Confusion infused by Covid in a Tapestry of ‘Rangoli’ Cowrie Shells

- By TT News

- October 13, 2021

First a dissection of the tyre market in four different sectors – one that was severely affected and three that have been the mainstay of resilience.

Cowrie Shells of Trade

Initially, Cowrie shells were used as currency for trading right after the barter age. Cowrie shells were/ are still used in astrology in many parts of Africa to predict the future. Four cowrie shells held in the hand, the astrologer would then shake the shells while clenching the fist and throw them to the ground. Depending on how many shells turned upside, the astrologer would then tell the future. In my case, three have turned upside and one facing down – an ominous sign.

(Cowrie Shell number 1) The Motorcycle Market

Also known as ‘bodabodas’, motorcycles are divided into the mid-premium, premium and commuter motorcycles. The rise in numbers in pre-pandemic times and presently is because of their ability to move efficiently in urban and rural areas, especially where the road conditions are poor.

Between 2011 and 2019, the number of motorcycles grew 233 percent from 500,000 to 1.7 Million. The average annual demand for motorcycles is 200,000 units – a demand that is fuelled by a relatively affluent rural population with a drive for personal mobility (Source: Kenya Automotive Sector Profile – 60 years Anniversary edition). Motorcycle tyres sales have not lagged behind in the regard, with most of the imports coming from India and China. Often these tyres are not recyclable.

(Cowrie Shell number 2) Commercial Market Truck

The shift in rules and regulations surrounding travel has come with uncertainty and border closures that were aimed at stopping the spread of the disease. Closure of some truck tyre producing plants and ensuring that the overseas parent markets demands were met before exports meant that there was a shortage in this sector. The sector has been supported by the Light Commercial Vehicle tyres from the 7.00-16, 7.50R16, 9.5R17.5, 265/70R19.5 and, more recently, 255/70R22.5 (FI engines). These vehicles are not under the spotlight of weigh-bridge restrictions as compared to their bigger rig 22 and above wheeler cousins and hence have become a vehicle of choice of up-coming and existing transporters wanting to squeeze the payload shilling to a longer mile. Even in the absence of verifiable date or research papers, it is estimated that commercial driving has dropped by about 20 percent.

(Cowrie Shell number 3) Agricultural Tyres

The sector that continues on an upturn is one that continues to feed the millions of people every day. Even with a prediction of drought at the end of the year, tractors and farmers on the road continue to grind tyres to ensure that there are products from the farm to fork. The OEM/ replacement/aftermarket sectors are experiencing a rise in demand for efficient and productive agricultural machinery that is driving the agricultural tyre market. It is primarily the technological advancements and expanding population that are propelling the agricultural tyre market. Sameer Africa, the only agricultural tyre manufacturing concern in the country, closed its doors in 2019. While the overall scenario of the market is positive, the demand is hugely dependent on the economic turmoil in the region that invariably affects the farmers’ income and purchase of farm machinery. However, a downturn in farming equipment sales is expected to continue till 2022 as Covid-19 severely impacted the automotive industries.

Changing agricultural machinery design and increasing penetration into new unexplored terrain will require tyres that have stronger rubber compounds. Flotation, forestry, trailer and compound rubber tyres with steel flex wall are now trending in the local agricultural tyre market.

(Cowrie Shell number 4) Passenger and 4x4

Regarding the future impact of personal and business travel, Bill Gates recently noted that we can ask the question “Do I have to go there personally? ” and predicted 50 percent decline for the post Covid-19 world. In addition to that, walking, cycling and motorcycling have gained preference.

In addition to the specifics of the tyre market, various factors continue to plague the East African tyre industry, and they include:

• Uncertainty that the virus will move into the winter months and the Delta variant. With less than 10 percent of the population now vaccinated in the East African region, it is difficult to say how the disease will pan out. What is certain is that the periods of confinement will continue deep into 2022 (an election year in Kenya).

• At some point this year, freight costs rose by 300 percent. Tyre sellers had no option but to pass the cost to the consumer. Supply chain disruptions are here to stay mainly because Kenya will be having the general elections next year. Tanzania and Uganda have already had theirs. In such times, many investors hold back on the resources waiting for regime change and the chaos that follow a general election.

