- Tyre Materials Conference 2025

- Tom Thomas

- Eonix Management Solutions

- Srikanth Chakravarthy

- HF Group

- Anil Nair

- Hasteri

- Dr Saikat Das Gupta

A Spectacle Of Excellence And Innovation Dazzles TMC 2025

- By Gaurav Nandi

- September 02, 2025

The Tyre Materials Conference 2025 unfolded as a high-octane showcase of innovation, urgency and collaboration amid the industry’s accelerating shift towards sustainability. With participation from global leaders, researchers and policymakers, the event addressed the fundamental transformation of tyre materials, from raw rubber to recycled steel and from EV-ready compounds to AI-powered sorting systems. Yet, beneath the applause and optimism lay sobering truths like systemic supply chain disruptions, regulatory uncertainty and the technological gap in scalable green alternatives. India’s growing ambition, collaborative initiatives and research strength emerged as hopeful beacons in a sector still grappling with fragmented standards and circularity bottlenecks.

A banquet hall in a posh New-Delhi hotel turned into an intellectual crucible to host a spectacle that drew in participants from different corners of the world for defining the future of the global tyre material industry.

As the emcee announced the commencement of the Tyre Materials Conference 2025 (TMC 2025), organised by Tyre Trends, applause rippled through the room, momentarily shaking the circular tables and rows of chairs that seated over 100 participants, each with eager eyes, ready to unwrap the future.

The hall gradually turned into a melting pot of ideas, innovation and future trends as the day unfolded. The spirit of excellence and innovation reverberated through the entire establishment with such grandeur that even outsiders wanted a peek inside.

Following the inaugural lamp lighting by Conference Chairman Tom Thomas and others, the stage was now set for insightful speeches and interactive sessions that encompassed everything from development of sustainable materials for the tyre industry to a panel discussion discussing the trends within the tyre materials sector.

“The theme of this year’s conference that hinges upon raw material of tyres for future mobility could not be timelier. This conversation comes at a pivotal moment for our industry as we face a new generation of challenges and opportunities. There is a growing and urgent push for sustainability across the value chain. As an industry, we must reduce our dependence on petroleum-based raw materials, which currently make up nearly 55–60 percent of the material mix used by tyre manufacturers,” said Thomas in his inaugural address.

“The theme of this year’s conference that hinges upon raw material of tyres for future mobility could not be timelier. This conversation comes at a pivotal moment for our industry as we face a new generation of challenges and opportunities. There is a growing and urgent push for sustainability across the value chain. As an industry, we must reduce our dependence on petroleum-based raw materials, which currently make up nearly 55–60 percent of the material mix used by tyre manufacturers,” said Thomas in his inaugural address.

“Today, we are writing the next chapter of tyre material science – one that achieves sustainability without sacrificing performance, embraces innovation without compromising reliability and drives technological advancement while protecting our environment,” he added.

Highlighting the importance of collective collaboration in driving the industry forward during a special address, Eonix Management Solutions Managing Director Srikanth Chakravarthy said, “The future should be something we don’t fear and something that excites us. With Zenith Group, we’re not just talking about another supplier but about the world’s largest steel cord maker in the making, backed by USD 2 billion in investment, a USD 30 billion parent and the industry’s most advanced solar-powered, automated plant.

It’s the only company tracking carbon emissions in real time and targeting 100 percent recycled steel by 2027. As India’s steel cord demand doubles, Zenith plans to support with imports, warehousing and eventually local manufacturing. Collaboration across suppliers, competitors and customers is essential to create lasting value for our industry.”

Speaking at the conference, HF Group Business Development Director Anil Nair delivered a sharp, data-driven keynote outlining the structural and technological turbulence reshaping the global tyre industry. From volatile raw material costs to rising demands for electric vehicle-ready compounds, he painted a picture of an industry at a critical inflection point.

“Challenges are mounting across regions. Europe leads in sustainability regulation with the push for digital tyre passports, while US buyers remain cost-focused. In Asia, Japan and Korea prioritise performance even as China leans into price efficiency. Globally, manufacturers are grappling with premature crosslinking, high-silica formulations that undermine shelf life and erratic compound quality, especially when integrating bio-oils and recovered carbon black,” Nair explained.

“Challenges are mounting across regions. Europe leads in sustainability regulation with the push for digital tyre passports, while US buyers remain cost-focused. In Asia, Japan and Korea prioritise performance even as China leans into price efficiency. Globally, manufacturers are grappling with premature crosslinking, high-silica formulations that undermine shelf life and erratic compound quality, especially when integrating bio-oils and recovered carbon black,” Nair explained.

He noted that artificial intelligence emerges as a vital tool amid production shifts as tyre majors relocate factories to cheaper regions, triggering expertise gaps and costly closures. Nair emphasised that artificial intelligence can bridge generational knowledge loss by codifying best practices from veteran staff.

