India Focuses To Be Global Hub For Quality Tyre Manufacturing: New ATMA Chairman

- By Sharad Matade

- April 14, 2025

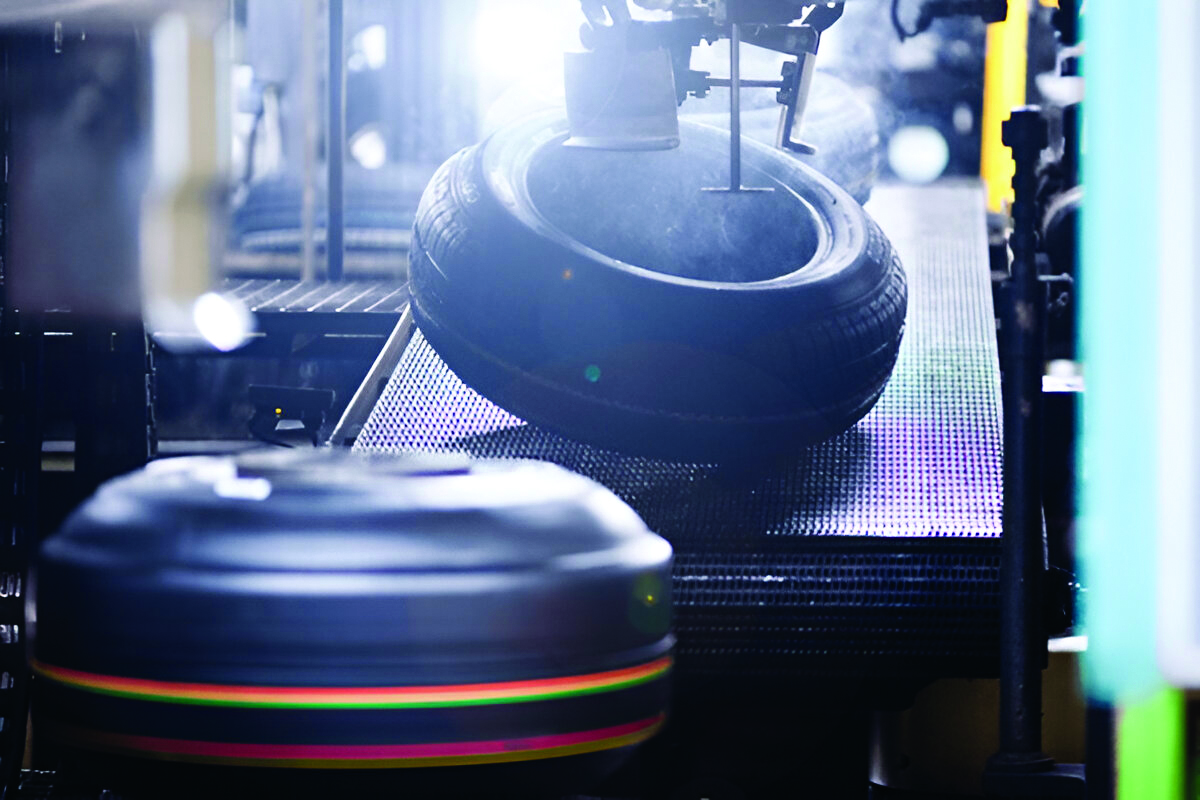

At a critical juncture for India’s automotive sector, Arun Mammen, Vice-Chairman and Managing Director, MRF Ltd, takes over as Chairman of ATMA (Automotive Tyre Manufacturers’ Association) on its Golden Jubilee Year 2025. At a time when the Indian tyre industry is faced with stringent global challenges, Mammen, with experience of more than three decades, takes over to lead the association through a stage of change with technology revolution, sustainability and strategic expansion. In this one-to-one interview, he presents his thoughts on the industry scenario presently, the challenges in the future that lie ahead and what is India’s vision for the tyre manufacturing industry.

How did the Indian tyre industry fare in FY2025?

FY2025 has been a year of consolidation wherein Indian tyre industry showed much resilience. Despite global headwinds, the domestic market showed steady growth, buoyed by robust demand in the replacement segment and gradual recovery in OEM demand. Infrastructure and road development, focus areas in successive budgets, contributed positively to the industry’s performance. While raw material costs remained volatile, prudent cost management strategies helped the companies ride through a challenging year.

The Indian tyre industry has faced persistent challenges with raw material volatility. What concrete steps will ATMA take under your leadership to reduce dependency on imported natural rubber (NR)?

