A proposed bill in Brazil’s Chamber of Deputies has ignited fierce opposition from the country’s tyre retreading sector, which sees the legislation as an ill-conceived and uninformed attack on an industry that plays a crucial role in the economy and sustainability efforts. The bill seeks to ban the use of retread tyres on buses and trucks operating on state and federal highways, a move that the industry argues is both impractical and detrimental.

Brazil is the world’s second-largest retread market, following only the United States. This achievement has been attributed to the reliability and quality of work carried out by retreaders, which has earned the market’s trust.

In September 2024, a draft bill was introduced in Brazil’s Chamber of Deputies to exercise a ban on the use of retread tyres in buses and trucks operating on state and federal highways. The Brazilian Association of Tyre Retreading (ABR) lashed out at the proposed draft, labelling it as ‘misguided and uninformed’.

Subsequently, ABR President and Federal Senator of Mato Grosso, Margareth Buzetti, told Tyre Trends, “The proposed bill focuses on retread tyres rather than broader factors such as overloading, poor road conditions or inadequate maintenance practices due to sheer misinformation on the part of the person who proposed the project. It is a simplistic and populist proposal that promises to increase road safety by fighting the wrong enemy. Tyres retreaded in Brazil undergo extremely rigorous inspections to ensure that they reach the transport companies safely and reliably.”

“We, as retreaders, meet Inmetro standards that define the technical requirements for tyre retreading, following the standards of excellence practiced in other countries. We are talking about large companies that have strict quality standards. We are in no way inferior to new tyres in terms of safety,” she added.

According to Buzetti, no reputable company would compromise on tyre safety as doing so could lead to financial losses from accidents and endanger lives. She also pointed out that the sector’s ability to generate approximately 300,000 direct and indirect jobs is a testament to the high quality of retreaded products.

Commenting on how the proposed bill might influence public perception about the sustainable practice, she noted, “The way it was proposed is terrible because it gives people the impression that retread tyres in Brazil are of poor quality and are responsible for road accidents. This is absurd misinformation. However, I do not see this issue as something that concerns the general population. Transport companies, which are the largest users of retread tyres, are aware of the reality.”

“Entities linked to both the reform and transportation sectors sent dozens of letters to the Chamber of Deputies against the proposed bill. We will continue this pressure in 2025,” she added.

The association plans to seek out the rapporteur and the author of the bill so that they understand the seriousness of the work carried out by the sector. “The right thing to do would be for the congressman to withdraw the bill he presented and file another one that focuses on combating illegally-made reforms or the poor-quality tyres that are imported from Asia without any control whatsoever. Then they will have our support. Otherwise, we will seek out partner congressmen to wage a real battle within the Chamber against the advancement of this absurd proposal,” contended Buzetti.

IMPLICATIONS OF THE BILL

Buzetti noted that if the proposed bill was implemented, then the implications would be ‘catastrophic’. “If the bill were to become law, the long-term impact on Brazil’s tyre industry would be devastating. Companies are already struggling with the rising cost of raw materials due to increase in the Dollar-Brazilian Real exchange rates. Banning tyre retreading would further cripple the sector, leading to significant financial and operational challenges,” she said.

Currently, tyre retreading saves Brazil BRL 7 billion in transportation costs. If the proposed bill becomes law, which the ABR believes is unlikely and will actively oppose, it would effectively force transportation companies to buy only new tyres overnight, causing a massive rise in costs.

Alluding to the potential impact of this legislation on Brazil’s carbon neutrality and sustainability goals, Buzetti emphasised, “The sector was recently recognised by the Ministry of the Environment as an important asset in the circular economy. This was a milestone that we achieved at great cost, and the government is finally beginning to see our importance for environmental sustainability. I believe that 2025 will be the year in which we will be able to make even more progress on this issue. We cannot ignore the importance for the environment of a sector that retreads 14 million tyres per year.”

While the association can furnish data demonstrating the safety and reliability of Inmerto-certified retread tyres to battle the proposed bill, Buzetti, attacking the project makers, said, “Can the deputy who created the project present data that guarantees that the lack of safety on the roads is caused by retread tyres?”