On the innovation front, he spotlighted smart tyres with real-time monitoring capabilities and self-adjusting pressure systems. He also stressed recyclability by design with tyres engineered for chemical disassembly and multi-cycle retreading. For EVs, the shift is clear, which includes quieter, lighter and longer-lasting tyres built around high-silica and nano-enhanced fillers.

Nair concluded with a call to rethink longevity, promoting materials that resist ageing, disperse uniformly and maintain performance across diverse geographies.

“This isn’t just evolution – it’s re-engineering the tyre from the molecule up,” Nair declared.

EMERGING MATERIALS

The tyre industry is embracing a sustainability revolution driven by regulation, innovation and performance demands. From circular economy models and advanced bead wire solutions to breakthrough chemical additives and EV-optimised rubber compounds, manufacturers are reshaping production to deliver high-efficiency, eco-conscious tyres fit for the future of mobility.

Speaking at the conference on sustainable materials, Hasteri Chief Scientist explained, “The global tyre industry is undergoing a profound transformation driven by increasingly stringent regulations and a commitment to sustainability. No longer a mere buzzword, sustainability is now central to manufacturing, encompassing economic, social and environmental considerations.”

“This shift is seeing a move from a linear ‘use and throw’ model to a circular economy with significant investment in bio-based materials, advanced recycling of end-of-life tyres and decarbonisation efforts across the supply chain. New regulations including extended producer responsibility and limits on tyre wear particles are accelerating this change. With the market for sustainable tyre materials projected to see over 26 percent growth by 2029, the sector is embracing innovation, from bio-sourced rubbers and recycled steel to energy-efficient production, aiming for a future where tyres are both high-performing and environmentally responsible,” he added.

“This shift is seeing a move from a linear ‘use and throw’ model to a circular economy with significant investment in bio-based materials, advanced recycling of end-of-life tyres and decarbonisation efforts across the supply chain. New regulations including extended producer responsibility and limits on tyre wear particles are accelerating this change. With the market for sustainable tyre materials projected to see over 26 percent growth by 2029, the sector is embracing innovation, from bio-sourced rubbers and recycled steel to energy-efficient production, aiming for a future where tyres are both high-performing and environmentally responsible,” he added.

Drawing from nine real-world defect cases, Sun Hong Kim, Technical Head of Tyre Bead Wire Division at Bansal Wire Industries, outlined how bead wire stiffness and mechanical behaviour critically affect tyre beading performance.

He noted that stiffness, regulated by the take-off machine’s killing roller, determines how the wire responds under load. “Low stiffness wires deform more easily, while high stiffness variants resist structural failure. Defects such as wire lift-up, bending, tilting and S-type straightness are linked to mismatched stiffness, over- or under-killing, reduced yield points and inconsistent brake tension during payoff,” explained Kim.

Furthermore, Kim pointed out that one recurring issue, namely fluctuating brake pressure, was resolved by installing an air regulator, highlighting the role of stable mechanical inputs.

Furthermore, Kim pointed out that one recurring issue, namely fluctuating brake pressure, was resolved by installing an air regulator, highlighting the role of stable mechanical inputs.

He also categorised defects into four types (A–D), each requiring specific interventions ranging from stiffness adjustment to wire straightening control. As tyre manufacturers demand higher consistency, his data-led approach offers a template for addressing bead wire variability across global production environments.

Leading chemical firm Schill + Seilacher “Struktol” is pioneering significant advancements in tyre manufacturing through its innovative additive, BP 19797, designed to enhance both production efficiency and product performance.

Speaking remotely at the conference, the company’s Senior Technical Sales Manager, Robert Kobel-Bryk, detailed how this new process promoter drastically improves silica dispersion in rubber compounds, enabling faster mixing cycles and a notable reduction in energy consumption during the manufacturing process. This translates directly into more efficient operations and a smaller carbon footprint.

“BP 19797 yields superior extrusion properties and smoother surfaces for tyre components, leading to lower scrap rates. The introduction of this additive maintains or even minimally enhances the final physical properties of the tyre including tensile strength while concurrently improving the complex balance between wet grip and rolling resistance,” said Kobel-Bryk.

“BP 19797 yields superior extrusion properties and smoother surfaces for tyre components, leading to lower scrap rates. The introduction of this additive maintains or even minimally enhances the final physical properties of the tyre including tensile strength while concurrently improving the complex balance between wet grip and rolling resistance,” said Kobel-Bryk.

The company emphasises these developments as key to addressing industry demands for cleaner, safer and more efficient production methods.