Reducing reliance on imported natural rubber is a key priority of the government as well as the industry. The planting under the INROAD project, a public private partnership aimed at new rubber plantations in 200,000 hectares in North East for enhancing domestic NR production, has entered well into the fifth year. The original target of planting 200,000 hectares of land with rubber will be completed by next year. Plantations supported by INROAD will start yielding from 2027 onwards, which will substantially reduce the production consumption gap of NR in India. Once these trees enter the yielding phase, the domestic NR output will certainly help in reducing NR imports. Meanwhile, ATMA will continue to work closely with the Rubber Board to enhance domestic production through means such as scientific farming practices. We are also working with Rubber Board through INROAD to identify the untapped rubber plantations in the country with an objective to find a way to start tapping them.

In spite of government efforts, the demand-supply gap of domestic natural rubber persists. How do you envision bridging this underlying supply hurdle?

Bridging the demand-supply gap requires a multipronged approach. First, improving productivity through agri-extension services and quality planting materials. We are promoting climate-resistant and high-yield clones through the INROAD project. Second, increasing farmer income by improving NR quality to make rubber farming viable. With iSPEED, a project of INROAD to improve quality of rubber produced in the country, we aim at significantly improving the quality of rubber produced in the country within next five years, which will substantially improve the income generation of the rubber farmers. Third, a long-term roadmap involving plantation expansion is essential. ATMA will continue to advocate for policy reforms and a long-term vision to build domestic industry and farmer confidence.

Indian export front has witnessed a peak in exports of tyres in recent years. Still, most export markets are fighting hard now. What will happen to export trends in coming months?

Global uncertainty may temper growth in the short term, but the structural competitiveness of Indian tyre manufacturers – cost efficiency, quality and compliance with international benchmarks – remains intact. While exports may stabilise in traditional markets, we expect opportunities to emerge in new geographies, particularly in Africa, Latin America and Southeast Asia. ATMA is actively engaging with the government to improve export competitiveness and bilateral trade facilitation.

There have been no tyres from China in the last two years. How has that benefitted the Indian tyre industry?

The restriction of Chinese tyres has helped provide a level playing field for domestic players, especially in the truck and bus radial (TBR) segment and also helped in stopping import of poor quality, cheap truck bias tyres which were unsafe to operate under heavy loading conditions in India, compared to the Indian bias tyres which are designed to meet the domestic service conditions. It has accelerated capacity utilisation, encouraged fresh investments and enabled Indian brands to increase their footprint in both replacement and OEM markets. More importantly, it has strengthened the ecosystem for local innovation and quality standards.

Now BIS certification is compulsory for tyre machines being sold in India. How will it help the industry? Also, there are numerous foreign tyre machine manufacturers who are finding it difficult to register and get the certification. As the apex body of the Indian tyre industry, will you assist them in this regard?

BIS certification ensures consistency in machine quality and enhances safety, efficiency and reliability in manufacturing. As tyre production gathers momentum, more avenues will open for machine manufacturers. ATMA, with the support of Department of Heavy Industry (DHI) has facilitated knowledge sharing sessions and interaction between the policy makers and machinery manufacturers, both domestic and international suppliers.

Global leading tyre manufacturers are shifting away from large-scale production of small-size tyres (14” to 18”) towards larger tyres or establishing a stronger presence in premium segments. Is there a sweet spot for Asian tyre companies, particularly Indian, in the global market?

With our cost advantage, strong engineering base and growing R&D capabilities, Indian companies are well positioned to become reliable suppliers in the volume segment, even as we continuously scale up in the premium niches. End-of-life tyre disposal is still not organised in India, even with regulations. Why has the industry failed to develop efficient recycling infrastructure, and what’s your strategy to deal with this environmental risk? The EPR regulations are a step in the right direction, but the ecosystem is still evolving in the country. ATMA is working on creating an industry-wide platform for end-of-life tyre traceability, supporting sustainable disposal technologies and partnering with recyclers to build a viable circular economy model. We are liaisoning with the authorities to create pollution-free ELT disposal by the recyclers. ATMA member companies are helping the pollution control department through auditing the process of recyclers to speed up setting checks and balance in this sector. ATMA is also following up with the government to ban import of used tyres, for the purpose of pyrolysis, into the country.

Increasing logistics costs are tightening industry margins. What are the infrastructural bottlenecks that most deeply affect the tyre industry, and how are you approaching government stakeholders to resolve them?