Commenting on the bill’s impact on small and micro enterprises if implemented, Buzetti said, “Tyre retreading supports 300,000 jobs in Brazil today. It is a well-established market. Banning retreading would be like taking food off the table for thousands of Brazilians who rely on this sector.”

ALTERNATIVE ROUTE

According to Buzetti, the legislative year ended with this bill being presented to the Chamber of Deputies’ Transport and Roads Committee and it did not receive any amendments within the statutory deadline. Now, in February, discussions on the proposal can begin and she highly doubts that it will move forward. As a senator, she will not participate in the votes in the Chamber but will personally go to the committee to talk to all the deputies to demonstrate the quality of tyre retreading in Brazil.

Speaking on the steps that the government should take to address any lingering safety concerns and prevent future proposals like this, in case the bill was withdrawn, Buzetti said, “Inspection of poor-quality tyres entering the country and incentives for tyre retreaders to continue operating within the law is a necessary step. I presented a bill that is currently pending in the Chamber of Deputies that provides tax exemption for tyre retreading companies, as a way of attracting them to formality.”

She also noted, “Instead of banning retread tyres, we could have greater oversight of imported tyres that enter Brazil illegally. We are talking about tyres that are so bad that they don’t even need to be refurbished. These should be a priority for parliamentarians. And, of course, improving road conditions and oversight of the rules that must be followed by transport companies (such as not exceeding the maximum load) are also important steps to increase road safety.”

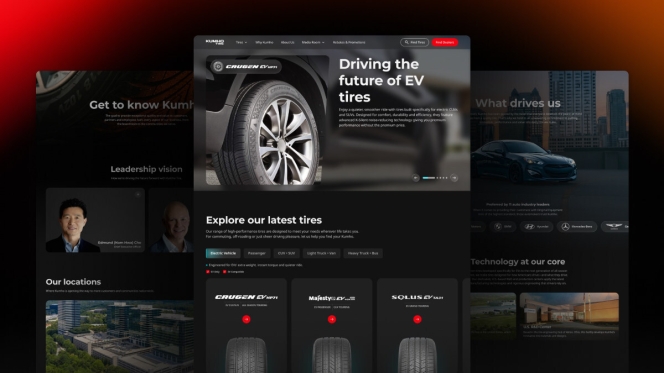

Kumho Tire USA Unveils Consumer-Centric Website Redesign To Elevate Digital Experience

- By TT News

- March 07, 2026

Kumho Tire USA has unveiled a completely overhauled consumer website, marking a pivotal step in its journey to establish itself as a premier alternative in the tyre industry. The redesign is a strategic move to modernise the company’s digital storefront, ensuring it accurately mirrors the brand's forward-thinking vision and evolving market identity.

Central to this transformation was the goal of creating a more intuitive and brand-enhancing user experience. The site’s architecture has been meticulously reorganised to guide visitors seamlessly through Kumho’s product lineup and corporate philosophy. By unifying the visual design, tone and messaging, the new platform projects a cohesive brand story designed to build confidence and instil a sense of pride among customers and partners alike.

More than just a catalogue of products, the updated site functions as a dynamic conduit between the company and its audience. It underscores Kumho’s commitment to delivering exceptional value through an innovation-led approach. This digital ecosystem now actively demonstrates how the manufacturer translates technological advancement into tangible benefits, reinforcing its dedication to exceeding expectations at every point of engagement.

Ed Cho, CEO, Kumho Tire USA, said, "The newly redesigned website marks a significant step in Kumho Tire's journey to solidify its position as a premium brand alternative. The enhanced digital platform showcases KUMHO's commitment to delivering high-quality products at a reasonable price to discerning customers who demand value. Our continued efforts to implement innovative technologies and build a brand that consumers can trust enable our ability to pioneer new segments of the global market."

- Michelin

- Michelin Primacy 5 Energy

- Michelin Lunar Airless Wheel

- BioButterfly Programme

- 2026 Tire Technology Expo

- Tire Technology International Awards

Michelin Sweeps Four Major Awards At 2026 Tire Technology Expo

- By TT News

- March 06, 2026

Michelin has achieved notable recognition at the 2026 Tire Technology Expo in Hannover, Germany, securing four major awards that underscore its leadership in innovation, sustainability and technical expertise. The accolades span breakthrough research, product excellence, environmental advancement and individual career achievement, reflecting the company’s comprehensive approach to advancing mobility both on Earth and in space.

