grinding is energy-intensive. Broader issues such as energy infrastructure strain and shifting global trade patterns also weigh on the industry.

Despite these challenges, Pliteq continues to reinvest its earnings back into the business. “We’re on a growth curve. We reinvest all the money back into the company and into the markets,” Downey said.

The company is currently operating at around 80 percent capacity, a level Downey stated is close to optimal. Expansion will focus first on strengthening existing teams across its seven offices before opening new locations.

“We’ve built the manufacturing model so it can scale as demand grows. But we only put new facilities where the market can sustain them,” he said.

After more than three decades in the ELT space, Downey remains pragmatic. The industry may not have transformed as dramatically as once hoped, but in moulded products and building applications, Pliteq continues to carve out a space where recycled tyres deliver measurable performance and growing acceptance in the built environment.

Safety First

- By Gaurav Nandi

- March 09, 2026

With road accidents claiming nearly two million lives globally each year, safety has become a shared responsibility across governments, industry and road users. Organisations like TyreSafe play a vital role in addressing this challenge by promoting tyre awareness, collaboration and evidence-led action to reduce preventable deaths and serious injuries.

The World Health Organization estimates a whopping 1.9 million deaths worldwide each year due of road incidents. Hence, it can be deduced that approximately 3,200 people succumb to road related incidents each day.

It is also true that governments and organisations are trying to curb this menace that dearly costs the global race. UK-based organisation TyreSafe is one of the many players that are caring for people’s lives.

It dedicatedly raises awareness on the importance of correct tyre maintenance and the dangers of defective and illegal tyres to fight safety issues.

Speaking to Tyre Trends, TyreSafe Chairman Stuart Lovatt said, “We take a strategic, risk-based approach. TyreSafe leverages key seasonal themes such as winter driving, summer journeys and harvest-time rural risks while maintaining suites of evergreen assets that can be used year-round.”

“Priority is given to vulnerable road user groups through targeted campaigns, alongside all road users via our flagship Tyre Safety Month. Partnerships are critical. By integrating tyre safety into partners’ existing calendars and campaigns, we significantly extend our reach without duplicating effort. This collaborative model ensures resources are used efficiently and messages reach the right audiences at the right time,” he added.

“Priority is given to vulnerable road user groups through targeted campaigns, alongside all road users via our flagship Tyre Safety Month. Partnerships are critical. By integrating tyre safety into partners’ existing calendars and campaigns, we significantly extend our reach without duplicating effort. This collaborative model ensures resources are used efficiently and messages reach the right audiences at the right time,” he added.

TyreSafe works with over 250 organisations to disseminate the message of safety. Each collaboration enables it to reach different regions, sectors or road user groups, whether that is police forces, road safety partnerships, rural safety groups or charities.

“Cross-sector collaboration is essential to delivering the safe system approach. Safe vehicles and tyre safety in particular must be embedded within long-term, joined-up efforts to reduce and ultimately eliminate death and serious injury on UK roads,” said Lovatt.

The key lesson is that collaboration requires persistence and clarity of purpose. Strong partnerships are built on shared goals, evidence-led strategy and tangible outputs such as research, campaigns and participation in influential working groups. From there, aligning on tone, timing and messaging becomes much easier.

SAFETY GOALS

Vision Zero is a global road safety approach that aims to eliminate all road traffic deaths and serious injuries. It is based on the belief that human error is inevitable but fatalities are preventable through safer road design, responsible speeds, safer vehicles and stronger shared accountability.

Lovatt noted it as an ambitious but essential goal and one that no single organisation can achieve alone.

However, he explained that TyreSafe measures progress not just through a single metric and more through its contribution to the wider safe system approach, particularly the safe vehicles and safe people pillars.

A significant recent milestone has been the launch of the National Road Safety Strategy, which creates a renewed framework for collaboration between government, charities, enforcement, industry and researchers. After more than a decade without a national strategy, this provides the foundation needed for coordinated, evidence-led action.