Japanese speciality chemical firm Kuraray’s Technical Service Engineer at Elastomer Division, Naoto Takahashi, highlighted the company’s nearly 100-year history and detailed how its unique low-molecular-weight rubber acts as a reactive plasticiser, preventing bleed-out by co-vulcanising with base rubber.

“GS-L-BR significantly enhances crucial EV tyre properties including high wear resistance for heavy, high-torque vehicles and low rolling resistance for extended range and energy efficiency. Our novel approach for tyre treads involves increasing natural rubber content, a combination traditionally challenged by filler interaction. GS-L-BR overcomes this by improving the bond between natural rubber and silica, outperforming conventional formulations in wear and rolling resistance while also boosting wet grip,” contended Takahashi.

He added, “For sidewalls, replacing carbon black with silica becomes viable as GS-L-BR dramatically improves fatigue resistance. This groundbreaking material promises to be a key component for the next generation of EV and even commercial vehicle tyres, addressing critical performance and sustainability needs.”

GOING GREEN

The tyre industry is undergoing a technological shift for going green with innovations in recycling, advanced materials and processing systems. From AI-driven sorting of end-of-life tyres to self-healing elastomers and high-silica mixing technologies, these breakthroughs are driving greater efficiency, sustainability and performance across the entire value chain.

Speaking at the conference, Senior Manager of Process Technology (Asian Countries and Global) at HF Group, Dr M N Aji, emphasised the critical role of combining machinery and processing expertise for optimal silica mixing, especially as silica usage in tyre technology is rapidly increasing with some applications reaching up to 160 parts-per-hundred-rubber (PHR).

“Incorporating high levels of silica with specialised polymers is crucial to achieve superior properties like better mileage, lower noise levels and improved traction. HF Group’s innovative mixer technologies including tangential (Z4 rotor) and intermeshing (PS7/PS5 rotor) designs offer enhanced shear, cooling efficiency and intake. The Z4 rotor’s versatility for both silica and final batch mixing is noted along with the development of new wear-resistant materials (HFSI 50) and intelligent ram technology (i-EXL) for energy and cost savings,” averred Aji.

“Incorporating high levels of silica with specialised polymers is crucial to achieve superior properties like better mileage, lower noise levels and improved traction. HF Group’s innovative mixer technologies including tangential (Z4 rotor) and intermeshing (PS7/PS5 rotor) designs offer enhanced shear, cooling efficiency and intake. The Z4 rotor’s versatility for both silica and final batch mixing is noted along with the development of new wear-resistant materials (HFSI 50) and intelligent ram technology (i-EXL) for energy and cost savings,” averred Aji.

He added that key to successful silica mixing were precise temperature control, viscosity reduction and excellent dispersion. The importance of maintaining optimal water quality for cooling and adhering to strict acid cleaning schedules for mixer maintenance is imperative.

“Tandem mixing technology was introduced as a cutting-edge solution for high-fill silica masterbatches, offering 100 percent productivity and superior temperature control by separating dispersion and distribution processes. HF Group’s TRC co-axial rotor technology was specifically designed for ultra-high silica content, ensuring better material cohesion and quality,” noted Aji.

Dr Shib Shankar Banerjee, Assistant Professor from IIT Delhi’s Department of Material Science and Engineering, presented cutting-edge research in polymer and elastomer materials, focusing on ‘new generation elastomeric materials’ that transcend conventional rubber properties. These materials aim for enhanced performance, functionality and processability, incorporating features like shape memory, self-healing, conductivity and magnetic properties.

One key area of research involved thermoplastic elastomers with improved phase compatibility and self-healing capabilities, particularly leveraging shape memory assistance to repair micro-cracks.

Dr Banerjee noted that his team is also exploring 3D printing of rubber-like materials for complex geometries and developing soft and multi-functional materials using liquid metals (Gallium and eutectic Gallium-Indium alloy) to create conductive, magnetic, yet soft elastomers for flexible and stretchable electronics.

A significant portion of his presentation was dedicated to the development of hydrogenated SBR (HSBR) based vulcanisates with superior traction performance, a collaborative effort with Hasetri. HSBR exhibits a more homogeneous network structure, leading to better ageing resistance, higher modulus at elongation, improved wet and dry traction, better rolling resistance and enhanced abrasion and fatigue properties compared to conventional SBR.

His research also explored the synergistic effect of hybrid fillers like CNT in HSBR, noting improved filler dispersion due to higher viscosity and styrene content.

Innovating tyre recycling with smart sorting technology, France-based Regom’s Chief Executive Officer, Arthur Wagner, introduced his company’s innovative approach to maximising the value of end-of-life tyres through advanced sorting. Recognising the challenges of manual sorting and the lack of data in the used tyre industry, Wagner stated, “Our core innovation is a machine that processes tyres individually, capturing images and using artificial intelligence to analyse brand, model, dimensions, load and speed indices and DOT codes in less than a second. This system, refined over six years with a vast database from processing over 20 million tyres annually, can operate efficiently even with wet or muddy tyres.”