Increasing logistics costs are tightening industry margins. What are the infrastructural bottlenecks that most deeply affect the tyre industry, and how are you approaching government stakeholders to resolve them?

High road freight costs, port congestion and insufficient rail-freight linkages are key concerns. We are in discussions with the government to improve multimodal transport connectivity, optimise freight corridors and simplify port logistics. Faster clearances and digital infrastructure can significantly lower turnaround time and costs. ATMA continues to be an active participant for policy formulation in this domain.

Some of the world’s major tyre makers have become carbon neutral in their businesses. Why are Indian companies not following suit, and how will ATMA propel sustainability?

Sustainability is a top priority, and many Indian tyre majors have already made significant strides in renewable energy usage, water recycling and carbon reduction. While carbon neutrality takes time and scale, we’re moving in that direction. ATMA is working on a sustainability roadmap to support industry players with benchmarks, best practices and technology collaboration to accelerate green transitions.

What could be the major challenge for the tyre industry in the near future and how do you plan to overcome it?

We need to look at the challenges for tyre industry along with that of the auto industry. With sustainability gaining traction and Euro 7 and BS7 standards likely to kick off in 2026/27, auto industry may have to work overtime to meet the proposed deadlines. Transition to non-fossil fuel combustion engine, hybrid engine and EV will gain traction. There could also be some standards on tread road wear particle emission (TRWPE) although there is no clear statistics to establish the current quantity of TRWP emission. In this regard, we should be careful not to copy / paste any European legislation without considering India specific challenges. For example, India is still a major bias tyre market and there are a large number of loyal customers for this product. Instead of replacing bias tyre entirely by radial tyre, we should focus on specific interventions to make bias tyre bridge the gap with radial tyre.As far as TRWP is concerned, we will have to admit that Indian road surface as well as road terrain is totally different from Europe. So this subject need a much larger study. To begin with we need to establish a proper data base to understand and work on the problem. We are sure that we will soon find a solution for all the above problems.

How do you see FY2026?

FY26 is expected to be a growth year, supported by robust infrastructure spending and sustained vehicle demand. While global macro challenges remain, the Indian tyre industry’s fundamentals are strong. Digitisation, innovation and sustainability will be our key focus areas as we aim to position India as a global hub for quality tyre manufacturing.

Nexen Tire Bags Gold Rating From EcoVadis For 2nd Consecutive Year

- By TT News

- July 15, 2025

South Korean tyre major Nexen Tire has added another feather to its cap and has received a Gold rating from EcoVadis for the second year in succession. This places the company among the top 3 percent of over 150,000 companies assessed globally.

Established in 2007 in France, EcoVadis evaluates corporate sustainability performance across Environment, Labour & Human Rights, Ethics and Sustainable Procurement. Its ratings are Platinum (top 1 percent), Gold (top 5 percent), Silver (top 15 percent) and Bronze (top 35 percent).

Nexen Tire showed improvements across all assessment areas. In the Environment category, the company's involvement in global sustainability initiatives, including the Global Platform for Sustainable Natural Rubber (GPSNR), the UN Global Compact (UNGC) and the Science Based Targets initiative (SBTi) was noted. Climate education programmes and greenhouse gas emissions disclosure were contributors.

For Labour & Human Rights, Nexen Tire's human rights policy aligns with international standards from the United Nations and the International Labour Organization (ILO). The company also began human rights assessments for risk management.

In the Ethics pillar, the company reinforced internal systems for risk prevention, monitoring, and mitigation. The Sustainable Procurement score improved through ESG assessments, supplier audits and risk response strategies.

John Bosco (Hyeon Suk) Kim, CEO, Nexen Tire, said, “Receiving the Gold rating from EcoVadis for the second consecutive year is a significant affirmation of our global ESG efforts. We remain committed to responsible and transparent management practices that meet the expectations of our stakeholders worldwide.”

TÜV SÜD Appoints Ishan Palit As Interim CEO During Leadership Transition

- By TT News

- July 11, 2025

TÜV SÜD AG’s Supervisory Board has named Ishan Palit as Interim CEO (Chairman of the Board of Management) effective 15 July 2025, following Dr Johannes Bussmann’s departure to assume the CEO role at MTU Aero Engines AG. Bussmann will leave TÜV SÜD on 14 July 2025. Palit will co-lead the company with CFO Sabine Nitzsche until a permanent successor is appointed.

