Elastomer Tackifiers

- By Dr. Samir Majumdar

- October 19, 2020

Elastomer tackifiers are those that produce green tack in elastomers. The term “tack” refers to the ability of two uncured rubber materials to resist separation after bringing them into contact for a short time under relatively high pressure. Building tack of rubber components is an important pre-requisite to enable tyre building on the tyre building drum where different rubber layers are put together on the tyre building drum before they are cured. Another important property of tackifier is, it should retain its tack on storage. A good tackifier, therefore, should have the following properties :

- Very high initial and extreme long-term tackiness

- No adverse effect on the rubber compound cure on scorch

- No interference on (a) rubber to metal bonding (b) rubber to fabric bonding

- Physical properties of the cured rubber remain unchanged

- No effect on the performance of aged rubber compound properties

- Improves rubber compound process reliability

- Show extreme good performance in silica / s-SBR based rubber compound.

In general, NR has enough tack because of the presence of a very high quantity of low molecular weight fraction, having its wide molecular weight distribution. Its low molecular weight fraction also generates during its break down in machines. On the contrary, synthetic rubber lack in tack property because of the absence of enough low molecular weight fraction in them, having narrow molecular weight distribute on (Fig.1). Synthetic rubber also resists in the molecular break down upon mastication and therefore, cannot produce low molecular weight fraction. Resins are typically produced with molecular weights (Mw) between 1,000 and 2,000 with maximum Mw around 3000. The molecular weight is important since tackifying resins work at the surface of the rubber compound and must be able to migrate to the surface to be effective. If the molecular weight is too low, the resin will remain soluble in the elastomer and not migrate its way to the surface. If the molecular weight is too high, the elastomer will be insoluble in the elastomer. Rubber industries use both synthetic and natural resins for tack. Following three types are in major use in the industry :

- Aromatic Resins (Phenolic, Cumaron Indane)

- Petroleum based resins

- Plant Resins ( wood rosin resins,Terpene resins)

Only plant resin is a source of natural resins. However, due to product consistency and different compatibility factors, synthetic resins are in major use. Besides tyre and other rubber applications, the major end-uses for resins are in pressure-sensitive adhesives, hot-melt adhesives, road markings, paints, caulks, and sealants. Manufacturers use hydrocarbon resins to produce hot melt adhesives (for infant and feminine) and packaging applications in addition to glue sticks, tapes, labels and other adhesive applications. All resins are sticky and because of their low molecular weight they migrate (diffuse) easily on the rubber product surface and behaves sticky and that causes tack. Tack property is apparently due to two major reasons :

- Spontaneous diffusion of molecules between two uncured rubber layers.

- Strong molecular forces resulting high degree of crystallinity

Highest level of tack in NR could be due to both the reasons, which means, NR has a high degree of crystallinity (stress induced crystallization) and it has also broad (wider) molecular weight distribution (Fig.1), so that, having plenty of lower molecular fraction can diffuse faster between two layers in contact each other. NR is reported to improve upon its tack on mastication because it generates a higher number of lower molecular weight fraction chains upon breaking down on shearing forces in machines. CR (Neoprene Rubber) shows exceptional adhesive property because it shows the highest degree of crystallinity, even much greater than NR, due to its strong intermolecular attractive force.

Honestly, NR may not require any tackifier because it has enough low molecular weight fraction of chain molecules, due to its wider molecular weight distribution (Fig.1), to be migrated on the rubber component surface and can produce enough tack. It loses its tack mostly because it might have been processed at a higher temperature and is already in the premature vulcanization stage. It can also happen due to the fact that although calendaring or extrusions were done at the right temperature stock was made before adequate cooling and thereby allowed scorching in windup liners. It also loses its tack at cold ambient temperature, in the rainy season and also if the filler level is too high or if the viscosity of the stock is substantially higher than required. However, all synthetic rubber or when synthetic rubber (SBR,BR) is blended with NR, may require to add adequate resins for compound processing.

