Nordic Market Will Fare Well For Premium Tyres: Citira

- By Gaurav Nandi

- August 21, 2025

Scandinavian tyre service provider Citira sees robust potential for premium tyres in the Nordic region, driven by seasonal demands and safety priorities. CEO David Boman highlights that premium tyres including Pirelli’s offerings hold a significant share in passenger car, light truck and truck tyre segments supported by harsh winter conditions that emphasise performance and reliability. Despite a slight recent decline amid broader economic pressures and rising price sensitivity, premium brands remain relevant. Citira’s new long-term partnership with Pirelli and acquisition of Dackia AB aims to consolidate and optimise premium tyre distribution across Sweden.

Scandinavian tyre service company Citira recently told Tyre Trends that Nordic countries have excellent potential for premium tyres during a discussion over its partnership with Italian tyre major Pirelli.

Speaking on the market potential, Chief Executive Officer David Boman said, “When it comes to the Nordic markets, Scandinavia in particular has a relatively high share of premium tyres across categories including passenger car, light truck and TBR segments. Compared to other global regions, the demand for premium tyres here is notably strong.

“One of the main reasons for this is the seasonal nature of our market. Winter tyres, in particular, drive a more premium-oriented approach because of the need for high performance and safety under harsh conditions. While we’ve observed a slight decline in the premium tyre share over the past few years, it still holds a significant portion of the market. This demand is closely tied to seasonal safety concerns, especially in winter, autumn and early spring. Drivers here prioritise safety and reliability, which naturally supports the continued relevance of premium brands like Pirelli.”

“One of the main reasons for this is the seasonal nature of our market. Winter tyres, in particular, drive a more premium-oriented approach because of the need for high performance and safety under harsh conditions. While we’ve observed a slight decline in the premium tyre share over the past few years, it still holds a significant portion of the market. This demand is closely tied to seasonal safety concerns, especially in winter, autumn and early spring. Drivers here prioritise safety and reliability, which naturally supports the continued relevance of premium brands like Pirelli.”

He noted that the decline is likely tied to broader financial challenges in the market, especially following the Covid period. Both consumers and companies have become more price-sensitive, making cost a bigger factor in purchase decisions.

As a result, there’s been a gradual increase in demand for lower-cost, imported non-European tyre brands, while the market share of European premium tyre brands has slightly decreased.

Pirelli and Citira have entered a long-term strategic partnership aimed at enhancing their market presence in Sweden. As part of the deal, Citira will acquire Dackia AB that has a network of 102 retail outlets from Pirelli.

In return, Pirelli and Dackia have signed a supply agreement extending to 2030, ensuring Pirelli remains the main tyre supplier. The transaction, pending regulatory approval, is expected to close by 2025. The partnership will boost Pirelli’s distribution and market coverage while supporting Citira’s goal of expanding a sustainable, flexible and high-quality customer service network.

THE PACT

Citira currently runs over 50 tyre shops and over five retreading units across Scandinavia and Poland. “Citira is actively working towards creating a more efficient and consolidated tyre market. While our current focus is primarily on the Scandinavian region, it’s not out of the question that we may consider expanding beyond this geographic perimeter in the future. This agreement is part of a broader industry trend where partnerships and acquisitions are used to enhance efficiency, strengthen distribution networks and provide end customers with better service coverage,” revealed Boman.

Nonetheless, the deal specifically pertains to the Swedish market, and as part of the regulatory process, Citira has conducted a market analysis to understand the potential implications on market share. However, the specifics of that study were said to be confidential and could not be disclosed prior to the official closing of the deal.

Explaining how this partnership will influence the supply chain of premium tyre in the Nordics, Boman said, “We do anticipate some changes, particularly within Citira. We operate a number of logistics centres, and this partnership presents an opportunity to optimise our overall supply chain setup. Enhancing logistics will be a key enabler of better service and responsiveness in premium tyre distribution.”

He added, “This particular deal is unlikely to have a direct or immediate impact on independent retailers or smaller distributors. More broadly, the Scandinavian tyre retail sector is undergoing consolidation. Several players are actively reshaping the competitive landscape and that trend could gradually influence the positioning of independents. But again, this specific acquisition is not a disruptive event in that context.”