He went on to say that the system allows customers to configure custom rejection criteria, automatically diverting tyres with no value to shredding and streamlining manual grading for valuable tyres. This automation significantly increases resale prices, optimises retreading and enhances material recovery, while also reducing labour pain points and costs.

A key application of Regom’s technology is in pyrolysis, where precise sorting of tyres helps maximise the quality of the output. The company is also at the forefront of integrating RFID technology into tyre sorting.

MARKET ECONOMICS

Natural rubber remains vital to the global tyre industry, yet its supply chain faces mounting pressures from climate change, labour shortages, regulatory shifts and price volatility. As demand grows, industry stakeholders are exploring innovation, sustainability and traceability to secure long-term supply and meet ambitious environmental goals.

Explaining the volatile raw material landscape, Yokohama Off Highway Tires Chief Sustainability Officer Padmakumar G said, “Change is the predominant challenge in the tyre industry’s raw material supply chain. Current volatility stems from several factors, which include the EU Deforestation Regulation causing natural rubber price and availability issues, Indian import restrictions impacting steel and unpredictable crude oil prices affecting petrochemical-derived materials like carbon black and synthetic rubber.”

“Global shipping faces constant disruptions from Suez Canal blockages to geo-political conflicts forcing longer, costlier routes. Even evolving trade policies such as new US-Mexico green corridors demand continuous vigilance. Looking ahead, the industry’s ambitious 2050 sustainability goals present formidable challenges. Shifting to 100 percent sustainable raw materials necessitates developing bio-based alternatives for carbon black, synthetic rubber, and fabrics, which is a significant hurdle given current technological limitations and lack of mass production,” he added.

He asserted that India’s ingenuity will be crucial in overcoming these profound material and supply chain transformations, ensuring the industry’s future viability amidst relentless change.

Alluding to the global natural rubber landscape ANRPC Senior Economist Dr Lekshmi Nair said, “Natural rubber (NR) is a crucial strategic raw material with use in diverse applications beyond tyres, though the tyre industry accounts for 70 percent of its global consumption. A significant challenge stems from the fact that approximately 90 percent of global NR production originates from small growers in tropical regions. These farmers face issues such as low productivity, limited access to resources, volatile prices and the changing demographics as younger generations are less interested in labour-intensive rubber tapping. The lengthy 30-year lifecycle of rubber trees including a six-year immaturity period also deters investment and quick innovation adoption.”

She noted that globally, Thailand, Indonesia and Ivory Coast are the largest NR producers, contributing around 65 percent of the world’s supply, with Vietnam emerging as the fourth. Historically, Asian producers accounted for 91-92 percent of global production, but this has decreased to 79 percent, while West Africa, particularly Ivory Coast, has seen its share rise to 21 percent.

Consumption patterns have also shifted with 67 percent of NR usage now in Asian countries like China, India and Thailand. Despite a projected deficit of 0.7 million tonnes (demand of 15.5 million tonnes versus supply of 14.8 million tonnes), price volatility is often driven by speculative factors rather than market fundamentals, partly due to low investment in replanting.

A key regulatory challenge is the EU Deforestation Regulation, which came into force in June 2023. Compliance for large and medium-sized operators is required by 31 December 2025 and for micro and small enterprises by 30 June 2026. This regulation demands full traceability to prove that NR and products containing it are not sourced from land deforested or degraded after 31 December 2020. While NR is inherently sustainable, this regulation complicates supply chains, especially for producers exporting to Europe, which accounts for 12 percent of total NR consumption in its final products.

“Initiatives like the Global Platform for Sustainable Natural Rubber are working on common guidelines, traceability programmes and capacity building to help the entire value chain, including smallholders, adapt to these new demands. Collaboration and policy support are will be essential for successful implementation of these sustainable transitions and for navigating price volatility, climate change impacts and evolving trade policies,” contended Nair.

THE PANEL

The panel discussion on ‘Emerging Scenarios of Tyre Materials’ brought together leading minds from India’s tyre industry to dissect the monumental shift towards sustainability. It featured CEAT Vice President of Research and Development (Centre of Excellence), Sujith Nair; Yokohama-ATG Head – Corporate Research and Development (Materials and Compounding), C Harimohan; Apollo Tyres’ Divisional Head Raw Material Development, Rajitha R and Ralson Tyres Chief Technology Officer Vidit Jain. The panel was moderated by Eonix Management Solutions Managing Director Srikanth Chakravarthy.