The prestigious Concept of the Year award was presented to the Michelin Lunar Airless Wheel, or MiLAW, developed for NASA’s upcoming Artemis lunar missions. This wheel represents over two decades of research into airless tire architecture, cutting-edge polymers and additive manufacturing techniques such as 3D printing. Engineered to endure the moon’s extreme environment, it must withstand abrasive terrain, intense radiation and temperatures ranging from minus 240 to plus 100 degrees Celsius while ensuring reliable traction and durability. The project demanded advanced digital simulation and rigorous testing, and the resulting innovations are already influencing Michelin’s terrestrial developments, particularly in applications where robustness under challenging conditions is essential.

The MICHELIN Primacy 5 Energy tyre earned the Tire of the Year award. This summer tyre has achieved a triple-A rating on the European Union label for wet grip, energy efficiency and noise while also being recognised as the most durable tyre in its category. It has been selected by approximately 20 major global automakers for integration into more than 50 upcoming vehicle models, well ahead of its commercial launch. Designed to meet heightened expectations for safety, electric vehicle compatibility, emissions reduction and sustainable materials, the tyre exemplifies Michelin’s response to evolving market demands.

The BioButterfly programme, a collaborative effort involving Michelin, IFP Energies Nouvelles and Axens, with backing from the French Agency for the Environment and Energy Management, received the Environmental Achievement of the Year – Industrial Contribution award. Following over 12 years of research and an investment exceeding EUR 80 million, an industrial demonstrator at Michelin’s Bassen site successfully proved a method for producing bio-based butadiene from bioethanol. The resulting elastomers meet tyre industry specifications while offering a significantly reduced carbon footprint compared to fossil-fuel-derived alternatives. This breakthrough marks a major step towards establishing a sustainable supply chain for bio-based materials in tyre manufacturing.

Pascal Prost, a Senior Fellow at Michelin, was honoured with the Tire Tech 2026 Lifetime Achievement Award for his 35-year career dedicated to advancing tyre technology. His work has consistently addressed complex and often conflicting performance requirements, particularly in the areas of low rolling resistance and eco-design for passenger and two-wheel vehicle tyres. Beyond his technical contributions, Prost has fostered collaboration across internal teams, academic institutions and automotive partners. His recognition highlights not only his personal dedication but also the collective expertise and innovative spirit present throughout the Michelin organisation.

Together, these four honours illustrate the breadth of Michelin’s capabilities, from fundamental research and product engineering to environmental stewardship and long-term talent development. They affirm the company’s commitment to creating safer, more efficient and sustainable mobility solutions for a wide range of environments.

Philippe Jacquin, Executive Vice President – Research & Development for Michelin and member of the Group Executive Committee, said, “Receiving four awards at Tire Technology Expo is testament to the collective strength of our teams and to the scientific, technological and environmental depth of our innovations. From the Moon to the road, and thanks to Michelin’s deep know‑how in polymer composites, we once again demonstrate our ability to push boundaries, create new experiences, transform research into real‑world solutions and accelerate the emergence of next‑generation materials. These awards honour not only our advances but also the daily commitment of everyone at Michelin who innovates to improve everyday life and drive mobility forward – for people today and for future generations.”

Kama Tyres Treads Cautious Global Expansion Amid Geopolitical Realignment

- By Nilesh Wadhwa

- March 06, 2026

As geopolitical tensions continue to reshape global trade routes and supply chains, tyre manufacturers are being forced to rethink not only where they sell, but how they grow. For KAMA Tyres – Russia’s largest and most diversified tyre manufacturer – this reassessment has become a defining element of its international strategy.

Rather than pulling back amid sanctions and market disruption, the company is steadily opening new doors, with the Middle East emerging as its next strategic frontier.

In an exclusive interaction with Tyre Trends, Shaydullin Ildar, Deputy Director – Marketing, KAMA Tyres, spoke about how the company is looking beyond its domestic market and recalibrating its global ambitions.

“We have rich experience of cooperation with machine producers across the world. This cooperation allows us to produce tyres exactly for certain machines – tyres that are suitable for specific clients,” Ildar said.