He added, “This particular deal is unlikely to have a direct or immediate impact on independent retailers or smaller distributors. More broadly, the Scandinavian tyre retail sector is undergoing consolidation. Several players are actively reshaping the competitive landscape and that trend could gradually influence the positioning of independents. But again, this specific acquisition is not a disruptive event in that context.”

Alluding to the current demand for replacement tyres, he said, “In general, the tyre market has proven to be quite non-cyclical. Even in challenging economic conditions, it tends to remain stable. That said, I believe we’re entering a phase where circularity and life-extension solutions will gain more momentum. We’re likely to see increased focus on services that extend tyre life, especially for larger fleets. This shift won’t just be driven by cost or fleet uptime concerns but increasingly by environmental responsibilities.”

THE BUSINESS

According to Boman, Pirelli represents a very minimal share of Citira’s overall sales, currently. However, the strategic partnership mainly revolves around Dackia and Pirelli, and the former is intended to become part of the Citira Group. “Moving forward, there is definitely an opportunity to deepen the collaboration with Pirelli and potentially grow their share within our overall brand mix,” added Boman.

Citira currently follows a multi-brand strategy and will continue with it even after closing of the deal. Besides, it is also involved in process and sales of retreaded TBR tyres and wheel rims.

“We operate a facility in Poland where we refurbish truck and bus rims. The process involves media blasting and repainting the rims to restore its appearance and functionality. The logic behind it is quite similar to retreading. In most cases, the structural integrity of the rim is still intact; it’s just the surface or aesthetics that degrade over time. By restoring these rims, we’re able to extend the life and reduce waste,” said Boman.

The company operates five retreading facilities collectively, located in Finland, Sweden and Poland. It uses both hot-cure and cold-cure retreading methods. Hot-cure is used in Poland and cold retreading in Finland and Sweden. Annually, it retreads around 160,000 tyres, averaging about 13,000 per month. While its current focus is on retreading, Citira is actively exploring expansion into tyre recycling as part of a broader push towards sustainability and circularity.

The company also manages tyre distribution for fleets across countries. Its circular tyre distribution approach involves not only delivering new tyres to customers but also collecting used tyre casings from them. These casings are then sent back to its retreading facilities, creating a closed-loop system. Besides, Citira has different suppliers across Europe for sourcing tyres for retreading.

MARKET WATCH

Citira sees a strong willingness in the market for consolidation and it has already engaged in several partnerships. Commenting on market challenges, Boman said, “One key challenge is the need for a player capable of driving consolidation at a larger scale. In the Scandinavian markets, this kind of brand-independent consolidation hasn’t really taken place over the last 10 to 15 years. Previously, consolidation efforts were primarily led by tyre manufacturers or affiliate networks players. However, consolidation has largely been on hold recently, leaving space for an independent actor to step in. We see that opportunity clearly and believe it is well received both by other market participants and customers. The challenge lies in successfully executing this consolidation while maintaining trust and delivering value across a diverse market.”

Commenting on the demand for retreading, he said, “The Scandinavian market has a long tradition of retreading heavy vehicle tyres. Currently, there is a growing shift towards pay-per-kilometre or tyre-as-a-service models, especially among large fleets like bus companies and hauliers. Notably, public tenders increasingly require a certain share of retreaded tyres, reflecting a strong environmental focus. Retreading extends the life of a tyre by reusing about 70 percent of its original material, making it a significant sustainability tool. The market share of retreaded tyres is gradually increasing with expectations that the retread market will grow faster than the new tyre market in the coming years.”

Commenting on the demand for retreading, he said, “The Scandinavian market has a long tradition of retreading heavy vehicle tyres. Currently, there is a growing shift towards pay-per-kilometre or tyre-as-a-service models, especially among large fleets like bus companies and hauliers. Notably, public tenders increasingly require a certain share of retreaded tyres, reflecting a strong environmental focus. Retreading extends the life of a tyre by reusing about 70 percent of its original material, making it a significant sustainability tool. The market share of retreaded tyres is gradually increasing with expectations that the retread market will grow faster than the new tyre market in the coming years.”

“The main challenges for the retreading industry lie in overcoming the longstanding perception that retreaded tyres are merely a low-cost option rather than an environmentally friendly and sustainable product. This is mostly prevalent is Scandinavia and it is crucial to shift this mindset by educating customers and the broader market about the true benefits of retreading. Moving away from a purely price-driven sales approach to one that highlights quality, durability and positive environmental impact remains a significant hurdle for the industry,” he added.