Chakravarthy opened the session by highlighting the immense scale of the transformation ahead. Citing projections of a five to six-fold growth in tyre production and a shift from 35 percent to 100 percent sustainable materials within 25 years, he posed the fundamental question: How is the Indian tyre industry preparing for this paradigm shift, particularly concerning the move away from petroleum-based materials like synthetic rubber and carbon black?

Nair outlined the industry’s approach in three key phases, namely sustainable and green materials with a focus on environmentally friendly and SoC-free options; reduce, recycle and reuse, aiming to lessen tyre weight, reduce carbon dioxide emissions and minimise material wear, encompassing practices like retreading and renewal and sustainable sourcing, exploring new and responsible ways to procure raw materials.

Nair underscored the excitement around green materials, particularly natural alternatives, despite inherent challenges in development and application and highlighted the push for recycled materials with a focus on enhancing the strength of high-tensile materials for use in compounds. The scaling up of new materials, maintaining quality and navigating diverse specifications and certifications across factories present significant hurdles.

Harimohan reinforced Nair’s points, stressing the importance of a holistic understanding of sustainability. He narrowed the focus to the six material types that constitute 85-88 percent of total raw material consumption in tyre manufacturing, namely natural rubber, synthetic rubber, carbon black, steel cord, textiles and rubber process oil.

While natural rubber is largely considered a sustainable material, Harimohan identified synthetic rubber and carbon black as the two areas requiring breakthroughs. He noted that bio-sourced butadiene (for synthetic rubber) is technologically proven with pilot plants in operation and collaborations underway such as Michelin’s European partnerships and Yokohama’s collaboration with a Japanese synthetic rubber company.

The challenge, however, lies in the circularity of carbon black. Harimohan explained that recovered carbon black currently acts more as a filler than a direct replacement for virgin carbon black due to significant degradation during pyrolysis.

He advocated for research to improve the properties of recovered carbon black to 80-90 percent of its original capabilities. Similarly, he called for advancements in recycled rubber, which currently retains only 5-6 MPA of tensile strength compared to 20-25 MPA for virgin compounds.

Recognising the shared nature of the sustainability challenge, the discussion turned to the need for greater collaboration within the industry. Nair revealed that the Indian Tyre Technical Advisory Committee (ITTAC) has already initiated a consortium of tyre companies to work with raw material manufacturers on developing common specifications.

Three such projects primarily focused on sustainable IT space, pyrolysis of carbon black and reclaim rubber are underway. Nair emphasised the necessity of expanding these efforts, citing examples like the European tyre industry’s consortiums.

He also called for greater investment in research and development centres across all tyre companies as a foundational step for effective collaboration and advocated for partnerships with academic institutes.

Rajitha introduced a sobering data point, which stated that in the last 50 years, no new major entrant has emerged in the global tyre industry, while some established players have diminished. She highlighted the immense potential of large Indian conglomerates like the Reliance Group, who are already involved in many tyre-related products to drive significant breakthroughs.

The panel unanimously agreed that achieving sustainability goals requires a holistic approach, encompassing the entire supply chain. Rajitha underlined the importance of selecting suppliers with strong research and development capabilities and a quick adaptability to new technologies, also stressing the need for local partners to meet global standards.

The panel unanimously agreed that achieving sustainability goals requires a holistic approach, encompassing the entire supply chain. Rajitha underlined the importance of selecting suppliers with strong research and development capabilities and a quick adaptability to new technologies, also stressing the need for local partners to meet global standards.

A key challenge raised by the moderator was the often-lengthy tyre approval process, especially when introducing entirely new materials. Rajitha acknowledged that validation processes would need to evolve.

She suggested that validation time could be minimised when new materials maintain similar basic molecular structures and properties and highlighted the increasing use of virtual and physical simulations and advanced ageing testing to expedite validation.

The standardisation of recycled materials like recovered carbon black with established specifications could also significantly streamline the process. Nair added that while striving for 100 percent performance equivalence when replacing virgin materials is ideal, a pragmatic approach might involve accepting 85-90 percent and then compensating through redesign.

Industry leaders from CEAT, Yokohama-ATG, Apollo Tyres, and Ralson Tyres engage in a dynamic panel on ‘Emerging Scenarios of Tyre Materials,’ moderated by Srikanth Chakravarthy.

He introduced a fourth ‘R’, calling it ‘redesign’, as a faster approach to validation. The potential of artificial intelligence and its integration with simulation models to accelerate the decision-making process for new materials was also briefly touched upon with the consensus that this is indeed the way to go.

The panel discussion underscored the Indian tyre industry’s earnest efforts in navigating the complex landscape of sustainable materials. While challenges abound in material science, supply chain collaboration and regulatory alignment, the collective commitment to innovation and a greener future appears strong.