Rangoli of Possibilities

Many years ago, I woke up every day to beautiful drawings made on the ground in front of a neighbour’s doorstep. Drawn by a young Indian girl, I later came to learn their meaning. Using multi-colored, ochre, dried rice sand, flour, rocks and petals, beautiful drawings were made on the doorstep as a part of an everyday Hindu household practice – even more so, during the important Hindu ceremonies such as Diwali, Pongal and Tihar (I would urge the reader to view some of these drawings on Google). The Rangoli represents happiness, positivity and liveliness of a household (nation) intended to welcome health and happiness. It is for this reason that I intend to paint here that African Tyre Market Rangoli during this very trying Covid times mostly for therapeutic purposes.

It is in these Rangolis of possibilities that I would like to offer my predictions and possible solutions:

Prediction no. 1

In East Africa, future urban mobility will not rely on individual car traffic regardless of the propulsion system. The pandemic will cause urban planners to re-think the transport framework policy. Policy makers will nurture the momentum gained to further transform the traffic landscape towards environmentally friendly towns and cities.

Prediction no. 2

In the midst of dwindling and scarce resources, the one that remains unlimited is ‘IDEAS’. E-commerce readiness will be vital in determining the survivability of a business during the Covid-19 pandemic. The level of readiness will determine their continuance and sustainability.

E-commerce readiness can be examined on the basis of Technological readiness / Organisational Readiness and Environmental Readiness. Challenges and constraints thrown our way, such as the Covid-19 proffers, only encourage a business to adopt e-commerce and take it to another level. (Ref. Journal of Asian Finance, Economics and Business)

Suggestions on how to weather the storm

In order to strive, thrive and stay ahead of the pandemic curve, businesses in East Africa have to adopt different business strategies:

• Tyre business owners and managers must consider going against the previous market stock trends such as Just in Time Management. Maximise coverage, over-order on fast moving items, plan way ahead, order early, sell what your competition can offer you and pro-actively communicate with customers about impending shortage (being upfront and honest)

• Being constantly in touch with suppliers, strategically allocate stocks, buy out of the normal circles, train front-line staff on up-downsizing-cross sizing and tyre husbandry.

• Invest in your people in training (preferably online) and keep moral high.

• With pricing; work around keeping your cost low and don’t raise prices when you can’t supply. This puts you up against a customer.

What the Cowrie shells on the ground say

I would like to pen-off with the words of Kenya’s finance cabinet secretary, Ukur Yatani Kanacho:

“Last year around this time, you would think that ours was a deserted city. Life is now back to normal, the vibrancy is back. We are quite optimistic. Kenyans have accepted and adopted to the new way of living and we are quite alive to the challenges posed by Covid-19”. (TT)

CEAT Drives Women’s Leadership And Inclusion Through Comprehensive Workplace Policies

- By TT News

- March 07, 2026

CEAT has introduced a comprehensive set of policies aimed at supporting the specific needs of its women employees and fostering their professional advancement. The organisation emphasises work-life balance as a means to enhance both personal well-being and workplace productivity, offering flexible remote work options in coordination with managers. A Wellness Leave policy allows women two days of monthly work-from-home or leave during menstruation without requiring justification, while shopfloor employees can access on-site Occupational Health Centres for shift changes or rest as necessary.

To cultivate leadership and career growth, CEAT has implemented targeted programmes such as Womentoring, the Women Accelerator Program and STARS, which focus on building digital, functional and leadership competencies. The EmpowHer Employee Resource Group further promotes inclusion and facilitates open dialogue within the organisation.

The company also provides extensive support for mothers, including 26 weeks of paid maternity leave, hospitalisation coverage and facilities such as crèches and lactation rooms across offices and plants. Returning mothers can benefit from flexible hours and a reduced four-hour workday until their child turns one, while shopfloor workers are assigned morning shifts during the first year after childbirth. A gender-neutral Child Caregiver Travel and Stay Policy ensures that caregiving responsibilities do not hinder career progression.

In manufacturing, CEAT has enhanced accessibility by introducing automated machinery, ergonomic fixtures and lift-assist devices. These changes have contributed to a 20 percent women workforce at the Chennai facility and 28 percent representation on the Nagpur shopfloor, which was the first in Maharashtra to introduce night shifts for women. Safe transport, women security personnel and ergonomic workplace design further support this inclusion. Collectively, these efforts reflect CEAT’s commitment to enabling women to lead and succeed in diverse roles.