Bekaert Acquires Steel Cord Business From Bridgestone In China And Thailand

- By TT News

- January 28, 2026

In a strategic expansion of its global footprint, Bekaert has agreed to acquire Bridgestone’s tyre reinforcement operations in China and Thailand, encompassing the tyre cord production facilities in China (Bridgestone (Shenyang) Steel Cord Co., Ltd) and Thailand (Bridgestone Metalpha (Thailand) Co. Ltd.). This move significantly strengthens the market leadership of Bekaert’s Rubber Reinforcement division, its largest business unit, which has led the global tyre cord sector for decades. The acquisition, set for completion in the first half of 2026 pending regulatory approvals, is a continuation of the division's proven strategy in integrating the captive production of major global accounts.

This transaction reinforces the enduring strategic partnership between Bekaert and Bridgestone, a leading tyre manufacturer. As part of Bridgestone's mid-to-long term plan to boost competitiveness through collaboration, the deal includes a long-term supply agreement ensuring continued provision of high-quality tyre reinforcement. For Bekaert, the integration of these two established production facilities enhances its manufacturing presence and solidifies its position in the tyre cord market.

Financially, the acquisition is projected to contribute approximately EUR 80 million in annual consolidated sales for Bekaert. The purchase involves a cash consideration of EUR 60 million, which will be drawn from the company's existing cash reserves. By securing these key assets and a lasting supply partnership, Bekaert not only expands its operational scale but also deepens its trusted supplier relationship with a pivotal global account.

Yves Kerstens, CEO, Bekaert, said, “Bekaert and Bridgestone share a longstanding strategic partnership built on mutual trust and collaboration. When the transaction closes, we are delighted to welcome the plant teams to Bekaert and remain committed to joint growth and innovation with Bridgestone. The acquisition is also a clear signal of strengthening our global leadership position in the tyre reinforcement industry.”

Yokohama Rubber Secures Certificate Of Rubber Fender Test Environment

- By TT News

- January 28, 2026

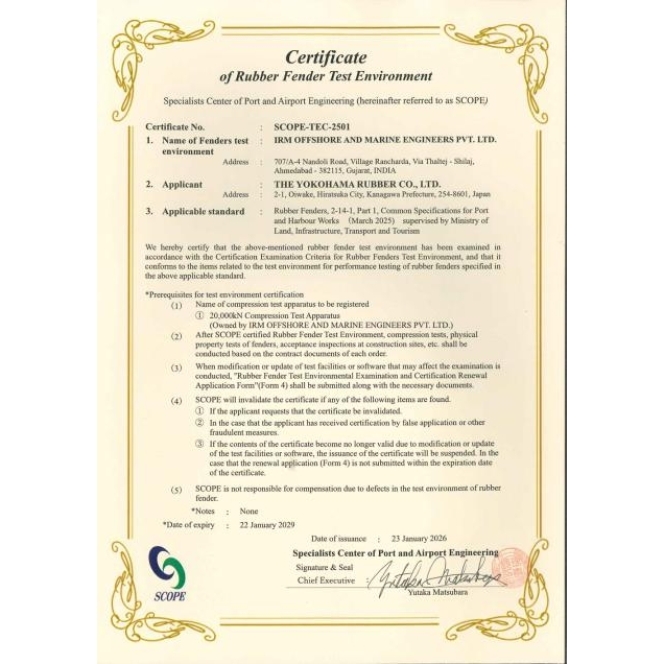

The Yokohama Rubber Co., Ltd. has successfully secured a Certificate of Rubber Fender Test Environment from Japan’s Specialists Center of Port and Airport Engineering (SCOPE), awarded on 23 January 2026. This certification follows a thorough assessment under SCOPE’s Rubber Fender Testing Environment Certification Program, which validates that the company’s testing facilities for marine rubber fenders operate with integrity and reliability. Specifically, the certification confirms that Yokohama Rubber employs a robust system designed to prevent data fraud, ensuring the trustworthiness of all test results for fenders it manufactures and sells.