TMC 2025 made clear that the journey to sustainable tyre materials is as complex as it is critical. While innovation is abundant, real progress hinges on global cooperation, scalable technology and faster validation systems. The path ahead demands collective resolve to redesign not just materials but the very approach to tyre manufacturing.

The next edition will be held in 2027 on a bigger scale!

KraussMaffei Technologies Appoints Dirk Musser As New Managing Director

- By TT News

- February 27, 2026

KraussMaffei Group is set to implement a leadership transition at its subsidiary, KraussMaffei Technologies, with a change at the board level. Jörg Stech, who has served as Chairman of the Board and global head of injection moulding, automation and additive manufacturing since 2023, will be departing on 31 March 2026 at his own request. He will be succeeded by Dirk Musser, the current Head of Group Transformation at the parent company, who has been appointed as the new Managing Director effective 1 April 2026. The leadership handover between Stech and Musser is already in progress, ensuring a seamless transition.

Stech’s tenure unfolded during a difficult economic period marked by financial losses and a contracting market. He responded with decisive measures aimed at margin enhancement and balance sheet improvement, which laid the groundwork for the company's long-term stability. Under his direction, the product lineup for injection moulding and automation was revitalised with the introduction of the LRXplus linear robot, the fully electric PX series and the MC7 control system, all launched in late 2025 alongside new artificial intelligence tools. He also launched a multi-year development initiative and pushed the company into new markets, such as aerospace and drone technology, by leveraging expertise in specialised processes like ColorForm. Through a focus on operational excellence, pricing discipline and capital efficiency, Stech guided the company to a significantly more resilient position compared to three years prior, despite the persistent downturn in injection moulding.

Musser brings to his new role extensive experience in transformation and finance. In his current capacity, he has already been closely involved with KraussMaffei Technologies, collaborating with its leadership to drive strategic initiatives and enhance operational performance. His qualifications include sharp analytical abilities, a strong grasp of industrial processes and a broad international perspective. An economist by training, Musser has accumulated over 20 years of leadership experience across various technology and industrial sectors. His background includes leading major transformation and turnaround projects at CRRC New Material Technologies, where he stabilised plant earnings in North America, as well as directing operational and financial restructurings during his time at Deloitte. He has also held roles with P&L responsibility, managing global supply chains and post-merger integrations at CRONIMET and has prior experience with automotive manufacturers including Daimler and Fujian Benz Automotive in China.

Alex Li, CEO, KraussMaffei Group, said, "Jörg Stech took on responsibility in a difficult situation, set clear priorities and launched decisive initiatives. The successful market launch of the LRXplus linear robot and the all-electric PX machine series, the consistent focus on profitability and the sustainable strengthening of our balance sheet are visible results of this work. We would like to express our sincere thanks to Jörg Stech for his leadership, integrity and team spirit. We value Dirk Musser as a leader who combines strategic clarity with operational excellence. In a short period of time, he has provided vital impetus for the transformation of the group and impresses with his analytical strength, decisiveness and deep understanding of our processes – not least through his successful collaboration with the managing directors of KraussMaffei Technologies. We are convinced that he will continue on this path with clarity and creative drive to successfully align KraussMaffei Technologies."

Stech said, "After many years in an environment full of technological, economic and geopolitical challenges, I look back with great gratitude on a time in which I was always surrounded by an exceptional workforce. Together, we achieved things that many initially thought were impossible. This cooperation, this willingness to push boundaries and create something new, was a joy for me. My special thanks go to all stakeholders in the company and, of course, to all employees. I leave with respect, gratitude and the conviction that this long-established company will continue to achieve great things in the future."

Musser said, "Together with my fellow managing directors Dr Frank Szimmat and Markus Bauer, I want to resolutely drive forward the further development of KraussMaffei Technologies. Our focus is on further expanding stability and performance and taking the necessary steps to successfully position the company in a dynamic market environment. I look forward to shaping this path together with our teams.”

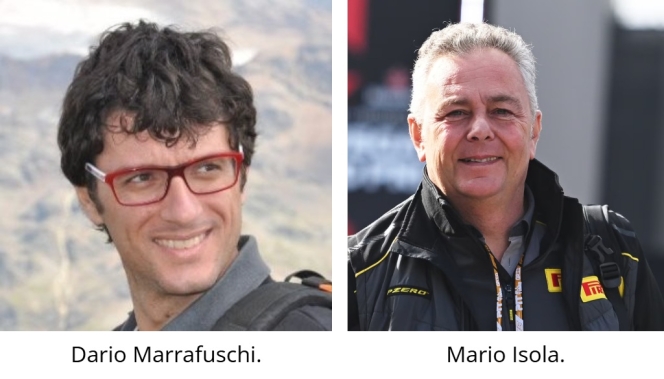

Dario Marrafuschi Succeeds Mario Isola As Pirelli’s Head Of Motorsport

- By TT News

- February 27, 2026

Italian tyre manufacturer Pirelli has announced that Dario Marrafuschi will become the Head of its Motorsport Business Unit, effective 1 March. He succeeds Mario Isola, who will remain with the company until 1 July to assist with the leadership transition.