With over 30 years at TÜV SÜD, Palit has held key leadership roles, including establishing the company’s India operations, serving as Asia Pacific CEO and leading the global Product Service Division. Since 2017, he has been Chief Operating Officer, driving strategic and operational initiatives.

Nitzsche, who joined as CFO in March 2025, brings extensive financial and executive expertise from the high-tech and automotive sectors. Her prior roles include CFO of Vitesco Technologies AG and senior financial leadership positions at Infineon Technologies and GlobalFoundries.

Frank Hyldmar, Chairman of the Supervisory Board of TÜV SÜD AG, said, “We are very pleased that Ishan and Sabine will oversee the interim management of TÜV SÜD during this transition. Ishan is a seasoned TÜV SÜD senior executive with deep knowledge of our business and strong global leadership experience. Sabine brings a proven track record as CFO across multiple multinational enterprises. Together, they form a strong leadership team as we work towards appointing a long-term CEO.”

Hankook Tire Rejigs North American Sales And Marketing Team

- By TT News

- July 09, 2025

Hankook Tire & Technology has announced a series of executive leadership changes at its North American headquarters in Nashville, reinforcing its commitment to growth in passenger and commercial tyre markets. The restructuring brings fresh leadership across key sales and marketing functions.

Kyuwang (Ken) Cho assumes the role of Senior Vice President of North America Marketing, transitioning from his previous dual leadership of PC/LT Sales and Marketing. The industry veteran brings 25 years of Hankook experience, including a stint as Vice President of Global Sales in Korea. K C Jensen steps up as Vice President of US PC/LT Sales, expanding his responsibilities from regional to national oversight after demonstrating strong leadership in the Western market since 2018.

The company welcomes back Mark Roe as Vice President of US TBR Sales, where his four decades of commercial tyre expertise will guide replacement and OE sales strategies. Roe's extensive background includes previous leadership roles at Hankook and most recently at Ralson Tire North America.

Regional sales teams also see strategic promotions. Shaun Prott advances to Regional Director of PC/LT Sales for the West, building on his eight-year tenure with Hankook and prior experience with National Tire Warehouse. Travis Jones rejoins the organisation as Northeast Regional Director, bringing valuable perspective from Michelin and Pirelli. Brian Ford earns promotion to Regional Director of TBR Sales for the West after successfully managing key commercial accounts since 2021.

Rob Williams, President of Hankook Tire America Corp, said, "These leadership appointments reflect Hankook's strong momentum in North America. Ken, K.C. and Mark each bring exceptional industry experience, strategic focus and leadership qualities to their roles. Together, they will help elevate our presence across both consumer and commercial channels, and support our long-term growth ambitions in the US. These moves speak to the strength of our internal talent pipeline & ability to attract top talent and our continued investment in customer relationships. Shaun, Travis and Brian all bring deep knowledge of their markets and proven ability to grow key partnerships."

Michelin X Line Grip D Tyre Promises Range Of Upto 1 Million Miles & Upto 4 Retreads

- By TT News

- July 08, 2025

French tyre major Michelin has introduced its new X Line Grip D range, which is designed to work up to 1 million miles (1.6 million kilometres) with up to four retreads. The company shared its designers' claim that this is a ‘once-in-a-lifetime’ leap in tyre technology for fleets.

In addition to the higher range, the tyres also provide 20 percent more mileage and a 20 percent reduction in rolling resistance compared to the Michelin XDN2 tyre.

Designed to meet both wet and snowy conditions thanks to the chevron tread design, these tyres are said to prove 90 percent better starting traction in snow and over 25 percent better wet starting traction.

Fleets also benefit from using the Michelin X Line Grip D tyre, as it is built on the company’s Duracore casing, featuring Infinicoil and Powercoil technologies.

Pierluigi Cumo, VP – B2B Marketing, Michelin North America, said, “Michelin is never satisfied with current tyre technology when it comes to constantly improving and innovating our products. That’s why Michelin is so proud to introduce the Michelin X Line Grip D tyre. This tyre has the potential going forward to redefine the drive tyre standard in fleets for years to come. It is not an evolution to existing products, but something entirely different the fleet world has never seen before.”

“Michelin has a proven track record of delivering high-quality, reliable products that exceed performance expectations. This fantastic leap in drive tyre technology bring new levels of performance to the road and new levels of savings to our customers,” he concluded.

The Michelin X Line Grip D tyre is available in sizes 295/75R22.5 and 11R22.5.

Comments (0)

ADD COMMENT