These fenders serve as critical safety components, acting as cushioning buffers to protect vessel hulls from impact during harbour mooring and ship-to-ship transfers at sea. To promote safer and more secure maritime operations, SCOPE launched its certification initiative in April 2023, focusing on verifying the reliability of fender testing environments. The programme is aligned with technical guidelines from the World Association for Waterborne Transport Infrastructure (PIANC) and evaluates compliance across multiple SCOPE-defined criteria. These include adherence to static compression testing standards, the elimination of opportunities for data falsification, the integrity of statistical values in test data and the establishment of corporate systems that prevent tampering.

Yokohama Rubber’s expertise in this field dates to 1958, when it pioneered the world’s first pneumatic fender for offshore vessel berthing. Recently, the company has broadened its portfolio beyond high-performance pneumatic fenders to include solid fenders, which represent a principal segment of the fender market. This strategic expansion establishes Yokohama Rubber as a comprehensive fender manufacturer and reinforces its revenue foundation.

The achievement aligns with the company’s ongoing medium-term management plan, Yokohama Transformation 2026 (YX2026), which spans fiscal years 2024 to 2026. A key element of this strategy involves driving growth in the MB Segment by focusing resources on core domains such as hose and couplings along with industrial products. Within this framework, Yokohama Rubber aims to strengthen its product lineup and sustain strong market shares for marine products, including fenders, to secure steady profit growth in the industrial products business.

Bridgestone India Taps Punjabi Star Parmish Verma For Regional Growth Push

- By TT News

- January 27, 2026

In a strategic move to strengthen its connection with vital regional audiences, Bridgestone India has partnered with multifaceted Punjabi star Parmish Verma. This collaboration is designed to resonate deeply in North India, a crucial and rapidly expanding market fuelled by increasing vehicle ownership and a youthful demographic. Verma, a prominent cultural figure and known automobile enthusiast, aligns naturally with the brand’s emphasis on safety, reliability and performance. His authentic passion for vehicles and responsible driving complements Bridgestone’s identity as a leading mobility solutions provider.

Central to this alliance is the co-creation of engaging, music-led narratives and digital content for Bridgestone’s campaigns, leveraging Verma’s artistic talents and significant social influence. This approach recognises the powerful role of popular culture in shaping brand preferences within the region. The partnership also advances the company’s broader regional engagement goals, aiming to build deeper trust with consumers nationwide. Furthermore, it embodies the ‘Emotion’ principle of Bridgestone’s corporate commitment, which seeks to inspire excitement and deliver joy through mobility. By uniting with a figure of Verma’s reach and genuine interest, Bridgestone India fosters a more dynamic and culturally relevant dialogue with its audience.

Rajiv Sharma, Executive Director – Sales & Marketing, Bridgestone India, said, “North India is a strategically important market for us. Parmish Verma’s credibility and deep connection with audiences make him an ideal partner to represent Bridgestone. This collaboration enables us to engage meaningfully with young consumers who seek fresh, inspiring and relatable brand experiences.”

Verma said, “Bridgestone is a brand people trust for safety and performance. I’m proud to be associated with an organisation that values quality and puts customers first. I look forward to connecting with audiences in a new and meaningful way through this partnership.”

Bridgestone Americas Appoints Michele Herlein As New Chief People Officer

- By TT News

- January 24, 2026

Bridgestone Americas has appointed Michele Herlein as its new Chief People Officer. In this role, she will oversee all human resources operations across the Americas, Europe, Middle East and Africa. Her primary focus will be advancing the company's Culture 2.0 initiative, which aims to enhance teammate empowerment, collaboration and accountability.

Herlein rejoins Bridgestone with over two decades of executive leadership expertise. Her background includes previous positions within Bridgestone Americas and Bandag, Inc., centred on culture, leadership development and succession planning. Most recently, she was the Founder and CEO of CultureMax and previously served as the Chief Administrative and Human Resource Officer at Barge Design Solutions. She is also a published authority on creating high-performance organisational cultures. Beyond her corporate work, Herlein is a co-founder of Impact100 Nashville, a philanthropic women’s collective that has awarded more than USD 1.2 million in grants to area nonprofits.

Scott Damon, Bridgestone West CEO and Group President of Bridgestone Americas, said, “I am excited to welcome her back to Bridgestone, recognising the perspective and presence she will add to our West leadership team, the HR function and the broader organisation.”

Comments (0)

ADD COMMENT