That customer-focused manufacturing capability, coupled with a broad and diversified product portfolio, is now underpinning KAMA Tyres’ cautious yet determined push into new international markets.

FROM 50 MARKETS TO 20: A STRATEGIC RESET

Until recently, KAMA Tyres had an expansive global footprint. “Earlier, we exported our tyres to more than 50 countries,” Ildar noted. Today, that number has come down significantly – not due to waning ambition, but because of shifting geopolitical realities.

“Now, because of the situation in the global market, we are exporting our tyres to around 20 countries,” he explained.

Despite the contraction, the company has retained a presence across a geographically diverse mix of regions. “For example, Egypt, Brazil, Turkey, Mongolia, Vietnam. Russia has good relations with Vietnam, so this is one of our key markets,” Ildar said.

Despite the contraction, the company has retained a presence across a geographically diverse mix of regions. “For example, Egypt, Brazil, Turkey, Mongolia, Vietnam. Russia has good relations with Vietnam, so this is one of our key markets,” Ildar said.

This pragmatic reassessment mirrors a broader trend across Russian manufacturing – prioritising markets where political alignment, trade frameworks and logistics remain workable.

“At the same time, we are trying to open new markets. Right now, we are opening for ourselves the Gulf countries,” he added.

This shift also explains KAMA Tyres’ growing presence at regional trade exhibitions. “That is why we are here at this exhibition,” Ildar said, referring to Automechanika Dubai 2025. “This is the first time we are participating here.”

For KAMA Tyres, the Middle East represents a significant opportunity – but one that requires patience. “Yes, for us it is a really big opportunity. We are trying to open it step by step,” he said.

MIDDLE EAST ENTRY: OPPORTUNITY WITH A COMPLIANCE HURDLE

While the Middle East offers scale and strategic relevance, entry into the region is far from straightforward. Regulatory compliance remains the biggest challenge.

“We haven’t started selling our tyres here yet. At the moment, we are preparing,” Ildar clarified.

That preparation, he explained, is extensive. “We are doing all the necessary procedures to start selling our tyres. This includes connecting with potential clients and preparing documents and certification for this market.”

Certification is, by far, the most demanding hurdle. “The main opportunity for us is opening a new market, new clients and new sales. The big challenge is that this market needs different certification,” he said.

Still, the company remains resolute. “We are doing it and we will do it anyway,” Ildar said firmly.

KAMA has already begun building visibility in the region through trade events. “In May, we participated in an exhibition in Riyadh – I think it was Automechanika Riyadh,” he recalled.

The timeline for commercial entry is now clearly defined. “In 2026, we are planning to start selling our tyres here,” he confirmed, with the first quarter of calendar year 2026 emerging as the tentative target.

ONE COMPLEX, EVERY TYRE SEGMENT

One of KAMA Tyres’ key competitive strengths lies in the breadth of its manufacturing capability. Unlike many tyre manufacturers that specialise in one or two segments, KAMA operates as a fully integrated tyre complex.

“We are the only tyre complex in Russia that produces all groups of tyres,” Ildar explained.

The portfolio spans passenger car tyres (PCR), light truck tyres, truck and bus radials (TBR) and off-the-road (OTR) tyres. “We are ready to offer different kinds of tyres. And potential customers are asking us for different groups,” he said.

This versatility gives KAMA considerable flexibility as it enters new markets such as the Gulf, where demand spans multiple vehicle categories. “We can offer both TBR tyres and PCR tyres,” Ildar noted, adding that OTR tyres are also part of the company’s global offering.

Rather than rushing to push specific products, the approach is deliberately measured. “We want to understand the market first. And then offer what is needed,” he said.

This mindset reflects KAMA’s longstanding experience of working closely with OEMs and equipment manufacturers. “Our cooperation with machine producers allows us to make tyres exactly suitable for the machines,” Ildar reiterated.

SANCTIONS, SUPPLY CHAINS AND PREPAREDNESS

Sanctions have been a defining force shaping Russian industry over the past decade. For KAMA Tyres, however, preparedness has significantly softened the impact.

“About sanctions – we are prepared for this situation from 2014,” Ildar said.

This long-term approach has been especially critical in securing raw material supplies, an area where many global tyre manufacturers continue to face volatility.

“At the moment, we don’t have problems with supplying raw materials. We have producers of raw materials in the Russian market and in the Asian market too,” he explained.