ZC Rubber Exhibits Industrial And OTR Tyre Solutions At CONEXPO 2026

- By TT News

- March 07, 2026

ZC Rubber is showcasing an extensive selection of industrial and off-the-road tyre solutions at the CONEXPO-CON/AGG 2026 trade show, being held from 3 to 7 March 2026 in Las Vegas. Attendees can visit the company at booth #N11041 in the North Hall to explore products from its key brands, including WESTLAKE, TIANLI, ARISUN and YONGGU. These offerings are specifically engineered to withstand the rigorous demands of sectors such as construction, agriculture, forestry and material handling.

The display features a comprehensive range of products, such as radial OTR tyres, agricultural tyres, forest tyres, material handling tyres and rubber tracks. Each product is designed to deliver durability, superior traction and operational efficiency in challenging work environments. The exhibition provides an important platform for ZC Rubber to engage with industry professionals, highlight its technological advancements and demonstrate its commitment to supporting global construction and industrial sectors with reliable, high-performance solutions.

Visitors can explore the lineup and speak with the team to learn how these tyre solutions can enhance productivity across a wide variety of applications.

Benjamin Lou, Global OTR Director, ZC Rubber, said, “CONEXPO brings together the people and machines that keep the world building, and it’s a great place for us to connect with customers face-to-face. With brands like WESTLAKE, TIANLI, ARISUN and YONGGU under one roof, we’re able to offer a true one-stop tyre solution across construction, agriculture, forestry and material handling. Our goal is simple – help customers find the right tyre for every job, all in one place.”

Bridgestone Develops Industry-First TRWP Vehicle Collection Method For Trucks And Buses

- By TT News

- March 07, 2026

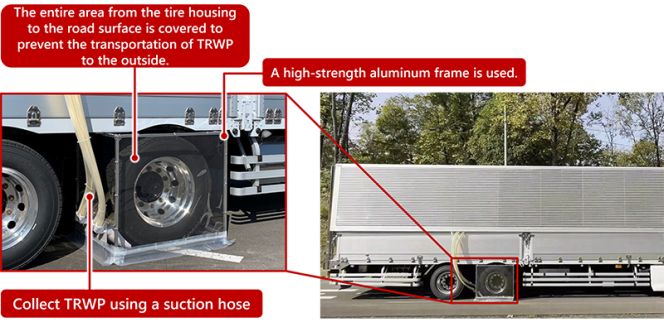

Bridgestone Corporation has announced a significant advancement in environmental research with the development of an industry-first vehicle collection method for tyre and road wear particles (TRWP) specifically from truck and bus tyres. This innovation is designed to enhance scientific understanding of how such particles may interact with the environment. Tyre and road wear particles are generated through the friction between a tyre’s tread and the road surface – a process essential for vehicle safety and comfort – and consist of a combination of worn tyre material and fragments of road pavement. The newly developed collection method for trucks and buses was also showcased at the Tire Technology Expo 2026, held from 3 to 5 March in Hannover, Germany.

The company had previously introduced a collection method for passenger car tyres in 2025 and has since been working to improve its efficiency. Applying insights gained from that earlier development, particularly regarding how particles are generated and dispersed, Bridgestone created a proprietary system tailored to the larger scale of truck and bus tyres. To ensure the accuracy of the collected samples, the company used a dedicated proving ground designed to replicate real-world driving conditions. Before each test, the track was meticulously cleaned to prevent contamination from pre-existing debris.

For the collection process, Bridgestone engineered suction devices and intake mechanisms compatible with larger tyres. A sturdy aluminium frame was used to construct the tyre cover, ensuring durability against strong winds during operation. Following controlled driving sessions, particles that remained both on the track surface and inside the tyre cover were gathered for analysis.

This effort is part of a broader commitment to investigate the physical and chemical characteristics of tyre wear particles and their potential environmental effects. Bridgestone participates in the Tire Industry Project (TIP) facilitated by the World Business Council for Sustainable Development and collaborates with external research organisations and corporate partners. With the ability to collect samples from both passenger vehicles and heavy-duty trucks and buses, the company aims to accelerate research, share findings widely and support efforts to reduce particle generation.

Alongside this research, Bridgestone is advancing several complementary initiatives. These include developing longer-lasting tyres with improved wear resistance, offering solutions that help customers lower total operating costs and working to minimise environmental impact throughout the product lifecycle.

UTAC Expands In China With New EV-Focused Proving Ground In Anhui

- By TT News

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

Comments (0)

ADD COMMENT