Looking ahead to 2030, TyreSafe’s focus is on embedding tyre safety more firmly into national conversations around vehicle safety, fleet responsibility and public behaviour change.

“Success will be measured through stronger cross-sector collaboration, increased visibility of tyre safety within wider road safety initiatives, improved data quality and sustained engagement from both industry and road users, which all lead to a marked reduction in number of serious incidents on our roads,” said Lovatt.

TyreSafe continually reviews its resources to ensure they remain relevant and valuable. “We already include EV tyre safety guidance on our website, and this is an area we expect to develop further. With a small team and a wide range of road users to serve, prioritisation is essential. Each year we expand our resource portfolio carefully, ensuring new content delivers genuine value for stakeholders and does not dilute impact,” added Lovatt.

CHALLENGES AFOOT

Lovatt contended that technology offers clear benefits for data collection and diagnostics. However, it also presents risks if it reduces the active, human element of tyre safety.

Visual and manual checks remain critical in identifying damage, wear and defects that technology may not always capture. There is a risk that increased vehicle automation could lead to complacency, so TyreSafe’s approach will continue to reinforce the importance of driver responsibility alongside technological advances.

On the other hand, scepticism and inertia are imminent challenges that are addressed through clear case-for-action statistics, which consistently resonate with the public, media and stakeholders.

“Culturally, the cost-of-living crisis presents real challenges with drivers delaying tyre replacement or repair for financial reasons. For fleets, education is key. We produce targeted content and resources for fleet and compliance managers that emphasise not only safety but liability, duty of care and reputational risk. By framing tyre safety as both a safety and business-critical issue, we are better able to overcome resistance and influence positive behavioural change,” said Lovatt.

Measuring real-world outcomes also remains one of the biggest challenges in road safety. “Data on tyre-related incidents relies heavily on third-party reporting, which limits our ability to directly attribute impact. To address this, TyreSafe conducts its own research, such as the 2023 national tread depth survey, which we are looking to repeat,” explained Lovatt.

It also runs smaller-scale public surveys to understand not just what behaviours exist but why, allowing the organisation to refine messaging and improve relevance. It also utilises partners data and research with their support to continuously refresh and strengthen the case for action.

“While awareness metrics remain important, our focus is increasingly on insight-led evaluation that informs practical behaviour change,” he said.

BALANCING SCALES

Balancing programme expansion with sustainable funding and supporter engagement remains a challenge for a charity organisation leading national safety efforts.

TyreSafe works closely with its industry supporters, who are its primary income stream. The organisation ensures that it has a voice and that its strategic direction, resource development and investment decisions align with their CSR objectives while avoiding conflict with commercial activity.

This collaborative approach helps maintain long-term trust, financial sustainability and shared ownership of TyreSafe’s mission.

TyreSafe also does not advocate for legislative change and operates strictly within existing regulatory frameworks. However, it works closely with a wide range of organisations and partners who are able to engage more directly in policy advocacy.

“Our priority is engaging stakeholders, industry, enforcement partners and the wider road safety community while using our research, status and channels to reach the public both online and offline. The goal is to drive real, practical behaviour change, rather than focusing solely on awareness,” explained Lovatt.

He added that by ensuring that organisational evidence, campaigns and resources are robust and credible, it supports informed dialogue across the sector and contributes to policy discussions indirectly through collaboration and shared insight.

“International engagement is driven by a desire to support organisations embarking on their own road safety journeys. By sharing TyreSafe’s 20 years of research, campaigning experience and resources, we can help others accelerate progress and reach audiences more quickly. The focus is on enabling and supporting, rather than exporting a one-size-fits-all model,” contended the executive.

TyreSafe’s work highlights that meaningful road safety progress depends on sustained collaboration, credible data and behavioural change. By embedding tyre safety within the wider Vision Zero framework and adapting to emerging technologies and challenges, the organisation continues to influence safer roads, vehicles and users, proving that incremental actions can collectively save lives.

Comments (0)

ADD COMMENT