Except C4,C5 petroleum-based resins, all other types of resins are compatible with NR and is added 1-2 phr. Comparatively C9 petroleum-based resin is better in NR. Plant-based resins are found to work better in 100% NR. When NR is compounded with synthetic rubber, the tackifier is a must and the dose could be as high as 2-4 phr depending on the content of synthetic rubber, oil and filler in the compound matrix. All synthetic rubber lag in rubber tack because, in general, synthetic rubber has :

- Narrow molecular weight distribution

- It resisting break down of molecular chains under mechanical shear

- Synthetic rubber is in very pure form

Aromatic Resins (Phenolic, Cumaron Indane) work better in SBR and BR than plant based resins. For hydrocarbon type of elastomers like butyl , halobutyl , EPM and EPDM , petroleum base resin (C4,C5) work better and usually added with 1-2 phr in the formulation, However, with a higher dose of filler, 2-4 phr tackifier could also be added.

Tackifier resins are added to base polymers/elastomers not only to improve tack (ability to stick) but it also helps in better wetting with filler. Increase in tensile strength by adding resins has been witnessed in different types of elastomers, aromatic resins have been witnessed to increase tensile strength of SBR and its blend.

Effect of Environment on Rubber Tack

The tack of a rubber article is greatly affected by environmental conditions such

as temperature, ozone level and humidity. Environment can not influence tack, however, if processed rubber compound is used with in 24 hrs. High temperature and humidity conditions have a detrimental effect on the initial tack and tack retention of an elastomer. Phenolic tackifying resins can help improve tack under these conditions, but they have their limits under extreme conditions. Superior tack retention under the influence of high humidity can be often be achieved with epoxy resin modified alkylphenol-formaldehyde polymers.

Hydrocarbon based tackifying resins are sometimes used as a low-cost alternative to phenolic tackifying resins. However, hydrocarbon resins are not as effective at maintaining tack under adverse environmental conditions, like elevated temperature and high humidity, nor do they have the same tack retention. Hydrocarbon resins however, preferred in butyl and EPDM rubber compound due to their compatibility.

Hydrocarbon resins are not as efficient as phenolic tackifying resins, and higher levels are often required to achieve the same tack. High tackifier resin levels can cause a loss in tensile strength, tear strength and, most importantly, hysteresis. In applications where these properties, especially hysteresis, are important, phenolic tackifying resins are excellent choices and should be used.

Midas, Asia’s largest manufacturer of tyre retreading materials, has launched O-rings designed for off-the-road (OTR) tyres, aimed at delivering reliable sealing performance in demanding operating conditions.

The O-rings are manufactured using high-quality natural rubber and are formulated to improve physical properties and ensure dimensional stability. According to the company, the product has been tested over many years in harsh environments and is intended to provide consistent, trouble-free performance in OTR tyre applications.

Midas said only REACH-compliant raw materials are used in the manufacture of the O-rings, underscoring its adherence to safety, quality and international regulatory standards.

Founded 56 years ago, Midas supplies tyre retreading materials to customers in more than 60 countries. The company said the launch reflects its continued focus on developing performance-oriented solutions for the global tyre and retreading industry.

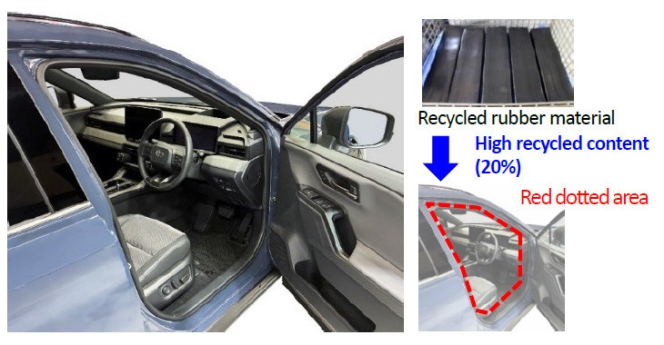

Toyoda Gosei Launches Automotive Parts With 20% Recycled Rubber

- By TT News

- January 08, 2026

Toyoda Gosei has successfully commercialised automotive weatherstrips using recycled rubber, starting with the new Toyota RAV4. This marks a significant breakthrough in a field where rubber has historically been difficult to reuse, often ending up incinerated instead of truly recycled. Unlike steel or plastic, rubber recycling requires devulcanisation, a complex process that traditionally weakens the material and leaves behind unpleasant odours.