Marrafuschi joined Pirelli in 2008 and has held positions within the Formula 1 Research and Development department. Most recently, he led the development of the company's road products.

He will report to Giovanni Tronchetti Provera, Executive Vice-President of Sustainability, New Mobility & Motorsport. The appointment comes as the company continues its role as the tyre supplier for various global motorsport categories.

Isola departs the company following a tenure that included the expansion of Pirelli’s motorsport operations. The company stated that Isola will pursue other professional opportunities following his departure in July.

Changing Tyre Dynamics In A Changing Car Market

- By Sharad Matade

- February 27, 2026

For Continental Tires India, the passenger vehicle market in India is entering a phase where scale and structure are finally aligning with its longstanding premium ambitions. Passenger vehicle sales reached a record 4.3 million units in 2024, expanding by 4–5 percent year on year, but it is the composition of that growth – rather than the headline volume – that is reshaping the company’s strategy. Utility vehicles now account for approximately 58 percent of total passenger vehicle sales, up sharply from about 51 percent the previous year, cementing SUVs and crossovers as the dominant force in the market.

This structural shift has direct consequences for tyre manufacturers operating at the upper end of the value spectrum. Larger vehicles bring higher kerb weights, bigger wheel diameters and greater expectations around refinement, safety and performance. For Continental, the change represents not merely an increase in addressable demand but a decisive move towards tyre categories where technology differentiation and pricing discipline can coexist.

Samir Gupta, Managing Director of Continental Tires India, calls this phase a turning point, not a temporary high. He says the surge in utility vehicles – driven by electrification and more premium cars – fundamentally changes the economics of the passenger tyre market in India.

“Let me clarify one thing first. The utility vehicle segment is no longer small. Last year, around 60 percent of passenger vehicles sold in India were utility vehicles, and including first-time buyers upgrading within this segment, the share goes beyond 65 percent,” Gupta says.

Industry data broadly supports this assessment. SUVs alone contributed close to three-fifths of all passenger vehicle sales in 2024, with compact utility vehicles accounting for a significant share of incremental volumes. The overall passenger vehicle market, at around 4.3 million units, has thus become structurally skewed towards larger formats – an inflection with long-term implications for tyre sizing, load ratings and product mix.

This shift shows in replacement demand. As vehicle footprints grow, rim diameters are increasing. “The market is clearly moving from smaller to bigger rim sizes. Demand for 17-inch and above tyres is rising sharply,” Gupta says. While these tyres are still a minority, their growth far outpaces the overall passenger tyre market.

Electrification is accelerating the shift. A substantial proportion of electric passenger vehicles sold in India today are SUVs, and Continental expects EVs to account for more than 50 percent of the passenger vehicle segment within five years. For tyre manufacturers, this creates new technical requirements – higher torque tolerance, lower rolling resistance and stringent noise control. “That creates a significant opportunity for us because our strengths lie in premium, high-performance tyres,” Gupta says.

Despite these favourable structural trends, premium tyres have historically struggled to gain traction in India. For much of the past decade, the market remained intensely price-sensitive, with tyres treated largely as commoditised replacement items. Continental’s response, Gupta explains, has been consistent rather than tactical pricing. “Right from the beginning, we have focused on fair pricing. The idea is simple – if we can clearly differentiate on performance and consistently deliver on those promises, price recovery will follow,” he explains.

The broader environment is now becoming more supportive. As vehicle prices rise and consumers migrate towards larger, more sophisticated vehicles, willingness to spend on tyres that enhance safety, comfort and driving confidence is increasing. This trend is also evident at the top end of the market. Premium and luxury passenger vehicle sales reached approximately 51,500 units in 2024, up around 6 percent year on year and crossing the 50,000-unit threshold for the first time – a symbolic marker of premium consumption in India.

Gupta sees premiumisation extending beyond luxury vehicles. “Earlier, India was extremely price-sensitive, but that is changing in higher segments. Consumers are upgrading vehicles and are more willing to invest in tyres that enhance safety, comfort and confidence,” he says.

The intensification of competition, with global premium tyre brands expanding or re-entering India, is viewed as a positive development. “Competition is always good,” Gupta says. “It gives you room to grow and improve.” More importantly, he believes it will help reframe the market. “More premium players will help move the market away from being purely cost-driven to being value-driven,” he adds.

Replacement market dynamics reinforce this view. Of the roughly 32–33 million passenger tyres replaced annually in India, tyres sized 17 inches and above account for about 12–13 percent. While the overall replacement market grows at 5–6 percent per year, this high-diameter segment is expanding at over 20 percent annually, closely tracking the shift in new vehicle sales.