By diversifying its sourcing base early, KAMA has ensured continuity even during periods of global disruption. “We are searching for different ways to be ready for any problems in the future,” he said.

As a result, the company has largely avoided the supply crunch faced by several global peers. “So now we have suppliers of raw materials and we don’t have a problem with it,” Ildar added.

In an industry increasingly shaped by geopolitical uncertainty, this resilience has become a competitive advantage.

INDIA ON THE HORIZON, BUT NO SHORTCUTS

Given the historically strong ties between India and Russia, the Indian market naturally features in discussions around KAMA Tyres’ longer-term expansion plans. However, Ildar is careful to manage expectations.

“We are moving step by step, starting with the Persian Gulf. If everything goes well, we will look at the Indian market,” he said.

The key constraint, he explained, is production capacity. “It depends on one thing – we have to sell Russian products. If we have free resources, we are ready to look at the Indian market.”

He is also realistic about the competitive intensity in India. “We understand that there are a lot of good products and strong competition in the Indian market,” Ildar noted.

Certification remains another important consideration. “At the moment, we do not export tyres to India because the Indian market needs BIS certification,” he confirmed.

Still, the door remains open. “If in the future we find potential clients who are interested in our products after studying the market, we will be glad to apply for this certification. We will be glad to open the Indian market too.”

For now, execution takes precedence over expansion promises. “Our strategy is to work step by step,” Ildar reiterated.

Giti Tire Unveils Next-Generation GitiSportS2+ Following AutoBild Test Success

- By TT News

- March 05, 2026

Giti Tire has launched its new ultra-high-performance GitiSportS2+ tyre, following an outstanding result in the AutoBild 2026 Summer Tyre Test, where it received one of the most prestigious independent endorsements in Europe. Rated as exemplary by the leading German publication, the tyre secured fourth place overall out of an initial field of 50 competitors. The evaluation praised its exceptional value for money, impressive driving dynamics and substantial safety margins.

Tested on a BMW 5 Series using the 245/45R19 size, the tyre initially shared fourth position based on wet and dry braking performance, recording a total stopping distance of 42.5 metres. It maintained this high standard across 12 additional assessments, ultimately ranking among the top five alongside several premium manufacturers. The new model is scheduled to be available from spring 2026, launching in 19 sizes covering rim diameters from 17 to 20 inches, widths between 225 and 255 and aspect ratios from 35 to 55.

Designed for sporty cars and powerful SUVs, the GitiSportS2+ features a newly engineered compound that reduces wet braking distances by eight percent and dry braking by two percent compared to its predecessor. It also achieves the highest possible EU Wet Grip label rating of ‘A’. In line with the manufacturer’s broader strategy, the tyre bears the AdvanZtech EV Ready sidewall marking, indicating its compatibility with internal combustion engines, mild hybrids, plug-in hybrids and battery electric vehicles.

During the initial rollout, many existing sizes of the original GitiSportS2 will remain on the market, ensuring continued coverage across the sport vehicle segment. Development took place at Giti’s European R&D Centre in Hannover, with testing and fine-tuning conducted at tracks in UK and Spain. The project leveraged the company’s AdvanZtech technology, a globally integrated research and development system.

Fabio Pecci-Boriani, Deputy General Manager – Product Planning PCR and LTR, Giti Tire R&D Centre (Europe), said, “The new GitiSportS2+ is testimony of the achievements that our engineers, testers and manufacturing facilities have been able to deliver in the area of performance while retaining the sustainability, endurance and mileage criteria that are important to the daily driver. To launch a tyre off the back of an ‘exemplary’ rating in AutoBild is nothing short of sensational; we are thrilled that one of the leading automobile titles in Europe has been able to validate and confirm our latest development and we are excited to share this news with our trusted customers.

“The target criteria for the GitiSportS2+ was to deliver further improvements in dynamic driving, enhanced control on wet roads with precise and exciting control on dry roads, all while maintaining the mileage and energy efficiency of the previous generation. Sportiveness is at the heart of the tyre with a particularly stiff design that contributes to stability at high speeds as well as in cornering. The increased grip performance goes is more precise, firm, predictable and constant.”

Comments (0)

ADD COMMENT