Through dedicated refinement of its proprietary devulcanisation technology, the company has overcome these longstanding quality hurdles. The advancements have dramatically increased the usable proportion of recycled material in automotive parts from under five percent to 20 percent, an achievement honoured by a Toyota Motor Project Award.

Looking ahead, Toyoda Gosei aims to extend this technology beyond synthetic rubber to include natural rubber, which is used in far greater volumes. The broader corporate ambition is to collaborate with automakers and partners to establish a full circular system. This system would collect and regenerate rubber from end-of-life vehicles, positioning the company as an industry leader in enabling both decarbonisation and sustainable resource circulation.

Michelin Reinforces Polymer Composite Solutions Business With Two Acquisition Projects

- By TT News

- January 05, 2026

Pursuing its strategic goals for 2030, Michelin is actively extending its technological leadership into adjacent, high-value sectors. This expansion is being accelerated through two key acquisitions announced in recent months: Cooley Group and Tex Tech Industries. Both US-based companies are leaders in advanced materials, specialising in high-performance fabrics and coatings, and align strongly with Michelin’s own focus on innovation and quality while bringing complementary geographic and technical strengths.

Cooley Group, marking its centennial in 2026, excels in creating engineered polymer-coated fabrics. Its fully integrated production enables custom solutions for critical applications in healthcare, industrial containment and waterproofing. Similarly, Tex Tech Industries, with over a century of operation, designs and manufactures specialised textiles for extreme demands, including thermal protection systems for aerospace, fire-blocking aircraft interiors and advanced composite materials.

These strategic moves significantly bolster Michelin’s existing position in coated fabrics, notably through its European brand Orca. By integrating Cooley and Tex Tech, Michelin anticipates accelerating its global market reach and increasing the revenue of its Polymer Composite Solutions division by approximately 20 percent, equating to roughly USD 280 million. Given the growing scale of this business, Michelin intends to establish it as a dedicated reporting segment starting in 2026.

The acquisitions, slated for completion in the first half of 2026 pending regulatory approvals, will be transacted in cash, with financial terms currently undisclosed.

Birla Carbon Secures Platinum Medal In EcoVadis Sustainability Rating

- By TT News

- December 27, 2025

Birla Carbon, a leading global manufacturer and supplier of high-quality carbon materials, has been awarded the prestigious Platinum sustainability rating by EcoVadis, ranking it within the top one percent of all assessed companies globally. This honour recognises the firm’s enterprise-wide leadership in integrating sustainability across its operations, innovation and value chain.

The evaluation specifically commended its strong performance across four key areas: Environment, Labor & Human Rights, Ethics and Sustainable Procurement. This achievement is further validated by extensive third-party certifications, with over 75 percent of operations certified to international standards including ISO 14001, ISO 50001, ISO 45001, SA8000 and ISO 27001, underscoring the consistency and strength of its sustainability management systems.

John Loudermilk, President and CEO, Birla Carbon, said, “This Platinum rating reflects the steady progress we are making in embedding sustainability at the core of our business. Our growth strategy is geared towards delivering sustainability through innovation, operational excellence and responsible practices across our global footprint. We continually invest in sustainability and circularity-driven processes, keeping our operations sustainably efficient while creating long-term value for our customers, partners, communities and employees. Our sustainability strategy, Share the Future, serves as a roadmap to a sustainable future and guides our actions towards our aspiration of reaching net zero carbon emissions over the next 25 years. Being recognised among the top one percent of companies globally is a testament to the commitment of our teams worldwide.”

Comments (0)

ADD COMMENT