This sharper focus on passenger tyres also explains Continental’s decision to exit the truck and bus radial segment in India. Gupta stresses that the decision was strategic rather than operational. Continental entered the TBR market in 2014, invested significantly and received strong feedback on product performance.

However, the economics proved limiting. Gupta says, “TBR in India is largely a B2B, fit-for-purpose market. Even if you have the best tyre, willingness to pay remains limited because fleet operators are under constant margin pressure.” Although commercial tyres offer higher absolute margins per unit, they consume substantially more raw material. “One commercial tyre uses six to eight times the raw material of a car tyre. Percentage margins are actually higher in passenger tyres,” Gupta explains.

After reviewing its portfolio, Continental chose focus over breadth. Exiting TBR allows the company to concentrate capital, technology and management attention on passenger and light truck tyres, where differentiation is more readily monetised. Gupta rejects the idea that a narrower portfolio weakens the company’s position. Commercial and passenger tyre customers, he argues, are fundamentally different – one driven by procurement economics, the other by consumer perception and emotion.

Indian consumers, Gupta believes, are becoming more tyre-aware. “Premiumisation is happening across the vehicle industry, not just in tyres. As consumers move to larger and more premium cars, their expectations also rise,” he says. Where tyres were once treated as an afterthought, buyers increasingly recognise their role in braking, grip, noise and overall driving confidence.

This change is evident at the retail level. Continental now operates more than 200 brand stores across India, and feedback from retail partners suggests customers are more informed and more demanding. Availability remains critical. “There is no point launching premium tyres if customers cannot find them,” Gupta says.

To support future demand, Continental is investing around INR 1 billion at its Modipuram plant, with the focus squarely on passenger and light truck tyres. The expansion will extend manufacturing capability from the current 20-inch limit to 22–23 inches, aligning local production with emerging vehicle trends.

Localisation, Gupta argues, is about adaptation rather than compromise. Indian road conditions, climate and driving habits require specific tuning without diluting global performance standards. Education and availability remain the principal challenges.

The recent launch of the CrossContact A/T² in India reflects this strategy. Introduced during Continental’s Track Day at Dot Goa 4x4, the product positions India among the early global markets for the tyre. “The first thing you notice is noise – or the lack of it,” Gupta says. “You hear the air-conditioning, not the tyre.” Ride comfort, grip and consistency across terrains define its appeal. As Gupta puts it, “Jahan tak soch jaati hai, wahan tak yeh tyre kaam karta hai.”

Looking ahead, Continental remains largely insulated from shifts in original equipment strategies, such as the gradual removal of spare tyres. Improved carcass design and stronger sidewalls are reducing puncture risk, but the company’s primary focus remains the replacement market.

For Gupta, the question is no longer whether India is ready for premium tyres, but how effectively manufacturers execute. “The market is finally ready for premium tyres,” he concludes. With passenger vehicle sales at record levels, SUVs firmly dominant and premium consumption expanding, Continental believes it is well positioned to grow alongside India’s evolving mobility landscape.

Falken Tyre Europe GmbH Rebrands As DUNLOP Tyre Europe GmbH

- By TT News

- February 26, 2026

Falken Tyre Europe GmbH has officially transitioned to operating under the name DUNLOP Tyre Europe GmbH, following its formal registration with the Offenbach Local Court. This change signifies a pivotal development for the Sumitomo Rubber Industries subsidiary. The rebranding represents a calculated and essential move to establish a more formidable European footprint for the DUNLOP brand. Company leadership acknowledges that this evolution is built upon the considerable equity established by Falken, including its strong market recognition, unwavering product quality and the commitment of its personnel.

This strategic shift positions the organisation under the umbrella of a globally respected marque, with its future strategy firmly centred on expansion, pioneering advancements and ecological responsibility. A prominent symbol of this new chapter will be unveiled shortly, with the renaming of the DUNLOP City Tower in Offenbach. A formal ceremony will mark the occasion, featuring the presentation of the DUNLOP logo at the tower. The event is set to be attended by Offenbach's Lord Mayor, Dr Felix Schwenke, alongside the company’s managing directors, Hiroshi Hamada and Markus Bögner, and the newly enlarged DUNLOP team.

Markus Bögner, Managing Director and President, DUNLOP Tyre Europe GmbH, said, “The name change is an important milestone of which we can be very proud. It strengthens our identity and underlines that we are ready for the next steps. Our strong heritage with Falken is and remains part of our success, laying the foundations for DUNLOP’s future in Europe. Our thanks go to all our employees and partners who have supported and accompanied us on this journey.”

Comments (0)

ADD COMMENT